Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

How Much Of A Mortgage Can You Afford

As a general rule, it’s a good idea to keep your monthly housing costs to 30% of your take-home pay, if not less. Those costs should include your mortgage payment, property taxes, homeowners insurance premiums, and any other recurring housing expense that’s predictable .

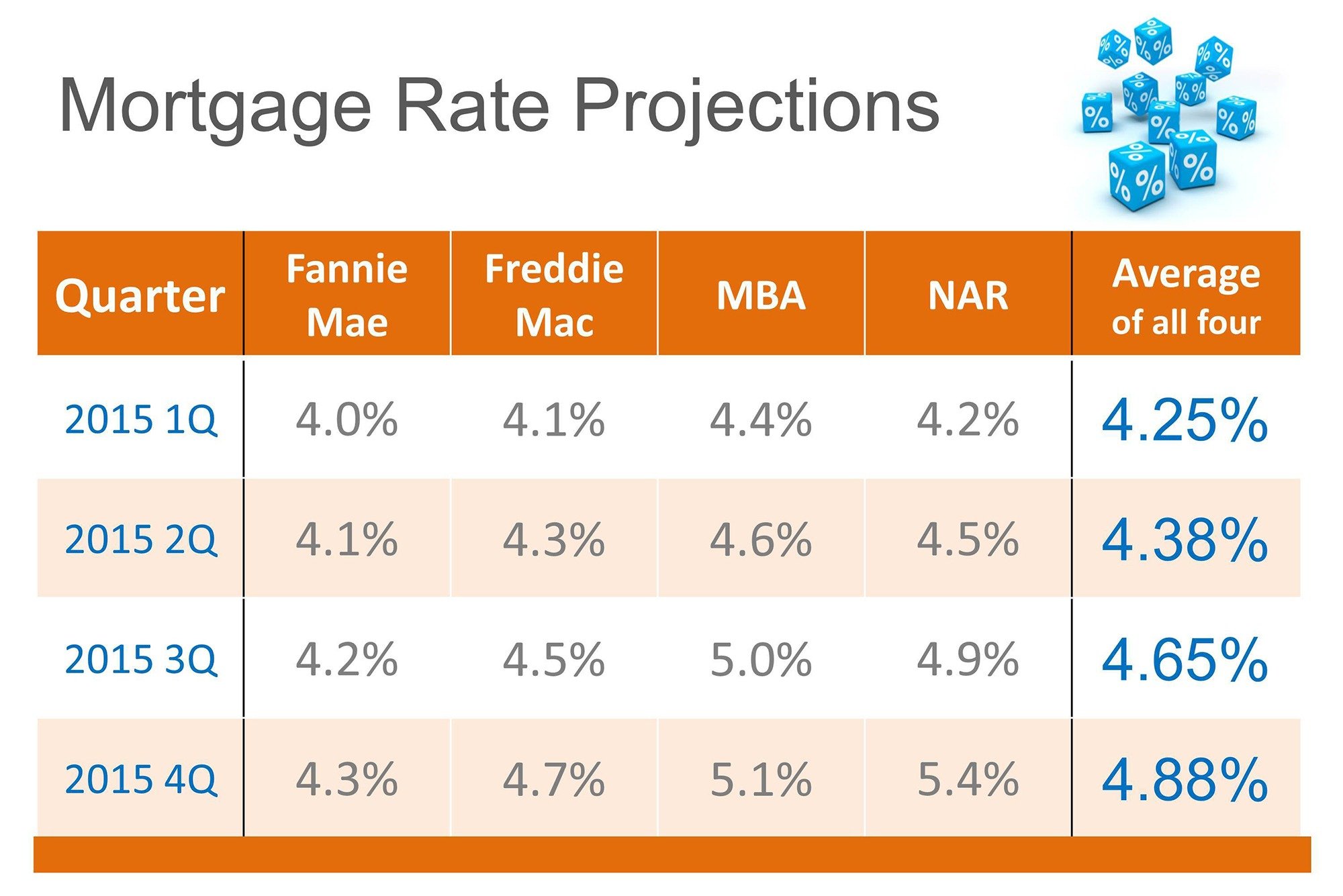

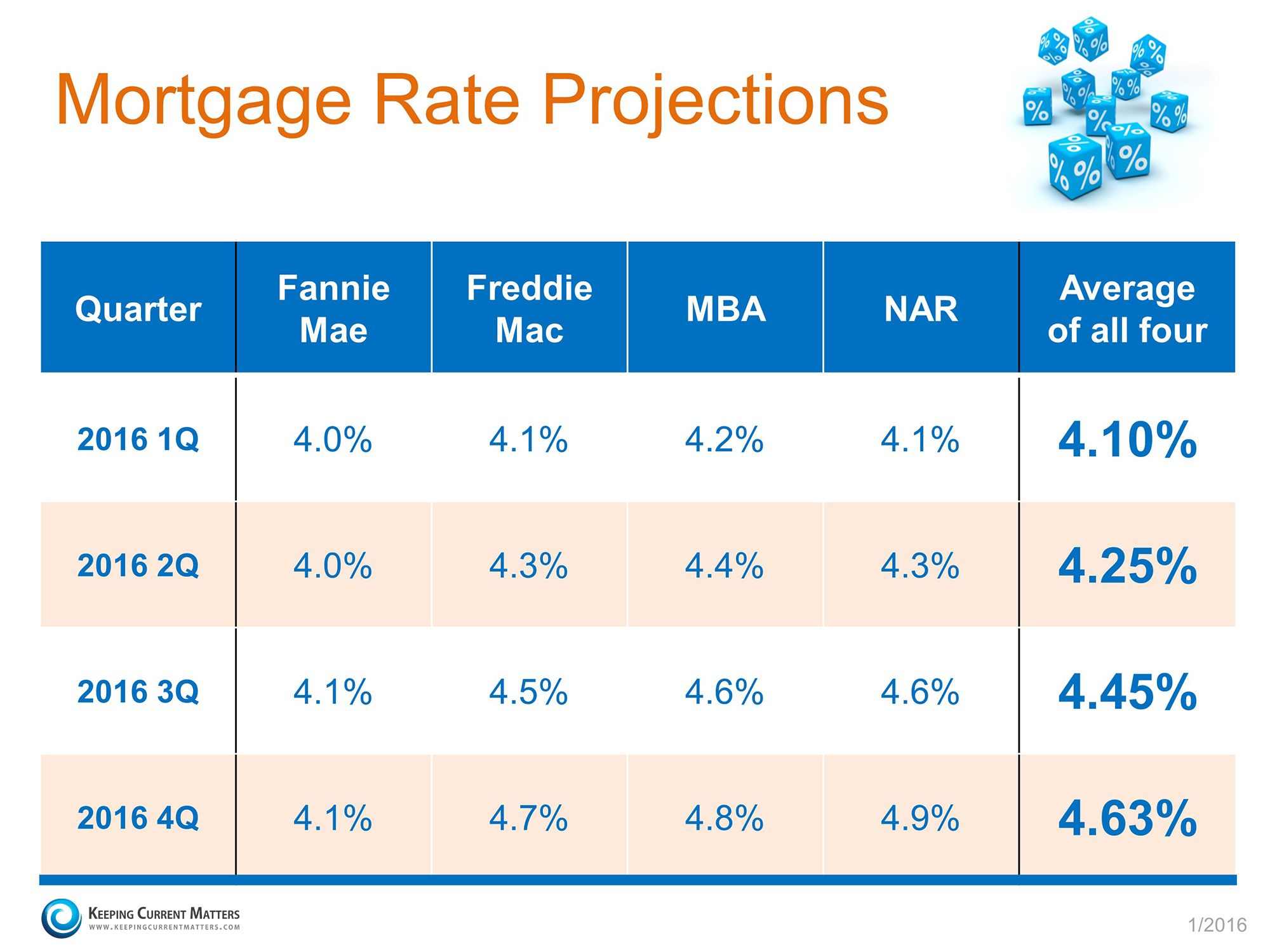

You can use a mortgage calculator to see what loan amount you can afford based on the interest rate you think you’ll qualify for and the amount of money you have for a down payment. Now, figuring what interest rate you’ll snag is tough because rates can change from day to day. Plus, the rate you’re eligible for depends on factors like your and where you live.

But if you take a look at how mortgage rates are averaging, you can get a sense of what rate you may be offered, or at least use that as a starting point in your calculations. And from there, you can figure out how much of a borrowing limit to set.

In fact, mortgage lenders themselves use formulas to determine how much of a loan amount you can qualify for. But it’s important to run your own numbers and land on a figure you’re comfortable with.

A lender might, based on your income and other factors, decide that you’re eligible for a $450,000 mortgage. But if you’re only comfortable borrowing $400,000, that’s the limit you should stick to.

Don’t Miss: Rocket Mortgage Loan Requirements

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

How To Get The Best Mortgage Rate

For the best chance at the lowest mortgage rate, follow these tips:

- Improve your credit score Lenders offer their lowest rates to those with strong credit. Some ways to boost your score include paying your bills on time and lowering your credit utilization ratio, the ratio of your credit balance to your credit limit.

- Build a record of your work history Lenders generally look favorably on borrowers with at least two years of consistent employment. If your work history has significant gaps or youre self-employed, you might have to provide more paperwork to get approved for the best possible rate.

- Save more for a down payment Putting more money down upfront can help you secure a lower rate. One way to grow your savings is to automatically set aside a portion of your income into a savings account. You can also look into down payment assistance programs, which can help you get the funds you need.

- Compare rates Comparing offers to find the lowest mortgage rate can save you thousands over the course of a 30-year loan.

- Consider a low-credit mortgage If your credit score isnt as high as youd like it to be, consider getting an FHA loan. FHA loans can sometimes have a lower interest rate, by about a half a point or more, compared to a conventional loan.

- Work with a mortgage broker A broker can help find you the best deal and negotiate a lower rate, and many dont charge any fees. Be sure to look for a broker who has experience with the type of loan youre after.

Also Check: Monthly Mortgage On 1 Million

British Columbia Housing Market

British Columbia is home to some of the highest average home prices in the country, despite experiencing a housing downturn in 2018 and early 2019, which quickly caused a 180 from a sellers market to a buyers market.

In 2019, the average home price was $700,397, down 1.6% from the previous year according to the British Columbia Real Estate Association . B.C. home prices are expected to rise by 4.8% in 2020 to $734,000.

There was a total of 77,349 sales in 2019, a 1.5% decline from 2017, though thats expected to rebound by 10% in 2020 to more than 85,000 sales. Keep in mind that these forecasts were derived prior to the COVID-19 pandemic and are likely to be revised down.

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

You May Like: Mortgage Rates Based On 10 Year Treasury

Example: Costs When You Break Your Mortgage Contract To Change Lenders

Suppose a different lender is offering you 3.75% interest. To break your mortgage contract with your current lender youll need to pay a prepayment penalty of $6,000.

You may also choose a blend-and-extend option with your current lender. This would give you a 4.6% interest rate.

| Costs | |

|---|---|

| $40,350 | $38,005 |

In this example, you pay less when you choose a blend-and-extend option with your current lender.

Note that youll usually need to pay fees when you set up a new mortgage, including when you choose a blend-and-extend option. This example doesnt take into account any fees. Lenders may be willing to pay some or all of the fees. If this is the case, your costs to renegotiate your mortgage will be less.

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

Also Check: Rocket Mortgage Launchpad

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

Calculation Of The Ird

To calculate the IRD, your lender typically uses 2 interest rates. They calculate the entire interest fees left to pay on your current term for both rates. The difference between these amounts is the IRD.

To do so, they can first use one of the following interest rates:

- the posted rate at the time you signed your mortgage contract

- your current rate or discounted rate as described in your contract

Your lender can calculate a second interest rate based on the following:

- the current posted rate for a term with a similar length

- the current posted rate for a term with a similar length minus the discount you were originally offered

Read Also: Who Is Rocket Mortgage Owned By

What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties

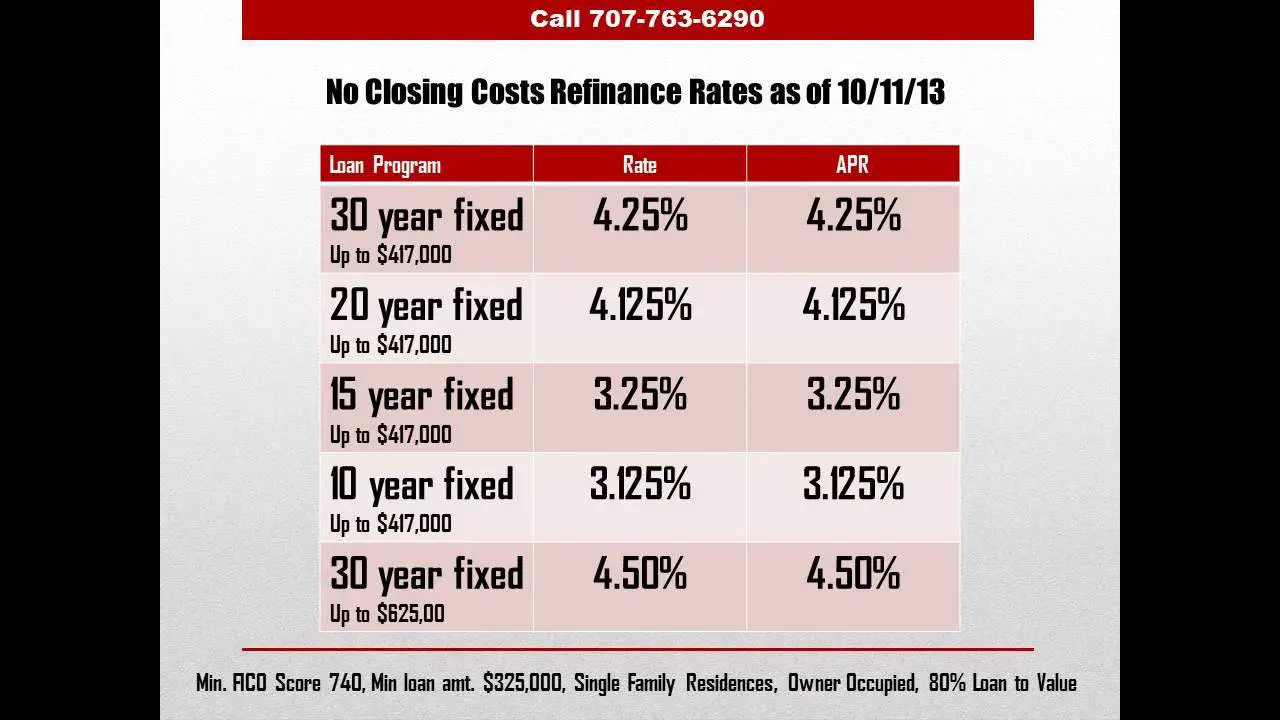

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rate and an annual percentage rate . Thats understandable, since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

What Your Lender Needs To Tell You

If your lender is a federally regulated financial institution, such as a bank, they have to provide certain information.

The following details must appear in an information box at the beginning of your mortgage agreement:

- prepayment privileges

- prepayment penalties

- other key details

Your lender must tell you how they calculate your prepayment penalty. Your lender must also tell you what factors they use to determine the penalty. These details must be clear, simple and not misleading.

Read your mortgage contract carefully. Make sure you understand the details about penalties before you sign your contract. Ask questions about anything you dont understand.

Factor: Mortgage Vs Refinance

Mortgages on refinances, for example, usually cost more than mortgages for purchases. Thats because refinances are deemed higher risk and because refinances cannot be default insured.

Jargon Buster:Default insurance protects the lender in case you dont pay your mortgage. Insurance is either:

- Optional , or

- Mandatory .

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

How Are Mortgage Rates Determined

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Don’t Miss: Chase Recast Mortgage

The Latest Interest Rate Forecasts

Forecasts for what the Bank of Canada mayor may notdo next week run the gamut from yet another rate hold, to the Bank shocking markets with a 50-bps hike in order to tackle inflation and runaway house prices.

Scotiabank, which for months had led the consensus forecast with its expectation of eight quarter-point rate hikes by 2023, has gone one step further and now expects 225-bps worth of tightening over the next two years, beginning with a 25-bps hike next week.

The BoC would not tighten policy just because of housing, but housing pressures on top of ripping inflation change the equation,writes economist Derek Holt. Waiting to hike until April or later, and doing so tepidly, will be too little, too late and the BoC would risk wearing full responsibility for another massive gain in house prices, more investor activity than even what weve observed so far, and greater housing imbalances and future vulnerabilities.

Holt added that mortgage rate commitments will start accelerating in the weeks ahead and carry on into an environment of rising immigration, no supply and a rebounding economy.

Bringing forward rate hikes is the best medicine for attempting to engineer a soft landing, he wrote. Hard landing risks would rise if the BoC continues to look the other way while maintaining overly accommodative policy.

Bond markets are now pricing in an 86% chance of a 25-bps rate hike at next Wednesdays rate meeting, with a slight chance of a 50-bps hike.

Break Your Mortgage Contract To Change Lenders

You may decide to renegotiate your mortgage contract and change lenders because another lender offers you a lower interest rate. In this case, you may need to pay a prepayment penalty to break your mortgage contract. Make sure the benefits of breaking your mortgage contract will save you money once you include all the fees.

You May Like: Rocket Mortgage Vs Bank

Should I Work With A Bank Or A Mortgage Broker

There are benefits and drawbacks to working with either a mortgage broker or a bank. Working with a mortgage broker gives you access to mortgage rates from a wide variety of lenders. That maximizes the chance that you’ll find a lower rate than you would by going directly to a bank. On the other hand, getting a mortgage from a bank can be quick and simple, especially if you already bank with them. We’d generally recommend seeing what rate your current bank will offer you, while also speaking to a local mortgage broker to see what other rates are on offer.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

We compare the most competitive brokers, lenders and banks in Canada to bring you today’s lowest interest rates, free of charge. Canadaâs current mortgage rates at the top of this page are updated every few minutes, so are the best rates currently on offer. to better understand what rate you could be eligible for in a few simple steps – – again, itâs completely free to use and youâre under no obligation whatsoever.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

Read Also: Rocket Mortgage Payment Options

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

What Do I Need To Refinance My Mortgage With A Fixed Rate Loan

A 30 year mortgage could be very beneficial, but you need to consider how long you plan to stay in your new home. If what matters most to you is having lower mortgage payments each month, you should consider a 30 year fixed rate mortgage with the help of a loan officer.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates