How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

What Is The Mortgage Qualifying Calculator

Our mortgage qualifying calculator was designed to help you determine how much you can borrow, how much income you need to qualify for your desired mortgage, and what your total monthly payment will be for the loan. The calculator uses information such as your mortgage rate, down payment, loan term, closing costs, property taxes, as well as homeowners insurance.

Determining the monthly mortgage payment that you qualify for is similar to determining the maximum mortgage loan you can afford. All you have to do is enter the value of your annual income and the length of your loan on the mortgage qualifying calculator, and it will display the monthly payment you should expect.

Yes, it is absolutely possible for you to get a mortgage on 20k a year. Assuming a loan term of 20 years with an interest rate of 4.5%, you would qualify for a mortgage that is worth $66,396, and a monthly payment of $467. Head on over to our mortgage qualifying calculator to find out what those amounts will be with different interest rates and loan terms.

With a total monthly payment of $500 every month for a loan term of 20 years and an interest rate of 4%, you can get a mortgage worth $72,553. Of course, this value might vary slightly, depending on the percentages of property tax and home insurance.

How Much Income Do I Need For A 200000 Mortgage

Lets say your ideal home is worth £225,000 and youre able to put up a £25,000 deposit. For a £200,000 mortgage youll need to earn a minimum of £44,500, though to be more comfortably offered this level of mortgage youd probably need to earn closer to £50,000 or above. Its also worth noting that this mortgage would equate to a loan-to-value of 88.9% in this scenario, which means first-time buyer mortgage dealswould be your best bet.

Need to work out your LTV, use our LTV calculator.

Recommended Reading: What’s A Conventional Mortgage

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

If I Make $50k A Year How Much House Can I Afford

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000.

Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Just to show you how much these different variables can affect your home buying power, take a look at a few examples below.

Read Also: Can You Refinance Mortgage Without A Job

How Much Income Do I Need For A $500 000 Mortgage

4.3/5mortgageincomeincome$500,000question here

To afford a house that costs $800,000 with a down payment of $160,000, you‘d need to earn $138,977 per year before tax. The monthly mortgage payment would be $3,243. Salary needed for 800,000 dollar mortgage.

Also, how much income do you need to qualify for a $200 000 mortgage? Example Required Income Levels at Various Home Loan Amounts

| Home Price |

|---|

| $76,918.59 |

Thereof, what’s the monthly payment on a $500 000 mortgage?

Monthly payments on a $500,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $2,387.08 a month, while a 15-year might cost $3,698.44 a month.

How much do I need to make to afford a 450k house?

A $450,000 loan for 30 years at 4% would cost about $2150/month. With taxes and insurance it’d be around $2650/month. Assuming no mortgage insurance and $2650/month as the payment, you’d need to make $102k per year. A lender will let you use about 31% of your gross income for a monthly payment.

can700can

| Home Price |

|---|

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Read Also: What Does It Mean Refinance Mortgage

Speak To An Expert Today

We understand that each situation is unique. If you would like a detailed insight into how much you could borrow on a mortgage from your household income, get in touch today.

Call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry here.

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. It costs nothing to make an enquiry and theres absolutely no obligation or marks on your credit rating.

Ask us a question

Want to know exactly how much you could borrow based on your income?Drop us a query with your exact income and we will have an expert broker answer any questions you have about how much you could borrow.

The Annual Salary Rule

The ideal mortgage size should be no more than three times your annual salary, says Reyes.

So if you make $60,000 per year, you should think twice before taking out a mortgage that’s more than $180,000. However, if you have a partner, and your combined income is $120,000, you can comfortably increase your loan amount to $360,000.

That’s not to say you should always opt for the most expensive mortgage you can qualify for. If you settle on something below your max, you’ll have more wiggle room to put money into a savings account or pay for other costs like home renovations.

Don’t Miss: How Much Is Mortgage On 1 Million

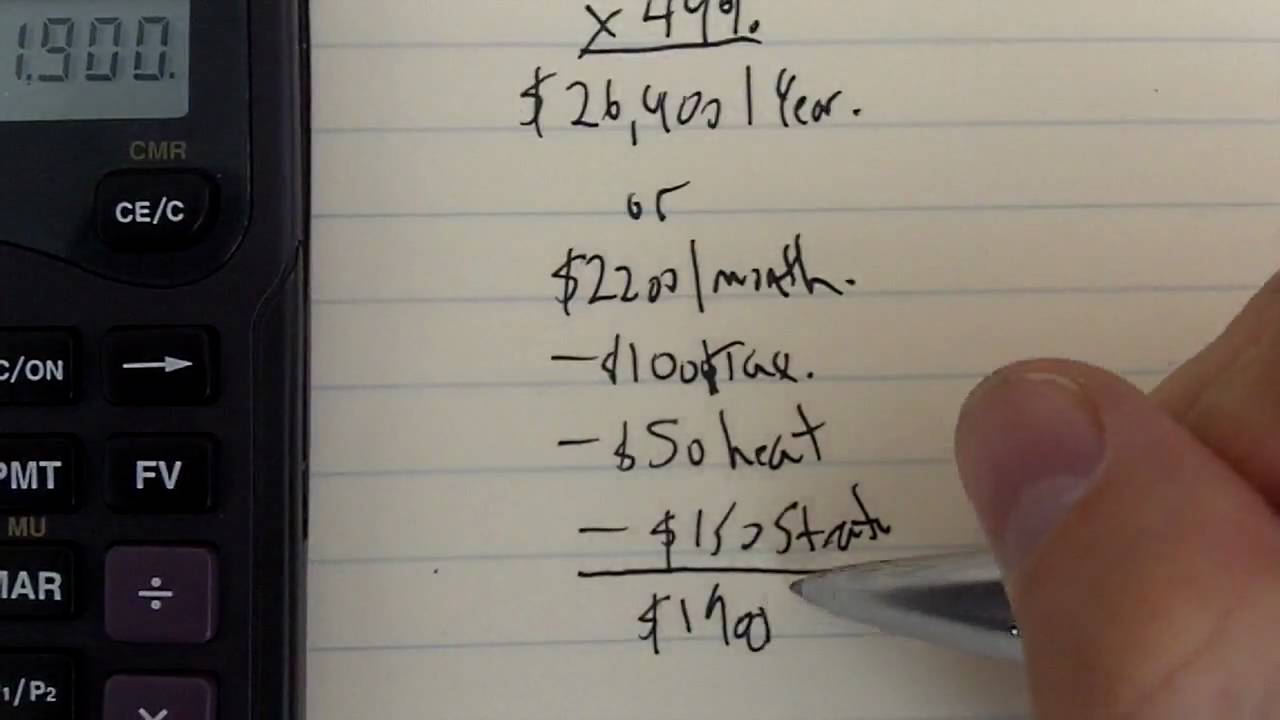

So What Actually Goes Into Your Mortgage

Instead of thinking of the price tag of a home as affordable, look at whether you can afford to borrow the money it will cost and can repay the loan in monthly payments.

First, lets figure out what your ideal mortgage payment will be also known as what youll essentially be paying instead of rent. Aside from the actual mortgage, there are some key expenses that will impact your monthly payments.

How Many Times Your Salary Can You Borrow For A Mortgage In 2021

How much youll need to earn for a particular size mortgage varies from lender to lender, and theyll often be more concerned about how much you can afford to pay back rather than a straight income calculation. That said, 4.5x your income is generally the maximum amount youll be able to borrow, so here we go through a few scenarios to help you get an idea of the amount you could be offered.

Don’t Miss: Does My Husband Have To Be On The Mortgage

Speak To An Expert On Mortgage Affordability

If you have questions and want to speak to an expert for the right advice, call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry online.

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. We dont charge a fee and theres absolutely no obligation or marks on your credit rating.

Ask a quick question

We can help!We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

Recommended Reading: What Banks Look For When Applying For A Mortgage

Where You Want To Buy

When it comes to real estate, its all about location, location, location especially when it comes to what you can afford. Every market and even every neighborhood within a market is different, and you can probably find a variety of price ranges where youre looking.

Its also good to keep in mind the property taxes youll be needing to pay depending on the state or city youre looking in and whether theres any additional home insurance youll need .

How Much Mortgage Can I Borrow On My Salary

Lots of potential homeowners come to us for advice about how much house they can afford based on the salary they earn. Most mortgage lenders will consider lending 4 or 4.5 times a borrowers income, so long as you meet their affordability criteria. In some cases, you could find lenders willing to go up to 5 times income.

In a few exceptional cases, you might be able to borrow as much as 6 or 7 times your income. Although to find lenders willing to lend at levels this high, its likely you will need help from a specialist mortgage broker.

According to the most recent Annual Survey of Hours and Earnings, the average annual salary in the UK is £28,677.

However, this amount is not representative of everyone and its important to know that even on a lower income, you may still be able to get a mortgage.

To find out how much you could get, make an enquiry. Well match you with an expert who can source the best mortgage loans for your circumstances via their whole-of-market access.

The following topics are covered below…

Don’t Miss: How To Pay Off A 200 000 Mortgage

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

How Much Mortgage Can I Afford If My Income Is $60000

Related Articles

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. That’s a $120,000 to $150,000 mortgage at $60,000. You also have to be able to afford the monthly mortgage payments, however. Lenders want your principal, interest, taxes and insurance referred to as PITI to be 28 percent or less of your gross monthly income. You can cover a $1,400 monthly PITI housing payment if your monthly income is $5,000.

You May Like: How To Market Yourself As A Mortgage Loan Officer

How Is My Affordability Calculated

Heres a breakdown of each factor impacting your home affordability and the limit it places on your asking price. Your affordability is the minimum of all the values shown.

| Limiting Factor |

|---|

| 1,207,0001.21m |

- Your down payment directly imposes a limit on your maximum asking price.

- UnderCMHC regulations, your total debt service ratio cannot exceed44%. The TDS ratio is calculated by dividing your total annual housing-related and debt expenses by your gross annual income. These expenses include:

- Yourmortgage payment

- Your property tax

- Half of your condo fees

- All forms of debt payments

Why Your Debttoincome Ratio Is Key

While many factors impact the amount you can borrow, your debttoincome ratio is essential to the equation.

DTI compares your monthly gross household income to the monthly payments you owe on all your debts including housing expenses. The standard maximum DTI for most mortgage lenders is 41 percent.

To achieve a 41 percent DTI with a $50,000 annual income , you couldnt exceed $1,700 a month in housing and other debt payments.

The less you spend on existing debt payments, the more home you can afford and viceversa.

Say $400 of your monthly debt payments go to a car loan, a student loan, and minimum payments on your credit card debt. In this case, you would have $1,300 to spend on housing.

With a $10,000 down payment and 4% interest rate, you could probably buy a home for a maximum price of around $200,000 and still have a $1,300 monthly payment.

If you had no existing monthly debts, you could spend $1,700 a month on your mortgage payment and still keep a 41 percent DTI.

In this case, your home buying budget would increase to about $300,000 even with the same $10,000 down and 4% interest rate.

Thats an additional $100K in home buying power all because of a reduction in your existing monthly expenses not an increase in your annual salary.

Frontend vs backend ratios

As you shop around between mortgage lenders, you may come across the terms frontend ratio and backend ratio.

Read Also: Who Is Rocket Mortgage Owned By

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.