Other Factors That May Affect A 100000 Mortgage Application

Weve already discussed how your credit rating, deposit and income can affect a £100k mortgage agreement, but whether your application is successful and the interest rate you end up on might also depend on the following factors

- Your age:Some lenders have strict age limits and wont deal with customers over 75. Others will go up to 85 and a minority will lender to customers even older than this, as long as the borrower can prove they can keep up with the payments during retirement.

- The property type:If the property youre buying includes an non-standard construction , a specialist lender might be needed as some consider these buildings high risk. Read more about non-standard construction mortgages.

- Whether you own another property:Some lenders consider borrowers who are in the market for a second home higher risk. Their deposit and income requirements might be higher, and they may be more stringent in their checks.

For more information about how to get a £100,000 mortgage loan, make an enquiry and one of the advisors we work with will connect you to the right lender for someone in your shoes.

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

What Are The Cons Of Using An Interest

- If you dont pay on your principal during the initial interest-only period, you wont build equity in the property, though it may or may not increase in value with the market.

- Once the interest-only period expires, your monthly payment can go way up.

- While you could gain equity if your homes value increases , the opposite is true as well. If home prices plummet, you may owe more than your home is worth, which will work against you if you plan to refinance before the end of the interest-only term. You could be potentially be stuck with the house unless you can come up with the cash to make the difference between what you can sell the house for and the amount owed on the mortgage.

You May Like: What Is The Mortgage Payment On 240k

Monthly Payments On A 100000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £477.42 a month, while a 15-year might cost £739.69 a month.

Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

-

See your monthly payments by interest rate.

Interest

Additional Fees To Consider

Buying a home is an investment. Along with the down payment and mortgage insurance , youll need to pay a range of closing costs, fees and taxes. These vary between lenders and property types, but they can add up to thousands of dollars. Be sure to factor these into your budget. If youre a first-time home buyer, you may be able to receive tax credits or rebates.

Costs may include:

- Miscellaneous condo or association fees

- Mortgage fees

- Mortgage insurance if down payment is less than 20%

- Land transfer tax

- Miscellaneous condo or association fees

Promoted for

About our promoted products

Don’t Miss: What Is The Effect Of Paying Extra Principal On Mortgage

Determining The Best Mortgage

Once you have a good idea of what your mortgage payments look like, try using the best Canadian mortgage rates to see how much you can save. Also explore our Mortgage Guides to learn more about mortgage payments and everything else you need to know when it comes to choosing the ultimate mortgage.

*Mortgage payment calculator disclaimer:

The mortgage payment calculator is intended to help you compare different mortgage options and understand your expected payment schedule. However, the mortgage payment calculation should not be used in isolation to influence your mortgage decision-making. Be sure to consult with a mortgage broker or lender about the various mortgage financing and payment options you can take advantage of. We’ll be happy to connect you with a licensed mortgage advisor. The best bet is to first start with analyzing different mortgages, which youcan do on RATESDOTCAhere.

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

> Related:How to buy a house with $0 down: First-time home buyer

Don’t Miss: Why You Should Get Pre Approved For A Mortgage

How To Calculate Your Mortgage Repayments

Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. First, simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years, however more lenders are now happy to offer mortgages over periods of up to 40 years.

Next, you need to specify the interest rate in order to calculate your monthly mortgage repayments. If you have no idea of the mortgage interest rate, you can always take a look at our mortgage comparison charts to get an idea of the deals currently available for your needs and circumstances.

Finally, our mortgage repayments calculator will need to know what type of loan repayment you need: capital and interest or interest only. Dont panic if you arent sure. Simply put, capital and interest repayments mean that each month you pay off a proportion of the sum borrowed plus interest, while interest only means that you are just paying off the monthly interest on your loan without ever repaying the sum youve borrowed. To find out more about the different types of mortgage repayment options and those that may be suitable for you check out our handy guide: Repayment and interest-only mortgages explained.

What Is An Interest

An interest-only mortgage is a loan with monthly payments only on the interest of the amount borrowed for an initial term at a fixed interest rate. The interest-only period typically lasts for 7 – 10 years and the total loan term is 30 years. After the initial phase is over, an interest-only loan begins amortizing and you start paying the principal and interest for the remainder of the loan term at an adjustable interest rate.

Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by factoring in your interest-only loan term, interest rate and loan amount. The result is your estimated interest-only mortgage payment for the interest-only period and doesnt account for the principal payments youll make later when the loan beings amortizing.

Also Check: How To Find Mortgage Payment

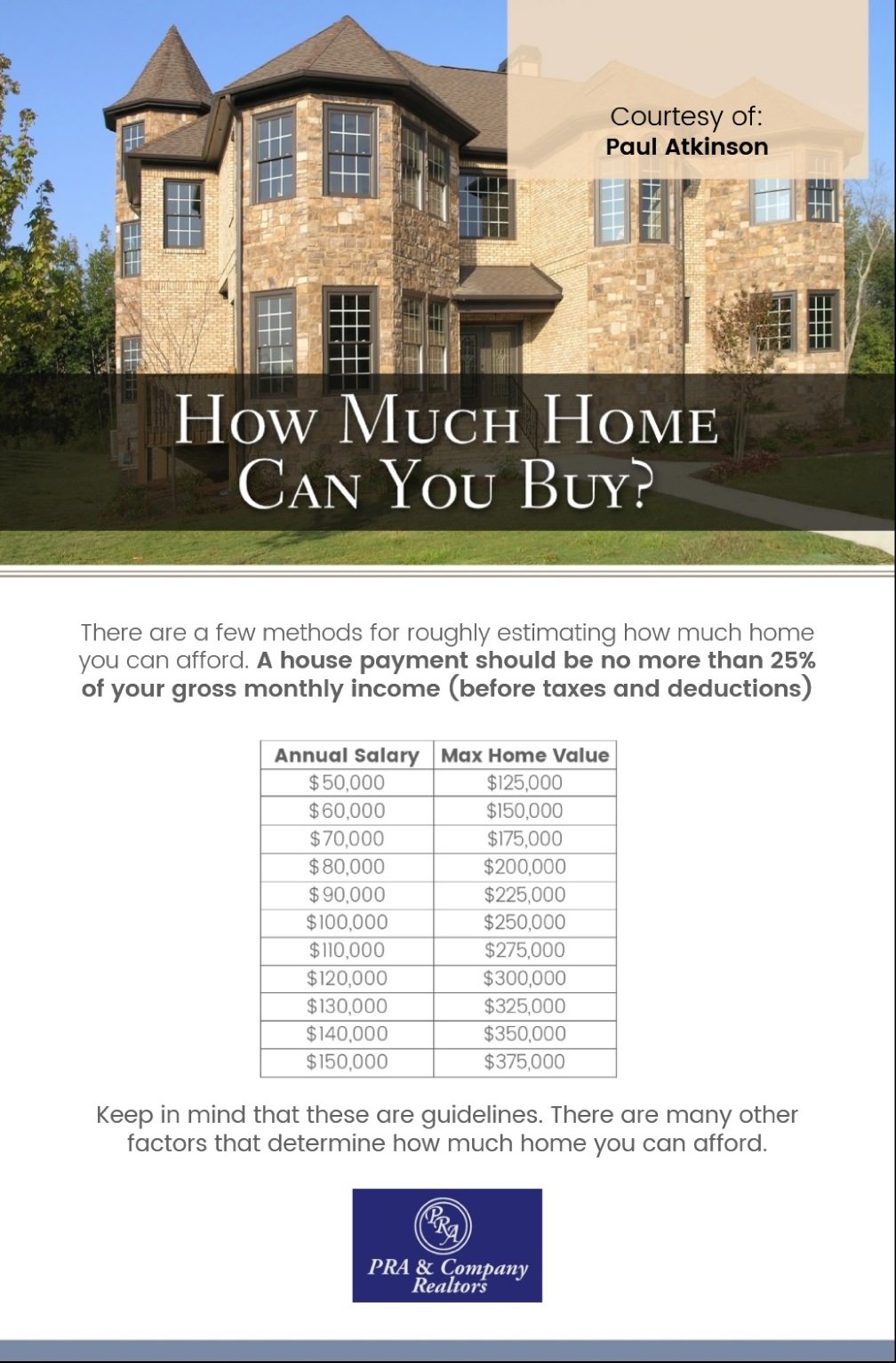

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

How Do You Lower Your Interest Expense

These are the most common ways to lower your interest costs. Some of these methods are similar to above and some are the exact opposite:

- Lower the purchase price

- Make a larger down payment

- Find a lower interest rate

- Reduce the amortization

- Choose accelerated payments

- Make lump-sum prepayments

Things that save you interest generally lower your amortization, resulting in you paying off your mortgage sooner.

Also Check: How To Determine What You Qualify For A Mortgage

The Benefits And Disadvantages Of A 15

Choosing a 15-year fixed home loan is advantageous if you can afford the shorter payment period. Its also a refinancing tool for people who want to reduce their current loan term and interest rate.

But before you decide this is right for you, you must understand the drawbacks of making larger monthly payments. The higher payments will stifle your spending power. Youll also have less savings and cash for emergencies. Moreover, you may not qualify for a higher loan amount to afford your prospective home.

Below are the benefits and disadvantages of taking a 15-year fixed mortgage:

| Benefits | |

|---|---|

| Gain home equity faster, pay off your debt sooner | Less money for savings |

| Get loan-level price adjustments and pay less fees if your loan is from a government-backed company | Less money for emergencies riskier if youre faced with a medical emergency or unemployment |

| Lower insurance premiums are charged for 15-year borrowers if your loan is from the FHA | Hinders opportunities for other profitable investments |

How Popular are 15-Year Fixed Home Loans?

Fifteen-year fixed mortgages are quite popular among U.S. consumers. According to the Urban Institute, 15-year fixed-rate terms accounted for 14.2 percent of new mortgage originations in April 2020. It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. This data is based on Housing Finance at a Glance: A Monthly Chartbook released in June 2020.

Quickly Estimate The Cost Of Interest Rate Shifts

For any fixed-rate mortgage, select the closest approximate interest rate to your loan from the left column, then scroll look at the payment-per-thousand column for the respective amount to multiply the number by. Then multiply that number by how many hundreds of thousands your home loan is.

- A 3% APR 15-year home loan costs $6.9058 per thousand. If you bought a $100,000 home that would mean the monthly payment would be 100 * $6.9058, so move the decimal places 2 spots to the right and you get a monthly payment of $690.58.

- The total loan cost would be 100 * $1,243.05 Again, move the decimal 2 places to the right & you get $124,305.

- And then if you wanted to figure out the cost of interest you would subtract the $100,000 from $124,305 to get $24,305.

Another way of thinking of the first thousand from the full cost per thousand category is that it includes the thousand you borrowed, so if you subtracted the first thousand from any of these figures that would represent the portion of spending allocated to interest on the loan.

This table scales by 1/8th of a percent from 2% to 10%. At the lower end 0%, 0.5% & 1.0% are added to highlight how little banks pay depositors relative to what they charge creditors. And at the top end 15%, 20% & 25% were added to show how extreme the spread is between deposits and what a credit card might charge a borrower.

| Interest Rate |

|---|

Recommended Reading: Are There Zero Down Mortgages

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Calculate The Cost Of Borrowing

When you buy a home, you already know that you’re going to pay a lot of interest over the life of the loan. However, you may not be prepared for just how much you are going to have to pay. In many cases you could buy your house two or three times over with the amount you end up paying back to your loan.

A good mortgage calculator like the ones we offer at MortgageCalculator.org can help you determine your monthly payment and your total interest payments. However, looking at the total interest you pay may seem too abstract. For instance, if you pay 5 percent on a $250,000 30-year fixed loan, you will end up paying $233,139.46 in interest alone. Since this amount is spread out over 30 years, it may be harder to contextualize the impact of.

Understanding exactly how much you pay in interest each month and each year rather than cumulatively over several decades can help make the amount seem more concrete and immediate. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up.

On that same $250,000 loan with 5 percent interest, you would pay $5.41 in interest each month for every $1,000 of the loan. You would pay $64.91 each year for every $1,000 of the loan.

Is there something else you could or should have invested in which would have offered better returns?

Higher Returning & More Diversified Opportunities

Recommended Reading: What’s The Interest Rate On A 15 Year Mortgage

How Does Credible Calculate Refinance Rates

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. Credible average mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage refinance rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

Don’t Miss: How Much Faster Can I Pay Off My Mortgage Calculator

Does The Term Length Affect The Repayments And The Total Amount Ill Pay

Customers often ask us how long does it take to pay off a £100,000 mortgage? and the answer will depend on the term length. How long youre able to take out a mortgage for will be based on how much you can afford to pay each month. A longer-term usually means lower monthly repayments youll be handing over more interest, in the long run, bumping up the overall cost.

Based on the average interest rate of 3%, the table below illustrates the total amount you will pay for a £100k mortgage and how this will differ across longer and shorter terms.

| Monthly Repayment | |

|---|---|

| £107,704.26 | £7,704.26 |

The above data is for illustration purposes only. Consult your lender or broker for the most up-to-date information and rates.

As you can see from the table above, there are substantial savings to be made if you take out your mortgage over a shorter term.

For example, the overall cost of borrowing £100,000 over 20 years is £133,200 compared to £142,200 over 25 years, which means youd save £9,000.

As a general rule, whether your lender will allow you to take a home loan over a shorter term depends on whether youd be able to afford the monthly payments. Talk to one of the expert advisors we work with for the right advice on your mortgage.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Read Also: What’s The Average Mortgage Payment

Can I Get A 100000 Mortgage With No Deposit

The vast majority of UK mortgage providers no longer offer 100% mortgages, so you would usually need some kind of deposit for a £100,000 mortgage. One of the only ways to get a mortgage with no deposit whatsoever is if a family member or close friend agrees to act as a guarantor.

With a guarantor mortgage, the family member or friend who is supporting you will need to secure the loan against a property they already own or place a lump sum in a savings account held by the lender. They will be unable to withdraw from this pot until a certain amount of the mortgage has been paid off, and maybe liable to cover any payments the borrower misses.

To learn more about guarantor mortgages and the other options that might be available or make an enquiry to speak to one of the expert mortgage brokers we work with.