Fha Loan Income Requirements

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If you’re in the market for a home, you may have heard of the FHA mortgage loan. If so, you’re probably curious about what an FHA home loan has to offer. Here, we’ll cover everything you need to know about FHA loans, including:

- FHA loan income requirements

- How an FHA loan compares to a conventional mortgage

- The credit score required to land an FHA mortgage

- How the FHA loan program can work for you

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Increasing Your Down Payment Can Afford You More

If you are able to increase your down payment to 20% you wont have to pay mortgage default insurance and your monthly payments will decrease allowing you to afford more. There are other ways to increase your down payment that we discuss in our Step-by-Step Guide to Saving for a Down Payment.

Ways you can increase your down payment:

- Using the Home Buyers Plan, which allows first-time home buyers to loan themselves funds from their RRSPs

- Using funds from your Tax-Free Savings Account

- Getting a gifted down payment from the bank of Mom & Dad

Be sure to use our Mortgage Affordability Calculator along with the Gross Debt and Total Debt Service equations from above to help you with your budget. When youre ready, book a call with us to discuss your unique financial situation so we can take you one step closer to homeownership!

You May Like: Are Mortgage Discount Points Worth It

How Much Are Closing Costs On An Fha Mortgage

Once you’ve made it to the closing table, plan to spend anywhere from 2% to 5% of the loan amount on closing costs. Closing costs are the fees you pay at the time the property title is turned over to you. It’s when you become the official homeowner.

Your actual costs will be determined by various factors, like:

- The loan amount

Build Your Credit Score

Another key piece of determining if you have the income required for a mortgage is to make sure your credit score is in good standing. A good credit score puts you in a likeable spotlight. It proves your responsibility towards debt. Even if you didnt have a good history with credit in the past, its not so difficult to rebuild a good score.

Heres a good resource on how to build your credit score for a great mortgage.

Read Also: What Banks Look For When Applying For A Mortgage

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Cleaning Up Your Creidt Profile

- Be sure you check your credit report 6 months in advance of purchase consideration so you can clear up any outstanding issues like missed payments or identity theft.

- If you have significant credit card debt lenders will presume you need to spend 3% to 5% of the balance to service the debt each month.

- If you have multiple credit cards with outstanding balances it is best to try to pay down your small debts and the cards with a lower balance in order to make your overall credit profile cleaner.

- If you decide to cancel unused credit cards or cards that are paid off be sure to keep at least one old card so you show a long opened account which is currently in good standing.

- Do not apply for new credit cards or other forms of credit ahead of getting a mortgage as changes to your credit utilization, limits and profile may cause your lender concern.

Don’t Miss: Does Bank Of America Do Mortgage Loans

How We Calculate Your Home Value

Mortgage data: We use current mortgage information when calculating your home affordability.

Closing costs: We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

Homeowners insurance: We assume homeowners insurance is a percentage of your overall home value.

Debt-to-income threshold : We recommend that you do not take on a monthly home payment which is more than 36% of your monthly income. Our tool will not allow that ratio to be higher than 43%.

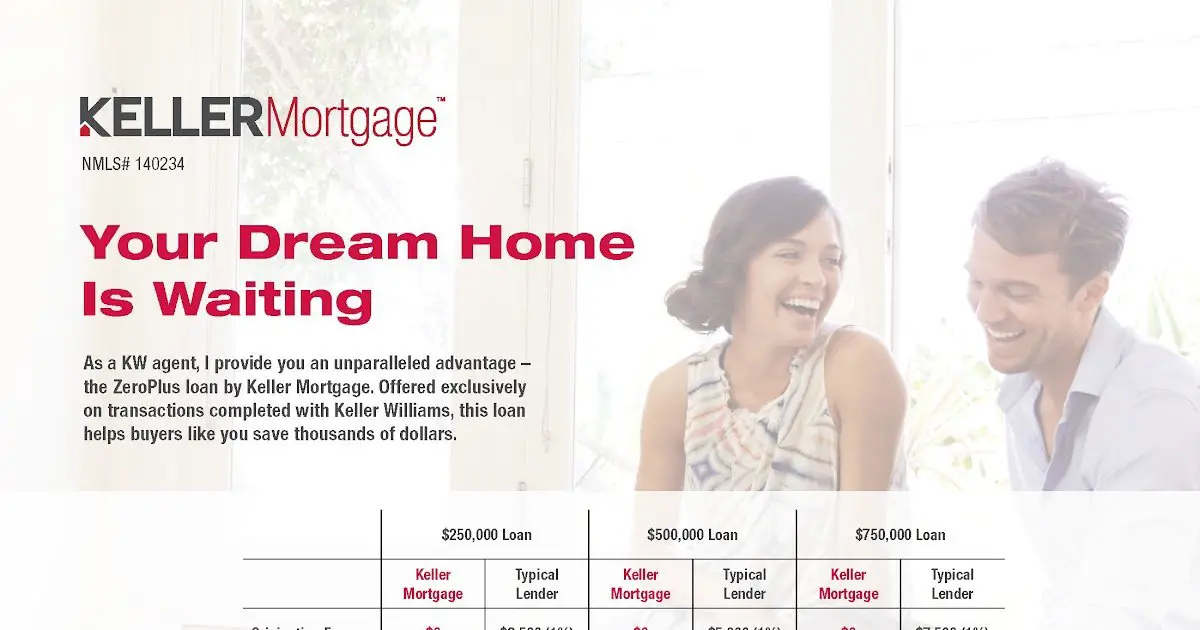

Mortgage Type: The type of mortgage you choose can have a dramatic impact on the amount of house you can afford, especially if you have limited savings. FHA loans generally require lower down payments , while other loan types can require up to 20% of the home value as a minimum down payment.

…read more

| * Includes a $ required monthly mortgage insurance payment.Other Expenses |

| Accuracy Grade*=A |

Rent vs Buy

Required Income For 500k Mortgage Under The Stress Test

Lets determine the Gross Debt Service for a $500,000 condo using the mortgage stress test rate of 5.19% over 25 year amortization. Your household expenses break down like this:

- Property tax $255/month ÷ 12)

- Heating $60/month

- Mortgage payments $2,927/monthTOTAL: $3,442

With your monthly household expenses amounting to $3,442 this means the required minimum income for a 500K mortgage under the Stress Test is $130,000 per year. This could also be two salaries of $65,000 per year.

$130,000 ÷ 12 = $10,833$10,833 x 0.32 = $3,447

Expenses $3,442 < $3,447 GDS

Dont forget about any debts, keeping in mind they should not exceed 40% of your monthly household income.

So while the above is how the bank will approach determining what you can afford, below is closer to the income one actually needs to afford a 500K mortgage.

Read Also: What Information Do You Need To Prequalify For A Mortgage

Lifetime Individual Savings Account

You can take advantage of a Lifetime ISA to purchase your first home or build savings for your retirement. This government scheme is open to individuals who are 18 years old but not over the age of 40. It allows you to contribute up to £4,000 each year until the age of 50. The government adds 25% bonus to your savings and up to a maximum of £1,000 each year. The account also allows you to hold stocks and shares to boost your savings.

Account holders are allowed to withdraw from their Lifetime ISA under the following conditions:

- If youre buying your first house.

- If youre 60 years old and above.

- If youre terminally ill with less than 12 months to live.

On the other hand, if you make any unauthorised withdrawals, are required to pay a withdrawal charge. The current withdrawal charge is 20% but is scheduled to revert back to 25% on April 6, 2021. You may visit the official Lifetime ISA page for more details.

Three Homebuyers’ Financial Situations

| $0 | $185,000 |

House #1 is a 1930s-era three-bedroom ranch in Ann Arbor, Michigan. This 831 square-foot home has a wonderful backyard and includes a two-car garage. The house is a deal at a listing price of just $135,000. So who can afford this house?

Analysis: All three of our homebuyers can afford this one. For Teresa and Martin, who can both afford a 20% down payment , the monthly payment will be around $800, well within their respective budgets. Paul and Grace can afford to make a down payment of $7,000, just over 5% of the home value, which means theyâll need a mortgage of about $128,000. In Ann Arbor, their mortgage, tax and insurance payments will be around $950 dollars a month. Combined with their debt payments, that adds up to $1,200 â or around 34% of their income.

House #2 is a 2,100-square-foot home in San Jose, California. Built in 1941, it sits on a 10,000-square-foot lot, and has three bedrooms and two bathrooms. Itâs listed for $820,000, but could probably be bought for $815,000. So who can afford this house?

House #3 is a two-story brick cottage in Houston, Texas. With four bedrooms and three baths, this 3,000-square-foot home costs $300,000. So who can afford this house?

Don’t Miss: Should I Refinance My 30 Year Mortgage

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Recommended Reading: What Do I Need To Become A Mortgage Broker

What Happens If You Default

Ten years ago, there was a terrible problem with people getting overextended & defaulting on loans. The problem was that low variable interest rate loans fueled speculators that got burned when the rates increased as they tried to roll into a fixed rate. The ugly truth for those people was that they either ended up doing a short sale or having their homes foreclosed upon because in many housing markets the price of homes shaply declined. Today, when your home value doesn’t match your loan, you are considered to be under water. If you owe more than your home is worth because it dropped in value and you have a variable rate loan, you will not be able to roll it to a fixed rate loan, leaving you with a sad decision to make.

Fortunately, while select cities like Toronto & Vancouver have ran up in prices, most of the housing market in Canada rarely contains bubbles. If you focus on getting the best fixed rate loan that you can & don’t chase prices in the few core hot markets, you will likely never experience the type of trouble that people had during that time period.

If you are unsure if you are running ahead of yourself, check out Garth Turner’s Greater Fool blog, which details some of the recent astromical home price rises seen in parts of Vancouver & Toronto, along with the justifications people make while over-extending themselves.

Here Is The Mortgage Approval Process That We Follow In Our Shop:

Rather than rely on assumptions, our mortgage approval process is designed to provide you with answers that you can rely on as early in the process as possible so that you can make decisions and progress towards your property objective with confidence and clarity.

Discovery Call – We discuss your financial situation and property objective , estimate your borrowing capacity, and identify any obstacles you may encounter. This helps you clarify your situation and provide you with an action plan to move forward, before you ever have to fill out an application.

Pre-Approval – We review your mortgage application and supporting documents, pull your credit report, and determine the best lenders and mortgage products for you. You will have a clear and reliable understanding of the lending options that are available to you BEFORE you make any final decisions or purchase commitments. This stage should confirm the information discussed in the initial discussion and hopefully not uncover any surprises.

Approval– Show you the money! We submit your file to the chosen lender and work with you to meet their closing conditions. Upon the lender’s final approval of your documents and the subject property, the contract is finalized and the mortgage funds.

Don’t Miss: Can You Get A Mortgage On A Foreclosed Home

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Read Also: Can I Use My Partner’s Income For A Mortgage

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Don’t Miss: How Much Is The Mortgage On A $300 000 House