How Can You Get Your Credit Report For Free

You are entitled to a free credit report once a year from each of the credit bureaus. This report can be requested directly or through AnnualCreditReport, the only permitted website for distributing the free annual credit report.

You might want to pull your Innovis credit report to make sure its not a mess. While each of the three major bureaus reports are available through AnnualCreditReport, your free report from Innovis must be requested by mail or phone. Still, its advised that you make an effort to get a copy of your Innovis report at least once a year if not for borrowing purposes, at least to protect yourself from identity theft.

To get a copy of your Innovis credit report, call Innovis toll-free at 1-800-540-2505. If you request your report by mail, you can use the printable request form.

How Does Fico Differ From Other Credit Score Models

VantageScore is another popular credit scoring model. Like FICO, VantageScore 3.0 grades credit on a 300 to 850 point scale and takes credit utilization, credit inquiries, and on-time payments into account. However, the two models differ in a few ways, with one major difference. FICO penalizes all late payments the same way, while VantageScore penalizes late mortgage payments higher than other late payments.

FICO and VantageScore also differ in how they handle combining similar credit inquiries. With FICO, you have a 45 day grace period where similar credit inquiries for auto loans, mortgages, and student loans are combined into one inquiry. VantageScore gives you a smaller 14 day grace period, which can make comparison shopping for loans harder.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

Why Are There Multiple Versions It Boils Down To Two Main Reasons:

FICO Scores have been an important component of most lenders’ credit criteria for the past 25 years. Over that time we have periodically updated the FICO Score mathematical formulas several times to keep them up to date and to maintain their predictive power. It’s similar to how there are multiple generations of smartphones in use today.

There are FICO Score versions tailored for select types of credit such as auto and bankcard lending. If youare applying for a car loan or signing up to get a credit card, there is a good chance the lender is using one of these tailored score versions

Each lender determines what FICO Score version they will use in their credit evaluation process. Generally speaking in most cases, you likely won’t know what version a lender is going to pull when evaluating your credit request.

However, in mortgage lending it’s less confusing. It is highly likely that the following FICO Score versions will be pulled on all mortgage applicants and from all three credit bureaus.

-

FICO Score 5 based on Equifax data

-

FICO Score 2 based on Experian data

-

FICO Score 4 based on TransUnion data

Sometimes you may see or your lender may reference these versions in slight variations to the list above. For example, check out FICO Score version information found on Fannie Mae’s website ) where they reference them as follows:

-

Equifax Beacon 5.0

-

Experian/Fair Isaac Risk Model V2SM

-

TransUnion FICO Risk Score, Classic 04

Tom Quinn

Estimate your FICO Score range

Don’t Miss: How To Get A Mortgage On A Foreclosure

What Numbers Do Mortgage Lenders Look At

Lenders use credit scores to determine a borrower’s level of risk.

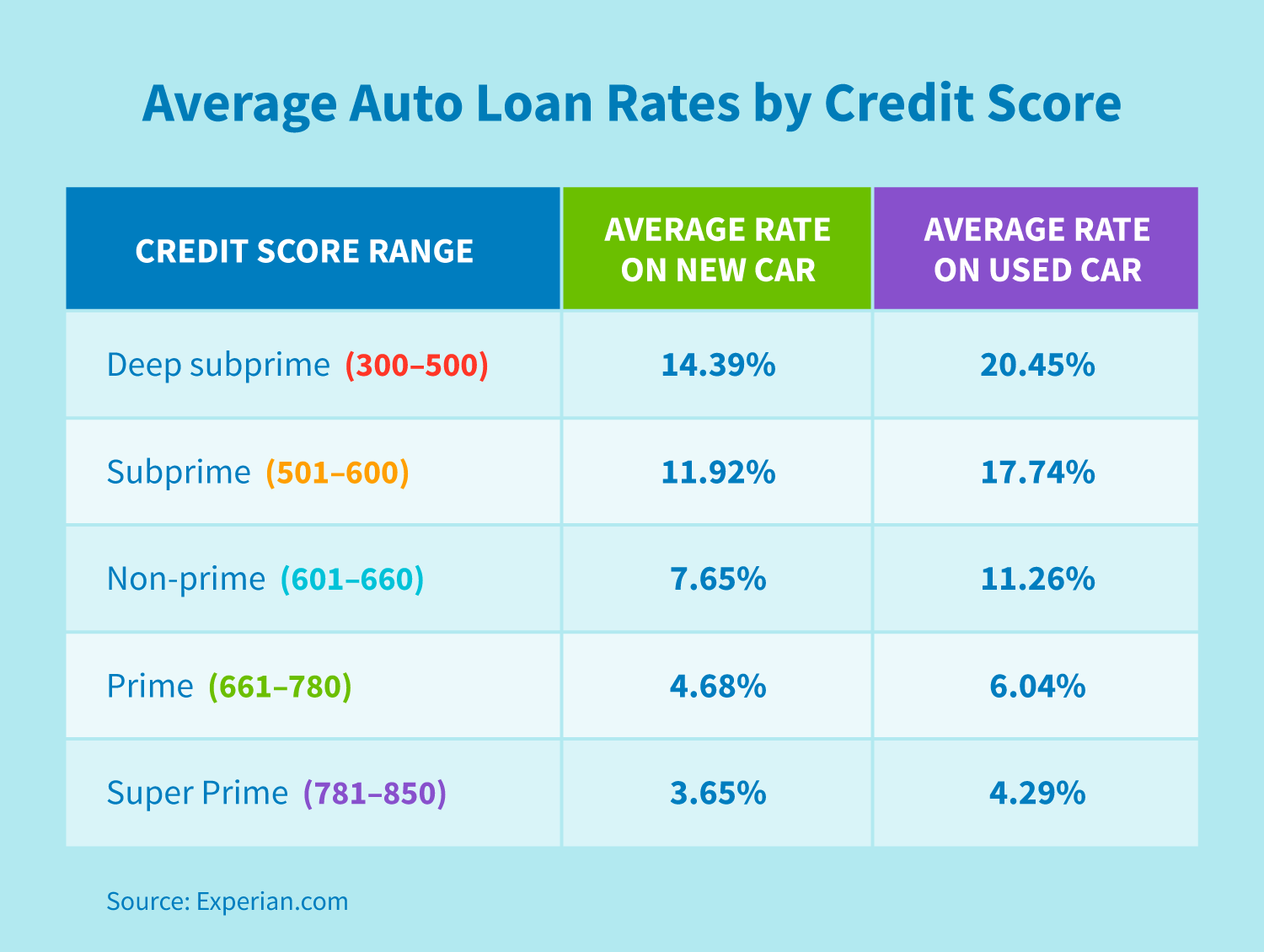

Three credit bureaus Equifax, Experian, and TransUnion calculate an individual’s credit score. The higher your credit score, the better interest rate you’re likely to get which also means you’ll have a lower monthly mortgage payment. Before you apply for a mortgage, it’s a good idea to check your credit score and review your credit report to make sure everything is correct.

Can I Include Spousal Income If The Mortgage Is In My Name Only

Along with your income, employment, asset and debt information, mortgage lenders consider your credit score when determining if you qualify for the loan program you desire. Rather than relying on a single VantageScore or FICO credit score from one credit bureau, lenders usually pull your credit information from multiple sources and focus on the middle or lower score in the set. The credit score needed for home loan approval can depend on the lender and loan program. Generally, you’ll want to have a high score to have the most financing options and avoid paying a high mortgage rate.

TL DR

Mortgage lenders often compute multiple FICO or VantageScore figures using credit reports from more than one bureau. They may then go with the middle number or lower number of the set.

Recommended Reading: Can You Reverse Mortgage A Condo

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

How Do You Choose Which Credit Score To Use

-

During pre-approval, we typically use the Experian FICO-II credit score from Experian. This is a soft credit check and won’t affect your credit score. If you apply with a co-borrower, we use the lower of your two scores.

When you want to continue with your loan application, with your authorization we pull your credit scores from all three major credit bureaus and use the median of the three scores received.

Related questions

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Better Real Estate, LLC dba BRE, Better Home Services, BRE Services, LLC and Better Real Estate is a licensed real estate brokerage and maintains its corporate headquarters at 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. A full listing of Better Real Estate, LLCs license numbers may be foundhere. Equal Housing Opportunity. All rights reserved.

Better Settlement Services, LLC. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007

Homeowners insurance policies are offered through Better Cover, LLC, a Pennsylvania Resident Producer Agency. License #881593. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007

Don’t Miss: Can You Get A Mortgage To Buy A Foreclosed Home

How To Improve Your Credit Score

Your FICO credit scores are broadly based on these five factors:

- Payment history This is the biggest factor and accounts for 35% of your credit score.

- Amounts owed How much debt you have makes up 30% of your credit score. This includes factors such as, your , the number of accounts with balances, and what you owe on different types of accounts.

- Age of accounts A longer credit history results in a better credit score. The duration of your accounts is 15% of your credit score.

- When you open new accounts or lines of credit, your score will take a small and temporary dip. These hard credit inquiries can stay on your account for up to two years, but only account for 10% of your overall credit score.

- The types of credit you have make up 10% of your credit score. So having different types of loans, a credit card, and a personal line of credit can help your credit score.

The nitty gritty of how certain aspects of your credit score are calculated varies depending on the credit scoring model. You have hundreds of scores. There are three credit bureaus, there are multiple generations of scoring software made by different companies, Ulzheimer says. But you dont need to fully understand or worry about every single type of credit score to start improving your credit score. The good news is that every single credit score is all based on the same thing one of your three credit reports, Ulzheimer says.

Check Your Credit Score Regularly

Checking your credit score regularly is one of the ways to ensure that the information on your credit score is indeed up to date.

It also informs you on what your credit score is and this allows you to have an idea of which credit providers may lend to you.

If you find any errors on your credit score or report you can contact all of the credit bureaus or the specific credit bureau where the error is mentioned and ask them to make the necessary corrections.

The credit bureaus will check and investigate the matter but in the meantime put a notice of correction on the record entry so that any third parties who are checking your credit score will be aware that the entry may be incorrect.

The credit bureau will usually let you know the outcome of their investigations within 28 days.

If you are unsure of what your credit score is then you should check your credit score from the four credit bureaus in the UK: Experian, Crediva, Equifax and Transunion.

Some of these credit bureaus may charge you a fee to view your credit report so what you can alternatively do is request a statutory credit report which is a free credit report which each credit bureau must provide to you upon you requesting it.

Alternatively, you can also use credit score services such as Checkmyfile and clearscore to check your credit report.

You May Like: What Documents Are Needed For Mortgage Pre Approval

Why The Scores Are Different

Your credit score may be different across the three reporting agencies because each agency may be using different data to calculate your score. Credit agencies do not collect credit data themselves but rely on the information that is supplied by lenders, collection agencies and the courts. These bodies report credit information to different credit bureaus at different times, so you cannot assume that each credit bureau has the same or even the most up-to-date information about your credit history. Other discrepancies, such as debts taken out under a maiden name, can also lead to variations in the three FICO scores.

Are Mortgage Credit Scores Different

- Mortgage lenders use FICO scores just like other finance companies

- But pull one version from each of the three major credit bureaus

- To create what is known as a tri-merge credit report

- The mid-score is used for qualifying and mortgage rate purposes

First and foremost, you might be wondering which credit score mortgage lenders use, seeing that theres no sense focusing on something they wont actually look at to determine your creditworthiness.

Ill save you the suspense. The short answer is FICO scores, which are the industry standard and relied upon by just about everyone.

I think something like 9 out of 10 lenders use FICO, and its pretty much 100% in the mortgage world.

As for the version of FICO, I dont know if any mortgage lenders use the newer FICO 8 or FICO 9 scores, which are the latest iterations available, because they tend to upgrade slowly to avoid any unwelcome risk.

This also explains why FICO is pretty much the only game in town its hard to change the status quo because there are a lot of moving parts in the mortgage space, so one seemingly small alteration could have major ramifications.

Recommended Reading: What Mortgage Can You Afford Based On Salary

Where To Check Your Fico Score Before Applying For A Mortgage

Many free credit services dont use the FICO scoring model, which is the one your mortgage lender will be looking at.

To be sure the score you check is comparable to what a mortgage lender will see, you should use one of these sites:

- AnnualCreditReport.com This is the only official source for your free credit report. Youre typically entitled to one free credit report per year, but the site is offering free reports each week during the coronavirus pandemic

- MyFico.com

Whether its free, or you pay a nominal fee, the end result will be worthwhile.

You can save time and energy by knowing the scores you see should be in line with what your lender will see.

As long as you continue to make your payments on time, keep your credit utilization relatively low, and you dont go shopping for new credit you dont need, over time your score is going to be pretty high for every credit scoring model.

Why Use A Mortgage Broker

Does giving up a day of your time to sit in an office or bank, answering questions and filling out paperwork sound like your idea of fun? No. Ours neither.

Most people assume that getting a mortgage means heading straight to your bank or building society, but unfortunately this can mean missing out on the right mortgage for your circumstances. Its a bit like searching for car insurance – you want to have a look at all of your options first before making a decision. The problem is, its not always clear where to look and thats where a mortgage broker comes in.

Also Check: What Is Verifiable Income For A Mortgage

Get A Credit Builder Loan

Another way to improve your credit score is by using a credit builder loan.

As you make these loan repayments on time your credit file records this and your credit score improves. At the end of the loan term you get all your loan repayments and whatever interest you have gained.

Loqbox is a credit builder loan provider in the UK.

When You Apply For Credit The Lender Will Check Your Credit Report With One Or More Of The Credit Reference Agencies But How Does This Affect You

The three main credit reference agencies in the UK Experian, Equifax and TransUnion each hold different personal and financial details about you which forms your credit history. They use this information to create your credit score and all of this is taken into consideration when you apply for credit.

But this is where it gets confusing there is no such thing as a universal score. Each agency has its own scale for example, Experians goes from 0-999 Equifaxs from 0-700 and TransUnion’s from 0-710 and each has its own method of calculating your score. You could even have a good score with one and fair with another.

Whether youre applying for a card, loan or mobile phone contract the lender will make a decision to approve your application based on your credit history. You could also be offered a higher interest rate or even declined if your credit score is low. Thats why its really important to check your report before you apply for financial products and dont worry, its easy to do.

With Experian, your credit score is now available for free through their website. TransUnion works in association with Credit Karma who offers the same service. And Equifax has teamed up with ClearScore who provides free access to your score and full report.

It helps to know which credit reference agency you have a better score with and which lenders work with who, as this could influence your chance of acceptance.

You May Like: What’s The Mortgage Rate

Report Your Rent To The Credit Bureau

Another way to improve your credit score is by reporting your rental payments to the credit bureaus.

If you currently pay rent or paid rent within the last 3 years you will be able to report your rental payments to the credit bureau and this will be an account on your credit file showing your payment history.

Paying your rent on time will ofcourse improve your credit score whilst missed payments will reduce your credit score. The scheme is known as the rental exchange scheme and is currently only being offered via Experian.

Why Is Your Credit Score So Important To Lenders

Lenders consider your FICO scores to understand if you can afford a mortgage. FICO scores are the credit scores most lenders use to determine your credit risk and the interest rate you will be charged. You have three credit scores from each of the three different credit bureaus, Experian, TransUnion, and Equifax.

When assessing whether you qualify for a mortgage, your credit score is a major factor because it summarizes your financial situation for a lender, including the following factors, in order of their impact on your score:

- Payment history

- Hard inquiries

Beyond these factors, any derogatory marks, missed payments, or bankruptcies are red flags to lenders.

With this picture of your financial standing, a lender can more easily determine whether youll responsibly pay them back for a mortgage they lend you.

The higher your score, the less you can expect to pay for your loan, as this can reduce your interest rate. For example, a score of 760, compared to 620, can mean the difference of tens of thousands of dollars over the lifetime of your loan. If your score is too low however, you may not get approved for a large enough loan to afford the home you want.

Read Also: Can You Get A 30 Year Mortgage On Land