How Can I Get Something Wrong On My Credit Report Removed

If you think that information on your credit report is wrong, you have the right to dispute it with the company that has registered the error. This can sometimes be a tedious process but errors on credit reports can delay mortgage applications and can exclude you from access to the best rates.

If you decide to seek help from a mortgage broker, youll be happy to know that they can assist with helping you to get bad credit removed from your record as well as advising you on how to improve your score with the CRAs in the UK.

Keep Your Balances Low

Keeping your balances low on your credit cards can help your credit utilization rate, or how much of your available credit youre using at any given time.

The usual advice is to keep your balance below 30% of your limit. Thats a good rule of thumb and a nice round number to commit to memory. But if you can manage to keep your utilization rate lower than 30%, thats even better.

Theres no credit-building benefit to carrying a balance on your cards if you can afford to pay off the full balance each billing cycle. When it comes to credit-building strategies, its best to make consistent charges to the account while keeping the total amount owed under 30% of your credit limit. If you can, pay your statement balance off in full and on time each month so you arent charged interest on those purchases.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Don’t Miss: What Is Loss Mitigation Mortgage

How To Improve A 575 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Don’t Miss: What Do I Need To Become A Mortgage Broker

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

You May Like: Who Should You Get A Mortgage From

Credit Score Credit Card & Loan Options

Many lenders choose not to lend to borrowers with scores in the Poor range. As a result, your financing options are going to be very limited. With a score of 575, your focus should be on building your credit and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

Re: Need A Va Loan With A 575 Credit Score

Well from what I was told by a broker that the VA do not have a minimum credit requirement, it’s the lenders that determine the credit score requirement. He has a repossession for $2300 from 2014 and a T-Mobile bill for $100 that’s on his report, which T-mobile says they have no record of him owing them anything. We did not pay off the repo because the broker said not to at this time because it would lower is credit score.

Also Check: What Credit Agency Do Mortgage Lenders Use

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

You May Like: Can I Use My Partner’s Income For A Mortgage

What Credit Card Can I Get With A 575 Credit Score

You might have a hard time getting approved for a credit card with poor credit scores.

The good news is, Credit Karma can help. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds arent a guarantee that youll be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

What Is A Heloc

MISHKANET.COM” alt=”550 credit score auto loan > MISHKANET.COM”>

MISHKANET.COM” alt=”550 credit score auto loan > MISHKANET.COM”> A HELOC is a line of credit that operates similar to a credit card. As with a home equity loan, your home is the collateral that secures the loan. This loan product lets you borrow money on an as-needed basis. At the beginning of the loan, theres a draw period that typically lasts for 10 years. During this draw period, youre responsible for making interest-only payments.

However, once the draw period ends, youre required to begin making payments toward the interest and principal portion of the remaining balance. Also, if you sell your home during the loans term, youll have to pay off the remaining balance in full.

Unlike home equity loans, HELOCs typically have variable interest rates. To secure the best interest rate, you need to have a good to excellent credit score, a good debt-to-income ratio and a healthy income.

Also Check: What Banks Look For When Applying For A Mortgage

What Is Considered A Good Credit Score

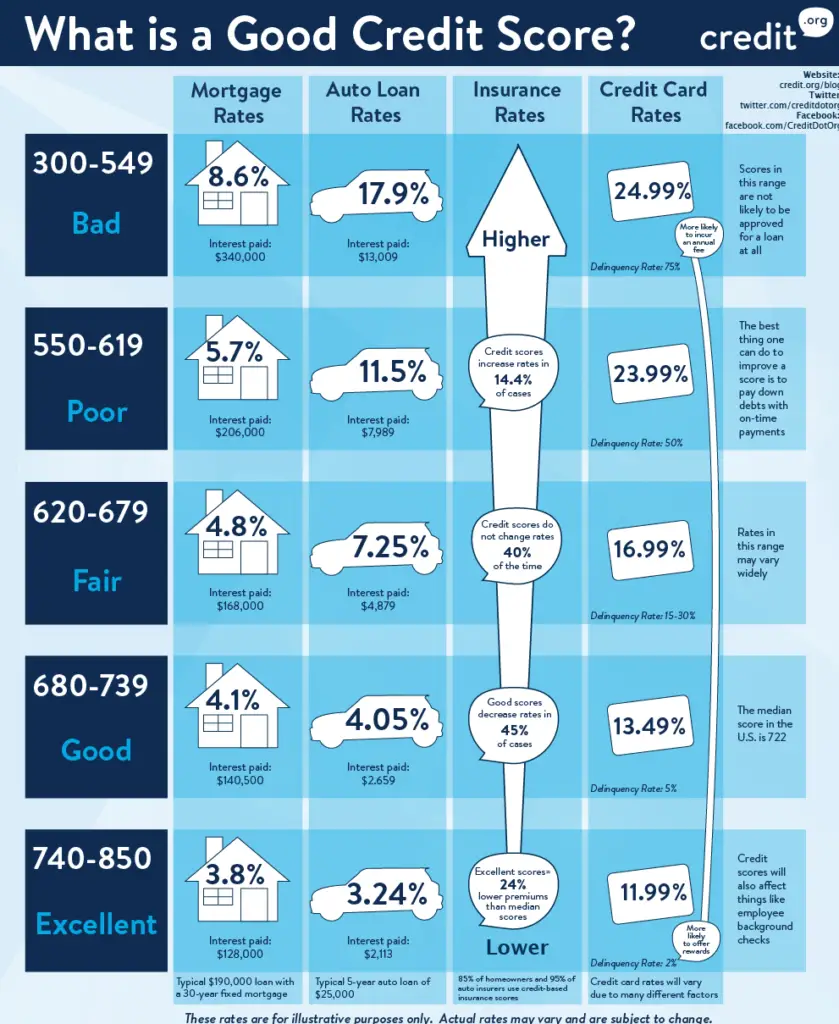

If you do know your credit score, you might be trying to figure out the scale and whether or not your number is good. Credit scores fall anywhere from âvery poorâ to âexcellentâ within the following ranges:

- Very Poor Credit: 300-499

- Good Credit: 661-780

- Excellent Credit: 781-850

If your credit score is not entirely up to par, there are some ways to improve the number. First and foremost, always check your credit report for any inaccuracies. Incorrect info can bring your score down, and correcting information can instantly boost your score. Paying bills on time, maintaining low balances on revolving credit, and keeping low balance-to-limit ratios can go a long way in maintaining a healthy credit score.

Your credit score is not a number to be ignored. Itâll be a massive factor in whether or not youâll be holding keys to a new home in 2020, so be sure youâre taking the necessary steps to keep it lookinâ sound.

Get A Statement From Your Employer

If you are concerned about your chances at qualifying for a loan, another thing you can do is ask your supervisor or your HR department to write a statement on your behalf. Explain the situation to them, and ask them to prepare or even just sign a statement that gives your current job title, your length of employment, and your current salary.

Lenders like to see a solid employment history with the same company or within the same industry for at least 2 years. If you can provide this information, youll have a better chance of convincing a lender to work with you despite your lower credit score.

We talked to a large group of homeowners with approved mortgages to find out if they used any alternative means or methods to prove their creditworthiness. As you can see, a letter from an employer is a popular method, with 30% of approved borrowers with a 550 credit score utilizing this strategy. Even individuals with excellent credit at times need additional documentation in order to qualify for a home loan.

Home Buyers with Poor Credit Proving Credit Trustworthiness

| 41% | 12% |

Recommended Reading: Is 720 A Good Credit Score For Mortgage

Can I Get A Loan With A 570 Credit Score

4.4/5Can I GetLoan570 Credit Scoreloansloanget570 credit score

Subsequently, one may also ask, can I get a personal loan with a 570 credit score?

Personal Consumer Loans Qualifying Income – Not A 570 – 579 VantageScore. To qualify for a personal loan with a FICO score of 572, 573, or 575, you will need to provide proof of your monthly income. To get approved, you will need to provide proof of your income, which can be done in many ways.

Furthermore, can you get a personal loan with a credit score of 550? It’s very difficult to get an unsecured personal loan with a credit score under 550 on your own, without the help of a co-signer whose is higher. Even the loans with the most lenient approval standards require a of 585.

Hereof, can I get car loan with 570 credit score?

of 570: Car LoansBuying a car with a of 570 is possible, but you’re most likely going to have an extremely high interest rate and will need repair services.

Can I get a loan with a credit score of 575?

For most mortgages you need to be above a 620 , but there are a few loans out there that go down to 575 for FHA. However, other parameters get harder , so it makes it pretty hard to qualify below 620. Let’s say that you may qualify for a FHA loan with a credit score of 575.

Best For Good Credit: Manufacturedhomeloan

ManufacturedHome.Loan

For borrowers with good credit scores, ManufacturedHome.Loan features competitive rates and programs for first-time home buyers.

-

Strong mortgage offers for applicants that meet credit/income standards

-

First-time homebuyer programs

-

Can finance homes in a mobile home park

-

Can finance mobile homes as vacation homes

-

Most efficient way to get pre-qualified is through an online form

Founded in Irvine, California, ManufacturedHome.Loan is a licensed nationwide mortgage broker. Therefore, as a broker with hundreds of financial institutions and private equity lenders to choose from, the company can shop for the lowest rates and best terms for you. As a result, MHL is our best for borrowers with good credit because it can save you time and shop on your behalf for the most competitive rates and terms in the nation.

MHL can finance new or used mobile homes for purchase or refinance. While most mobile home lenders will only lend to you for your primary residence, and even then, only if you also own the land, and with good credit above 700, MHL can expand your options. You could finance a vacation home or buy a mobile home in a park where you lease the land.

While MHL is best for borrowers with good credit scores above 700 because they can provide more options and flexibility, it also uses government-backed programs that support credit scores in the 600s, such as VA and FHA.

Also Check: What Is The Mortgage Rate In Florida

How Long Does It Take To Get A 575 Credit Score

It depends where you started out.

If you had great credit starting out, this score may take some time to reach, requiring many bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Conventional Loans: Minimum Credit Score 620

Non-government conventional mortgage loans charge higherinterest rates and fees forborrowers with lowcredit scores.

Fannie Mae and Freddie Mac, the agencies thatadminister most of the conventional loans in the U.S., charge loan-level priceadjustments, or LLPAs.

These fees are based on two loan factors:

- Loan-to-value: the ratio between the loan amount and home value

As LTV rises and credit score falls, the fee goes up.

For instance, a borrower with 20% down and a 700credit score will pay 1.25% of the loan amount in LLPAs.

An applicant with a 640 score and 10% downwill be charged a fee of 2.75%.

Thesefees translate to higher interest rates for borrowers. That means lower-creditscore applicants will have higher monthly payments and pay more interest overthe life of the loan.

The majority of lenders will require homeowners tohave a minimum credit score of 620 in order to qualify for a conventional loan.

But although conventional loans are available tolower-credit applicants, their fees often means FHA loans end up being cheaperfor borrowers with bad credit scores.

You May Like: What Does A Mortgage Consist Of

Learn More About Fha Loans

For more on FHA loans including the advantages of the FHA option and how it works, we invite you to explore your FHA loan options.

If youd like to see how FHA or another mortgage option could work for you, you can apply online with Rocket Mortgage® or give one of our Home Loan Experts a call at 785-4788.

Why Should I Check My Credit Score Before Applying For A Mortgage

Some soon-to-be borrowers make the mistake of applying for loan or mortgage products without knowing their credit score and their chosen lenders stance on whether theyll lend to someone with their circumstances.

Always check your eligibility before applying for any line of credit to avoid damaging your credit report. Lenders can see your previous loan applications when accessing your credit report and a recent rejection for credit can hinder your ability to get approved for a future loan.

Don’t Miss: What Mortgage Can You Afford Based On Salary

Apply For A Mobile Home Loan

Before you apply for a mobile home loan, there are a few steps youll need to take. You should first obtain an estimate for the loan amount you need, which will depend on the total cost of the mobile home youre interested in purchasing or building. Youll also need to decide on what type of mobile home loan you want to pursue. Some government-backed loan programs like VA or FHA loans, may have lower down payment requirements.

Before you apply for a loan, you should make sure that you have enough saved up for a down payment and that you meet certain minimum credit score and debt to income ratio requirements. If possible, you should see if there are any loans that you can pre-qualify for without affecting your credit. Be sure to secure quotes from multiple different lenders so that you can compare rates and get the best deal possible.

Best For Manufacturers Financing: Vanderbilt Mortgage And Finance

Vanderbilt Mortgage and Finance, Inc.

- Starting interest rate: Varies

Vanderbilt Mortgage and Finance partners with Clayton homes to offer affordable mobile home loans with an easy application process.

-

Limited information available online

Vanderbilt Mortgage and Finance, Inc., is a Berkshire Hathaway Company and one of the partner financing companies of Clayton Homes. This lenders partnership integration with Clayton Homes earned it our top choice for borrowers who want manufacturers financing.

Vanderbilt is a national housing lender that provides a number of home loan programs. It primarily focuses on the manufactured housing sector, offering loans for new and used modular homes. It has serviced over 175,000 loans in its more than 40 years of service. It also provides traditional home loans.

The company offers fixed and adjustable rate mortgages in a very wide range amounts. In most states, as big as the government will allow.

The company offers purchase, fixed, adjustable, and FHA mortgages, with loans starting as low as $75,000 and as high as the government programs allow, typically over $600,000 in most states. The preferred maximum debt-to-income ratio is in the low 40% range.

The typical underwriting process takes four to six weeks for home and land financing. If you are financing just the home, It generally takes only two weeks.

Read Also: Can You Apply For A Mortgage Before Finding A House