What Is A High

A mortgage with a down payment below 20% is known as ahigh-ratio mortgage. The term ratio refers to the size of your mortgage loan amount as a percentage of your total purchase price.

All high-ratio mortgages require the purchase of CMHC insurance, since they generally carry a higher risk of default.

See Other Mortgage Types

| Avg. Days on Market | Home Costs as % of Income |

|---|

Methodology A healthy housing market is both stable and affordable. Homeowners in a healthy market should be able to easily sell their homes, with a relatively low risk of losing money. In order to find the big cities with the healthiest housing markets, we considered the following factors: stability, affordability, fluidity and risk of loss. For the purpose of this study, we only considered U.S. cities with a population greater than 200,000.

We measured stability with two equally weighted indicators: the average number of years people own their homes and the percentage of homeowners with negative equity. To measure risk, we used the percentage of homes that decreased in value. To determine housing market fluidity, we looked at data on the average time a for-sale home in each area spent on the market – the longer homes take to sell, the less fluid the market. Finally, we calculated affordability by determining the monthly cost of owning a home as a percentage of household income in each city.

Affordability accounted for 40% of the healthiest markets index, while each of the other three factors accounted for 20%. When data on any of the above four factors was unavailable for cities, we excluded these from our final rankings of healthiest markets.

How Your Interest Rate Is Determined

We can only showyou todays 15-year mortgage rates as averages. The rate you actually end uppaying will be determined by a large number of factors.

You can influencesome of the factors that determine you interest rate and get yourself a better deal.These include things like:

- The mortgage lender you choose

- Your credit score and credit report

- The size of your down payment

- Your debt-to-income ratio

- Your employment history

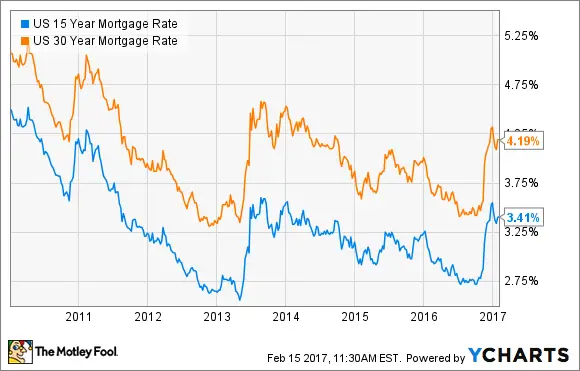

Of course, mortgageinterest rates also move up and down on a broader scale with the overallinterest rate market. Supply and demand for mortgage-backedsecurities will have a big impact on your rate.

But theres littleyou can do about that so focus on factors you can control, like yourloan-to-value ratio and credit score, if you want to save money.

Recommended Reading: What Is The Mortgage On A 3 Million Dollar Home

How Do I Get Preapproved For A Mortgage

Getting preapproved for a mortgage can help you during the homebuying process. Mortgage preapproval represents a lenders offer to loan you money. It can help you appear more attractive to sellers.

To get preapproved for a mortgage, start by gathering documents. Youll need your Social Security card, W-2 forms, pay stubs, bank statements, tax returns and any other documents your lender requires.

The lender you select will guide you through the preapproval process.

Cardinal Financial Company Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, makes mortgages in all 50 states, including both fixed- and adjustable-rate loans ranging from 10- to 30-year terms.

Strengths: Cardinal Financial has closed loans in as few as seven days , and can accept credit scores as low as 620 for a conventional loan, 580 for an FHA or USDA loan, 550 for a VA loan and 660 for a jumbo loan. This can be ideal if your credit needs some work.

Weaknesses: If youre hoping to compare Cardinal Financials 15-year mortgage rates with those of other lenders, youll have to contact the lender directly this information isnt listed on its website.

Read Also: Can You Get A Second Mortgage With An Fha Loan

What Type Of Mortgage Do You Need

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

Also Check: How To Become A Certified Mortgage Underwriter

Who Should Consider A 15

Homeowners who want to save significantly on their home loan and can afford to pay the higher monthly mortgage payments are best suited for 15-year mortgages. Thats because these types of loans tend to have lower interest ratesgovernment-supported agencies like Fannie Mae and Freddie Mac tend to impose loan-level price adjustments, which drive up the costs of 30-year mortgages.

Borrowers considering 15-year mortgages need to consider whether they can afford the monthly payments, as they will be higher compared to a 30-year or 20-year mortgage because you are paying the loan off in less time. Its critical that you determine whether you have ample savings set aside and room in your budget to afford the higher payments in addition to your other monthly obligations.

What Are The Benefits Of A 15

The main advantages of a 15-year fixed mortgage are outlined below. An experienced U.S. Bank mortgage loan officer can help you learn more.

- Stability Youll be able to lock in the interest rate on your mortgage for the entire 15-year term. This gives you a degree of predictability you wont have with an adjustable-rate mortgage .

- Lower interest rate Interest rates on 15-year loans are usually lower than on 30-year loans.

- Less time to own your home With a 15-year term, youll pay off your loan in half the time of the more common 30-year term loan.

- Lower total cost of borrowing Between a lower interest rate and a shorter term, you’ll reduce the total interest you pay over the life of the loan.

Read Also: What’s An Affordable Mortgage

Mortgage Rate Forecast For July 2021

Rates have remained enticingly low throughout the first half of 2021 lower than many experts predicted six months ago. And the outlook for July doesnt call for a radical rate leap, either.But several factors are in play that can easily result in you paying at least slightly more for a purchase or refinance home loan in the coming weeks or months. Thats the consensus opinion among the group of industry pros Bankrate recently polled, who envision mortgage rates edging marginally higher at worst or standing pat over the next month.

Over the next month, rates may rise a bit but will likely be pretty close to where they are today around 3 percent for the 30-year fixed-rate mortgage, says Leonard Kiefer, deputy chief economist for Freddie Mac in McLean, Virginia. While inflation has ticked higher in recent months, many analysts consider much of the increase in consumer prices to be transitory. Thus, even with higher inflation rates, mortgage rates have held pretty steady. Id expect these near historically low mortgage rates to stay through at least early summer.

Learn more about specific loan type rates| Loan Type |

|---|

Other Mortgage Loan Types To Choose From

Besides conventional 15-year and 30-year fixed-rate mortgages, there are other loan types to choose from when buying a new home or refinancing.

- Adjustable rate mortgagesAdjustable rate mortgages come in 30-year terms. The major forms of these mortgage types are 5/1, 5/6, 7/6 and 10/6. For each of these, the loan starts with a low rate for the first 5, 7 or 10 years, then adjusts every six months to a year for the remainder of the loan. These types of mortgages are great if you don’t plan on staying in the home long-term. Disclaimer: Rocket Mortgage® does not currently offer 5-year ARMs.

- Jumbo mortgages Jumbo loans are typically 30-year loans for expensive properties. Conventional loans have limits on how much you can borrow depending on the average property value where you’re buying. A jumbo loan is an option if the property you’re buying exceeds this limit. Since it’s a higher loan amount and a higher risk for the bank, jumbo loans come with higher interest rates.

- Cash-Out refinance A cash-out refinance is a type of mortgage refinance in which you can turn the home equity you have into cash. You then take on a new mortgage for the rest of what you owe.

Also Check: How To Apply For A 2nd Mortgage

Benefits Of A 15 Year

There are many benefits of selecting a 15 year loan. Some of the main benefits are:

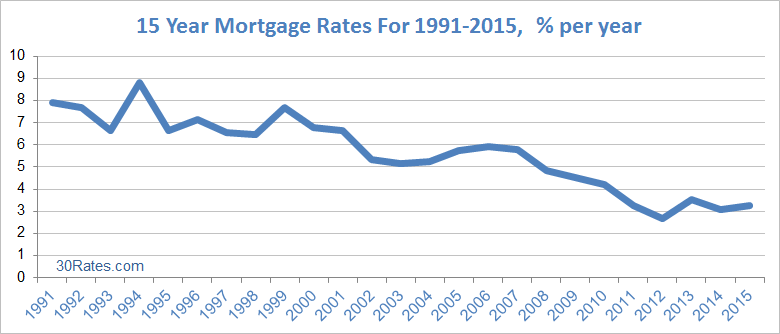

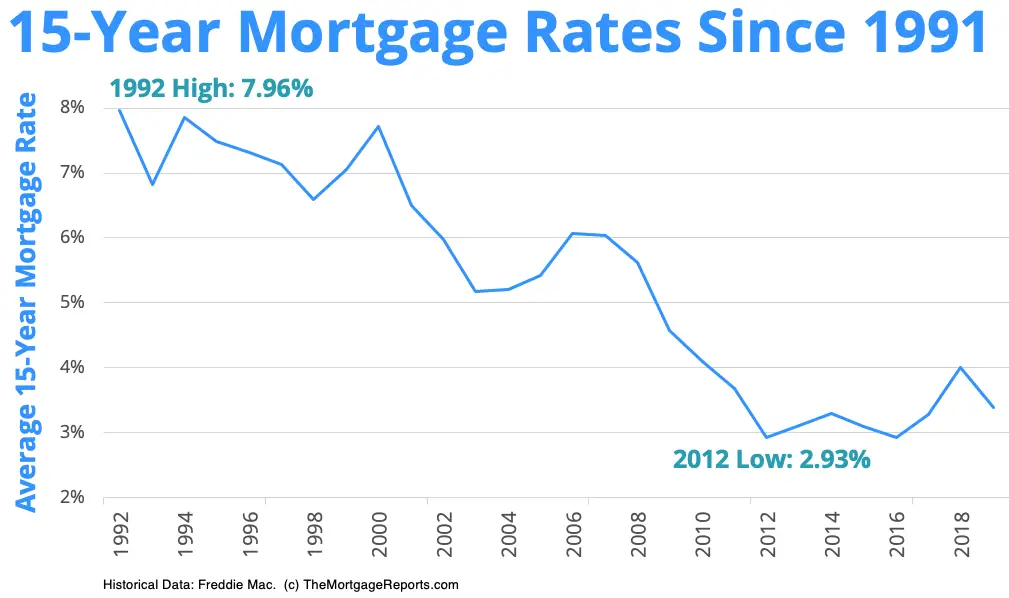

- Low Interest Rate As mentioned earlier, a 15 year normally comes with an interest rate of .50% to .75% lower than a 30 year rate. Coupled with the fact that the loan is paid off much quicker, a 15 year will save a borrower thousands of dollars each year in interest payments. Over the course of a $200,000 loan, a borrower could save a substantial sum of money. On the day this article was published, they would have saved $147,000 in interest expenses by selecting a 15 year over a 30 year.

- Build Equity Quickly Another benefit of selecting a 15 year is that a homeowner will build home equity much quicker than someone who selects a 30 year. Assuming a $200,000 loan with interest rates of 6% for a 30 year and 5.25% for a 15 year, after just five years a borrower with a 15 year will have $35,000 more equity in their home than a person with a 30-year. After the 15 years, a person with a 30 year will still have $144,000 pinciple balance left.

- Fixed Payment Another benefit of a selecting a 15 year is that the borrower will have a fixed payment for the life of the term. Because of this, a borrower will be assured that their payment will never adjust dramatically and they will always have an affordable payment.

Comparison To Other Options

While the 15 year is one of the more popular mortgages, there are several other products which are available. A 15 year can be compared to the following:

Get the Best of Both Worlds

You can take out a 30-year mortgage then use that interest rate to calculate how much you would need to pay each month to get your home paid off in 15 years. This method would have you pay a slightly higher interest rate than the 15-year fixed, but it would give you more financial flexibility month to month. If your loan is structured as a fixed-rate loan and interest rates go up then you can pay off the home loan more slowly while investing in other faster appreciating assets.

Read Also: How To Shop For Mortgage Refinance

How Much Can You Potentially Save By Refinancing

Refinancing comes with closing costs, just like original mortgages. Closing costs vary, but they can be 2 to 5 percent of the loan amount. On a $100,000 refinance, closing costs of 3 percent would be $3,000 not an insignificant sum.

You should try to negotiate with your lender to see if the fees can be lowered. The lender may offer to let you fold the closing costs into the loan, so you dont have to come up with the cash upfront. But that means youll also be paying interest on the extra amount. Instead, ask whether the lender would be willing to waive part of the closing costs, such as the application fee or credit check fee. Particularly if you are a repeat customer, you might be able to work out a better deal.

Since the goal of refinancing is saving money, youll want to calculate how long it will take you to break even on the closing costs and start realizing actual savings. Our refinance calculator helps you quickly figure how long it will take you to recoup closing costs so you can decide if refinancing is worthwhile.

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

How Do I Shop For 15

NerdWallet’s mortgage rate tool can help you find competitive 15-year fixed mortgage rates. In the filters above, enter a few details about the loan you’re looking for, and you’ll get a personalized rate quote in minutes, without providing any personal information. From there, you can start the process to get preapproved for your home loan. It’s that easy.

» MORE:Pros and cons of a 15-year fixed mortgage

Also Check: How Much Do Mortgage Underwriters Make

What Are The Differences Between A 15

Both a 15-year and 30-year mortgage are fixed-rate loans. The biggest difference between the two is that they have different loan terms. A 30-year mortgage will take 30 years, or 360 monthly payments. Compare this to a 15-year term, which will take less time and where borrowers will end up paying less in interest over the loans life of 180 months.

Since a 30-year mortgage spreads out your monthly payments for a longer period of time, youll make lower monthly payments compared to one for a 15-year term. However, itll also mean that youll end up paying more interest throughout the lifetime of the loan because of both the duration of the loan and, typically, a higher interest rate.

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Read Also: Does Rocket Mortgage Affect Your Credit Score

When To Refinance

If rates are dropping, you’re planning on staying in your home for a while and you’re not close to paying off your current mortgage, consider refinancing. The cost of refinancing needs to be balanced out by the savings you’ll receive with a lower interest rate.

If the market has shifted and rates are low enough, refinancing to a 15-year mortgage may not change your monthly payment. This can help you save big on interest, without putting a burden on your monthly expenses.

It should be noted that, if you have an adjustable rate mortgage, it’s smart to refinance to a lower fixed rate before your rate adjusts up.

Who Is A 15

Borrowers who dont mind a higher monthly payment might find a 15-year mortgage to be a more attractive option than a longer-term loan. Thats because 15-year mortgages come with a lower interest rate and less interest paid overall.

If youre looking to refinance, its smart to consider refinancing into a 15-year mortgage, especially if youre more than halfway through repaying your current 30-year loan. If you refinance into another 30-year loan, youd extend your repayment period, which costs more in the long run.

Another reason to consider a 15-year mortgage is if you want to retire mortgage-free. Locking in the shorter duration of a 15-year mortgage now, especially if youre in your 40s or 50s, allows you to pay it off in time for when you stop working.

Read Also: How Much Mortgage Can I Afford On 200k Salary

How To Find Personalized 15

We’re showing today’s average mortgage rates, but you can find personalized rates based on your down payment amount, credit score, and debt-to-income ratio.

If you’re a little further along in the homebuying process, then you can speak with multiple lenders to receive personalized rates to compare and contrast rates before choosing a lender.

Do I Need Cmhc Insurance

UnderOffice of the Superintendent of Financial Institutions regulations, you are required to purchase CMHC insurance if your down payment is below 20%.

You may beineligible for CMHC insuranceif:

- your purchase price is $1,000,000 or above, or

- your amortization period is longer than 25 years.

In these cases, you must make a down payment of 20% or higher.

Don’t Miss: What Will Be My Mortgage

Today’s Mortgage Rates Drop Off Here’s What That Means For Your Home Loan Payments

A handful of important mortgage rates sank today, including 15-year fixed and 30-year fixed mortgage rates. Also, the 5/1 adjustable-rate mortgage declined. Although mortgage rates are always changing, they are quite low right now. So it could be an optimal time for prospective homebuyers to secure a fixed rate. As always, make sure to first think about your personal goals and circumstances before purchasing a home, and shop around to find a lender who can best meet your needs.