How Does My Amortization Period Affect My Mortgage

When deciding between a short amortization or a long amortization, you will need to take into account your financial situation. A long amortization means that your individual mortgage payments will be smaller, which might allow you to qualify for a larger mortgage amount based on your futuredebt service ratios. Likewise, higher mortgage payments from a shorter amortization may reduce themortgage amount that you can afford.

You wont be able to get a CMHC-insured mortgage if your amortization is more than 25 years. While your monthly mortgage payment might be higher with an amortization that is 25 years or less, youll be able to make a smaller down payment that can be as low as 5%. Otherwise, youll need to make a down payment of at least 20% for an uninsured mortgage with an amortization greater than 25 years.

You can use ourmortgage amortization calculatorto see how changing your amortization period can affect the cost of your mortgage. For example, the table below compares the cost of a mortgage and the amount of each monthly mortgage payment for different amortization periods.

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

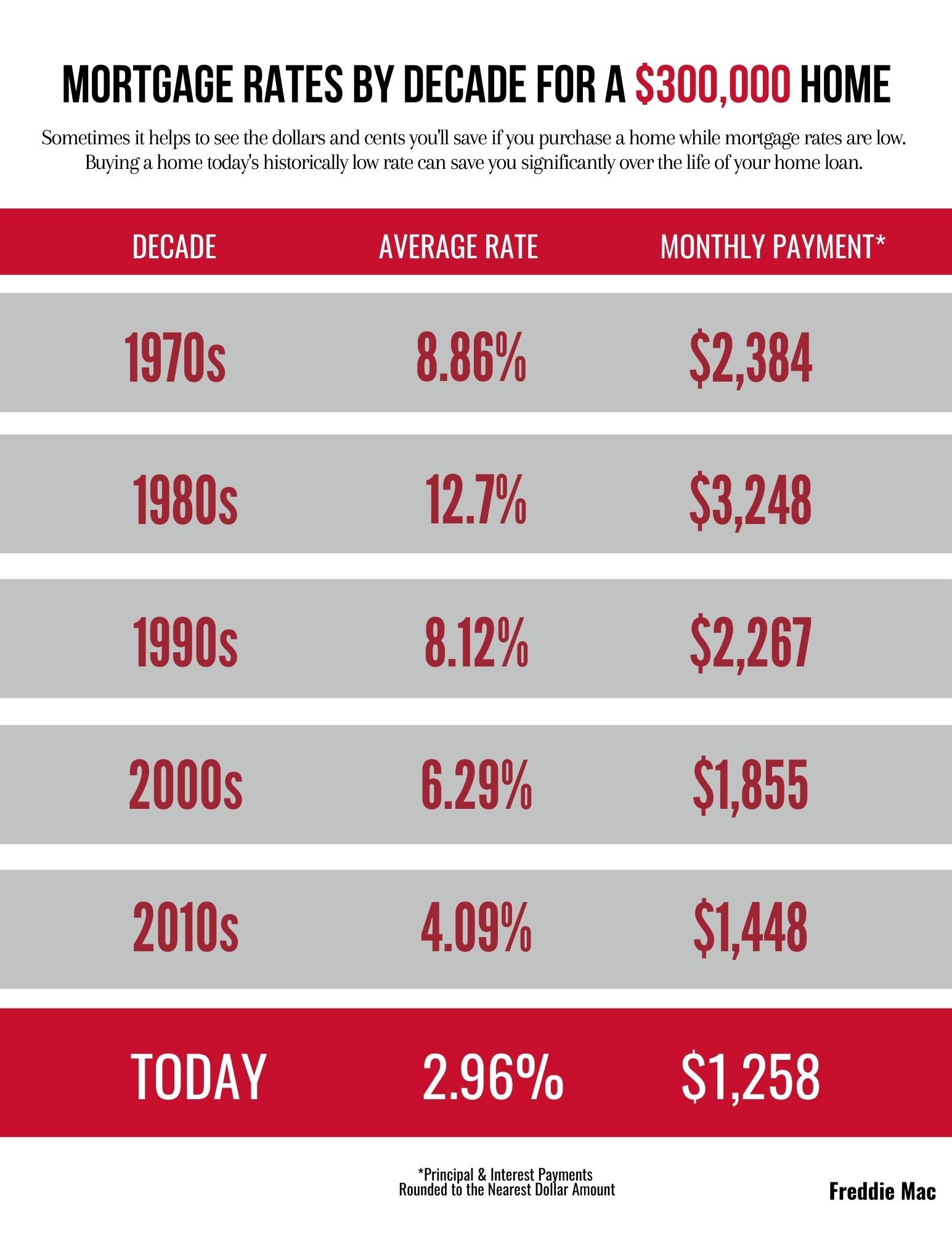

Is It A Good Time To Buy A Home

Whether its a good time to buy a house depends on who you ask. Many economists, forecasting low, stable interest rates and only modest rises in housing prices, say, unequivocally, yes.

Others, citing tight inventory of affordable housing nationwide, throw up a caution flag.

Still, home sales were at a record high in the spring of 2021, with many people anxious to take advantage of low interest rates and blind to the inflated price they paid.

But buying a house is an intensely personal experience in many ways, the ultimate microeconomic decision.

Whatever else is going on in the residential market space, whether its a good time for you to buy is dependent upon factors such as these:

- You have access to a substantial down payment .

- You are confident about the stability of your household income, not only to meet the payments, but also to take care of upkeep and weather financial surprises.

- Your credit score is in good shape.

- You can be happy for a number of years in the house and neighborhood you can afford.

Recommended Reading: Should You Buy Down Mortgage Rate

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

What Are The Differences Between 15

A 15-year mortgage’s monthly payments are higher than a 30-year mortgage, often significantly higher. A 30-year mortgage allows a borrower to stretch out payments over a long time and keep more of their monthly earnings. A 30-year mortgage has a higher interest rate than a 15-year mortgage, and you will pay more in interest rather than principal payments on a 30-year mortgage.

Also Check: How To Reduce My Monthly Mortgage Payment

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

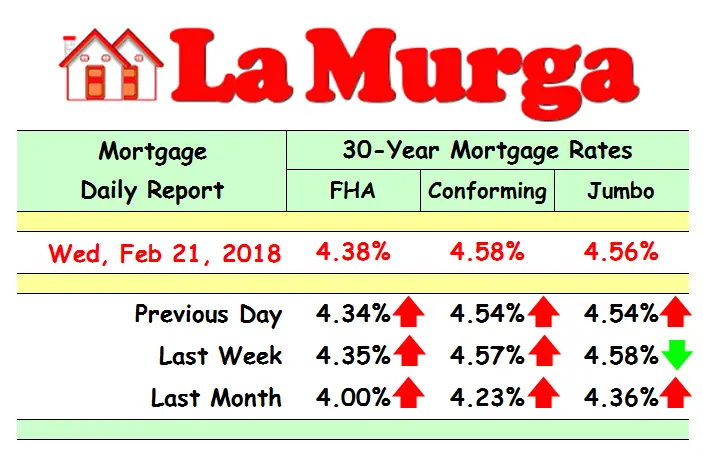

What Are Todays Mortgage Rates

The average 30-year fixed mortgage rate rose to 3.05 percent, up 2 basis points from a week ago.The 15-year fixed mortgage rate rose to 2.30 percent, up 1 basis point from a week ago.To compare todays customized rates from a variety of trusted lenders, use Bankrates mortgage rates comparison tool.

| 3-month trend |

|---|

| 3.380% |

Also Check: What Does A Cosigner Do For A Mortgage

Is A Variable Rate Better

If youre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todays low interest rate environment, its not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.

Amerisave Mortgage Corporation Best For Refinancing

AmeriSave Mortgage Corporation is an online lender, licensed in almost every state, that offers 15-year fixed-rate mortgages and several other loan types. It was named one of Bankrates top online lenders and best FHA lenders this year.

Strengths: Among the perks of its website, AmeriSave Mortgage Corporation offers a historical look at its 30- and 15-year fixed rate trends.

Weaknesses: The lender charges a $500 non-refundable application fee.

Recommended Reading: What Are Mortgage Underwriters Looking For

Current Mortgage Refinance Rates

The average refinance rates for 30-year loans, 15-year loans and ARMs are:

- The refinance rate on a 30-year fixed-rate refinance is 3.519%.

- The refinance rate on a 15-year fixed-rate refinance is 2.62%.

- The refinance rate on a 5/1 ARM is 2.593%.

- The refinance rate on a 7/1 ARM is 3.684%.

- The refinance rate on a 10/1 ARM is 4.018%.

Do I Need Cmhc Insurance

UnderOffice of the Superintendent of Financial Institutions regulations, you are required to purchase CMHC insurance if your down payment is below 20%.

You may beineligible for CMHC insuranceif:

- your purchase price is $1,000,000 or above, or

- your amortization period is longer than 25 years.

In these cases, you must make a down payment of 20% or higher.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

How Do I Pay Off A 30

There are a few ways to pay down a 30-year mortgage in 15 years. First, you could consider refinancing your current mortgage into a 15-year fixed mortgage. Another way is to make extra payments towards the principal amount or make biweekly payments equally one additional mortgage payment per year. This might not get you to the 15-year mark, but the amount of principal would most certainly go down.

Recommended Reading: How Much Per 1000 On Mortgage

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

Year Fixed Loan Options

The 15 year fixed is ideal for first-time home buyers, move-up buyers, or for refinancing your current mortgage. Loan options include:

- Purchase and Refinance

- Conventional

- Government-Insured

Many home buyers enjoy the advantages and many benefits a 15 year fixed mortgage affords. Ask us today how to get started!

Also Check: Can I Get A Mortgage With No Credit

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youâre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youâll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

How To Get A Low 15

If you want to lower the cost of homeownership, you can start by finding a way to lower your mortgage rate. The higher your mortgage rate, the more interest youll pay over the life of your home loan. Thats why its important to compare mortgage rates before committing to working with a specific lender.

The homebuyers who qualify for the lowest mortgage rates tend to have good credit scores. According to the FICO scoring model, youll likely need to have a credit score of at least 740 if you want access to the best rates. Of course, the exact credit score youll need to qualify for a 15-year fixed-rate mortgage will depend on the mortgage lender you choose to work with.

If your credit score isnt as high as it could be, it might be a good idea to work on improving your credit before you apply for a mortgage. Eliminating debt, paying bills every month on time and in full and keeping your below 30% are all things you can do to boost your credit score and put you in the best position to get a favorable mortgage rate.

While its possible to qualify for a mortgage with a low credit score , itll be more challenging and could result in a high interest rate. If this is your situation, your best bet might be to go for an FHA loan or a USDA loan. The former is designed for first-time homebuyers, while the latter is built for those buying a home in a rural area.

You May Like: How To Shop For Mortgage Refinance

What Are The Benefits Of A 15

The main advantages of a 15-year fixed mortgage are outlined below. An experienced U.S. Bank mortgage loan officer can help you learn more.

- Stability Youll be able to lock in the interest rate on your mortgage for the entire 15-year term. This gives you a degree of predictability you wont have with an adjustable-rate mortgage .

- Lower interest rate Interest rates on 15-year loans are usually lower than on 30-year loans.

- Less time to own your home With a 15-year term, youll pay off your loan in half the time of the more common 30-year term loan.

- Lower total cost of borrowing Between a lower interest rate and a shorter term, you’ll reduce the total interest you pay over the life of the loan.

How Your Interest Rate Is Determined

We can only showyou todays 15-year mortgage rates as averages. The rate you actually end uppaying will be determined by a large number of factors.

You can influencesome of the factors that determine you interest rate and get yourself a better deal.These include things like:

- The mortgage lender you choose

- Your credit score and credit report

- The size of your down payment

- Your debt-to-income ratio

- Your employment history

Of course, mortgageinterest rates also move up and down on a broader scale with the overallinterest rate market. Supply and demand for mortgage-backedsecurities will have a big impact on your rate.

But theres littleyou can do about that so focus on factors you can control, like yourloan-to-value ratio and credit score, if you want to save money.

Recommended Reading: When To Get Prequalified For A Mortgage

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenâor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisorâs mortgage rate tables to get the latest information.

The lower the rate, the less youâll pay on a mortgage. Todayâs rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youâre offered might be higher than what lenders advertise or what you see on rate tables.

If youâre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Are Interest Rate And Apr The Same

The terms interest rate and APR tend to be frequently confused, with many consumers believing that theyre one and the same . Its important to understand the differences so you understand exactly what youll be paying when it comes to your mortgage.

The interest rate is just that, the cost you’ll pay to borrow the money. The APR, on the other hand, includes the interest rate plus additional fees involved in obtaining the mortgage. These costs include any application fees, broker fees, discount points, and closing costs. It also factors in rebates you get back. The APR is usually expressed as a percentage.

Its because of these additional costs that the APR is greater than the interest rate. There are some exceptions, such as when a lender provides a rebate for a portion of the interest charged.

Don’t Miss: How Does A Reverse Mortgage Work When The Owner Dies

What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.