How To Calculate Your Mortgage Payment

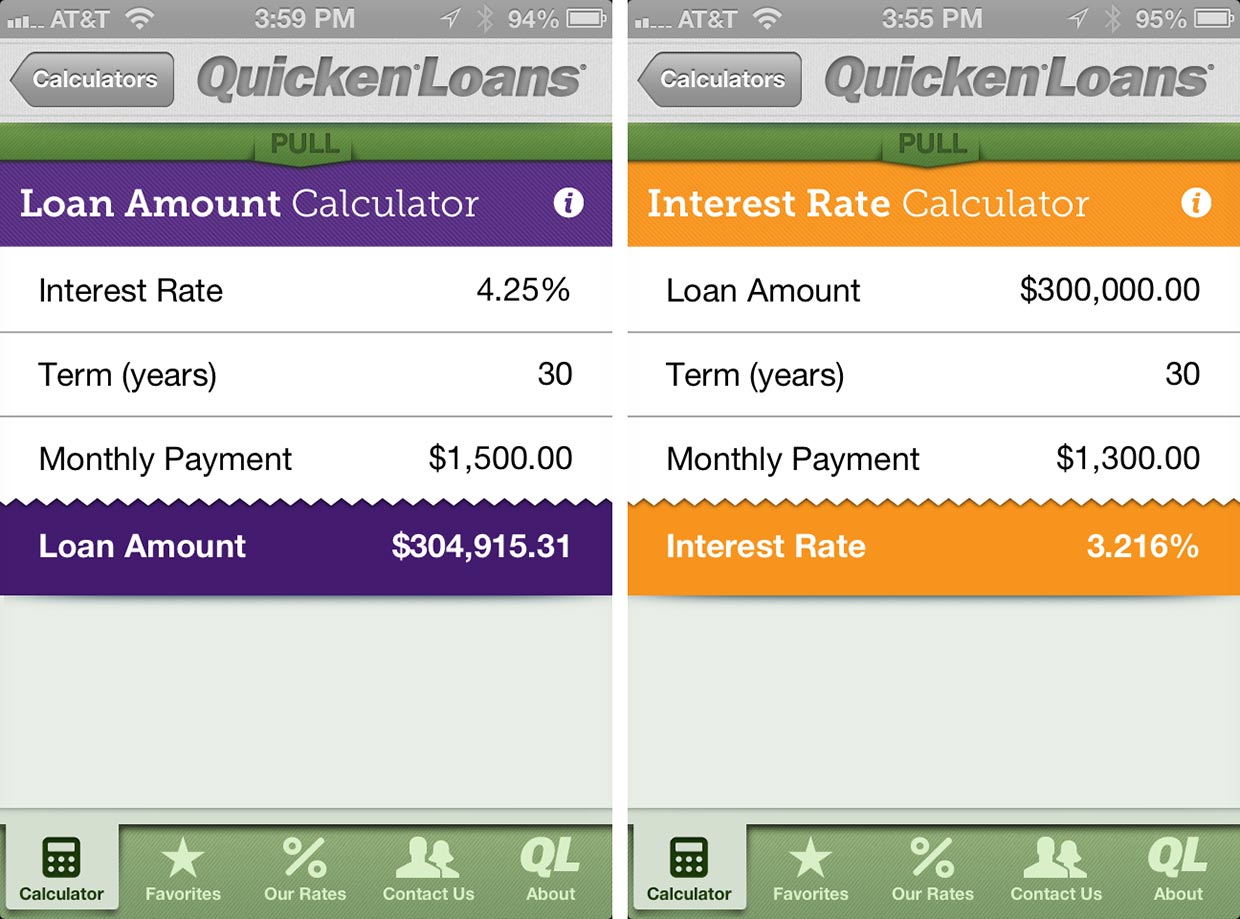

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)

What Is The Difference Between Interest Rate And Apr

Simply put, the main difference between interest rate and APR is that APR provides a broader look at what youll pay when you borrow money. Since APR includes your interest rate as well as other fees connected to your loan, your APR will reflect a higher number than your interest rate. You can also consider APR to be your effective rate of interest.

Thanks to the Truth in Lending Act , your lender must tell you both your interest rate and your APR. Youll see this information on both your Loan Estimate and your Closing Disclosure .

Remember to consider both the interest rate and the APR when you decide on the best mortgage loan for you.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Principal And Interest Vs Interest

Another factor that impacts your mortgage payment is whether youre making principal and interest payments or interest only payments.

- Principal and interest payments: These are the most common way to pay off a mortgage. In this case, a portion of your monthly payment goes towards the principal and the other portion goes towards the interest you owe.

- Interest only payments: These loans are designed to make interest only payments for a certain period of time. Property investors with an investment mortgage or those building a new property often use interest only mortgage structures. The reason is that the monthly payment is typically reduced.

Mortgage payments

Susie is borrowing $700,000 to buy a house and she wants to save as much money on interest as possible. She decides to calculate the impact on the total cost of the mortgage using two APRs with a 0.25% difference.

If she can find a loan with an interest rate of 4% APR on a 30-year loan term, her monthly principal and interest payments will be $3,328.63. The total interest she will end up paying over the life of the loan is $498,307.00.

If Susie finds a loan with a marginally lower interest rate of 3.75% APR, her monthly payments will be $3,230.31 and the total interest over the life of the loan will be $462,915.00. With the lower rate, Susie will save $35,392.00 in interest costs.

Also Check: Does Pre Approval For Mortgage Affect Credit

Lets Go Through One More Thing Quickly And Then Get To Mortgage Rates

The one principle that binds all investment activity is: The higher the risk, the higher the rate of return that an investor demands

Why so? Because if an investor gets the same return for two investments with different levels of risk, why would they ever put their money in the more risky investment. Would you, as an investor, ever do that? No. That would be irrational.

The only way investors are willing to put their money into riskier investments is because they expect to make a higher return on those.

This idea not only applies to mortgages, but this is the fundamental idea that drives all of finance, including pricing of stocks, bonds, commodities, or any investment in general.

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Recommended Reading: Can You Refinance Mortgage With Poor Credit

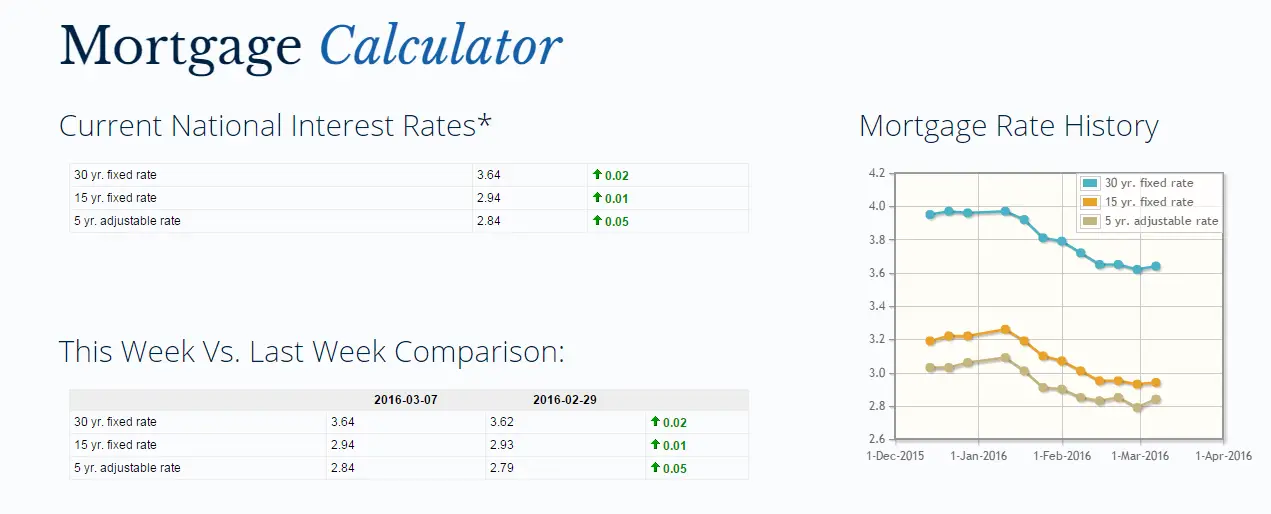

Changes In Mortgage Interest Rates

Most new mortgages are sold in the secondary market soon after being closed, and the prices charged borrowers are always based on current secondary market prices. The usual practice is to reset all prices every morning based on the closing prices in the secondary market the night before. Call these the lenders posted prices.

The posted price applies to potential borrowers who have been cleared to lock, which requires that their loan applications have been processed, the appraisals ordered, and all required documentation completed. This typically takes several weeks on a refinance, longer on a house purchase transaction.

To potential borrowers in shopping mode, a lenders posted price has limited significance, since it is not available to them and will disappear overnight. Posted prices communicated to shoppers orally by loan officers are particularly suspect, because some of them understate the price to induce the shopper to return, a practice called low-balling. The only safe way to shop posted prices is on-line at multi-lender web sites such as mine.

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Recommended Reading: How Much Should Your Mortgage Be In Relation To Income

How Do Those Factors Translate Into Mortgage Rate

The lower the DTI, the lower the risk for the investor and lower the mortgage rate hell ask you to pay.

Same applies for LTV. If your loan amount is small compared to the value of the home, the lenders risk is lowered and youll get a better rate.

Higher FICO scores lead to the same outcome. You have demonstrated a good history of paying back your debt. The lender will see you as less risk and offer you a lower rate.

Remember, a lower DTI, a lower LTV and a higher FICO score will get you the lowest rate. That is what you have to aim for.

How Amortizing Payments Work

If you have a fixed-rate loan the amount paid each month is determined by the interest rate and the lenght of the loan. Lenders can look at the term of the loan and charge an interest rate which they feels compensates them for the risk of loss, the cost of inflation, their business overhead & their profit margin. With a fixed rate loan the amount of each payment stays the same across the duration of the loan, but the percent of each payment that goes toward principal or interest changes over time. Early on in the loan’s term a relatively large share of the payment is applied toward interest, then as the borrower pays down the loan an increasing share of the payment goes toward interest.

Rather than using the above calculator repeatedly you can use an amortization schedule to print out the entire schedule for a loan. We host an amortization calculator which enables you to create printable amortization tables. It shows the monthly payments and amortization schedule for the principal and interest portion of loans, while other costs of borrowing like licensing or taxes are excluded.

More Ways to Calculate Your Loan Payments

If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or future balance will be.

Prefer to calculate offline? See our free Simple Excel loan calculator.

You May Like: Is 720 A Good Credit Score For Mortgage

Third Federal Savings And Loan Best Bank Lender

Third Federal Savings and Loan Association is a bank and lender in 25 states and Washington, D.C., with branch locations in Ohio and Florida. The bank offers mortgage products including fixed- and adjustable-rate loans, 10-year loans, jumbo loans and bridge loans.

Strengths: Borrowers can find 10-year and other mortgage rates updated on Third Federals website daily, including for the banks 10-year low-cost loan, which costs just $295. The bank also offers a $1,000 rate guarantee and free 60-day rate lock . Third Federal also services all of its loans, so your mortgage will be originated and managed by the same entity.

Weaknesses: Third Federal is not licensed in every state, and if youre looking for a government loan , youll have to look elsewhere.

The Structure Of Mortgage Interest Rates

On any given day, Jones may pay a higher mortgage interest rate than Smith for any of the following reasons:

- Jones paid a smaller origination fee, perhaps receiving a negative fee or rebate.

- Jones had a significantly lower credit score.

- Jones is borrowing on an investment property, Smith on a primary residence.

- Jones property has 4 dwelling units whereas Smiths is single family.

- Jones is taking cash-out of a refinance, whereas Smith isnt.

- Jones needs a 60-day rate lock whereas Smith needs only 30 days.

- Jones waives the obligation to maintain an escrow account, Smith doesnt.

- Jones allows the loan officer to talk him into a higher rate, while Smith doesnt.

All but the last item are legitimate in the sense that if you shop on-line at a competitive multi-lender site, such as mine, the prices will vary in the way indicated. The last item is needed to complete the list because many borrowers place themselves at the mercy of a single loan officer.

Don’t Miss: Are Mortgage Rates Predicted To Go Up Or Down

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

Don’t Miss: How Much Income To Qualify For 1 Million Mortgage

How To Compare Mortgage Interest Rates And Aprs

When you review your loan estimates and evaluate your options, remember not to compare a mortgage rate to an APR because thats not an apples-to-apples comparison. Instead, always compare rates to rates and APRs to APRs.

Its important to compare rates because the interest you pay is a big part of your monthly payment. With a lower rate, youll pay less interest over the life of the loan.

Its important to compare APRs because interest isnt the only cost youll pay for your loan.

Never compare an APR for a loan with mortgage insurance to an APR for a loan without mortgage insurance. Mortgage insurance protects your lender if you dont repay your loan. You may have to pay for it if your down payment isnt at least 20% of your homes purchase price.

A loan with mortgage insurance will have a higher APR than the same loan without mortgage insurance because the insurance is a cost thats included in APR.

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

You May Like: What Is Rocket Mortgage Interest Rate

Mortgage Rate Factors That You Control

Lenders adjust mortgage rates depending on how risky they judge the loan to be. A riskier loan has a higher interest rate.

When judging risk, the lender considers how likely you are to fall behind on payments , and how much money the lender could lose if the loan goes bad. The major factors are credit score and loan-to-value ratio.

Daily Interest And Annual Interest Mortgages

As mentioned, most lenders work out your interest on a monthly basis and advertise the rate on an annual calculation.

With a daily interest or simple interest mortgage, interest will be added to your balance each month based on the number of days in the coming month.

Youâll see a decreasing monthly balance which will take into account the amount you paid last month and the amount of interest added for the coming month. Thereâs not a huge amount in it between daily and monthly interest, with the difference between the longest and shortest month being just 3 days.

On an annual interest mortgage, your lender will take your balance on 31st December of the previous year, calculate the amount of interest they expect you to pay in the coming year, and divide that amount by 12.

In the first year of your mortgage, theyâll take the balance from the date they lend it to you and calculate what they expect you to have to pay until 31st December.

Recommended Reading: What’s The Average Mortgage Payment

Knowing Your Mortgage Interest Rate

Before you even apply for a mortgage, you have to get preapproved. That means going to your bank, telling them you have the intent to buy a home, and submitting some basic information about your credit and finances. Once youâre preapproved, youâll get a loan estimate document, which, in addition to your mortgage amount and any up-front costs, will also list your estimated interest rate.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Preapproval is the first step in the mortgage process. After you lock down a home you like, you need to get approved. Before the mortgage is official, youâll receive a closing disclosure, which lists your actual mortgage amount and interest rate. Once you sign, these become what you have to pay.

Which Loan Is Cheaper Interest Rate Vs Apr

| Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR | Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|---|---|

|

Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR |

Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|

Time into loan |

|

|

+ $4,000 = $322,960 |

$9,480: Loan 1 is cheaper |

Eventually, you might pay off your mortgage and own your home free and clear, ideally before retirementunless youre the type whos happy to carry a low-rate mortgage so you can have extra cash to invest .

But each time you get a new loan, you pay closing costs all over again, except in the case of a no-closing-cost refinance. That means all the loan fees you pay should really be averaged out over, say, five years or however long you think youll keep the loan, not 15 or 30 years, to give you an accurate APR. You can do this math yourself with an online APR calculator. This same logic can help you determine whether it makes sense to pay mortgage points.

Also Check: Can You Get A Mortgage On Disability