How Much Should You Put Down On The House

How much you should pay on a down payment is a personal choice. It depends mostly on your financial condition and what mortgage programyou will be using.

If youve saved a good amount of cash over time or received money unexpectedly by luck, youre already ahead of the game. But, if youre beginning, it might take you months or even years to accumulate money for a down payment. Moreover, there are a few costs during the closing to consider.

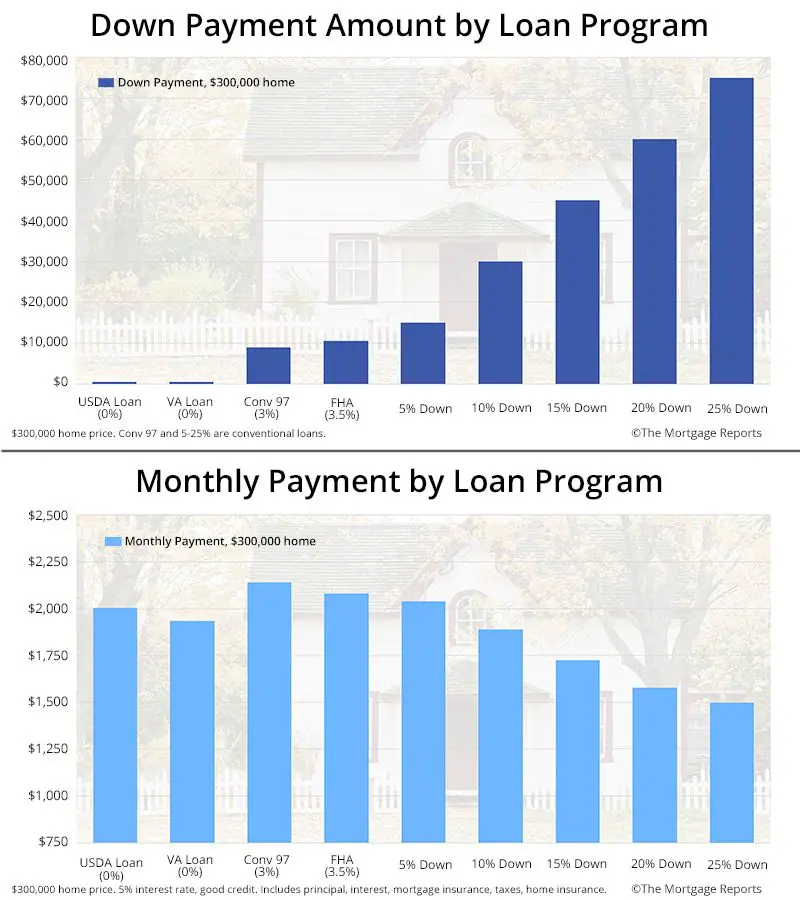

Several mortgage programs permit you to pay 0% as a downpayment whereas others require a 3% down payment for a conventional mortgageloan. However, theres a drawback: lenders usually charge a higher interestrate to minimize their risk, which means that you have to pay more in interestover the period of the mortgage with these lower down payment options.

When you pay more as a down payment, youll get a lower monthly loan payment and a lower loan-to-value ratio. The LTV ratio plays a vital role in the approval of your mortgage. It also enables you to determine your borrowing amount from the lender.

Your Down Payment Determines The Amount Of Cmhc Insurance You Pay

Your CMHC insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about CMHC insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| Total Payments over 25 Years | $402,726 | $377,991 |

|---|

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments, and/or debt repayments, for example, to make an informed decision.

The Reality Of Down Payments

A recent Freddie Mac survey found that nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.

What most people don’t realize is that you have choices when it comes to your down payment, even the possibility of putting as little as 3% down through Freddie Mac’s Home Possible® mortgages.

Also Check: Are Mortgage Rates Predicted To Go Up Or Down

Current Minimum Mortgage Requirements For Homeready And Home Possible Loans

The mortgage loan requirements for these conventional low-down-payment programs include income limits. Both Fannie Mae and Freddie Mac provide online lookup tools you can use to determine the maximum income based on an address you enter:

- For Freddie Mac Home Possible loans, use the Income and Property Eligibility Tool

Both programs have extra qualifying features such as:

Homebuyer education. HomeReady and Home Possible borrowers must complete a homebuyer education course before closing.

No credit score option. Homebuyers without a credit score can prove their creditworthiness with alternative data. For example, lenders may accept 12 months of consecutive, on-time rent payments, along with utility bills and car insurance payments, to prove your history of paying bills on time.

Additional income from a boarder. You can add rental income received from someone who has lived with you for at least 12 months to help qualify for a HomeReady loan. Youll need proof the person has lived with you for a full year.

Freddie Mac HomePossible loans only:

Alternative down payment sources. Home Possible guidelines allow for the entire down payment to come from sweat equity, which means you can convert your DIY skills rehabbing a home that needs improvements into cash toward your down payment and closing costs.

Can A Lender Or Seller Contribute To The Down Payment

One party that cannot be part of a “gift” for a down payment is the seller. They qualify as a person with a vested interest in selling the house, which excludes them from being able to write you a check. They can, however, make concessions or offer credits at closing in designated amounts to cover specific items such as repairs on the property.

Lenders can play a role in helping certain borrowers – often those who qualify as low- to moderate-income – get to the finish line via down payment grant programs and lender credits that help offset closing costs. Not every lender offers down payment assistance options, so you’ll want to ask about availability as you compare loan programs.

Recommended Reading: How To Know How Much Mortgage I Can Afford

How Do I Pay For Cmhc Insurance

Your lender is theparty responsible for paying CMHC insurance costs, but in the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan. This will slightly increase your monthly or bi-weekly payments. In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum. Only in a few exceptional cases will the lender pay for your mortgage insurance.

Do You Have To Put 20% Down On A House

No, in fact the median down payment for first-time home buyers in 2019 was just 6% according to the National Association of Realtors. You may have heard that a down payment should be 20% of a homes purchase price, and while it does have advantages, its not necessary.

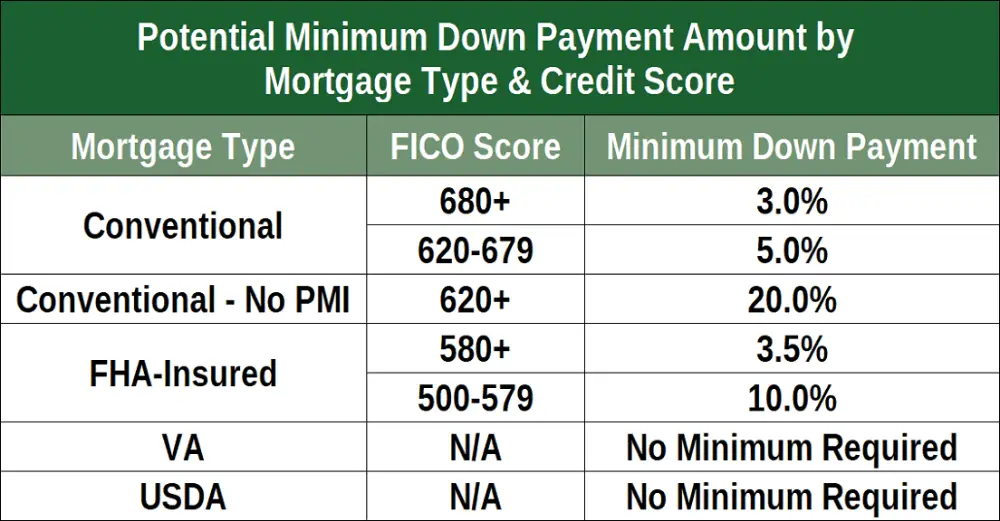

A Federal Housing Administration Mortgage has a minimum down payment of only 3.5%. Its available to all qualified buyers, regardless of income level. Also, you can buy a home with no down payment if you meet the specific restrictions of a United States Department of Agriculture loan or a Veteran Affairs loan.

Read Also: How Long Is The Mortgage Process

What Is A Conforming Loan

A conforming loan is a mortgage that fallswithin the purchase price limits set by the Federal Housing Finance Agency. These loans are insured by government-sponsored agencies like the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation . The loans must have aloan to value ratio of at least 80%and adebt to incomeratio no greater than 43%to be considered conforming loans. If these criteria of loan size, loan to value ratio, and debt to income ratio are not met, then government agencies will not insure the loan, which can result in highermortgage rates. If the loan is beyond the limit it is classified as aJumbo loanand will requirePrivate Mortgage Insurancein rare cases where the down payment is less than 20%.

For 2021, theconforming loan limitfor most counties is set at $548,250 which is the base limit. In some high-cost counties such as New York City and Los Angeles, the limit is $822,375 which is $274,125 or 50% higher than the base limit. Therefore, if your mortgage size in New York City is $1,000,000, it isnot a conforming loan and is considered a Jumbo Loan. It is important to note that different government home loan programs like those offered by the USDA use different loan limits.

When To Pay Your Mortgage Default Insurance

When you are approved for a mortgage that requires mortgage default insurance, you have the choice of either paying the default insurance premium amount up front or adding it to the principal portion of your mortgage.

Mortgage borrowers can see the amount of their mortgage default insurance premium by looking at their TD Canada Trust Mortgage Loan Agreement. From time to time, the company providing the insurance may amend the calculations for the premiums. In that case, because of timing, this document may not reflect the most current percentages. However, your Mortgage Loan Agreement will always reflect the correct premium amount. Depending on your province of residence, you may be charged a provincial sales tax on the mortgage premium amount, which you are required to pay. As of June 1st, 2015 the following provinces charge a sales tax on the mortgage premium amount: Ontario, Quebec and Manitoba.

Don’t Miss: What Salary Is Required For A Mortgage

Why Is 20% Ideal For A Down Payment

The minimum down payment required for a conventional loan is 3%. And the minimum down payment for an FHA loan is 3.5%. Some special loan programs even allow for 0% down payments. But still, a 20% down payment is considered ideal when purchasing a home. You may have heard this referred to as the 20% rule.

For many home shoppers, saving up for a 20% down payment is not easy, but it can have significant financial benefits. For starters, it will help you avoid paying private mortgage insurance and lower your monthly mortgage payments. The infographic below looks at all the benefits of a 20% down payment for a mortgage:

Embed This Image On Your Site :< div style=”clear:both”> < a href=”http://www.zillow.com/mortgage-learning/20-percent-down-payment/”> < img src=”http://cdn1.blog-media.zillowstatic.com/1/Blog_20Percent_Infograph_Zillow_05-27_a_02-546f85.png” border=”0″ /> < /a> < /div> < div> Courtesy of: < a href=”http://www.zillow.com/mortgage-rates”> Zillow< /a> < /div>

Current Mortgage Rates

Current Minimum Mortgage Requirements For An Fha Loan

Down payment. FHA loans require a 3.5% down payment with a 580 or higher credit score, and funds can come from employers, close friends, family members or charitable organizations. The down payment requirement jumps to 10% with a credit score of 500 to 579.

Mortgage insurance. FHA borrowers are required to pay two types of FHA mortgage insurance. The first is an upfront mortgage insurance premium of 1.75% of the loan amount, typically financed into the mortgage. The second is the annual mortgage insurance premium that ranges from 0.45% to 1.05% of the loan amount, and is divided by 12 and added to your monthly payment.

. You can have a credit score as low as 500 up to 579 with a 10% down payment. Homebuyers making a minimum 3.5% down payment will need a score of at least 580.

Employment. FHA loan income requirements look at the borrowers stability of income and employment for the past two years. Job-hoppers need to explain changes or gaps in employment.

Income. There are no income limits for FHA loans. However, borrowing power is limited to the FHA maximum loan limit cap of $356,362 in 2021, compared to $548,250 for conventional loans in most parts of the country.

Cash reserves. FHA loan qualifications dont usually require cash reserves unless youre buying a two- to four-unit home, or trying to qualify with a lower credit score.

Occupancy. A one- to four-unit home financed with an FHA loan must be your primary residence for at least the first year after buying it.

Also Check: Does Navy Federal Sell Their Mortgages

So How Much Should You Put Down On A House

Theres no one-size-fits-all answer. But a good place to start is by taking a realistic look at how your down payment will affect how much youll pay each month. To get an idea for how a certain down payment will affect your monthly mortgage payment, take a look at a mortgage calculator. You’ll enter some basic info to get an estimated monthly payment, and you can play around with different down payment amounts to see what works best for you.

What Are The Types Of Fha Loans

The FHA offers a variety of loan options, from fairly standard purchase loans to products designed to meet highly specific needs. Here’s an overview of FHA loans commonly used to buy a house:

» MORE: Learn more about FHA 203 loans and Title I loans

|

FHA Loan Type |

|

|---|---|

|

Can be used to make improvements that make the home more energy-efficient. |

The home must be professionally assessed to qualify. Improvements must be deemed cost-effective. |

Read Also: How To Select A Mortgage Lender

How To Calculate Your Minimum Down Payment

Example Minimum Down Payment BC #1: A home that is worth $500,000

- The minimum down payment is 5% for this bracket therefore, numerically the minimum down payment on a $500,000 purchase price is $25,000.

Example Minimum Down Payment BC #2: A home that is worth $900,000

- Therefore, on $900,000 purchase, you would pay $25,000 to cover the minimum for the 1st $500K, and then $50,000 for the amount between $500,000 and $1M .

- Total $65,000 as a minimum down payment for a home purchased for $900,000.

Example Minimum Down Payment BC #3: A home that is worth $1,200,000

- For example, on a purchase of $1,200,000, the down payment of 20% would be calculated on the entire balance not on a sliding scale.

- Total minimum down payment in this scenario is $240,000.

Prior to this February 15, 2016 change, the rule of thumb was 5% for all properties regardless of the price. Thus, it is important to note that this has changed.

For more information on down payments in BC, read our blog post here: Down Payment 101

If You Put A Minimum Down Payment It Will Affect Your Affordability

If you put the minimum down payment towards your purchase, then it means you will need to qualify for a larger amount of funds.

Your down payment is a benchmark that is used to determine your maximum affordability. However, there are many other factors such as income, debt levels, credit score, and whether your are salary vs. self-employed that will also affect your affordability.

Ultimately, the more you have in down payment the more youll be able to afford & the more likely it is for the lender to overlook hiccups in various other factors.

Don’t Miss: Can You Refinance Mortgage With Poor Credit

Down Payment 20 Percent Or More

Pros

- Lower borrowing amount means lower interest total over the life of the loan

- Potential for lower monthly payments

- Will qualify for better interest rates

Cons

- May drain a large chunk of your savings

- May need more time to save enough to hit the magic 20 percent marker, which means delaying ownership

Lonette And Al Want To Purchase A Home And Avoid Paying Private Mortgage Insurance What Minimum Amount Of Down Payment Is Required For Them To Purchase A $36750 Home To Avoid Pmi

Answers

Private Mortgage Insurance is an added insurancepolicy that protects the lender if you are unable to pay your mortgage.As a borrower, Lonette and Al should put down at least 20% so that they canavoid paying PMI. Therefore,Minimum down payment = 0.20 * $36,750Minimum down payment = $7,350

Don’t Miss: Are Home Equity Loan Rates Lower Than Mortgage Rates

How Much Home Can I Afford

The answer to the question of How much home can I afford? is a personal one, and should not be left solely to your mortgage lender.

The best way to answer the question of how much can you afford for a home is to start with your monthly budget and determine what you can comfortably pay for a home each month.

Then, using your desired payment as the starting point, use a mortgage calculator and work backward to find your maximum home purchase price.

Note that todays mortgage rates will affect your mortgage calculations, so be sure to use current mortgage rates in your estimate. When mortgage rates change, so does home affordability.

Funding Your Down Payment

While most buyers use personal savings to finance down payments, there are many other options, including gifts or loans from relatives. In addition, many state, county, and city governments offer down payment assistance programs to people in their communities who are well qualified and ready for homeownership.

Read Also: How Do You Calculate Points On A Mortgage

Where To Get That Kind Of Money

Conventional wisdom says that you should put down as much of a downpayment as you feel comfortable doing. More is generally better than less, but you don’t want to wipe out your savings account to do it, either. You’ll still need funds set aside for a rainy day and for the things you’ll want to purchase after you buy your home.

Fortunately, you have some options for leaving your savings account, at least somewhat intact.

How Much Should You Put Down

Its important to understand how much the down payment for a house will impact your payments. Consider a $200,000 home and a 30-year fixed mortgage with a 3.12 percent interest rate:

| Home price | |

| $160,000 | $684 |

The monthly mortgage payment above doesnt include homeowners insurance, property taxes, and, for the 5-percent down payment scenario, mortgage insurance. Making a 20 percent down payment means you wont have to pay this added cost.

Theres another way to look at things, though. The premiums you have to pay on private mortgage insurance for a conventional loan are cancelled once you build 80 percent equity in the property. So, dealing with that extra cost temporarily can mean the difference between continuing to rent and buying your own place.

Another important consideration: A higher down payment can get you a lower interest rate, further saving you money each month. We didnt account for that in the example here, but its one more reason why a larger down payment can be beneficial.

As you think about how much to put down on your house, consider these key factors before settling on an amount:

You can use Bankrates down payment calculator to understand how different amounts will impact your bottom line. If you can afford a bigger down payment, remember not to stretch yourself too thin. You want to be able to enjoy living in that new house without depleting your entire savings and stressing about your finances.

Don’t Miss: Can You Take A Cosigner Off A Mortgage

Qualifying For A Usda

Income limits to qualify for a home loan guarantee vary by location and depend on household size. To find the loan guarantee income limit for the county where you live, consult this USDA map and table.

USDA guaranteed home loans can fund only owner-occupied primary residences. Other eligibility requirements include:

-

U.S. citizenship

-

A monthly payment including principal, interest, insurance and taxes thats 29% or less of your monthly income. Other monthly debt payments you make cannot exceed 41% of your income. However, the USDA will consider higher debt ratios if you have a above 680.

-

Dependable income, typically for a minimum of 24 months

-

An acceptable credit history, with no accounts converted to collections within the last 12 months, among other criteria. If you can prove that your credit was affected by circumstances that were temporary or outside of your control, including a medical emergency, you may still qualify.

Applicants with credit scores of 640 or higher receive streamlined processing. Below that, you must meet more stringent underwriting standards. You can also qualify with a nontraditional credit history.

Applicants with credit scores of 640 or higher receive streamlined processing. Those with scores below that must meet more stringent underwriting standards. And those without a credit score, or a limited credit history, can qualify with nontraditional credit references, such as rental and utility payment histories.