Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Why You Should Speak To An Expert Broker If Youre Looking For A 15 Million Mortgage

At Online Mortgage Advisor we can offer you a first-class service tailored to your own specific needs with access to the most experienced brokers available that:

- Have whole of market access

- Have excellent relationships with specialist high value mortgage lenders

- Are OMA accredited advisors

- Have completed a 12 module LIBF accredited training course

In fact our clients consistently rate us 5 stars on Feefo for the level of service and successful outcomes we provide.

How Much Mortgage Can I Afford

While the idea of buying a house may sound fun, the actual securing of a mortgage usually isnt. Pretty much nobody looks forward to the day they take out a mortgage. Rarely do you hear someone talk about how much they enjoy going through the mortgage process. Theres good reason for this: taking out a mortgage can be a painful, laborious, even depressing endeavor . All the more incentive to make enough money that you dont even need a mortgage. Odds are, though, youre not in that lucky minority. So instead, were here to help make the process a little easier. Well walk you through the answer to that all-important question, How much mortgage can I afford?

Read Also: What Is Mortgage Insurance For Fha Loan

Asymmetric Risk And Reward

In America, when you borrow a ton of money from a bank and cant pay it back one day, you dont get stoned to death. Instead, you hand back the keys to the bank. After all, your bank agreed to take on your home as collateral in case of non payment.

If you are lucky to live in a non-recourse state, the bank cant go after your other assets! If you live in a recourse state, then a short-sale or foreclosure will temporarily slaughter your credit score for 3-7 years. Better your credit score then your private parts right?

Meanwhile, if you happen to invest in the right cycle, you can make a massive amount of money when you finally sell or rent the property out. Further, you dont have to give the bank any of the upside! Isnt America great?

Can I Get A 1000000 Mortgage For A Buy

One million pound buy-to-let mortgages are out there, but the terms can be different.

As a general rule, lenders view buy-to-let as higher risk, and will expect you to put down a larger deposit. 25% deposit is fairly standard, though some of them will go down to 15% if circumstances are right. A private bank might be more flexible.

Minimum income requirements can also be a factor, especially with high street lenders. Many mainstream lenders wont offer a BTL mortgage to anyone who earns less than £25k though some of them will decide based upon the projected rental yields, with 125-130% of the mortgage payments being the general minimum.

Some private lenders will decide by factoring in additional income. For example, it may be possible to get a mortgage with bonus income factored in, or perhaps capital from property, savings or pensions.

A great many buy-to-let mortgages are interest-only, so keep reading to see what an interest-only mortgage on £1,000,000 might look like.

You May Like: Who Should You Get A Mortgage From

What Are Your Total Ongoing Housing Costs

You can use a mortgage calculator to find out how big of a mortgage you could get and still keep your payments below 30% of monthly income. This lets you know the maximum mortgage you can afford, which in turn determines how much house you can buy.

You also need to look beyond just the monthly check you’ll write to a mortgage lender because there are many other costs associated with owning and maintaining a home. These include:

- Property taxes and insurance: Bigger homes that are worth more money cost more to insure, and property taxes are higher.

- Utilities: A bigger house means more electricity, a larger septic system, or other added utility costs.

- Maintenance and repairs: You generally should plan to budget around 1% of your home’s value for maintenance and repairs per year.

- Homeowners’ association dues: If you live in a neighborhood with an HOA or a condo with association fees, you’ll need to budget for these. Find out the rules for when the dues can rise and circumstances under which a “special assessment” could be made, as this could mean a really big bill.

Ask your realtor to obtain information about all of these costs for any home you’re looking at so you can see if you can afford it.

For example, if you bought a $300,000 home, at 4% interest, you should have a $240,000 mortgage — assuming a 20% down payment — and your monthly payment would be $1,146.

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee

Read Also: How To Lower My Mortgage

Speak To A High Net Worth Mortgage Expert

If you have questions and want to speak to an expert for the right advice, call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry here.

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. We dont charge a fee and theres absolutely no obligation or marks on your credit rating.

Ask us a question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Down Payments On A 1 Million Dollar Home

It is important to remember that most conventional loans have a maximum amount that can be borrowed. According to BankRate, the maximum amount is $484,850 as of 2019, although in some specific locations, the amount available rises to over $700,000. In either case, the only way to receive a conventional loan would then be to make a down payment of over $300,000 in some areas and over $500,000 in the rest.

Since many people will stick to the average 20% down payment, they will have to qualify for a jumbo loan instead. These come with stricter requirements.

Anything less than a 20% down payment might subject your loan to private mortgage insurance. This can be an additional cost 0.5% to 1% of the home price each year .

Also Check: How To Get A 15 Year Fixed Mortgage

What Deposit Will I Need For A One And A Half Million Mortgage

The amount of deposit you have has a very strong bearing on both your repayments and the chances of your mortgage being approved.

Lenders will be looking at your loan to value the lower the loan to value, the less of a risk you will be perceived, and the higher the deposit, the lower the repayments.

The repayments below show how a higher deposit on a property worth £2 million, can affect your monthly repayments. The figures are based on 3.5% over 25 years.

| Loan to Value | |

|---|---|

| £5,008 | £2,919 |

The above is for indicative purposes only and you should always check with your lender or one of the advisors we work with for the most up-to-date information.

All lenders are different and the amount of deposit they require will differ. Mortgages of this amount require specialist lenders and the advisors we work with have an established relationship with these companies. For the best deal, talk to one of our advisors today.

The Ideal Mortgage Amount Is $750000

Updated: by Financial Samurai

The ideal mortgage amount was $1,000,000 before the Tax Cut & Jobs Act was passed for 2018 and beyond.

The reason why $1,000,000 was ideal was because that was the mortgage limit for where you can write off the interest. Today, that ideal mortgage amount is $750,000 because $750,000 is the maximum mortgage you can take to be able to write off the mortgage interest.

Back in 2002, a $1 million mortgage cost around $50,000 to $65,000 a year in interest expense given mortgage rates were 5%-6.5% for a 5/1 ARM or a 30-year fixed. Multiply the annual interest expense by three, and you get $150,000-$195,000, the minimum annual income recommended to take out such a loan.

In 2021, a $1 million mortgage costs around $20,000 to $30,000 a year in interest expense given mortgage rates are now 2% 3% for an ARM or for a 30-year fixed. Interest rates plummeted to all-time lows due to coronavirus fears. However, interest rates are finally ticking back up as the economy reopens.

Multiply the annual interest expense by three again and you get $60,000 to $90,000, a far cry from the $150,000 $195,000 in income you originally needed to make! As a result, buying real estate looks attractive in 2021+ because affordability has gone way up! You no longer need as high of an income to afford the same property.

Recommended Reading: How Much Should Your Mortgage Be In Relation To Income

Income To Afford A Milliondollar Home

As we said above, income is just one factor in your home buying budget.

The purchase price you can afford also depends on your:

- Debttoincome ratio

- Down payment amount

- Mortgage rate

We experimented with a few of these factors using our home affordability calculator to show you how much each one can affect your budget.

Prime borrower $147,000 income needed

Our first example looks at a traditional prime borrower. They have:

- A 20% down payment

- Only $250 in preexisting monthly debts

- An excellent mortgage rate of 2.75%

This borrower can afford a $1 million dollar house with a salary of $147,000. Their monthly mortgage payment would be about $4,100.

High DTI $224,000 income needed

Lets leave everything else the same as in the first example, but increase the borrower’s monthly debt payments to $2,500.

For those paying multiple child support and alimony payments, that might be more realistic, even if their debts are only average.

And others have that level of debt payment even without family commitments. Think luxury car, boat, motorhome, and other bigticket toys.

In this scenario, the income needed to afford a home costing 1.031 million would be $224,000.

To afford this home, youd need a slightly higher down payment of $214,000. And monthly payments would cost about $4,220.

Clearly, existing debts make a big difference in home affordability. Your salary needs to be $77,000 higher to buy a similarlypriced home.

Lower credit $224,000 income needed

How Much Do You Have To Make To Afford A $1 Million Dollar Home

On the low end, you will need to make $140,000 per year to afford a million-dollar home. You will also have to have great credit and no debt.

If you have additional debt, you will need to make more money and as much as $200,000.

Dont forget the down payment which will be around $200,000 and your monthly mortgage of about $5,000.

Don’t Miss: Can You Take A Cosigner Off A Mortgage

Analyze Your Monthly Expenses

When estimating what you can afford, its also important to have a clear view of your monthly expenses. These can be hard to track and will likely vary based on the size of your household and your spending habits. According to the Bureau of Labor Statistics, the average individual has monthly expenditures that include:

- Food: $644

- Internet: $47

- Cell phone: $120

For an individual, these expenses add up to a monthly total of $2,463. Some of these items are discretionary and will fluctuate based on your lifestyle, city, the size of your home, and the size of your family. The goal is to estimate how much money youll need to spend each month after you pay your mortgage and other debts.

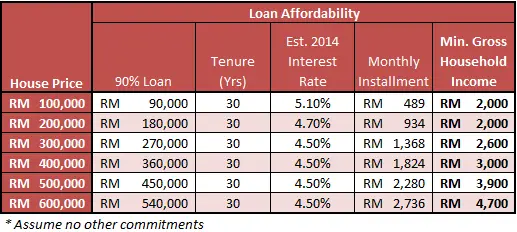

How Much House Can I Afford Home Affordability Calculator

To determine how much house you can afford, use this home affordability calculator to get an estimate of the property price you can afford based upon your income and debt profile. Generally, lenders cap the maximum monthly housing allowance to lesser of Front End Ratio and Back End Ratio .

Prequalifying for a mortgage is simple, and is intended to give you a working idea of how much mortgage you can afford. Combine this amount with your down payment, and you’ll answer your question of how much house can I afford? This is not the same as being preapproved for a loan, which involves placing an application and providing documentation to a lender.

Remember — this is just a guide. Your final amount will vary depending on a number of factors, especially interest rate, which will be based on your credit score. When you’re ready, a lender can give you a more exacting figure.

You May Like: Can A Locked Mortgage Rate Be Changed

How A Rental Suite Affects Your Mortgage Qualification

To see how much difference the change in rental income makes, lets run through an example.

GDS = /Gross household income + Gross rental income x 100

P = Mortgage Principal

I = Mortgage Interest

T = Property Taxes H = Heating

For example, if you have an annual mortgage payment of $17,400, property taxes of $3,000, heating bill of $1,320, gross household income of $72,000, and gross rental income of $9,600, your GDS under the old rules would be:

GDS = / $72,000 + x 100 = 28.28%

Under the new rules your GDS would be:

GDS = / $72,000 + $9,600 x 100 = 26.62%

Since your GDS ratio is lower under the new rules, youll be able to qualify for a higher mortgage and buy a more expensive home.

Speak To A Mortgage Expert

As you can see from the details here, getting a million pound mortgage works in very similar ways to any other amount. Its really a case of finding the right lender who can offer the best terms that match with your requirements .

This is where we can help. The advisors we work with can offer the expert knowledge and advice you need, tailored to your own circumstances. Call us on 0808 189 2301 or make an enquiry to get started.

Don’t Miss: What Score Do Mortgage Companies Use

Down Payment On A $1 Million Home

Most jumbo mortgages require a 20-30% down payment. For a $1 million home, that translates to $200,000-300,000.

Note that criteria will vary by lender. You may be able to secure a jumbo mortgage with a smaller down payment, depending on your overall financial situation.

However, there’s a tradeoff:

If you put less money down, your monthly payment will go up, and you’ll pay more interest over the long term.

Moreover, if your down payment is smaller than 20%, your lender will likely require you to purchase private mortgage insurance , which protectsthem if you default on your loan. PMI premiums could hike your total housing costs by hundreds of dollars per month.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Don’t Miss: How To Get A Million Dollar Mortgage

What It Takes To Get A Million

Even if the mortgage rates today are favorable, youll have to meet certain requirements set by jumbo loan lenders if you want to get a mortgage on a million-dollar home. Jumbo mortgage lenders have their own guidelines for lending, which can differ from guidelines for standard conforming loans. A conforming loan a loan that meets guidelines set by Fannie Mae and Freddie Mac, which buy this kind of loan from financial institutions is for a mortgage thats usually less than $424,100 but can go as high as $636,150 in certain high-priced markets. Those amounts will increase to $453,100 and $679,650 in 2018. Jumbo loans are loans that exceed the limits of what Fannie Mae and Freddie Mac are allowed by law to purchase.

Reviewing different lenders specific requirements could help you find the best lender for your needs. Here are common criteria youll need to fulfill in order to qualify for a jumbo loan.

Learn: How to Save for a House While Renting