Weekly Mortgage Payment Calculator To Compare Mortgage Interest Savings

This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

Or, if you are already making monthly house payments, this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per year on a bi-weekly or weekly basis.

Plus, I recently added a field wherein you can enter an optional, extra weekly payment amount to be added to the calculated weekly payment amount. You’ll be amazed at how much a small extra amount per week can save you in time and interest over the long run.

Finally, I have also recently added an “Estimated payoff date” row to the comparison results so you can immediately see the month and year each payment interval will pay off the mortgage.

How To Make Biweekly Payments Through Your Lender

In many cases, switching to biweekly payments is as simple as asking your lender to alter your current payment plan. However, it’s important to get the timing right if you’re already enrolled in automatic drafts for your payments.

If you switch to biweekly payments in the middle of the month after making your regular mortgage payment, you’ll need to schedule your first biweekly payment for the beginning of the next month. Otherwise, you’d be making one and a half payments in the same month, which could strain your budget.

To calculate a mortgage, you need a few details about the loan. You can then complete the calculations by hand or use this mortgage calculator to crunch the numbers.

When switching to biweekly payments with your lender, be sure to ask how your payments will be credited. Specifically, you need to know whether the extra payment that results from making biweekly payments will automatically be applied to the principal.

You also must make sure that your lender will immediately credit each biweekly payment upon receipt. If your lender waits until the second payment has been received before crediting your loan, you’ll never see the financial benefits of biweekly payments.

Things To Watch Out For

Making biweekly payments is a handy tool, but be careful of scams or special programs that claim they can do this for you. Some companies offer to convert your monthly mortgage payment into biweekly payments for a one-time fee. Avoid those offers. It shouldnt cost you anything to make extra payments on your loan.

Make sure that making biweekly payments fits your budget. If you’re typically paid once per month, you might be used to paying all of your bills at once instead of spreading them out. If you’re paid weekly, make sure that you’re holding enough cash in reserve each week to make your next biweekly payment once it comes due.

Finally, make sure there isnt a penalty for prepaying your mortgage. Most mortgages these days do not have a prepayment penalty, but there are still some out there that will penalize you for trying to pay off your mortgage early. Just be sure that you wont be doing more harm than good by making extra biweekly payments.

Also Check: Can You Get A Mortgage While In Chapter 13

Why Switch To Biweekly Payments

If you pay your mortgage monthly, like most homeowners, youre making 12 payments a year. When you enroll in a biweekly payment program, youre paying half your monthly amount once every two weeks instead. There are 52 weeks in a year, so this works out to 26 biweekly payments or, in effect, 13 monthly payments.

Because youre making the equivalent of 13 monthly payments each year, youll pay less total interest while lowering your principal balance at a much quicker pace, says Joe Zeibert, senior director of Ally Home, a division of Ally Bank in Charlotte, North Carolina.

Zeibert gives the example of a 30-year fixed loan of $250,000 at a 4% interest rate. Biweekly payments would save a borrower nearly $30,000 in interest charges and have the loan paid off in five fewer years, he says. Even if homeowners stayed in their home for only seven years, they would still save several thousand dollars in interest charges while paying off $10,000 more in principal, which they could then use toward a larger down payment on their next home, Zeibert says.

Less Money For Other Needs

Before you commit to making biweekly mortgage payments, consider whether doing so would benefit your overall financial plan. A biweekly plan means putting more money toward your mortgage every year, which could pull from other financial obligations like saving for retirement or paying off high-interest debt. Be sure to work a biweekly payment plan into your budget and see if the savings outweigh any losses elsewhere.

Paying the extra amount means a portion of your monthly money is tied up elsewhere, and without proper planning, this might affect your budget and your ability to pay for other pressing financial needs besides your mortgage, explains Connie Heintz, founder and president of DIYoffer, a for-sale-by-owner toolkit.

If you have already locked in a low interest rate, accelerating your mortgage might not make much of a difference, Heintz adds. Youll just put in more of your money toward paying the mortgage.

Don’t Miss: What Banks Look For When Applying For A Mortgage

Types Of Mortgage Payments

Your mortgage payment consists of two parts: the principal and the interest. The payment frequency you choose will impact the amount of time itll take for you to fully pay off your principal, as well as the amount of interest youll end up paying. You can select from five different payment frequencies:

- Monthly

- Accelerated Weekly

Monthly

The most common way of paying a mortgage is with monthly payments. Under this method, youll make a single payment every month, usually on the 1st, for a total of 12 payments per year. For example, if your mortgage payment is $1,200 per month, youll pay $14,400 in total over a year.

Though paying once a month is convenient for many homebuyers, a major drawback is the large amount of interest that accrues between payments. Following a monthly payment schedule is also the slowest way to pay off your mortgage.

Bi-Weekly

Bi-weekly payment schedules are quite prevalent. Many homeowners receive a paycheque twice a month, so using this payment plan allows them to time their incoming cash flow with their mortgage payment. Bi-weekly payment schedules are determined by multiplying your monthly mortgage payment by 12 and then dividing by 26. Youll make a total of 26 payments per year under this payment method. Using the previous example, this means youll pay $553.85 every two weeks. At the end of the year, your total payments still add up to $14,400.

Check out how a basement suite can help you pay off your mortgage.

Accelerated Bi-Weekly

Weekly

How Does Paying Your Mortgage Biweekly Work

Interest on mortgage loans is typically calculated on a monthly basis. This means that the lower your principal balance, the lower the interest charged will be.

By paying biweekly, youll reduce your principal balance just a little bit extra, prior to that monthly interest being calculated. These savings will add up month after month, not only reducing your total mortgage interest, but also paying off your loan sooner.

Read Also: How Much Usda Mortgage Can I Qualify For

Biweekly Mortgage Payments: Are They For You

A mortgage is one of the biggest debts youll have in your life. And while you may be tackling your credit debt, car loan or student loans, your mortgage may be a little harder to chip away. Did you know theres a way to make an additional mortgage payment every year? This can be achieved by switching to biweekly mortgage payments, or paying your mortgage twice a month, making half the payment each time. Just by making an extra payment each year, you can pay your mortgage off several years earlier than planned.

Before you hop on the biweekly bandwagon, take a moment to consider if its right for you. There are many factors that go into biweekly mortgage payments. Its important to know what they are and how they can impact your finances before making the switch.

Get approved to refinance.

Calculate Your Saving If Switching To A Weekly Or Bi

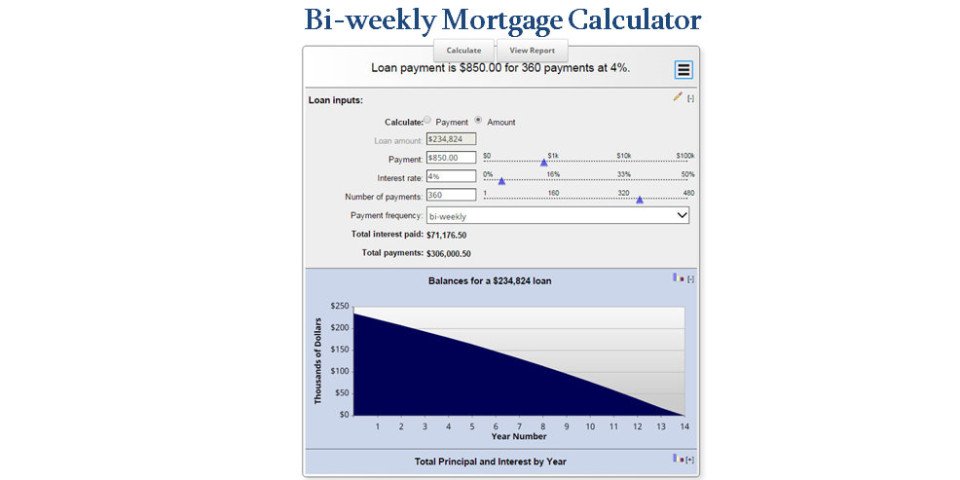

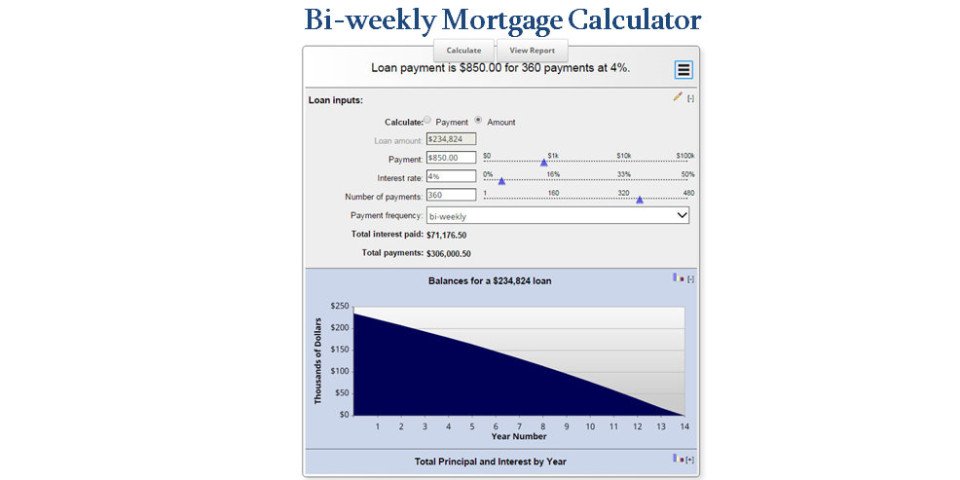

Here are some tools that can help you determine the benefit of switching from a monthly payment to a weekly or bi-weekly payment. Bi-Weekly Mortgage Payment Calculator

If you have any questions about making weekly or bi-weekly payments, contact your lender or mortgage broker. A good loan originator will always look out for your best interests, and will show you how to save the most money possible on your mortgage.

The Marimark Mortgage Newsletter will keep you informed with important events in the mortgage industry that could impact your finances.

We especially focus on ways to save money on your current and future mortgages. And, we continually share the information we share with our clients, because we believe informed consumers are the best consumers.

Real estate agents, and other professionals in the industry, will receive an ongoing wealth of information that will help them serve their clients.

Filed Under: MortgagesTagged With: Bi-weekly Mortgage Payment, Weekly Mortgage Payment

Read Also: Why Are Mortgage Rates Dropping

How Smart Are Biweekly Payment Plans

Biweekly plans will save you a lot of interest over the life of your loan, but it’s only a smart move if the extra payments work for you. You’re essentially paying the equivalent of one additional mortgage payment each year, so you should be sure you can budget for that. It’s also smart to compare your interest savings to what you could potentially earn by investing that extra payment instead.

You May Find It Easier To Budget

According to the U.S. Department of Housing and Urban Development , the median monthly mortgage payment in 2019 was $975. That same year, the median household income was $68,703 this means that mortgage payments accounted for more than 17% of the average familys budget.

Its no surprise then that making a lump sum mortgage payment each month can sting, especially when it represents such a large chunk of your income.

If nothing else, biweekly mortgage payments take the stress out of those big payments. If youre paid biweekly, splitting your mortgage payment makes even more sense just send in a check each time you get paid, if thats the due date you agree on with your lender.

This strategy helps you stay on top of your budget and eliminate financial stress. And rather than letting that money sit in your bank account until your due date rolls around , making biweekly payments may also keep you from overspending.

Don’t Miss: What Is The Longest Mortgage Term Available

The Bottom Line: Are Biweekly Payments Right For You

For the right type of borrower, biweekly payments can help you save on interest and quickly add equity into your home. As with any major financial decision, its important that you weigh the pros and cons of paying your mortgage more frequently.

If you have questions on how you can start biweekly payments through Rocket Mortgage®, you can talk to a Home Loan Expert today for more information.

Is Making Biweekly Mortgage Payments A Good Idea

If you are a homeowner with a conventional mortgage who makes monthly payments on your home, you may have heard about biweekly mortgage payment programs as an alternative to traditional payment plans.

The way to do this, according to some lenders, is by paying biweekly mortgage payments versus monthly payments. The conventional logic is that increasing the frequency of the payments doesn’t allow interest to build up and over the course of a 30- or 15-year mortgage that can equal years eliminated from your loan.

Before you sign up for these biweekly payments, it may be wise to examine if this logic is actually true and will save you money.

You May Like: What Is The Average Time To Pay Off A Mortgage

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

How To Set Up A Biweekly Mortgage Payment Plan

If your lender allows biweekly payments and applies the extra payments directly to your principal, you can simply send half your mortgage payment every two weeks. If your monthly payment is $2,000, for instance, you can send $1,000 biweekly.

In general, you wont need to involve your lender in order to start making payments this way, according to David Reischer, attorney and CEO of LegalAdvice.com.

It is simply unnecessary to involve the lender in changing the loan terms so that a borrower must make a payment every two weeks instead of the normal payment due once a month, explains Reischer. If a borrower wants to make an extra payment to accrue the benefit of a biweekly mortgage plan, then they can simply send a payment every two weeks instead of the payment due every 30 days.

You can also divide your monthly payment by 12 and park that amount in a savings account each month, then send the accumulated amount to your lender as an extra payment at the end of the year.

No matter how you do it, Heintz says you should be sure to make it absolutely clear that this entire amount goes toward your principal balance. Otherwise, your lender might return the extra amount or forward it to your next payment, which negates the goal of biweekly payments.

To confirm your biweekly mortgage payment plan works the way you intend it to, make sure that:

In addition, make sure your lender confirms any extra payments are being applied to the principal in a timely manner.

Also Check: How To Modify Mortgage Loan

Biweekly Payments Can Save Thousands And Shave Years Off Your Mortgage

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

The chances are that if you own a home, youre making monthly mortgage payments. The typical mortgage is structured to make a single payment each month, for 12 payments per year. The good thing about this is that it means you pay the same amount at the same time each month, so there are no surprises, and its easier to budget.

But what would happen if you were to split that monthly payment up and make biweekly payments instead? Surprisingly, you could save yourself tens of thousands of dollars in interest charges and achieve mortgage debt freedom sooner. Heres how to make biweekly mortgage payments work for you.

Drawbacks To Biweekly Payments

One drawback to biweekly mortgage payments is that some lenders may charge fees to enroll in their biweekly payment plan. When it comes to fees, you should crunch the numbers to confirm you’ll still get ahead financially by paying biweekly.

Another factor worth noting is that biweekly payments won’t enhance your credit score. While they won’t negatively affect your score, the credit bureaus use 30-day time frames when they analyze credit data to set ratings. Therefore, you’ll make out the same, credit rating-wise, with monthly or biweekly payments.

Don’t Miss: Which Credit Reporting Agency Do Mortgage Lenders Use

How To Do It Yourself

The good news is that if your lender doesnt offer a biweekly payment option, you can take matters into your own hands.

Take your monthly mortgage payment and divide it by 12. Make an extra principal-only payment of that amount every month. Or save that amount every month for 12 months in a separate savings account, then make one extra mortgage payment for that year using the total, which is the equivalent of how much extra you would pay annually on a biweekly plan.

Before you go this route, however, confirm with your lender that there are no prepayment penalties on your loan and that the extra payments will be applied entirely to your loans principal rather than to principal plus interest.

Biweekly payments are certainly worth making if your finances allow for it, Torres says. You can use a biweekly mortgage payment calculator to estimate your potential savings.

About the author:Emily Starbuck Crone is a former mortgage writer for NerdWallet. Her work has been featured by USA Today and MarketWatch. Read more

How About A Bi

Question: After refinancing my house with a low-rate, conventional 15-year mortgage, I received an offer to set up bi-weekly or weekly payments. What are the benefits and pitfalls of such a plan? Ron, Richmond Hill, GA

Answer: The benefit of a bi-weekly plan is its an easy way to accelerate mortgage payments. By paying half of your monthly payment every 2 weeks, the bank gets the equivalent of 13 monthly payments instead of 12. You own your home faster and pay less interest without putting much of an additional strain on your budget.

For example, I assumed you had a $100,000 mortgage at a 4.5 percent interest rate and 15 years to go. With a bi-weekly payment schedule, youll own your home in 13.5 years and save $4,193 on interest compared to making the monthly payment over 15 years.

The typical drawback to this payment scheme is a big one: fees. A bank or mortgage servicer often charges a hefty upfront fee, an ongoing fee or a combination of the two to establish the bi-weekly payment account. I would check to see how much it will cost you. You can make bi-weekly payments on your own without paying any additional fees, assuming your bank allows it . You could also make a 13th payment on your own every year, telling the bank to put the money toward principal.

Unless the fees are minimal to non-existent, I like the DIY approach. I dont see why banks should charge a fee for getting an automatic payment that returns their money faster.

You May Like: Is A Mortgage A Line Of Credit