How Much Is A Mortgage On A 200k House

4/5mortgageanswer here

To afford a house that costs $250,000 with a down payment of $50,000, you’d need to earn $43,430 per year before tax. The monthly mortgage payment would be $1,013. Salary needed for 250,000 dollar mortgage.

Additionally, how much is a 200 000 Mortgage A month UK? Monthly payments on a £200,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £954.83 a month, while a 15-year term might cost £1,479.38 a month. Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

Also to know, how much is a mortgage on a 250k house?

Your total interest on a $250,000 mortgageOn a 30-year mortgage with a 4% fixed interest rate, you’ll pay $179,673.77 in interest over the life of your loan. That’s about two-thirds of what you borrowed in interest.

What house can I afford on 40k a year?

3. The 36% Rule

Is 500k A Year Rich

$500,000 a year or higher is a level which I think is considered rich. Anybody who thinks otherwise has no concept of financial reality. Even the government agrees after compromising by raising the income level for when the highest marginal tax bracket kicks in to ~$400,000 from $200,000 back in 2013.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Read Also: How Much Is The Mortgage On A $300 000 House

Costs To Expect When Buying A Home In California

One of the costs youll want to consider during the home-buying process is a home inspection. Before you close the deal on a house, theres usually a period where you can arrange a home inspection to determine the state of the house and any potential problems with the property. If problems are found, you generally have some negotiating power over the seller for repairs or price. Typical costs range from $300 to $550, with larger houses falling on the higher end of the price range. Some types of mortgages will require additional tests such as termite inspections. Any additional services will cost extra, but may help you discover serious issues prior to moving in, such as a mold infestation. One last consideration for testing is radon. California doesnt have as high of risk for radon as some regions in the U.S. However, there are some areas, such as Tulare, that are depicted as having high concentrations of radon, according to the California Department of Conservations indoor radon potential map. Youll want to check to see if your property is in one of those high-risk areas.

If the inspection goes well and you set a closing date for the home, youll have to budget for the additional fees that are called closing costs. These costs vary based on the location and value of the home, your mortgage lender and a number of other factors. On a county to county basis, closing costs in California range from 0.81% to 2.57% of your home’s value.

Mortgages For The Self

Being self-employed is certainly not a barrier to home-ownership, but you may need to look for a specialist lender to get the best rates on a £200,000 mortgage. More conventional lenders often look at self-employed applicants as non-standard, and thus higher risk.

You can read more about self-employed mortgages here.

Also Check: How Long Does Fha Mortgage Insurance Last

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Today’s Mortgage Rates In Minnesota

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Don’t Miss: Should I Refinance My 30 Year Mortgage

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Costs To Expect When Buying A Home In Minnesota

If youre still in the initial stages of home-buying planning, youll want to consider some of the one-time upfront costs. One of the first costs youll come across is a home inspection. This is when you find a home youd like to buy. Generally most buyers will arrange for a home inspection after putting in an offer on the house, but some buyers will negotiate for a pre-offer inspection. Whichever you choose, the cost is the same. Most home inspections run between about $350 and $500, and depend on the size and type of home. Smaller square footage dwellings and condos generally are on the lower end of the scale. While a home inspection covers structural system, roof, plumbing, electrical and more, it wont cover specialties such as radon, termite damage or mold. If youd like to arrange additional tests, it will cost you extra and is optional.

One of the last costs youll factor in is a bundle of service fees and charges known as closing costs. These fees are for your mortgage lender, the state and county and a number of other entities, depending on who was involved in the mortgage and buying process. The exact sum depends on a number of factors, and youll pay it on the day you finalize paperwork and get keys to the property.

Recommended Reading: What Documents Do I Need To Get A Mortgage

Can I Buy A House With 20k Income

The DTI is the total house payment including taxes, insurance and mortgage insurance if any, plus any debt payments, divided by your gross monthly income. Lenders can approve conventional loans with a DTI up to 50%. You have no debt and a 3% down payment. Youll qualify for a home of about $200,000.

How Much Is A Mortgage On A 200 000 House

200,000mortgage

Monthly payments on a $200,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $954.83 a month, while a 15-year might cost $1,479.38 a month.

Secondly, how much is the monthly payment for a 250 000 Mortgage? Mortgage Loan of $250,000 for 30 years at 3.75%

| Month |

|---|

| 380.08 |

Accordingly, how much money do you need to buy a 200 000 House?

Total cash needed to buy a $200,000 home is roughly $16,250 which is about 8% of the purchase price. The monthly payment would be $1,400 per month including escrow.

How much house can I buy for 2500 a month?

On the left column is paying rent of $2,500 a month. On the right column, you can purchase a property for $435,000 with only 5% down, with a 4.25% 30-year fixed rate with No monthly PMI. The total monthly mortgage payment is $2,470 a month.

Read Also: How To Get Assistance With Mortgage Payments

Local Economic Factors In California

While the West Coast is attractive to many with its long stretches of coastline, warm weather and plethora of exciting cities, it comes at a price: high taxes. California’s taxes are some of the highest in the U.S., with a base sales tax rate of 7.25% and a top marginal income tax rate of 13.3%.

Although the Golden State has high taxes, it does play host to a number of bustling industries. Data from Statista.com shows the state has the second-most Fortune 500 company headquarters at 53, which is only one behind the top state, New York, which has 54 companies.

Some of the most notable employers in the state include Apple, Chevron, Alphabet, Intel, Disney and Oracle. Of course, California is well-known for Silicon Valley, home to many startups and tech companies. Los Angeles, home of Hollywood, is key in the entertainment industry which is another large source of revenue. Theres also a number of military bases in the state in the San Diego area as well as northern California. And for tourism, the wine region of Napa Valley is a huge draw for many out-of-state visitors, as well as native Californians.

In December 2020, the overall unemployment rate for California was 9% compared to the national rate of 6.7%, according to the Bureau of Labor Statistics. However, California’s per capita personal income in 2019 was $66,619, while the national average was $56,490, based on data from the U.S. Bureau of Economic Analysis.

Mortgage Legal Issues In California

One benefit of buying a property in California is its buyers protections. The state was at the forefront of abandoning the caveat emptor rule, also known as buyer beware, in real estate transactions. This means that sellers are required to disclose any issues or defects with the property on an extensive transfer disclosure statement that both the seller and real estate broker are required to sign. California, unlike many other states, has these rules backed by law. Its not an optional disclosure, its mandatory.

The state also runs the Department of Consumer Affairs Bureau of Real Estate. This entity was created to protect public interest and increase consumer awareness in real estate transactions. You can visit its website to read information on the homebuying process, loan modification or foreclosure prevention, verify a real estate license, find answers to frequently asked questions and find who to call for complaints.

When a judicial foreclosure occurs , the process is much slower as the court is involved. The benefit to this process is that the homeowner has the right of redemption. This right allows the homeowner to buy the property back up to one year after the auction. However, with a judicial foreclosure, a lender can get a deficiency judgement which allows the lender to pursue the full mortgage amount from the borrower.

Recommended Reading: How Much Is Mortgage Tax In Ny

How Much Is The Monthly Interest On A 200000 Mortgage

Below you can see how a repayment mortgage compares with an interest-only mortgage, based on monthly payments and a term of 25 years.

The lower column illustrates how much monthly interest you would pay on a £200k mortgage at various interest rates.

| Interest Rate | |

| £666 | £834 |

For more accurate figures, or if you want to see if a repayment mortgage might be right for you, drop us a line. Well connect you with an expert who can help you see if this is the best fit for you.

Can You Borrow With Your Current Income

Though you may feel that your finances are ready for a new home, the bank may not feel the same way. Mortgage lenders use a complex set of criteria to determine whether you qualify for a home loan and how much you qualify for, including your income, the price of the home, and your other debts.

The pre-qualification process can provide you with a pretty good idea of how much home lenders think you can afford given your current salary, but you can also come up with some figures on your own by learning the criteria that lenders use to evaluate you.

Also Check: What Is A 30 Year Fixed Jumbo Mortgage Rate

How Much Would A $200k Mortgage Cost

So you are considering getting a $200k mortgage but want to know what it will end up costing you.

There are many aspects to consider when applying for a $200,000 mortgage. This includes the down payment, interest rate, mortgage length, and monthly payments.

A 15-year $200k mortgage could save you a considerable amount of money compared to a 30-year mortgage when taking interest into account.

Below you will find how much you could expect to pay each month with various interest rates. On top of that, you will also find the different down payment options explained in detail so you can choose the best way to go about getting a $200,000 mortgage.

This post may contain affiliate links. For more information, see our disclosure policy.

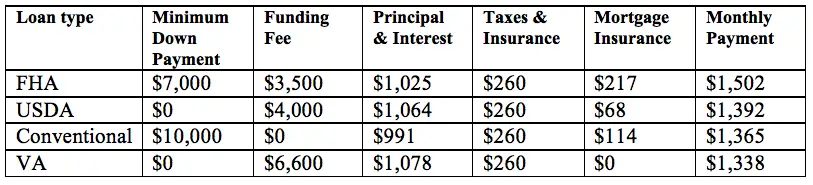

What Are The Different Loans And Programs For First

While the 28/36 rule applies most conventional mortgage lenders, certain programs designed to help first-time homebuyers, veterans and certain low-income home buyers allow some exceptions:

- Mortgages backed by the Federal Housing Administration, known as FHA loans, are designed to help first-time homebuyers qualify for mortgages and allow back-end DTIs of up to 43%.

- Mortgages known as VA Loans, issued through the U.S. Department of Veterans Affairs, are geared toward veterans, service members and qualifying spouses, and allow back-end DTIs of 41%.

- The maximum back-end DTI allowed on USDA Loansmortgages issued under guidelines set by the U.S. Department of Agriculture to help low-income borrowers buy homes in certain rural areasis 46%.

- State and national programs designed to assist with homeownership may be able to help if you’re having trouble meeting the down-payment requirements for a loan, or if your income falls below the level needed to secure some conventional loans.

The factors that determine the amount of a monthly mortgage loan, including your credit score and history and down payment amount, along with your monthly non-housing debt expenses, play a major role in determining how much income you’ll need to afford a mortgage. Understanding DTI and the 28/36 rule can help you anticipate your needs and plan for the mortgage-application process.

If you need to improve your DTI, there are two things you can do:

Don’t Miss: How To Determine Ltv Mortgage

How Much Did You Save Before Buying A House

How Long Will It Take to Save for a House? Saving 20% of your income could catapult you into purchasing a home in the next one to three years, depending on your market. For example, if youre earning $96,000 per year, thats $19,200 saved after one year. Its $38,400 after two years and $57,600 after three.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Don’t Miss: What Banks Look For When Applying For A Mortgage