Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

How Much Income Is Needed For A 200k Mortgage +

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Read Also: Rocket Mortgage Requirements

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

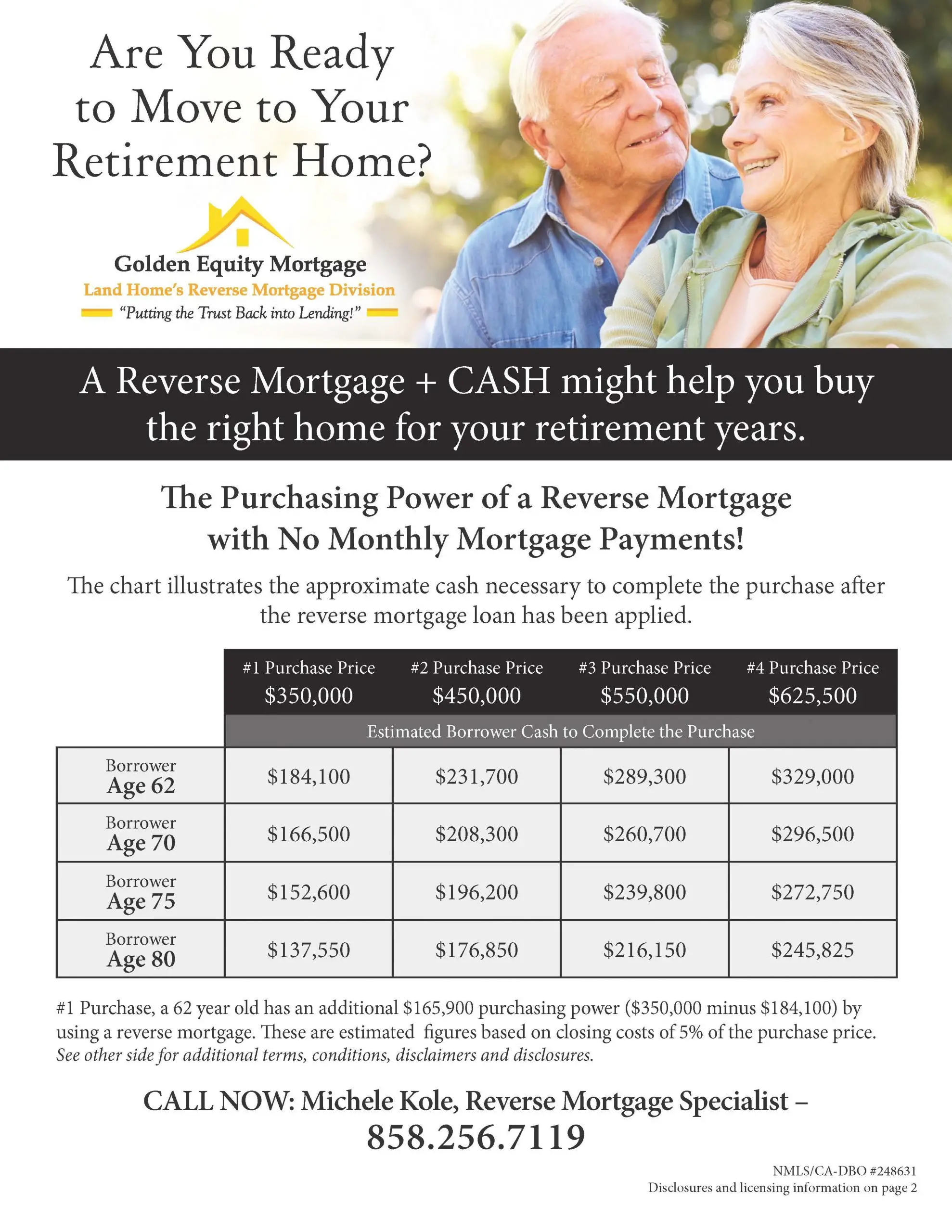

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Meet The Mortgage Payment Calculator

This mortgage payment calculator will estimate exactly that. You can set everything from your amortization and payment frequency to extra payments. The calculator then determines your monthly mortgage payment and provides an amortization schedule showing how fast it will take to whittle down your principal.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Recommended Reading: Does Prequalification For Mortgage Affect Credit Score

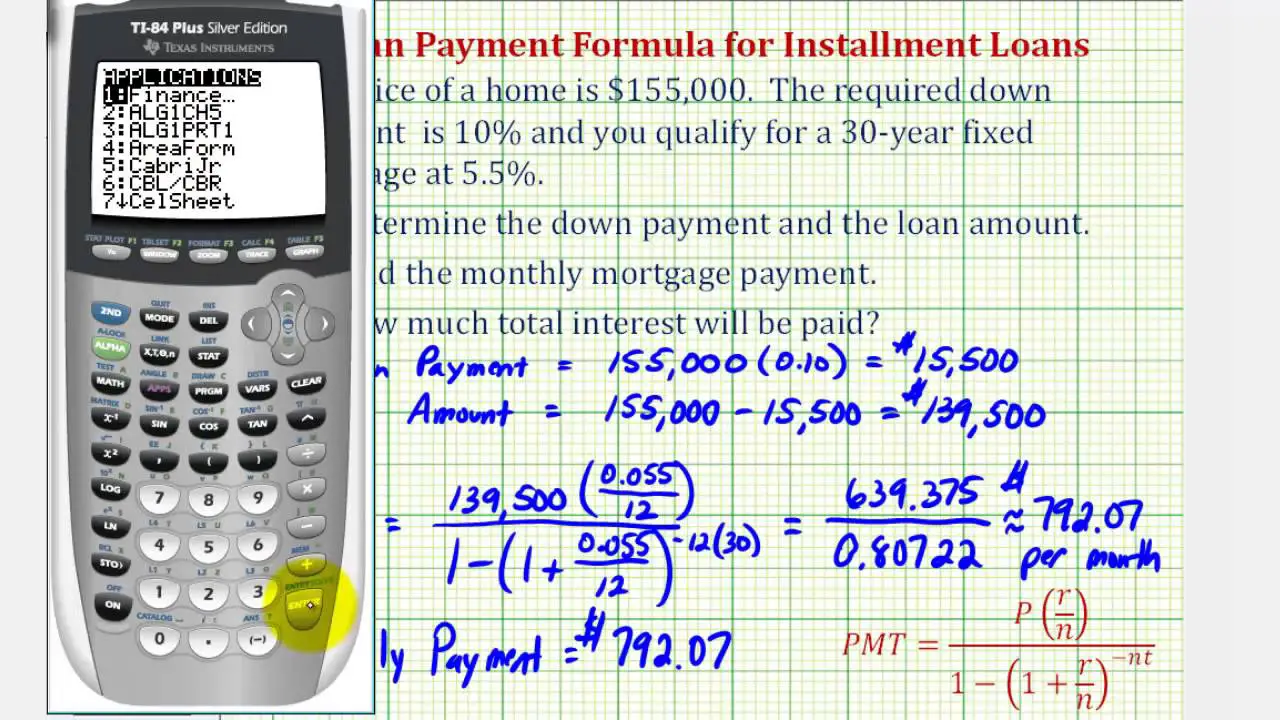

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Don’t Miss: Rocket Mortgage Loan Requirements

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

You May Like: Recast Mortgage Chase

How Much Does A 30 Year Mortgage Cost

30 Year $600,000 Mortgage Loan. Monthly payment: $3,040.11 This calculates the monthly payment of a $600k mortgage based on the amount of the loan, interest rate, and the loan length. It assumes a fixed rate mortgage, rather than variable, balloon, or ARM. Subtract your down payment to find the loan amount.

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Don’t Miss: What Does Rocket Mortgage Do

The Mortgage Payment Calculator In Action

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

If you switch from monthly to accelerated weekly payments, for example, you’ll increase your repayment frequency from 12 monthly payments to 52 weekly payments. That can shave two years and 10 months off your mortgage, versus monthly payments .

Similarly, if you switch from monthly to an accelerated bi-weekly payment schedule, youll increase your repayment frequency from 12 monthly payments to 26 bi-weekly payments. This means youll make a payment every two weeks. That too adds up to one extra monthly payment over the course of a year. As with accelerated weekly, accelerated bi-weekly payments shave about two years and 10 months off your mortgage, versus monthly repayment.

Quickly Estimate The Cost Of Interest Rate Shifts

For any fixed-rate mortgage, select the closest approximate interest rate to your loan from the left column, then scroll look at the payment-per-thousand column for the respective amount to multiply the number by. Then multiply that number by how many hundreds of thousands your home loan is.

- A 3% APR 15-year home loan costs $6.9058 per thousand. If you bought a $100,000 home that would mean the monthly payment would be 100 * $6.9058, so move the decimal places 2 spots to the right and you get a monthly payment of $690.58.

- The total loan cost would be 100 * $1,243.05 Again, move the decimal 2 places to the right & you get $124,305.

- And then if you wanted to figure out the cost of interest you would subtract the $100,000 from $124,305 to get $24,305.

Another way of thinking of the first thousand from the full cost per thousand category is that it includes the thousand you borrowed, so if you subtracted the first thousand from any of these figures that would represent the portion of spending allocated to interest on the loan.

This table scales by 1/8th of a percent from 2% to 10%. At the lower end 0%, 0.5% & 1.0% are added to highlight how little banks pay depositors relative to what they charge creditors. And at the top end 15%, 20% & 25% were added to show how extreme the spread is between deposits and what a credit card might charge a borrower.

| Interest Rate |

|---|

Don’t Miss: Mortgage Recast Calculator Chase

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Where Does Someone So Dumb Aboutmoney Get 100k And Has No Clue

where does someone so dumb about money get 100K and has no clue Someone said: you can either help by telling which websites or just be silence bur not call people names. All he needs is help not name calling Someone said: Wow, sounds like you hate your life and probably spend way too much time on the computer. Howardloanfirm322 said: Hello,i am Mr Howard Normson,a private loan lender whogives life time opportunity loans.Do you need an urgent loan toclear your debts or you need acapital loan to improve yourbusiness?have you been rejected bybanks and other financialagencies? Do youneed a consolidation loan or amortgage?search no more as we are hereto make all your financialproblems a thing of the past.We loan funds out to individualsin need of financial assistance,that have a bad credit or in needof moneyto pay bills,to invest onbusinessat arate of 2%.I want to use thismedium to inform youthat we render reliable andbeneficiary assistance and willbe willing to offer you aloan.So email us today on :[email protected]

Recommended Reading: Rocket Mortgage Payment Options

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

If I Can Afford My Payment Can I Get A Mortgage

It depends. If you use an actual rate to calculate your payments, that payment may be lower than the theoretical payment a lender requires you to afford. Were referring here to the mortgage stress test. The governments stress test requires that you prove you can afford a payment based on a rate that is typically 2+ percentage points higher than actual rates.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Mortgage Calculator: Fees And Definitions

The above mortgage calculator details costs associated with loans or with home buying in general. But many buyers dont know why each cost exists. Below are descriptions of each cost.

Principal and interest. This is the amount that goes toward paying off the loan balance plus the interest due each month. This remains constant for the life of your fixed-rate loan.

Private mortgage insurance . Based on recent PMI rates from mortgage insurance provider MGIC, this is a fee you pay on top of your mortgage payment to insure the lender against loss. PMI is required any time you put less than 20% down on a conventional loan. Is PMI worth it? See our analysis here.

Property tax. The county or municipality in which the home is located charges a certain amount per year in taxes. This cost is split into 12 installments and collected each month with your mortgage payment. Your lender collects this fee because the county can seize a home if property taxes are not paid. The calculator estimates property taxes based on averages from tax-rates.org.

Homeowners insurance. Lenders require you to insure your home from fire and other damages. This fee is collected with your mortgage payment, and the lender sends the payment to your insurance company each year.

Loan term. The number of years it takes to pay off the loan . Mortgage loans most often come in 30- or 15-year options.

Interest rate. The mortgage rate your lender charges. Shop at least three lenders to find the best rate.

Also Check: 10 Year Treasury Vs Mortgage Rates

How Big Was The Mortgage Crisis In The United States

U.S. home mortgage debt relative to GDP increased from an average of 46% during the 1990s to 73% during 2008, reaching $10.5 trillion. From 2001 to 2007, U.S. mortgage debt almost doubled, and the amount of mortgage debt per household rose more than 63%, from $91,500 to $149,500, with essentially stagnant wages.

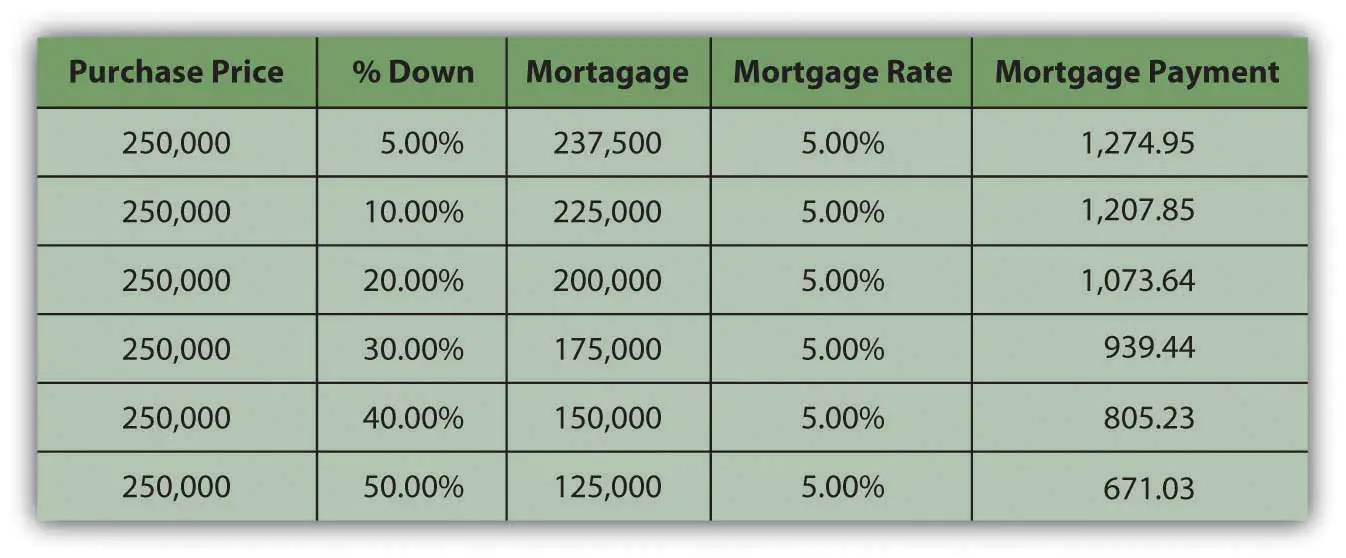

How Much Income Is Needed For A 250k Mortgage +

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Don’t Miss: Rocket Mortgage Loan Types

What Mortgage Payment Options Do I Have

The frequency of your mortgage payments can be monthly, weekly or bi-weekly, depending on your mortgage terms and conditions.

Mortgage payments can be made in the following ways:

- Monthly mortgage payments

- Weekly accelerated payments

- Semi-monthly (twice a month, e.g., on the 1st and 16th of each month.

Accelerated payments help you pay off your mortgage quicker compared to other payment schedules, helping you avoid thousands of dollars in interest. About 350,000 borrowers increased their payment frequency in 2019, found MPC.

When you choose to make accelerated mortgage payments, you end up making the equivalent of 13 monthly payments per year. The result is that you pay off the mortgage years earlier, saving thousands of dollars on interest.

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.