Is It Possible To Increase Your Mortgage Preapproval Amount

In general, its a good idea to spend no more than 30% of your monthly gross income on your housing expenses. Although this number should include your mortgage, you should also consider other costs such as your utilities or HOA fees.

Look at your budget closely to decide for yourself what size mortgage payment you are comfortable with. Lets say that you decide that you can comfortably afford a larger mortgage than you were preapproved for. In that case, there are several options to potentially help you boost your preapproved amount.

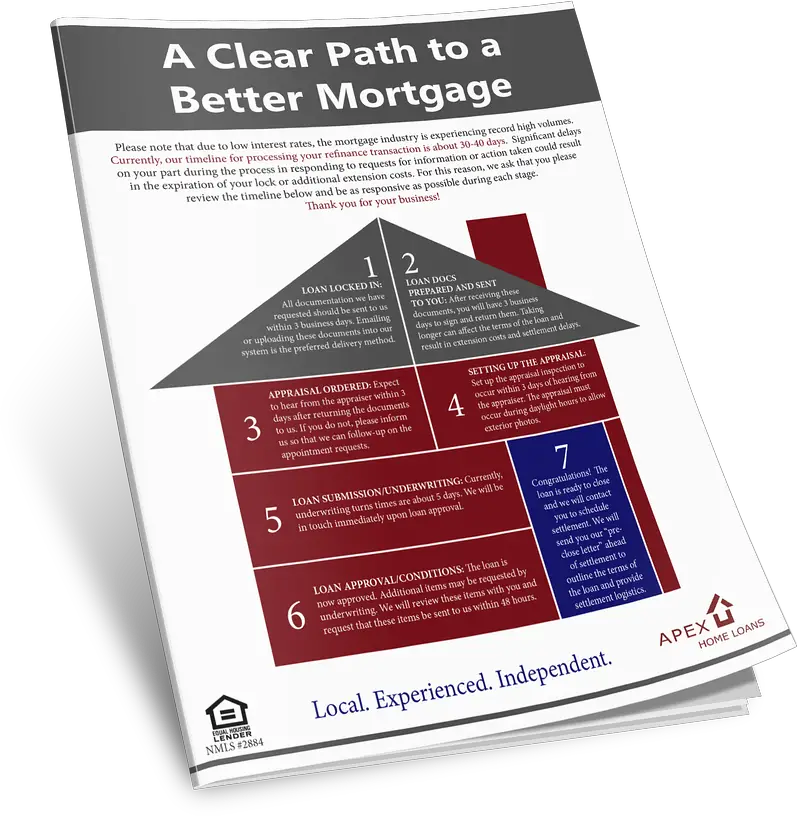

Begin The Underwriting Process

Underwriting can be the most nerve-racking part of getting a mortgage, even if youve been preapproved. Its more waiting, this time to get officially approved for the loan. You may also find yourself working with an underwriter rather than the loan officer who’s helped you up until this point.

During the underwriting process, the lender determines whether youre eligible for the loan. Factors evaluated include:

-

Current debt obligations.

The lender will take a look at your updated credit report and order a home appraisal. An appraisal tells the lender the market value of the home, since they won’t lend you more than the home is truly worth.

Meanwhile, you will schedule a home inspection, which will look for any defects in the home. Depending on how it goes, you may want to negotiate with the seller for repairs or a lower price before closing.

During the underwriting process, you’ll want to avoid making changes to your finances, such as switching jobs or taking out another line of credit. Same goes for large purchases that increase your debt. Increasing your debt can lower your credit score, which could make the loan costlier or even jeopardize your qualification.

Small Mortgage Loan Requirements

Small home loan lenders typically require borrowers to meet the same minimum mortgage requirements as they would for larger loan amounts.

If youre getting a conventional loan, for example, some of the main requirements include:

- A 620 credit score or higher.

- A 3% down payment or higher.

- A 45% debt-to-income ratio or lower.

- Proof of steady employment and income for the last two years.

- Private mortgage insurance for a down payment less than 20%.

Another factor to consider is that the closing costs on a small mortgage may amount to a higher percentage of the loan amount than is typical for mortgages in general. A common rule of thumb given to homebuyers is to expect to pay 2%-6% of the loan amount in closing costs. But, because many of the fees you pay are fixed, someone with a small loan amount will pay proportionally more during the closing process.

Small-dollar loans also have higher application rejection rates across all of the major conventional and government-backed loan types, including FHA loans and VA loans.

Don’t Miss: What Mortgage Can You Afford Based On Salary

Check Your Mortgage Eligibility

A high debt-to-income ratio can make it tougher to get a home loan. Fortunately, lenders have some flexibility when it comes to mortgage requirements. If your DTI is high but youre a reliable borrower in other respects, theres a good chance you could still qualify. To find out, check your eligibility with a lender.

How To Ensure You Get The Lowest Refinance Rate

Mortgage refinance rates are influenced by your personal finances. Those with higher credit scores and lower loan-to-value ratios will generally receive a greater discount on their refinance interest rate.

But your personal financial situation isnt the only factor that impacts your refinance rate. Your homes value compared to your loan balance also factors into the decision. You want to have at least 20% equity, or a loan-to-value ratio of 80% or less.

Even the mortgage itself has an affect on your refinance interest rate. A loan with a shorter repayment term generally has better refinance rates than mortgage refinance loans with longer repayment terms, all else equal. The type of refinance you need makes a difference in the mortgage refinance rate. A cash-out refinance loan typically has a higher interest rate than other types of mortgage refinancing.

Recommended Reading: How To Figure Debt To Income Ratio For Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Great Resignation: Money Tips When Transitioning Your Job

With a record number of job openings all over the country, its a great time to look for a new job. But transitioning careers can leave you without income for several months or more, depending on how long you are out of work. If you are thinking of changing jobs, learn how to manage your finances during this period of transition.

Also Check: Who Bought Out Ditech Mortgage

Find Other Sources Of Income

Another way to improve your credit score is to find another way to earn money. Some do freelancing to help them earn more aside from a day job. This way, it keeps you afloat with monthly dues as well as the amortization for your new property.

Other income sources that creditors consider:

- Income from part-time jobs or freelance work

- Royalty payments from published works

- Social security income

Mortgage Prequalification And Mortgage Preapproval Aren’t The Same Thing

Mortgage prequalification and mortgage preapproval are steps most people take before making an offer on a house. However, they aren’t the same thing.

Being prequalified or conditionally approved for a mortgage is the best way to know how much you can borrow. A prequalification gives you an estimate of how much you can borrow based on your income, employment, credit and bank account information.

Preapproval comes from a lender who has analyzed your finances carefully. They’ll tell you how much you may be able to borrow and what your interest might be. Mortgage preapproval is usually done after prequalification, but before you find a home. Preapproval doesnt guarantee you’ll get a mortgage, but if all key factors stay the same it’s very likely.

You May Like: What Mortgage Rate Would I Qualify For

Increase Your Qualifying Income

When underwriters look at income, they take a pretty conservative stance. For example, income from your part-time job might not be considered unless you have a history of working more than one job. And if you deduct unreimbursed business expenses on a Schedule 2106, your lender will probably also deduct them from your qualifying income.

However, sometimes the rules work in your favor. Per the Equal Opportunity Act Amendments of 1976, you can use income that you receive from public assistance programs to qualify for a loan if the income is likely to continue.

Here are other sources of income that you might not have considered, according to Fannie Mae:

- Alimony or child support

Helpful: How Interest Rates Affect Your Wallet and the Bigger Economic Picture

How Can I Increase My Mortgage Preapproval Amount

Sometimes, the amount a lender preapproves you for isnt the final word on how much you can borrow. If youre not satisfied with your mortgage preapproval amount, look at your finances for opportunities to increase your preapproval limit.

You may be able to increase your mortgage preapproval amount by reducing debt, generating more income or finding a different lender. Other common strategies to increase your preapproval amount include increasing your down payment, opting for a longer-term home loan or getting a co-signer.

Keep in mind that larger mortgages typically come with larger monthly mortgage payments. If youre financially prepared to take on more mortgage debt and larger monthly mortgage loan payments, check out our steps to optimize your mortgage preapproval application.

You May Like: What Is A Mortgage Advisor

Tips To Help You Get Approved For A Higher Mortgage Loan

If you arent satisfied with your initial preapproval amount, you can take steps to possibly unlock a higher mortgage loan amount.

Before you jump into increasing your mortgage loan amount, consider whether you can truly afford the bigger payments. Take the time to realistically assess your budget before attempting to increase your preapproval amount.

If you decide that a larger preapproval amount is the right move for your finances, you have several ways to give that amount a boost. Consider these actionable steps to get approved for a higher mortgage loan:

Will Uk Property Prices Fall

There has been much discussion about the impact of rising mortgage rates on house prices.

While significant demand has pushed prices higher in the last couple of years, some have predicted that demand for homes will fall due to increasing mortgage costs, resulting in fall in house prices.

The latest House Price Index from Zoopla showed that UK house prices had risen 7.2% during 2022.

However, the report also showed that quarterly house price growth had slowed by the end of the year. In this report, Zoopla predicts to record quarterly house price falls over the first half of 2023.

Recommended Reading: How To Pay A Mortgage In 10 Years

Personal Home Improvement Loan

Personal home improvement is an unsecured financing option that offers loans to people without equity percentage. Qualifying for a personal home improvement loan is not a difficult process.

Homeowners will also be able to spend money on both minor and major renovations if they borrow a personal home improvement loan. Some personal home loans might ask for an excellent credit score since it doesnt make your home collateral. But, TGUC Financial will offer you the loan amount with a low credit score and no equity percentage. A homeowner should submit their income certificate for verification without any strict requirements.

Tips To Qualify For Low

Income matters to mortgage lenders, but not because of strict income requirements. Income matters within the context of your existing debt load and your credit profile. Even if you cant increase your income, you can increase your home-buying budget by improving your financial life before applying for a mortgage. Start by:

Don’t Miss: What Are Negative Mortgage Points

Close Old Inactive Accounts They Can Kill Your Application

If you’re not using an account, it may be worth closing it. Leaving it open might be a fraud risk, and it could display out-of-date details.

Having said that, when applying for a mortgage, longer, stable credit relationships are a positive. So, if you’ve two credit cards, one recently opened and an older one, it’s probably not worth closing the older one before the mortgage application as you could lose the credit score boost it gives you.

See the Should I cancel? section of our Credit Scores guide for full information on why you should close old accounts. Remembered, if you are closing an account, just cutting up the card isn’t good enough you must tell the bank you want it closed.

Tip Email

Alternatives To A Small Mortgage Loan

Its possible to find small mortgage loans, but it also pays to consider other options. Here are some alternatives to consider when looking to finance a home under $100,000.

Hard money loans. These loans typically have higher interest rates and shorter terms than mortgages, but you can get them fast and without a credit check.

Personal loans. An unsecured personal loan wont leave you vulnerable to foreclosure because it doesnt require that you use your home as collateral. You will likely have to pay a higher interest rate, but on a small-dollar loan, this might not add to the total cost of the loan nearly as substantially as it would with a traditional mortgage.

Rent-to-own. They may be a little harder to find in todays hot housing market, but rent-to-own deals can allow renters to work towards homeownership, even if they dont have the cash to buy right now.

Read Also: How Much Would I Get Pre Approved For A Mortgage

How Can I Get A Mortgage More Than 5 Times My Salary

Yes. While it’s true that most mortgage lenders cap the amount you can borrow based on 4.5 times your income, there are a smaller number of mortgage providers out there who are willing to stretch to five times your salary. These lenders aren’t always easy to find, so it’s recommended that you use a mortgage broker.

Lenders Value Job Stability

While your credit score and the size of your down payment matter, don’t underestimate the value of stable employment. While a stint of unemployment will obviously stand out, sometimes even changing companies can make lenders nervous. If you’re contemplating getting a mortgage, you should stay in your current job if possible. The same holds true for any co-signers. Once your mortgage is approved, you can start pursuing new career opportunities again.

Don’t Miss: How Much Is My Mortgage Going To Be

How Do I Know If My Credit Score Is Good Enough For A Higher Mortgage Loan

Your credit score is one of the most important factors lenders use when approving a mortgage loan application. A low credit score can prevent you from getting approval for a higher loan amount, so its important to take steps to improve your credit rating. If you have questions about your credit score or believe there may be some issues with it, consult with an experienced lender who can help you correct any problems before applying.

Save Up For A Bigger Down Payment

When you make a small down payment on a home, the lender considers you a higher-risk borrower than someone who makes a larger down payment.

One place where youâll see lenders account for this risk is with private mortgage insurance . If you put down less than 20% on a conventional loan, youâll usually have to pay PMI premiums. Until you have enough equity to cancel it, PMI will affect you the same way a higher interest rate would: by increasing your monthly payment and your total borrowing costs.

Saving up for a bigger down payment can help you avoid PMI altogether. Even if you canât put 20% down, you can pay less for PMI with a larger down payment. On top of that, a larger down payment can actually get you a lower interest rate.

The more of your own money youâre willing to invest in the property, the less risky youâll be for the lender, and they may be able to offer you a lower interest rate.

Having trouble saving up? Check Down Payment Resource to see if youâre eligible for any down payment assistance programs in your area.

What if youâre refinancing? This strategy still works. You can bring cash to closing to increase your equity.

You May Like: Does Chase Sell Their Mortgages

Correct Credit Score Errors Pronto

If your credit file info’s wrong, you have a right to do something about it either having the error corrected or, at the very least, having your say.

Your first step should be to check if the error is on your credit file held with other agencies, then talking to the lender. If this doesn’t work, the free Financial Ombudsman could step in and order corrections.

Here’s our step-by-step help:

Check your file with other agencies. See if your file with them has the same error. If you get it corrected with one agency the information should be sent to the others, but it’s better to contact them yourself to ensure your file with all three TransUnion, Equifax and Experian have the right details.

Contact the lender. Most will have a system in place to deal with customer disputes, and if you’ve proof, it should be resolved quickly. Write to it, say you think the error is unfair and ask it to wipe it from your file.

If it’s a default and you’re prepared to settle with your lender, either in part or in full, you could also try negotiating with it. As part of negotiations, you could make a condition of settlement that the default is wiped off your credit file. Companies can do this for disputed defaults.

I Need Cash To Buy Another Property

Are you thinking about buying more real estate, like a second home, vacation home, or investment property? If so, youll likely need cash for a down payment and closing costs.

You can use your own funds, of course. But if youre short on cash or you dont want to touch your personal savings or other investments a cash-out refinance or a home equity line of credit can help you buy another property.

The benefit of using a cash–out refi to buy another home is that you can lock in a low fixed rate. But it requires you to refinance a portion of your homes current value. So youll have a larger loan amount and pay interest for a longer time likely 30 years.

A home equity line of credit lets you tap only the amount of cash you need. You can also pay the money back and then reuse the credit line. This lets you borrow – and pay interest on only the sum you really need.

On the flip side, HELOCs can have higher interest rates than cash-out refinancing, and the rate is often variable, which leaves you with less certainty about your future rate and monthly payments.

You May Like: Why Does My Mortgage Payment Keep Going Up