How Big Of A 30

There are a few considerations to look into when determining how much of a mortgage you can afford. While lenders consider factors include your assets, liabilities, and income, your DTI will be the most significant factor in determining how much you can afford. The front-end DTI considers how much of your monthly income goes toward housing expenses. Lenders want to see this ratio at 28% or less.

More On How To Maximize Total Wealth

The decision of whether to refinance your mortgage is multidimensional, especially if you account for maximizing total wealth. We believe it can be an oversimplification to focus on only one factor of savings . This approach doesnt take into account other variables in your financial picture that affect your total wealth over the course of the loan. Here are 6 other variables to account for when calculating total wealth:

1) Tax deduction of your closing costs and mortgage interestIn the tool, were assuming a current and future marginal tax rate of 28%. This is used to estimate the amount by which you can reduce your taxable income over the loan term.

2) Opportunity cost of investing your moneyIf you lower your monthly mortgage payment, you might choose to invest the difference in bonds or stocks. This can add up to a lot of money in the long run! We assume a post-tax investment yield of 3.5%. If you keep most of your savings in a bank account, decrease this to 0%. If you invest most of your savings in the stock market, increase it to 6%.

3) Cash flowIn the tool, we factor in one-time, out-of-pocket closing costs as well as the adjustment to your current monthly payment. Both of these affect your cash flow. If it will be difficult to absorb these adjustments, it may not make sense to refinance your mortgage even though it might save you money in the long run.

Wanting More For Less

The goal of every borrower is to pay less for mortgage financing. With that standard, no time for borrowers was better than the past decade. The last time the average annual interest rate topped 5 percent was in 2009, according to Freddie Mac. By 2016, the average annual rate reached 3.65 percent, the lowest since records were first kept in 1971.

How good have rates been in the past decade? Freddie Mac reports that the average mortgage rate between 1971 and August 2018 was 8.16 percent. That fearsome 5 percent rate is more than 3 percent lower than the longterm average.

But lets be honest. Nobody cares that todays rates are low by historical standards. What everyone does care about is that rates are up when compared with recent years.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Avoid Costly Loan Churning

If you look only at rates and payments, you can be a victim of loan churning or serial refinancing. Those are scams which stick borrowers with needlessly high costs and bigger debts. Or, you may simply pay too much to refinance.

Loan churning is a form of refinancing in which the borrower appears to benefit but does not. For instance, the Smiths have a mortgage at 4.25%. The lender says they can refinance to 3.875%. The new rate is lower than the old one. The payment is lower and the loan broker shows them the “savings” the new loan offers.

Sounds pretty good. However, this refinance costs thousands of dollars and in fact it would take decades to break even. The Smiths might not notice this because the lender allows them to wrap the refinance costs into the new loan. So they don’t pay upfront to close the loan, and they do see the lower payment right away. But every time they refinance, they add thousands to their loan balance and years to their repayment.

Loan churning can be avoided by shopping around for rates and terms. However, loan churning is such a serious problem that the VA issued new guidelines in 2018 to protect borrowers. While the new guidelines only apply to qualified veterans seeking to refinance through the VA program, they’re actually useful for all borrowers. You should make sure that any refinance delivers the benefit you expect.

Net tangible benefit

Seasoning

To prevent loan churning, the VA says the current mortgage must be in place the longer of

Arming For Rate Increases

What can buyers do to offset todays rising rates? There are two alternatives.

If the concern is that higher mortgage rates will make financing unaffordable, consider the use of a 5/1 ARM. At this writing, such financing is likely to have a fiveyear start rate about .75 percent lower than fixedrate financing.

Example: Instead of 5 percent fixedrate financing, you might be able to find a 5/1 ARM in the 4.2 percent range, and a 7/1 ARM in the 4.3 percent area.

The risk: ARM rates and monthly payments may go higher once the start rate ends. As long as you expect to refinance before that period ends, you can minimize that risk. Ditto if you expect to sell before the fixed introductory rate expires.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Were Heading Towards Long

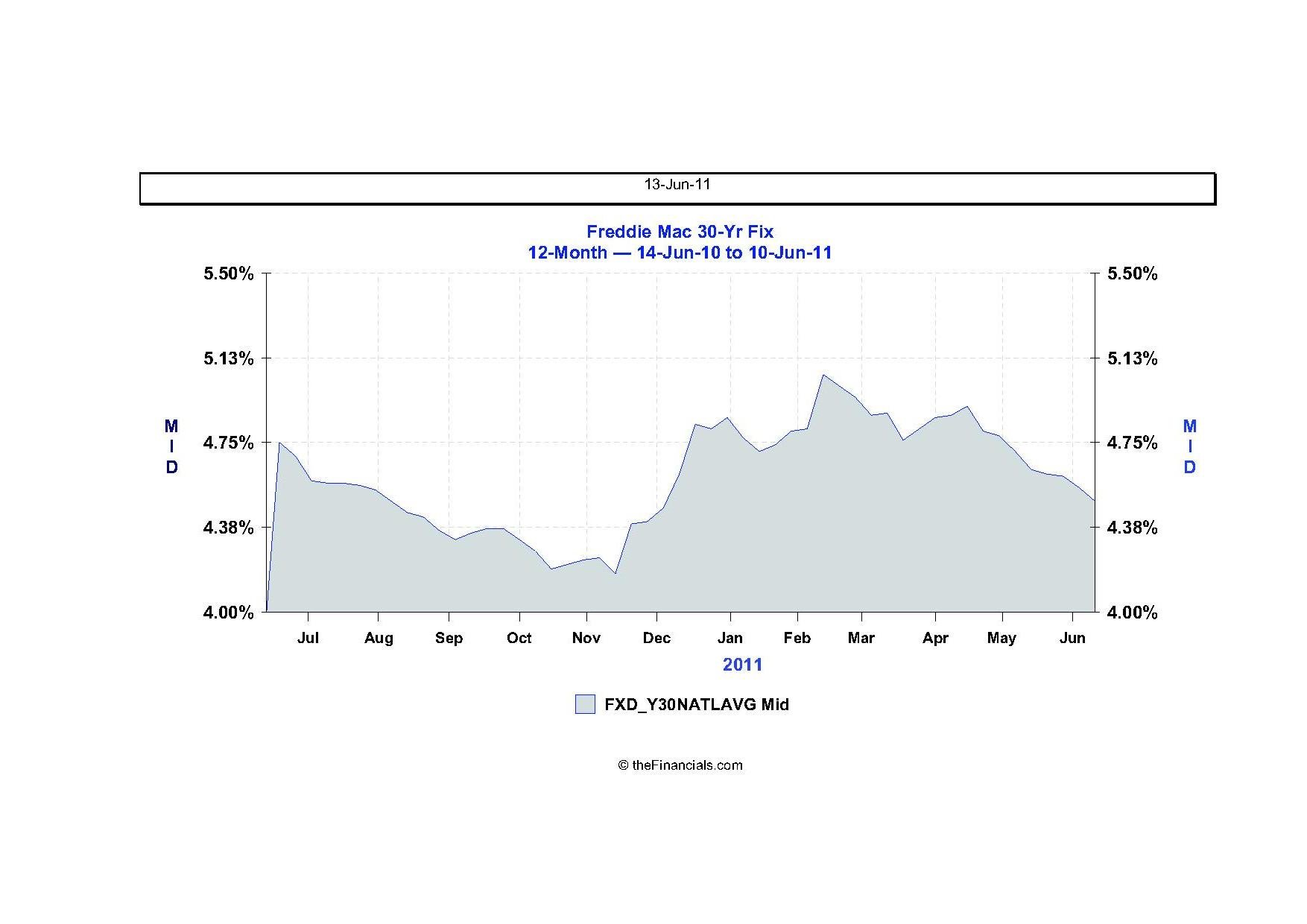

Rates cooled off heading in the summer months, but that proved to be the eye of an ongoing storm. As long as the wall street and economy reports remain strong, rates can continue to move higher in general, even though there may be brief periods of correction. Mortgage rates have continued to rise throughout September anywhere from at least an eighth of a percentage point to a quarter of a percentage point. This largely equates to conventional 30yr fixed rates of 4.875% to 5.0% remains far more prevalent. Thats as high as mortgage rates have been since 2011 for most lenders.

Going forward though, Ted Rood, Senior Originator and regular Mortgage Daily News contributor says that A .25% Fed rate increase is all but given, the big question is Fed Members outlook for future hikes. Im still locking new clients at application, if closing within 60 days. Its going to take a significant shock, not just some disappointing data, for this upward rate trend to reverse.

We Can No Longer Say Rates Are Stagnant

If September is any indication, were no longer remaining that stagnant as far as rates go, but its not looking favorable either. Rates on a national level have moved up from 4.6% to hang at an average of 4.75% through much of the last couple weeks, and continued unfavorable reports have pressed rates higher. The consistent reports across every day of the last two weeks have been mortgage rates had a bad day, but when were saying it every day or almost every day, I think its safe to say its more than just a day, especially in context of the entire year where weve moved from just over 4% as the average at the beginning of the year, to now heading towards averages of close to 5%. We are definitely in a trend of increasing rates.

Read Also: Reverse Mortgage On Mobile Home

Requires Good Credit To Get A Lower Rate

Each lender has its own requirements for refinancing, but to get the best rate that makes refinancing an intelligent strategy, youll need good credit. According to FICO, credit scores of 670 or higher are considered good, very good, or excellent. If you have fair or poor credit, you could end up with a higher interest rate.

Shop Around To Find Your Best Interest Rate

Mortgage lenders personalize your interest rates based on your credit history and other details about your financial life. So you wont know for sure what your rate options look like until you apply and get preapproved.

The first rate youre quoted may not be your best interest rate. Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal.

Read Also: Rocket Mortgage Qualifications

The 5 Percent Mortgage And Sales

There are already signs that the market has begun to cool. NAR says, Existinghome sales remained steady in August after four straight months of decline. Sales are actually down 1.5 percent from last August.

Fewer closings are likely to continue. Lawrence Yun, NARs chief economist, estimates that each .1 percent mortgage rate increase results in 35,000 fewer sales.

Fewer sales suggest more supply and less demand. That combination should lead to lower prices or smaller price increases. However, in todays market, many areas may see both fewer sales and rising prices. How is that possible?

Processing Fees And Discounts

A point is equal to 1 percent of the mortgage amount. If you borrow $150,000, the cost of one point is $1,500. A point can also be called a discount fee and sometimes even a rate adjustment factor.

While origination fees are set in stone, points are negotiable. This is VERY IMPORTANT. You can change your interest rate by paying more points or fewer points.

The Consumer Financial Protection Bureau offers this example.

Lets say you borrow $180,000. The interest rate is 5 percent with 0 points. When a loan is quoted with zero points you are seeing the par price.

But instead of zero points, youre willing to pay .375 points. Thats 3/8ths of a point. In the case of a $180,000 loan thats an additional $675, you must pay at closing. Now, the lender will offer the loan at 4.875 percent in the CFPB example. Your rate has gone DOWN.

Working from the CFPB model, the lenders rate sheet might show several pricing options for a $180,000 mortgage.

- 5.375 percent means the lender will pay $2,025 in closing costs

- 5.25 percent means the lender will pay $1,350 in closing costs

- 5.125 percent means the lender will pay $625 in closing costs

- 5.00 percent plus 0 points equal par pricing

- 4.875 percent plus .375 points

- 4.75 percent plus .750 points

- 4.625 percent plus 1.125 points

Read Also: Does Getting Pre Approved Hurt Your Credit

Does The Federal Reserve Decide Mortgage Rates

The Federal Reserve doesnt directly decide mortgage rates. Instead, it influences the rate by keeping inflation under control. Their goal is to help guide the economy, encouraging its growth. Raising or lowering short-term interest ratesa decision made by the Federal Open Market Committeemay encourage lenders to raise or lower their mortgage rates also.

Rates Are Back In Historically Low Territory

After the dramatic, and consistent, rise in interest rates throughout the summer, many rate watchers failed to notice that rates have actually been falling now for several weeks. This leaves one to wonder if the market had been essentially pricing in an anticipation of no Fed action.

Related Article: Buy vs Rent: 6 Examples to Help You Decide

After 30 year fixed mortgage rate reached a peak at around 4.875 percent, they have fallen to below 4.5 percent. It looks likely to fall further after this weeks news from the Fed.

This is good news for all prospective homeowners. It is especially good news for people who thought they had missed their window to be able to refinance at a low rate.

You May Like: Can You Get A Reverse Mortgage On A Condo

Apply For Your Refi In Just 3 Minutes

If refinancing is right for you, theres no better time than now to apply. You can get pre-approved in just 3 minutes, without affecting your credit score. And with our 24/7 rate lock option, you can be sure youre getting the best possible price.

Mortgage refinance calculator for illustrative purposes only. Accuracy not guaranteed.

Agarwal, Ben-David, and Yao , forthcoming in the Journal of Financial Economics

- More

Is 4875 A Good Mortgage Interest Rate

Asked by: Morgan Windler

We say 4.875% is the best execution conventional 30 year fixed mortgage rate because the average cost to permanently buydown your mortgage rate from 4.875% to 4.75% is outrageously high, reflecting a complete lack of liquidity for 4.0 MBS coupons in the secondary mortgage market.

Anything at or below 3%4.42% to 5.5%an ultralow mortgage rate3.86%40 related questions found

You May Like: How Much Does Getting Pre Approval Hurt Credit

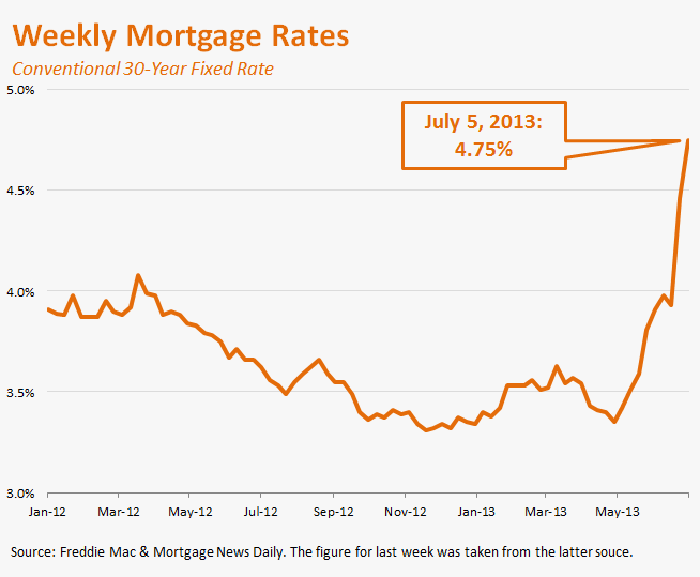

Mortgage Rates: 4875% Is Best Execution 475% Buydown Is Expensive

Yesterday we informed you that the best execution conventional 30 year fixed mortgage rate had fallen to 4.75%. Well it moved back up to 4.875% today.

In yet another volatile trading session, lenders were excessively unfriendly with loan pricing out the gate this morning. However, following a strong 10-year Treasury note auction, MBS prices benefited from a modest benchmark interest rate recovery rally. The corresponding effect on mortgage rates was widespread repricing for the better. Repricing for the better = cheaper closing costs. Repricing for the worse = more expensive closing costs.

Unfortunately, even after reprices for the better, loan pricing was still worse than it was yesterday and the best execution conventional 30 year fixed mortgage rate still moved back up to 4.875%. We say 4.875% is the best execution conventional 30 year fixed mortgage rate because the average cost to permanently buydown your mortgage rate from 4.875% to 4.75% is outrageously high, reflecting a complete lack of liquidity for 4.0 MBS coupons in the secondary mortgage market.

If you’re shopping for an FHA 30 year fixed mortgage, 4.75% is your “Best Execution” target. If you’re shopping for a 15 year fixed mortgage rate, we see a sweet spot at 4.25%. On 5-year ARMs, we’ve heard of very well qualified borrowers being quoted rates as low as 3.50%.

Is Refinancing Worth It

There are several things to consider when deciding whether a refinance is right for your personal situation. Although market interest rates play a factor in how much you can save with a refinance, they shouldnt be the only deciding factor. If a refinance improves your situation, then go for it. If it doesnt, dont, says Schlesinger. Dont try to time the market. If you can do this and save money, you dont have to find the absolute bottom.

If you are secure in your job and expect to be in your home for more than a few years, right now is a great time to consider refinancing because of relatively low interest rates. Any time you are going to be in your house for the foreseeable future and can save one half to three-quarters of a percentage point on your interest payment, its worth considering, Greg McBride, CFA, chief financial analyst for Bankrate.com.

But there are also situations where refinancing might not be a good idea. Schlesinger says those moving in the next few years wont be in their homes long enough to make up for the expenses incurred during the refi. Lets say that I am saving $100 a month, but the whole refi process cost me $5,000, she says. Its going to take a while for me to recoup my savings. Youd be saving $1,200 a year in Schlesingers example, but if you move in two years, youll only have recouped half of the refi costs.

You May Like: Rocket Mortgage Loan Requirements

How Much Does A 1% Difference In Your Mortgage Rate Matter

The interest rate on your mortgage tells you how much youre paying each year to your lender for just having the loan.

If you want numbers specific to your home purchase, you can use an online mortgage calculator to customize your costs.You can also insert what you’re looking for below and find the perfect loan type for you.

Basically, a lower interest rate means a lower overall cost of your investment.

For example, consider a mortgage loan for $300,000 with a fixed interest rate of 4.5 percent and 30-year terms. Over the life of your loan, youll pay a total of $547,220 . Monthly payments on this loan would be about $1,520.

If you get the same loan at 3.5 percent, the cost of your investment over 30 years will be $484,968 . Monthly payments on this loan would be about $1,347.

In this example, a 1 percent difference in interest rate could save you $173 per month or $62,252 over the life of your loan.

When youre shopping for a home loan, mortgage lenders that offer lower mortgage interest rates can lead to lower monthly mortgage payments and save you over the life of your investment.

If you own a home, it may be a good time to look at refinancing your home loan. Refinancing your loan now is especially valuable if you have an adjustable-rate mortgage and your introductory rates will expire.

Should You Choose Low Mortgage Rates And High Processing Fees Or Vice Versa

In this article:

In general, the lowest mortgage rates come with the highest processing fees. That said, mortgage rates and costs vary widely between lenders for the same loan to the same borrower.

The best combination of interest rate and fees depends on a few factors, and everyones sweet spot is probably a little different.

Read Also: Mortgage Recast Calculator Chase

Average Mortgage Rates Today

We present the average 30- year, 15- year, and 5/1 ARM rates for all 50 states and the District of Columbia. These current rates update on a weekly basis and vary according to your state of residence.

Our current mortgage rates reflect several assumptions: The most important of these include the loan amount and loan-to-value ratio .

If your mortgage balance is greater than the $200,000 baseline used to find these averages, then your rate will likely be higher as well. For LTV, our mortgage rate averages assume a value of 80%equal to a down payment of 20%.

A lower down payment means a higher LTV, resulting in a rate estimate that’s higher than average.

| Loan Type | |

|---|---|

| 3.76% | 2.38%7.75% |

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%. ARM rates apply to the initial fixed-rate period, after which rates can change based on market conditions.

On the other hand, having a lower mortgage balance or larger down payment means that your quoted rates might fall below the average rates of the loan types you request.

Mortgage lenders may also offer lower rates to applicants based on credit scores and debt-to-income ratios .

A higher credit score leads to more favorable loan terms, including a lower interest rate.

DTI is calculated as your total monthly debt payments divided by monthly gross income, so a lower DTI:

- Indicates better financial health

- Reduces the mortgage rates you’ll be offered.