How Your Credit Score Affects Your Mortgage

Your credit score is important because it affects which lender you can get your mortgage from, and what your interest rate on that mortgage will be. Prime lenders, such as major banks, will definitely give you a mortgage if your credit score is above 700, and they will consider applications with credit scores between 600 and 700.

If your score is between 600 and 700, the rest of your application will need to be strong in order to get approved. The lower your score the greater risk you pose to the lender. To compensate for that risk, some lenders, such as trust companies and private lenders, will charge you a higher interest rate. And some lenders wont lend you money at all, if your credit score is too low.

Here is a table showing which lenders you can get a mortgage from in different credit score range scenarios.

| Description |

|---|

Can I Refinance With A 550 Credit Score

candoRefinance550

. Beside this, can you refi with bad credit?

Homeowners with bad credit often refinance to reduce their monthly mortgage payment with a lower interest rate, or to take cash out to pay off other high-interest debt. If your score isn’t strong enough to get a loan by yourself, lenders may suggest adding a cosigner.

Similarly, can you refinance with a 580 credit score? The FHA Cash-Out Refinance program is available to people with as low as 580. Some lenders may want a score of 600 or higher though. This program has a maximum LTV of 85%, so you won’t be able to qualify if you still own a lot on the home. You‘ll need at least 15% equity.

Hereof, what is the minimum credit score for refinance?

Conventional Loan RefinanceThe average minimum credit score for conventional refinancing programs is 620 to 680, although the best rates are generally available to homeowners with scores of 740 or higher. Conventional refinances are always fully documented.

Can you get a personal loan with a credit score of 550?

It’s very difficult to get an unsecured personal loan with a credit score under 550 on your own, without the help of a co-signer whose is higher. Even the loans with the most lenient approval standards require a of 585.

The Real Fha And Va Guidelines

FHA Purchase: The minimum credit score is 500. Your qualifying score is middle of your three scores from credit bureaus Equifax, Transunion, and Experian.

- For credit scores between 500 579, the minimum down payment is 10%

- For credit scores of 580 and above, the minimum down payment is 3.5%

FHA Cash-Out Refinances:

- For credit scores of 500 and above, the max cash-out is 85% of the appraisal value

FHA Streamline Refinance:

- There is no minimum credit score. You can streamline without even having a lender look at your scores

VA Down Payment:

Also Check: What Is A Good Dti For A Mortgage

Can I Get A Home Loan With A 450 Credit Score

A credit score of 450 is categorised differently depending on the credit checking agency youre using. For example, a credit score of 450 on Experian or TransUnion is categorised as Very Poor, which means youll have less options available to you when you apply for a mortgage than you would if you had an Excellent rating. But, there are specialist mortgage lenders who will consider your application. You just need a specialist broker. We can help with that. Get in touch and get matched to the perfect mortgage broker for you now.

If your credit score is 420 and youre with Equifax, youre categorized as having an Excellent rating, so shouldnt struggle to get a mortgage from most lenders.

Where To Go From Here

Its important to know which factors make up your credit score. As you can see in the image below, there are 5 factors that make up your credit score.

Pay down your balances and keep your credit utilization under 30%. Its also wise to have a mix of installment and revolving accounts.

Of course, you also want to make sure you are making your payments on time from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an important role in your credit score. You want to show potential creditors that you have a long, positive payment history.

Building good credit doesnt happen overnight, but you can definitely speed up the process by making the right moves. So give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having good credit.

Categories

Don’t Miss: How Much Would A 70000 Mortgage Cost

Working On Your Credit

Debt is not for everyone. In fact, some people will go so far out of their way to make sure they are not racking up debt. Unfortunately, this is a tough road to take with not many benefits, obligating you to pay in cash all the time and using more unorthodox ways of borrowing money. The bad news is, for many people, including those who would prefer to stay out of debt, emergencies can happen at any time. And if you dont have any credit history to show lenders, it can be so much harder and a lot more expensive to borrow the money you absolutely need.

Hear us out. You must work on your credit. Regardless of whether youre considering a car or home purchase soon, its better to be ready for such an eventuality. However, we also recommend you dont rest on your laurels, no matter how low or high your credit score gets. Credit scores can change so fast. A higher credit score will not only give you more savings, but it will also give you peace of mind thats very valuable during these times.

What Credit Score Do You Need To Buy A House

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

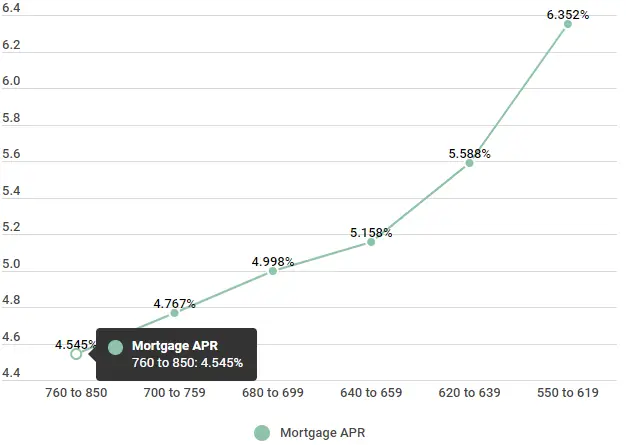

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

Recommended Reading: Who Has The Best Mortgage Loan Rates

Calculate Your Usda Payments

To qualify for a USDA loan, your mortgage payment cannot exceed 29 percent of your monthly gross income and your mortgage, car, credit card and other debt payments cannot exceed 41 percent of your monthly gross income. You are not required to make a down payment but doing so can lower these ratios since you will be applying for a smaller loan.

Figure what priced home and mortgage payment you can afford using Realtor.com’s Home Affordability Calculator. Enter the required information, including your annual or monthly before-tax income and estimated mortgage interest rate, then click “Calculate.”

Tips

-

Pull a free credit report from AnnualCreditReport.com. Look for any errors, such as accounts that you do not have or never opened, or outstanding accounts you have satisfied. Dispute the errors in writing to the credit reporting agency.

Ask your lender to run a Rapid Rescore if you think your score to be higher, such as having paid off a large amount of debt, and you wish to avoid waiting for the credit bureau to process the information. The lender will likely charge you a fee for this service.

If you have trouble meeting the debt-to-income ratios, reduce your credit card and other loan balances by paying above the minimum payments and not taking on new debt. Another option to find a less expensive home or increase the down payment.

References

What Is The Minimum Credit Score To Get A Mortgage

Several different types of mortgage loans exist, and each one has its own minimum credit score requirement. Even so, some lenders may have stricter criteria in addition to credit score they use to determine your creditworthiness.

Here’s what to expect based on the type of loan you’re applying for:

If your credit score is in great shape, you may have several different loan types from which to choose. But if your credit score is considered bad or fair, your options may be limited.

Recommended Reading: How Long Does Fha Mortgage Insurance Last

When You Should Rent Vs Buy

Your credit score can offer insight into whether you should rent or buy. Lenders use your credit score as a crystal ball to predict how likely you are to repay a mortgage. But they dont actually know you. What do you think about your credit score? Does it say more about the type of borrower you are today or the type of borrower you were in the past?

If you have a bad score because you didnt understand how to manage credit, but youve learned since then because you went through a rough patch, but youre fine now or because a divorce or identity theft trashed your credit, you might be comfortable buying a home now if you can get a loan despite your credit score.

If you have a bad credit score because youre not good at making payments on time or you tend to overspend, renting while you improve your habits is probably the wiser option.

What Qualifies As A Good Credit Score

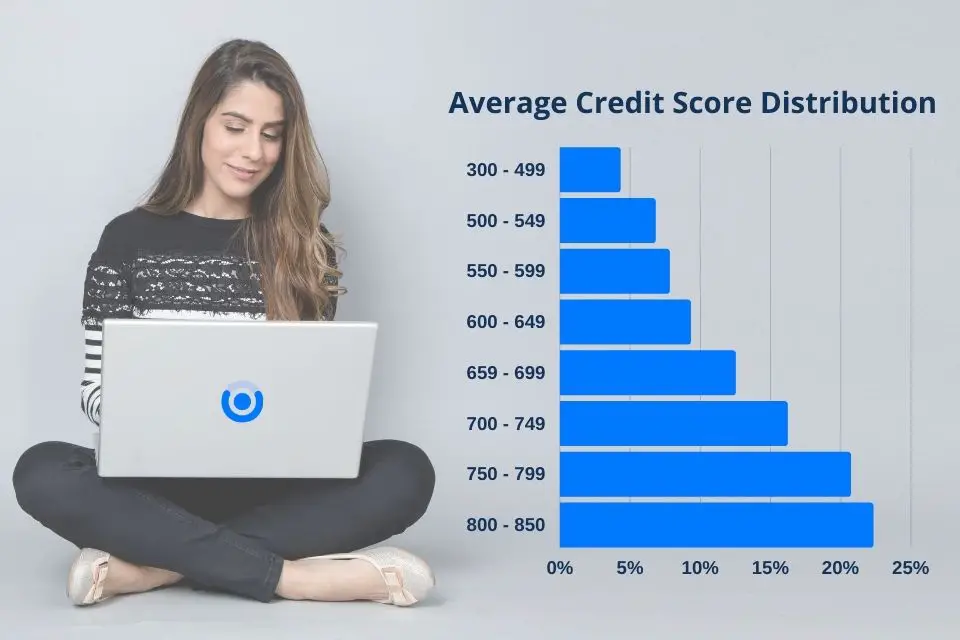

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

Read Also: What Does A Mortgage Consist Of

Summary Of Best Mortgage Lenders Of 2021 For Low Or Bad Credit Score Borrowers

| Lender | NerdWallet Rating NerdWallet’s ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. |

Min. Credit Score

Minimum credit score on top loans other loan types or factors may selectively influence minimum credit score standards |

Min. Down Payment |

|---|

Is 550 A Bad Credit Score

If we are taking a look at the normal range of 300-850, a credit score of 550 is considered bad. Do not let this discourage you. This particular score is only a couple of points away from being considered fair .

Bad scores can be a result of multiple factors. Some people pay their bills on time each month and still have bad scores. This can be a combination of many things. For example, you could have a high balance on a credit card, you could be maxing out your cards monthly, or you could even have an error on your credit statement that you never consented to. Make sure you stay on track of your score so that you are aware of why it is where it is. With the proper efforts of making correct patterns, you will be able to bring up your score.

Don’t Miss: Can You Take A Cosigner Off A Mortgage

Credit Score: Reasons & Remedies

Regardless of what caused the damage, the best treatment for a credit score of 550 is a steady dose of positive information into your credit report. And the best way to get that going is to open a secured credit card account. Whether you lock the card in a drawer or use it to make purchases and pay the bill on time every month, positive info will stream into your report, offsetting previous mistakes.

That said, lets take a closer look at some of a 550 credit scores common causes and what to do about them.

Heres what can lead to a 550 credit score:

Remedy: If you have not yet defaulted on a delinquent account, making up the payments youve missed is your best option. Having your account default will cause your credit score to fall further, possibly leading to collections and even a lawsuit, both of which could add to the credit damage. Each missed payment you make up will reduce your delinquency level, so you dont have to pay the total amount due all at once. You can also explore debt management and debt settlement.

Minimum Credit Score For Each Loan Type

To give you an idea of the general loan options out there, here is a shortlist of the most common types of mortgages you might find as you shop around.

VA Loan

This might be the hardest to qualify for because unless you have military experience or are married to someone who has, you cant qualify for a mortgage insured by the Department of Veterans Affairs. You also need to have a minimum credit score of 640 to ensure that you have a good chance of getting approved.

Conventional Loan

If you already have a lot of savings and need a high loan amount, you might need a conventional loan. This type of loan is most ideal for someone who can make a larger down payment because without this, youll have to pay for private mortgage insurance. Youll need to score at least 620 in your report if you have any plans of applying.

USDA Loan

To encourage Americans to purchase real estate in the rural country, the U.S. Department of Agriculture backs USDA loans. Unfortunately, these dont actually have a minimum credit score, but ideally, you should score a minimum of 640. Below this number, youll want to prepare documentation about the factors that led to your low credit score so that they can hear you out.

FHA Loan

You May Like: Can I Get A 30 Year Mortgage

Improving Your Credit Score Vs Getting A Mortgage Now

You could spend several months or more improving your credit. But what will happen to interest rates during that time?

- If they go up, you may not save any money despite your improved credit.

- If they go down, you could save money from both your improved credit and the markets lower rates.

No one knows where interest rates are headed. The countrys most educated guess comes from the Federal Reserve, so thats a good source to consult.

In the press release section of the Federal Reserve website, look for the most recent economic projections from the Federal Open Market Committee . Do they think the federal funds rate is headed up or down?

If they think its headed up, mortgage rates could be headed up. Right now, they expect the federal funds rate to stay around zero through 2021 and possibly 2022. But thats a prediction, not a guarantee.

Determine Your Usda Home Eligibility

Verify that you are income-eligible by first choosing Single Family Housing under Income Eligibility on the Property Eligibility Site. Select the state in which the home is located from the pull-down menu and follow the prompts on the succeeding pages to enter the county, household information, expenses and monthly gross income. Click Finish. The next page will tell you whether you are eligible or ineligible for the Section 502 Guaranteed Rural Housing Loan.

Don’t Miss: Is A Timeshare Considered A Mortgage

What Credit Card Can I Get With A 550 Credit Score

You might have a hard time getting approved for a credit card with poor credit scores.

The good news is, Credit Karma can help. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds arent a guarantee that youll be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

Should You Get A Mortgage Or Increase Your Credit Score First

If you look at the loan savings chart above you can see two things: First, bad credit means higher mortgage loan costs. Second, although the chart doesnt go below 620, you can guess that credit scores below 620 lead to even higher financing costs.

So, should you take out a mortgage now or increase your credit score before you apply for financing? The best answer is to plan ahead.

A few straightforward ways to improve your credit score are to pay down existing debts, make sure you stay current on your bills and avoid opening new lines of credit while youre applying for a mortgage. For more advice, check out Bankrates guide to improving your credit.

Read Also: How To Figure Out Mortgage Rates