How A Mortgage Works

Every month you make a mortgage payment, it gets split into at least four different buckets that make up principal, interest, taxes and insurance or PITI for short. Here is how each bucket works:

In the early years of your mortgage, interest makes up a greater part of your overall payment, but as time goes on, you start paying more principal than interest until the loan is paid off.

Your lender will provide an amortization schedule . This schedule will show you how your loan balance drops over time, as well as how much principal youre paying versus interest.

THINGS YOU SHOULD KNOW

Mortgage lenders require an escrow account to collect your property taxes and homeowners insurance each month if you make less than a 20% down payment on your mortgage. Your lender uses the funds in an escrow account to pay your property tax bills and homeowners insurance premiums.

Conventional Mortgages: Everything You Need To Know

6-minute read

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

Conventional mortgages are a great choice for many homeowners because they offer lower costs than some other popular loan types. If you have a high enough credit score and a large enough down payment, a conventional mortgage might be right for you.

Conventional Loans Vs Fha Loans

Conventional loans have stricter credit requirements than FHA loans. FHA loans, which are backed by the Federal Housing Administration, offer the ability to get approved with a credit score as low as 580 and a minimum down payment of 3.5%. While conventional loans offer a slightly smaller down payment , you must have a credit score of at least 620 to qualify.

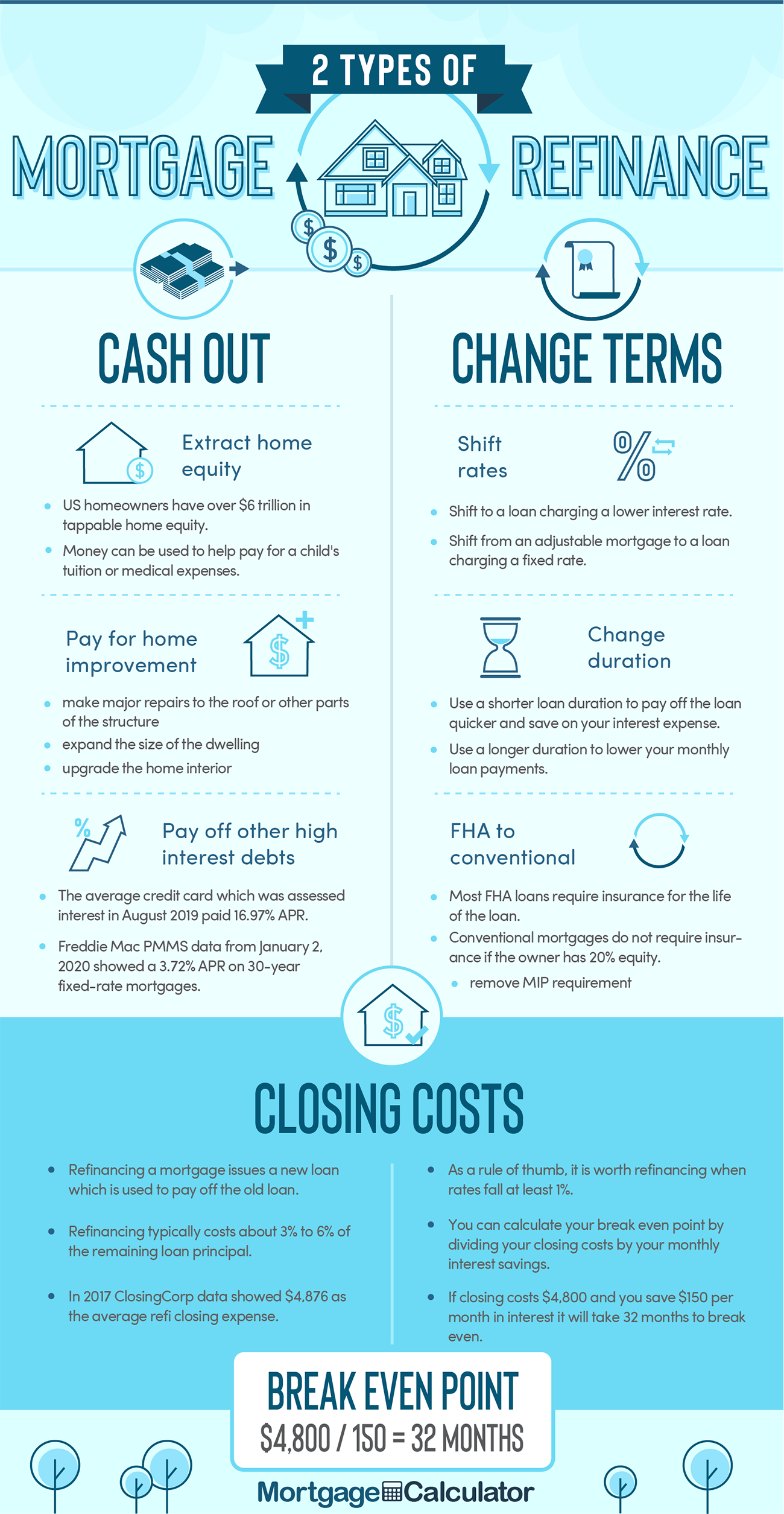

When youre deciding between a conventional loan and an FHA loan, its important to consider the cost of mortgage insurance. If you put less than 10% down on an FHA loan, youll have to pay a mortgage insurance premium for the life of your loan regardless of how much equity you have. On the other hand, you wont have to pay private mortgage insurance on a conventional loan once you reach 20% equity.

Also Check: Are There Any Mortgage Lenders For Bad Credit

Why Use An Assumable Mortgage

An assumable mortgage could be a great find in a rising interest rate environment.

One of the biggest benefits to this type of mortgage is that you could lock in a rate far below the current market, provided rates have risen since the original loan was made.

Take a look at one example.

According to Freddie Mac, the all-time low weekly mortgage rate occurred on Jan. 7, 2021, when it dipped to 2.65% for a 30-year fixed-rate mortgage.

But, just two months later, rates had risen above 3%. And some expect these rates to top 4% or higher over time.

Now imagine its a few years later, and Freddie Macs weekly average is 4.6% for a 30-year mortgage. If youre offered an assumable mortgage at 2.6%, youd likely be over the moon.

According to our mortgage calculator , monthly principal and interest payments at 4.65% would be $1,025 on a $200,000 loan. But theyd be $800 at 2.6%.

Thats a saving of $225 per month or $2,700 per year every year.

Thats the fantastic advantage assumable mortgages can offer. But few scenarios will play out exactly like this. So we also need to look at the restrictions and downsides of assumable home loans.

Can I Get A Second Mortgage To Eliminate Pmi

Piggyback mortgages are second-lien mortgages used to âpiggybackâ off the first-lien mortgage on a home purchase. These are popular because they help buyers avoid private mortgage insurance when theyâre not able to meet the 20% down payment threshold. Piggyback mortgages are primarily portfolio loans and as such the qualifying criteria can vary considerably from lender to lender.

Don’t Miss: Which Bank Is Best To Get A Mortgage

What Is The Difference Between Conventional And Government

When youre thinking about your mortgage options, its important to understand the difference between conventional loans and government-backed loans.

Government-backed loans include options like VA loanswhich are available to United States Veteransand Federal Housing Administration loans. FHA loans are backed by the Federal Housing Administration, and VA loans are guaranteed by the Veterans Administration.

With an FHA loan, youre required to put at least 3.5% down and pay MIP as part of your monthly mortgage payment. The FHA uses money made from MIP to pay lenders if you default on your loan.

To qualify for a VA loan, you must be a previous or current member of the U.S. Armed Forces or National Guardor have an eligible surviving spouse. A VA loan requires no down payment, but you must pay a one-time funding fee, which usually ranges from 1%3% of the loan amount.

With a conventional loan, the lender is at risk if you default. If you can no longer make payments, the lender will try to recoup as much of the remaining balance as they can by selling your house through a short sale process or even foreclosure. You didnt think borrowers get out of not paying for their house, did you? No way!

Because of this additional risk to the lender, youre required to pay private mortgage insurance on a conventional loan if you put less than 20% down.

Top Conventional Mortgage Lenders

Conventional home loans are funded by private companies, which vary widely in their pricing, guidelines and quality. Before choosing a lender, its recommended that you shop around to find the best conventional mortgage lender for your specific needs and situation. Even so, MoneyGeek chose three top lenders to feature that provide a great place to start your search.

Recommended Reading: Can You Add Money To Mortgage For Improvements

Interest And Partial Principal

In the U.S. a partial amortization or balloon loan is one where the amount of monthly payments due are calculated over a certain term, but the outstanding balance on the principal is due at some point short of that term. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed.

Decide If A Conventional Loan Meets Your Needs

The first step to apply for a conventional loan is to decide if it is an option for you.

You can evaluate your needs and if these benefits would help you reach your goals:

- a fixed interest rate with predictable payments

- options for how long youd like to take to pay off your loan

- saving money by avoiding or reducing fees and mortgage insurance

- Options for how you want to use your purchase

You May Like: What Is Typical Debt To Income Ratio For Mortgage

Apply For Your Mortgage

Once youve decided on which lender best suits your needs, you can apply for your mortgage. At this point, your house hunt can begin! The application process can take some timesometimes more than a monthand involves heavy documentation so its smart to start this early, preferably before youve started house hunting in earnest.

Conventional home loans can feel confusing and stressful, especially because there is so much money at stake. However, by learning the ins and outs of mortgages prior to applying, you can give yourself a leg up in the game, and the resources you need to find the financial product thats right for you.

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

You May Like: How Many Times Can I Apply For A Mortgage

Benefits Of A Conventional Loan

Theres a reason why conventional loans are so popular. This type of loan has several features that make it a great choice for most people:

- Low interest rates

- Diverse down payment options, starting as low as 3% of the homes sale price

- Various term lengths on a fixed-rate mortgage, ranging from 10 to 30 years

- Reduced private mortgage insurance

Because conventional loans offer so much flexibility, there are still some decisions you have to make even after you choose this loan type. Youll also have to consider how much you can put down, how long you want your loan term to be, and how much house you can afford.

We know that sounds pretty overwhelming, but dont panic! Weve got some super simple tips to help you confidently buy a house with a conventional loan.

Requirements For A Conventional Loan

Lenders view conventional loans as a higher risk because the government doesnt guarantee them. As a result, lenders stand to lose all of the remaining principal and interest on a mortgage if the borrower ends up unable to make payments.

Important!

All conventional loans have to meet certain baseline requirements set by Fannie Mae and Freddie Mac. Each lender, however, is free to impose its own, higher standards, which are known in the business as lender overlays. What lenders cannot do is impose standards that would qualify as mortgage discrimination.

As a borrower, these are the minimum conventional loan requirements you should be prepared to meet:

Credible makes comparing prequalified conventional loan rates quick and easy you can see personalized rates from our partner lenders in just three minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Don’t Miss: Can I Throw Away Old Mortgage Papers

How Does Murabahah Work For Islamic Mortgage

Murabaha is a type of halal mortgage offer where the expense of the products to be sold, and also the benefit on the deal is known to the two gatherings. The buy and offering cost and the net revenue must be unmistakably expressed at the season of the deal assertion. Instalment of the Murabaha cost might be in a spot, in portions or single amount after a specific timeframe. This Islamic financial instruments and many other instruments are discussed in more details in diploma in Islamic finance, Islamic finance certification, and Islamic banking certification programs by AIMS.

Benefits And Disadvantages Of A Conventional Loan

Did you know that conventional loans offer advantages, such as more credit access? Conventional loan rates can be very competitive too. These are sometimes lower than what is available through an FHA loan. Another differentiating factor is mortgage insurance. Consumers do not have to pay mortgage insurance on conventional loans, but they do on most traditional FHA loans.

FHA or Conventional Loan? Which Is Better?

This depends on a persons individual situation. FHA loans and other government-backed loans can be a good deal. Federally backed loans may offer loans to those who have lower credit scores or a smaller down payment. Yet, they may have stricter requirements and may not loan as much as a conventional loan would. It is best to compare both options before making a decisioncontact one of our Mortgage Coaches to see which home loan best fits your needs!

Don’t Miss: Can You Reverse Mortgage A Condo

Benefits Of A Conventional Home Loan

Conventional loans are themost popular typeof mortgage.After that come government-backed mortgages, including FHA, VA, and USDAloans.

Government-backed mortgages have some unique benefits,including small down payments and flexible credit guidelines. First-time home buyers oftenneed this kind of leeway.

But conventional loans can outshine mortgages subsidized bygovernment agencies in several ways.

For example, conventional mortgageshave diverse repayment plans, borrowers dont have to meet any specialcriteria to qualify, and theresno upfront mortgage insurance fee.

Flexible repayment plans

As with most mortgages, conventionalloans offer several repayment options.

Conventional loans come in15, 20, 25, and 30-year terms. Some lenderseven offer 10-year conventional loans.

The shorter your loan term,the higher your monthly payment.

Fortunately, a 30-year fixed-rate conventionalloan stillcomes with low fixed-interest payments that are accessible to the majority ofhome buyers and refinancers.

Adjustable rates available

Conventional loans are also a smart choice for those who know they wont remain in their house long and want a shorter-term, adjustable-rate mortgage. This option comes with a lower interest rate than that of a fixed-rate loan.

Adjustable rates are in factfixed, but only for a period of time usually 3, 5, or 7 years. During thatinitial teaser period, the homeowner pays ultra-low interest and can savethousands.

No special requirements to qualify

Conventional Loan Credit Scores

In general, conventional loans are best suited for those with a credit score of 680 or higher. If you have a higher credit score, its possible that a conventional loan will offer the lowest mortgage rate. Applicants with lower scores may still qualify, but they can expect to pay higher interest rates.

Lower credit score buyers might benefit from a different type of mortgage, perhaps one back by a government agency. The associated costs may be lower with other these loan programs. For example, Fannie Mae and Freddie Mac impose Loan Level Price Adjustments to lenders who then pass those costs to the consumer. This fee costs more the lower your credit score.

For instance, someone with a 740 score putting 20% down on a home has 0.25% added to their loan fee. But, someone with a 660 score putting the same amount down would have a 2.75% fee added.

You May Like: Can You Get A Second Mortgage With Bad Credit

How Does A Balloon Loan Differ From Other Loans

The difference between a balloon loan and the other types of home loans is that balloon loans have a lump sum payment at some point during the loan. Other loans fully pay off at the end of the loan without any lump-sum payments. This is accomplished through amortization, which refers to the way a loan is paid off over time.

An amortization schedule will show you how much of your monthly payment goes toward interest and how much goes toward the principal, or the balance of the loan. At the beginning of the term, you pay more toward interest than principal, but that flips the closer you get to the end of the loan. When you reach the end of your term, the loan reaches maturity and pays off.

To give you an idea of what this looks like, lets take a look at the beginning and end of 30-year fixed-rate mortgages.

30-Year Fixed-Rate Mortgage Schedule

| $980.41 | $0.00 |

Youll notice that with the loan above, youre always making payments toward the balance and it fully pays off by the end of the loan. This is the case with all fully amortizing loans, whether theyre fixed or adjustable.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Who Qualifies For A Conventional Loan

Conventional home loans are more accessible to those with middle- to high-income, as they often necessitate a down payment and favorable financial profiles in order to secure a reasonable rate. This distinguishes them from government-backed loans, such as FHA loans, VA loans, and other products that are aimed at people with lower incomes, and make purchasing homes accessible to them.

In general, there are three areas that lenders care most about when assessing an applicant for a conventional loan: , debt-to-income ratio, and down payment. Lets take a look at each one of those qualifying criteria and what a lender might look for in a loan applicant.

Don’t Miss: What Is The Cost Of Mortgage Insurance

What Happens If Your Mortgage Is Foreclosed

There are two ways a lender can collect if you fall behind on payments through the courts in a process called judicial foreclosure, or with a trustee in a process called non-judicial foreclosure. If you cant make your payments, its essential you know the timeline and processes for how long a foreclosure will take.

Judicial foreclosure. A judicial foreclosure is a court process and generally takes much longer than a non-judicial foreclosure. It gives you more time to either find a way to bring the mortgage current or make plans for other housing arrangements.

Non-judicial foreclosure. If you signed a note and a deed of trust at your closing, then you are probably in a state that allows a non-judicial foreclosure process. The courts are not involved in this process, and the foreclosure process timeline may be much faster, leaving you with less time if you are unable to bring the payments current.

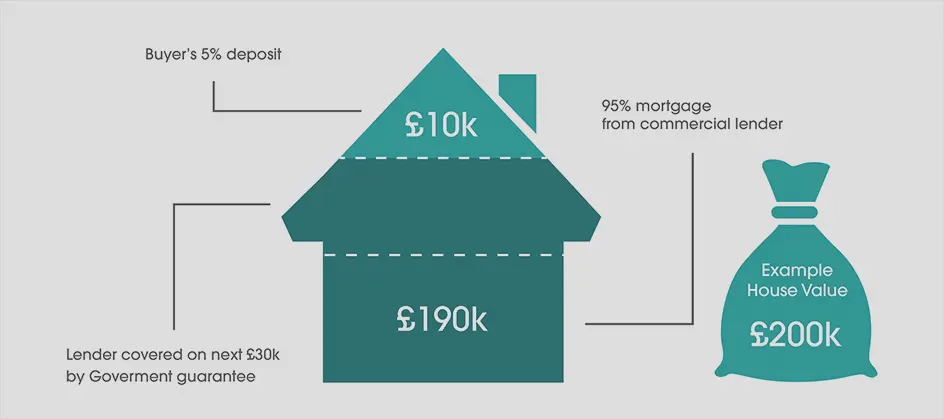

Do I Need A Down Payment When Assuming A Mortgage

When you assume a mortgage, you take over the homeowners remaining principal balance.

The current borrower has likely paid off a chunk of their mortgage. The home may have also increased in value since it was purchased. So there will be a difference between the loan amount you assume and the purchase price.

That difference is your down payment. And it may be higher than the down payment youd have to make on a new loan.

Lets go back to the example we used above: Say the seller got a $200,000 mortgage at 2.6% in January 2021.

Imagine its now January 2023, and you want to assume that mortgage.

Well, the original borrower made a 3.5% FHA down payment of $7,500 on a $207,500 home. And home price inflation means the market value is now, perhaps, $220,000.

Working out your down payment amount

Because the homeowner made all their monthly payments over the past two years, they reduced the mortgage balance to around $190,900.

Imagine youre buying the house at its exact market value: $220,000.

- Youre paying $220,000

- But your assumed mortgage is only $190,900

- You need a down payment of $29,100

- Thats a 13% down payment

If youre assuming a VA or FHA loan, the minimum down payment is 0% or 3.5%, respectively. So youre putting a lot more money down than youd need to on a new mortgage.

But, youre also securing a far lower interest rate than youd likely get otherwise.

Using a home equity loan to fund your down payment

Read Also: How To Get A Mortgage At 21