A Guide To Private Mortgage Insurance

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

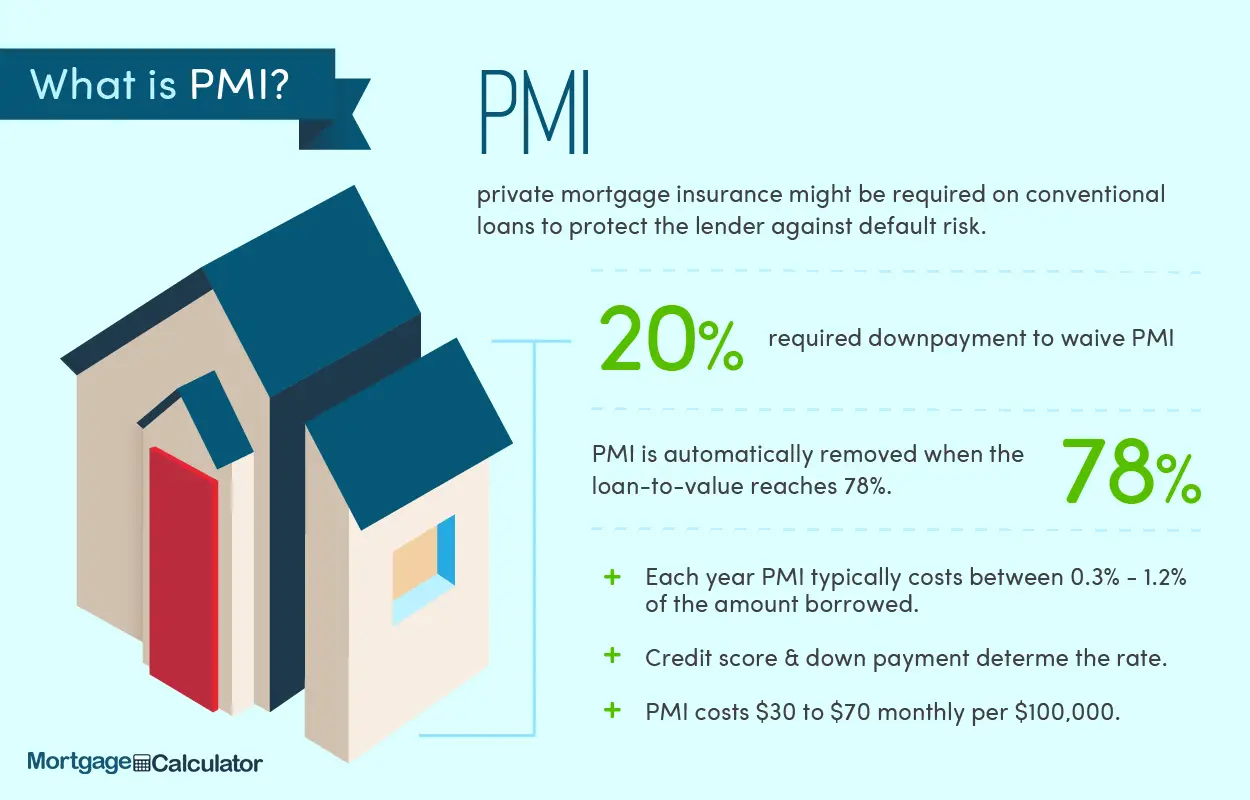

Its a myth that you need to put down 20% of a homes purchase price to get a mortgage. Lenders offer numerous loan programs with lower down payment requirements to fit a variety of budgets and buyer needs. If you go this route, though, expect to pay for private mortgage insurance . This added expense can drive up the cost of your monthly mortgage payments and, overall, makes your loan more expensive. However, its almost unavoidable if you dont have a 20% or more down payment saved up.

Private Mortgage Insurance

How Much Does Private Mortgage Insurance Cost

For conventional mortgages, private mortgage insurance generally costs around 0.2% to 2% of the loan amount per yearbut can sometimes be much more. The exact amount you’ll pay could depend on the type of loan, the insurance provider, your credit scores and your loan-to-value ratio. Here’s a closer look at how PMI can impact your total mortgage cost, and how you may be able to save money by canceling your PMI.

Examples Of Private Mortgage Insurance Payments

Insurance rates vary based on your down payment and credit score, usually ranging between 0.3 and 1.15 percent. The actual price is typically $30 to $70 per month for every $100,000 you borrow.

For example, imagine you buy a house for $150,000 and make a 10 percent down payment. This means you end up borrowing $135,000. The mortgage insurer you get your loan from charges an annual PMI premium of 0.8 percent for an annual premium cost of $1,080, or $90 per month.

Recommended Reading: Are Discount Points Worth It

If Mortgage Insurance Is Canceled Will I Receive A Refund For Pre

There’s a lot of information out there when it comes to refundable mortgage insurance.

If the mortgage insurance was financed at the time of origination and is canceled prior to its maturity you may be entitled to a refund if the refundable option was chosen at the time of origination. However, if there was no refund/limited option, this would negate any option for a refund. When PMI is canceled, the lender has 45 days to refund applicable premiums.

That said, do you get PMI back when you sell your house? It’s a reasonable question considering the new borrower is on the hook for mortgage insurance moving forward. Unfortunately for you, the seller, the premiums you paid won’t be refunded.

What Does Fha Loan Mortgage Insurance Cost

The upfront mortgage insurance premium is 1.75% of the loan amount, or $1,750 for every $100,000 borrowed.

The annual premium rate is based on your loan amount and down payment. Those factors also determine how long youll owe MIP.

Most FHA borrowers put down less than 10% and will pay annual MIP between 0.80% and 0.85%. But those who put down 10% or more will only pay annual MIP for 11 years, after which the MIP requirement ends.

Annual MIP is divided into 1/12th payments that are included in your monthly mortgage installments.

MIP rates for a 30-year FHA loan

| Loan amount |

|---|

| Annual MIP | $1,668 |

FHA guidelines allow you to roll the upfront MIP into your loan. If you choose this option, your total loan amount would be $196,378.

Upfront MIP can also be included in your closing costs. You can pay those from your savings, or from closing cost assistance funds if you qualify for a state or local assistance program.

You can look up homebuying assistance programs through the U.S. Department of Housing and Urban Affairs website, and by Googling closing cost assistance programs in .

You May Like: Reverse Mortgage Manufactured Home

How Much Is Mortgage Insurance

Mortgage insurance costs vary by loan program . But in general, mortgage insurance is about 0.51.5% of the loan amount per year.

So for a $250,000 loan, mortgage insurance would cost around $1,250$3,750 annually or $100315 per month.

Mortgage insurance rates

Note that for most loan types, there are two mortgage insurance rates: an annual rate and an initial rate or fee.

The initial mortgage insurance fee is usually higher, but its only paid once when the loan closes. And both types of mortgage insurance vary by loan program.

| $84 | $0 |

Theabove example assumes a $300,000 home purchase with 3.5% down, and a 30-yearfixed interest rate of 3.75%. Your own rate and mortgage insurance costs willvary

*Annual mortgage insurance cost is calculated based on year 1 loan balance. Annual costs will go down each year as the loan balance is reduced

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: Chase Recast Calculator

Your Heirs Get Nothing

Most homeowners hear the word insurance and assume that their spouse or kids will receive some sort of monetary compensation if they die, which is not true. The lending institution is the sole beneficiary of any such policy, and the proceeds are paid directly to the lender . If you want to protect your heirs and provide them with money for living expenses upon your death, youll need to obtain a separate insurance policy. Dont be fooled into thinking PMI will help anyone but your mortgage lender.

What Does Mortgage Insurance Cover

Mortgage insurance covers the borrowers contractual obligations of a home loan. Policies cover a certain percentage of the loss if a borrower forecloses on their home. In other words, it protects the lender in case the borrower is unable to pay back the loan.

Mortgage insurance protects the lender, not the borrower. Borrowers need to be aware that its not the other way around. For example, it does not cover the borrower if their house is destroyed by a disaster thats what homeowners insurance is for.

For example, imagine you lose your job and cant make your payments. You default on your loan with a remaining balance of $250,000. At foreclosure, the lender chooses to auction off the home at a lower price of $200,000. The insurance company covers the $50,000 difference, fulfilling the original terms of your loan.

Recommended Reading: Chase Mortgage Recast

What Is Mortgage Insurance

PMI private mortgage insurance is a type of insurance policy that protects mortgage lenders in case borrowers default on their loans. Heres how it works.

If a borrower defaults on their home loan, its assumed the lender will lose about 20% of the homes sales price.

If you put down 20%, that makes up for the lenders potential loss if your loan defaults and goes into foreclosure. Put down less than 20%, and the lender is likely to lose money in the event of a foreclosure.

Thats why mortgage lenders charge insurance on conventional loans with less than 20% down.

Mortgage insurance covers that extra loss margin for the lender. If you ever default on your loan, its the lender that will receive a mortgage insurance check to cover its losses.

That might sound like a tough deal. But the upside is, mortgage insurance gives you a fast track to home ownership.

Without mortgage insurance, many people would have to wait years to save up for a bigger down payment before buying a house.

Those are years they could have spent investing in their home and building equity rather than paying rent to a landlord each month.

Private Mortgage Insurance For Conventional Loans

Unlike FHA loans, not every person who buys a house with a conventional loan is required to pay for mortgage insurance. If you make a down payment of 20% or more, you do not need to pay for PMI. If you make a down payment of less than 20%, you will mostly likely be required to pay for private mortgage insurance by your lender.

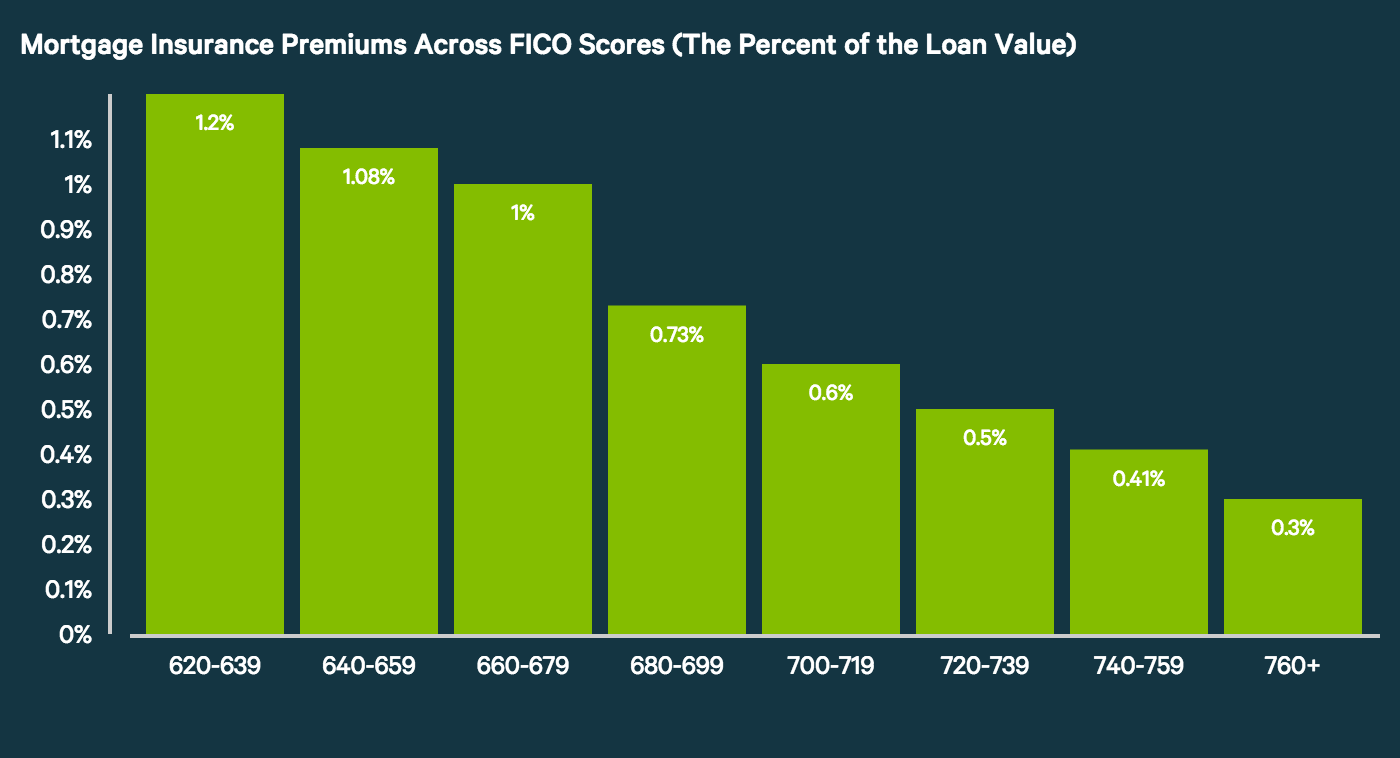

The cost of PMI is affected by factors like your credit score and the amount of your down payment. The cost can vary from borrower to borrower and generally runs between 0.5% and 2% of the loan amount of the mortgage.

There are similar requirements when you refinance a conventional loan. You need to have 20% home equity or you will most likely be required to pay for private mortgage insurance.

You May Like: Does Getting Pre Approved Hurt Your Credit

Key Questions About Pmi

If the idea of paying private mortgage insurance gives you pause, it should. PMI is an avoidable extra cost associated with buying a home.That said, sometimes paying PMI is the right move it can help you get into a home that would otherwise be out of reach. So before you make the decision to take out a home loan that includes PMI, learn the answers to these four key questions first.

If Your Mortgage Is From A Minnesota

Minnesota law, unlike federal law, allows homeowners to benefit from market appreciation. Under Minnesota law, the value of your home is based on what it would be worth if you sold it today. For instance, if you bought your home for $100,000 with 5 percent down and your house is now worth $130,000, you probably are eligible to cancel PMI under Minnesota law because you owe less than 80 percent of the market-value of your home.

You will need to hire an appraiser to establish the market value of your home to prove that you owe less than 80 percent of its current value. You should feel confident in the market value of your house before you obtain an appraisal. If the appraisal value falls short, you will have paid for the appraisal and must still continue to pay PMI, as well. Minnesota law gives you the right to shop for and pick an appraiser, as long as he or she is reasonably acceptable to your lender. A Minnesota-chartered lender cannot reject your appraiser without reason and cannot require you to pick only from a short list approved by the lender. Nonetheless, before you pay for the appraisal, contact your lender and make sure that the appraiser is acceptable.

You May Like: Chase Recast

Dont Let Fha Loan Mortgage Insurance Scare You Off Homeownership

The idea of mortgage insurance can seem off-putting, but remember that it can actually help you get into a home sooner than you think. Sure, its an extra cost. But you have to weigh that against the equity you could be building if you decide to buy now rather than waiting to save up 20%.

Plus, there are ways to minimize your mortgage insurance payments so that homeownership becomes even more affordable.

If youre ready to become a homeowner, the next step is to speak with a knowledgeable mortgage lender who can explain your loan options including mortgage insurance and other details.

What Factors Should I Consider When Deciding Whether To Choose A Loan That Requires Pmi

Tip

You may be able to cancel your monthly mortgage insurance premium once youve accumulated a certain amount of equity in your home. Learn more about your rights and ask lenders about their cancellation policies.

Like other kinds of mortgage insurance, PMI can help you qualify for a loan that you might not otherwise be able to get. But, it may increase the cost of your loan. And it doesnt protect you if you run into problems on your mortgageit only protects the lender.

Lenders sometimes offer conventional loans with smaller down payments that do not require PMI. Usually, you will pay a higher interest rate for these loans. Paying a higher interest rate can be more or less expensive than PMIit depends on a number of factors, including how long you plan to stay in the home. You may also want to ask a tax advisor about whether paying more in interest or paying PMI might affect your taxes differently.

Borrowers making a low down payment may also want to consider other types of loans, such as an FHA loan. Other types of loans may be more or less expensive than a conventional loan with PMI, depending on your credit score, your down payment amount, the particular lender, and general market conditions.

You may also want to consider saving up the money to make a 20 percent down payment. When you pay 20 percent down, PMI is not required with a conventional loan. You may also receive a lower interest rate with a 20 percent down payment.

Recommended Reading: What Does Gmfs Mortgage Stand For

Consider Your Credit Score

The lower your credit score, the more likely lenders feel you may default. As such, PMI premiums increase as a borrower’s credit score decreases. Even if everything else about them is the same, a borrower with a credit score of 780 or better may enjoy a PMI premium of 0.3 percent while a borrower with a credit score of 630 may have to pay 1.2 percent. Borrowers with a low credit score can sometimes combat higher PMI premiums by putting down a large downpayment. Ideally, these borrowers would do best to put down 20 percent and avoid PMI altogether.

What Determines The Cost Of Private Mortgage Insurance

The amount of private mortgage insurance you pay over the life of the loan is tied to the amount of your down payment. Things like credit score, loan amount, amount of coverage, and transaction type also come into play here.

So if your down payment is just 5%, you can expect to pay more per month than if you were to put 10% or 15% down. PMI that translates into seemingly small numbers like 0.23% or 0.4% are common, but they can translate into a few hundred a month depending on your loan size. The better your credit and other factors, the less youll pay. The exact amount can also change from year to year.

Essentially, anything that drives up your mortgage interest rate will also increase your private mortgage insurance costs. Some borrowers pay some at closing and some later on. Others build it into their interest rate or pay the total up front. Lenders typically dont care as long as you pay your mortgage insurance premium.

The private mortgage insurance company will likely want to collect an escrow equal to two monthsinsurance premium at closing, i.e. between $200 and $400 when using the example above.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Why Do We Pay Mortgage Insurance

Mortgage insurance protects the lender. Youll have to pay for it if you get an FHA or USDA mortgage or put down less than 20% on a conventional loan. Mortgage insurance makes it possible to hand over a much smaller down payment and still qualify for a home loan. It protects the lender in case you default on the loan.1 2019 .

When Can I Cancel Pmi

PMI cancellation should happen automatically when your loan balance falls to 78% of your homes original purchase price.

However, you may be able to cancel PMI a little sooner when you reach the 80% threshold by contacting your loan servicer.

Keep in mind that these rules apply only to conventional loans. Mortgage insurance works differently for subsidized loans such as USDA and FHA mortgages.

FHA mortgage insurance premium

FHA loans, backed by the Federal Housing Administration, require their own type of mortgage insurance. This is known as mortgage insurance premium, or MIP.

MIP charges two separate fees: an upfront payment and an annual one

- Upfront mortgage Insurance Premium costs 1.75% of the loan amount. It can be paid at closing but most home buyers roll it into the loan balance

- Annual mortgage insurance premium costs 0.85% of the loan amount per year, split up into 12 installments and paid monthly with the mortgage payment. This is due the life of the loan unless you put at least 10% down. In that case, the MIP payments will cancel after 11 years

Of course, a homeowner could refinance out of an FHA mortgage to get rid of their MIP payments. If the homes loantovalue ratio has fallen below 80%, refinancing into a conventional loan could help eliminate MIP later on.

USDA and VA loans

USDA loans also charge both an upfront and ongoing mortgage insurance fee. However, USDA mortgage insurance rates are slightly lower, with a 1% upfront fee and 0.35% annual charge.

You May Like: Reverse Mortgage Mobile Home

Avoiding Pmi With A Piggyback Loan

One other solution for avoiding PMI with a lower down payment and a conventional mortgage is through a piggyback loan. In this scenario, a borrower would make a down payment of at least 10 percent and then take out a home equity line of credit , or a second mortgage, in order to cover the remainder needed to reach 20 percent equity.

Because this means taking out two separate loans, it also results in two monthly payments, with the second mortgage rate typically being higher. Its important to crunch the numbers to determine if this scenario would be a cost-effective option and would ultimately help you save money in the long run.