Mortgage Interest Rates Forecast 2022

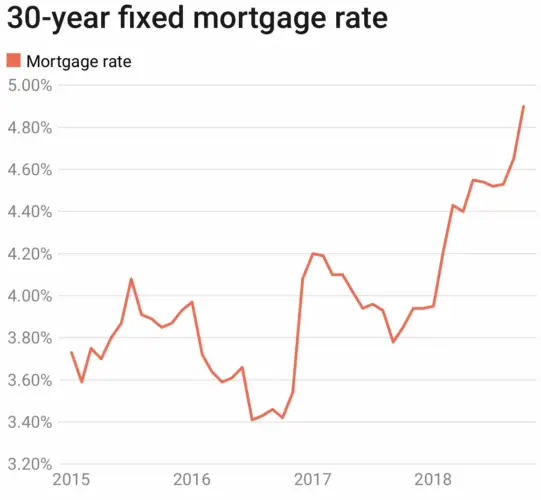

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserves monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

The pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year, says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . Additionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : Mortgage rates are expected to end 2022 at 4.8%and to decline gradually to 4.6%by 2024 as spreads narrow.

- NARs Yun: All in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.

- Matthew Speakman, senior economist at Zillow: Competing dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.

Is It A Good Time To Buy A Home With Rates Where They Are

The big increase in mortgage rates this year has taken a lot of potential homebuyers out of the market. That could present opportunities for you if you can afford the higher cost of borrowing money.

Homebuyers are facing less competition and prices are down compared to their all-time highs earlier this year, but theyre still high. If you can find a deal you can afford, it can still be a good opportunity. After all, nobody knows what mortgage rates and prices will be like next year, and buying a home is a lifestyle decision, not just a financial one.

If they find a house that they love, then they should absolutely pull the trigger, says Joe Allen, a senior mortgage lending officer at Quontic Bank, an online community development financial institution.

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

You May Like: Which Bank Is Best For Mortgage

How The Fed’s Actions Affect Mortgage Rates

When the Fed cuts interest rates, especially by a large or repeated percentage-point drop, people automatically assume that mortgage rates will fall.

But if you follow mortgage rates, you will see that most of the time, the rates fall very slowly, if at all. Historically, when the Feds have dramatically cut rates, mortgage rates remain almost identical to the rates established months before the cut as they do months after the cut. The Feds moves arent totally irrelevant, though. They tend to have a delayed and indirect impact on home loan rates.

For example, when investors worry about inflation, this concern will push rates up. When Congress wants to stimulate action and raise money for a deficit, it will create more U.S. Treasuries for folks to buy. This added supply of new Treasuries can also cause mortgage rates to move higher.

Even more crucial is when a buyer is in the process of making a decision whether to lock a loan just before a Fed rate cut. Say a buyer is in a contract and is thinking the Fed is going to lower rates next week. The buyer might be tempted to wait before locking the loanbig mistake.

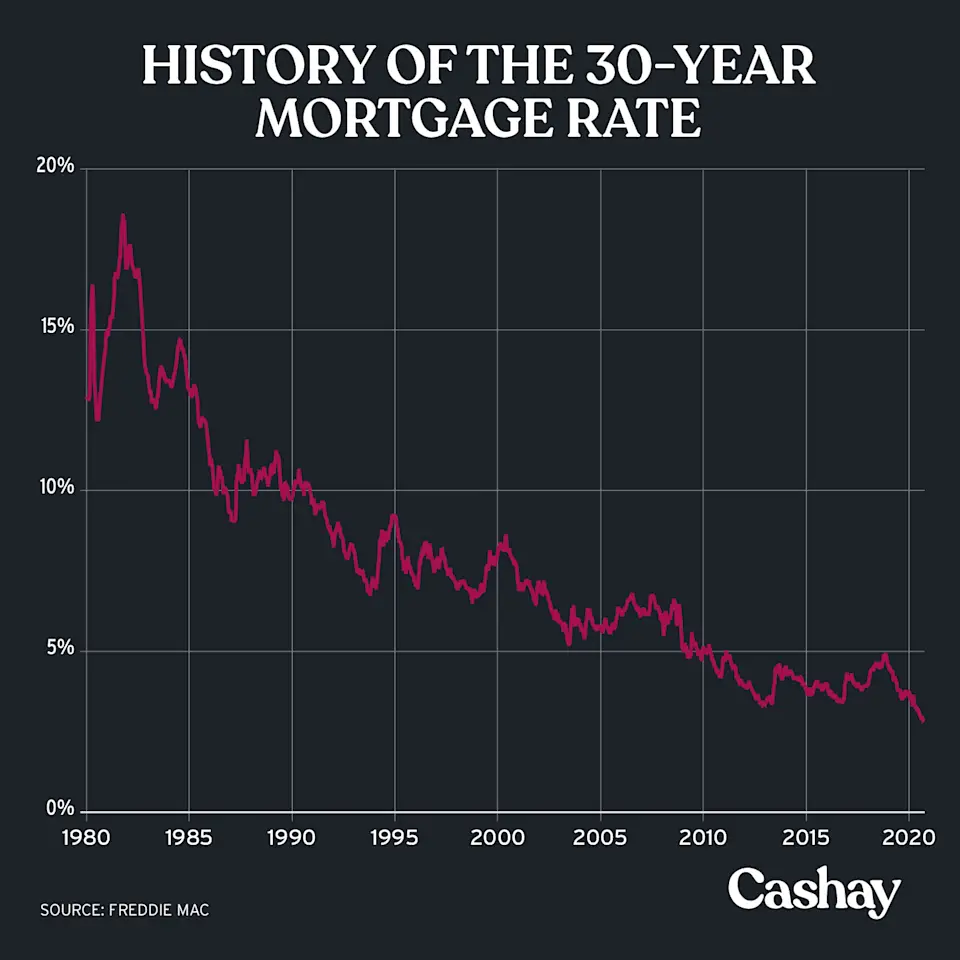

Historic Mortgage Rates: Important Years For Rates

The long-term average for mortgage rates is just under 8 percent. Thats according to Freddie Mac records going back to 1971. But mortgage rates can move a lot from year to year. And some years have seen much bigger moves than others.

Lets look at a few examples to show how rates often buck conventional wisdom and move in unexpected ways.

Don’t Miss: How Long Is The Mortgage Process

It Begins With The Federal Reserve

The Federal Reserve doesnt set mortgage rates, but the central banks decisions definitely influence mortgage rates. As the coronavirus pandemic hammered the U.S. economy in 2020, the Fed said it would keep rates near zero for the foreseeable future and mortgage rates plunged. As the Fed began hiking rates in 2022, mortgage rates rose in anticipation of those moves from the central bank.

The Feds rate decisions typically drive shorter-term products, like credit cards or home equity lines of credit, says Greg McBride, CFA, Bankrates chief financial analyst. Meanwhile, mortgage rates move based on longer-term interest rates.

Its the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates, McBride says. Because mortgages are packaged together into securities and sold as mortgage bonds, its the return investors demand to buy these bonds that dictates the general level of mortgage rates.

Mortgage rate levels are priced above that of the 10-year U.S. Treasury, considered by investors to be a risk-free investment. The spread in pricing between mortgage rates and the 10-year Treasury reflects the risk that investors bear for holding those bonds, McBride adds.

What Are Today’s Mortgage Rates

Although mortgage rates fluctuate daily, 2020 and 2021 were years of record lows for mortgage and refinance rates across the US.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they’re never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you’ll want to gather rates from multiple lenders.

| Mortgage type |

You May Like: How Old Is Too Old To Get A Mortgage

Us Department Of Agriculture Loans

USDA loans are geared towards homebuyers with low to moderate incomes. It provides a zero downpayment option to borrowers with credit scores not lower than 640. The USDA home financing program was designed to aid economic development in areas with low populations in the country.

To be eligible for a USDA loan, you must purchase a house in a USDA rural area. This may seem like a limitation if you want to live in a city. However, 97 percent of land in the U.S. is actually qualified for USDA home financing. You just might find a house near a good location. Consider this option before you cross it out your list.

Qualifying for USDA Loans

To qualify for a USDA loan, borrowers should have a minimum credit score of 640. If your credit rating is lower than 640, you must provide additional documentation of your payment history to get approval. For front-end DTI ratio, you must not go beyond 29 percent. Likewise, your back-end DTI ratio must not be over 41 percent.Be sure to check the USDA income limits in your preferred home location. This will also determine if you can obtain a USDA loan. There are different income limits for households with 1 to 4 members and larger families with 5 to 8 family members. For example, under the 2008 Housing and Economic Recovery Act , high-cost areas for 1 to 4 member households are set at $212,55.

Historical Mortgage Rates Chart

Despite recent rises, todays 30-year mortgage rates are still below average from a historical perspective.

Freddie Mac the main industry source for mortgage rates has been keeping records since 1971. Between April 1971 and August 2022, 30-year fixed-rate mortgages averaged 7.76 percent.

So even with the 30-year FRM above 5%, todays rates are still relatively affordable compared to historical mortgage rates.

Don’t Miss: How Much Does A Mortgage Payment Increase For Every 100000

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates â personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

How To Compare 30

If you compare loan offers from mortgage lenders, youll have a better chance of securing a competitive rate. Heres how to compare:

Read Also: What Score Do Mortgage Lenders Use

Real Estate Deal Volume & Appreciation

- Fannie Mae anticipates home sales which were at 6 million units in both 2018 and 2019 will end 2020 with 6.2 million transactions and will see 6.1 million transactions in 2021.

- Real estate appreciation in the United States during 2018 and 2019 ran at 5.1% and 4.2%. In 2020 Fannie Mae anticipates home prices to increase 5.5% and increase a further 2.6% in 2022.

The Best Time To Get A 30

The best time to get a 30-year mortgage is when interest rates are low. Interest rates tend to fluctuate significantly over time. In late 2020 average 30-year rates were below 3%. Prior to the Great Recession rates were above 6% and were as high as 18.45% in October of 1981.

Rates depend on various economic factors, including the following:

Also Check: Do Mortgage Companies Verify Tax Returns With The Irs

Mortgage Rate Forecast: Why Do Mortgage Rates Change

Mortgage rates have been pushed up primarily by the highest inflation in four decades. The consumer price index showed prices up 7.7% year-over-year in October, compared to 8.2% in September. Inflation has remained higher than expected, but appeared to be slowing down in October.

In response to that high inflation, the Federal Reserve has increased its benchmark short-term interest rate, known as the federal funds rate. In November it raised the federal funds rate by 75 basis points for the fourth time in a row. While the Feds changes dont directly drive increases in mortgage rates, they have some correlation because they both respond to inflation.

Inflation is absolutely in the drivers seat, particularly as it pertains to mortgage rates. Until we get some sustained evidence that inflation is beginning to recede, the upward pressure on mortgage rates will remain, says Odeta Kushi, deputy chief economist at First American Financial Corporation.

Todays Mortgage Rates: Still Near Historic Lows

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

For today, December 13th, 2021, the current average mortgage rate for a 30-year fixed-rate mortgage is 3.344%, the average rate for a 15-year fixed-rate mortgage is 2.579%, and the average rate for a 5/1 adjustable-rate mortgage is 3.019%. Rates are quoted as annual percentage rate for new purchase.

A home is one of the biggest purchases youll ever make. Current mortgage rates are significantly lower than they were a year ago. You can save thousands of dollars simply by paying attention to the interest rate on your loan.

To land the best mortgage deal for you, its important to shop around with multiple lenders. Check out the most recent mortgage rates and get personalized quotes as well as a full rundown of your estimated monthly payment.

You May Like: Why Are Condo Mortgage Rates Higher

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

How Does Credible Calculate Refinance Rates

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. Credible average mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage refinance rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Don’t Miss: What Is A Prepayment Penalty On A Mortgage

Window Of Opportunity For Borrowers

While its difficult to time the market in order to get a low mortgage rate, plenty of would-be homebuyers are seeing a window of opportunity.

Following generally higher mortgage rates throughout the course of 2022, the recent swing in buyers favor is welcome and could save the buyer of a median-priced home more than $100 per month relative to what they would have paid when rates were above 7% just two weeks ago, said Hale.

As a result of the drop in mortgage rates, both purchase and refinance applications picked up slightly last week. But refinance activity is still more than 80% below last years pace when rates were around 3%, according to the Mortgage Bankers Association weekly report.

However, with week-to-week swings in mortgage rates averaging nearly three times those seen in a typical year and home prices still historically high, many potential shoppers have pulled back, said Hale.

A long-term housing shortage is keeping home prices high, even as the number of homes on the market for sale has increased, and buyers and sellers may find it more challenging to align expectations on price, she said.

How Do 5/1 Arm Rates Compare

The initial interest rates on ARMs are generally lower than those for fixed-rate loans. Often, adjustable rates are about 0.5% lower.

For example, if you were in line for a 3.0% fixed-rate mortgage, you could likely get a 2.5% adjustable rate. That lower rate might mean you could afford a bigger mortgage and a better, more costly home.

But the relationship between fixed rates and adjustable rates is not an iron rule. Sometimes, the gap is a bit wider. And sometimes its a little narrower. There are also periods when ARM rates are actually higher than fixed rates.

So its up to you to check where ARM rates stand in comparison to FRMs at the time when you are deciding which to choose.

You also need to shop around between different lenders for your best possible rate.

The ARM rate lenders can offer you depends on your credit score, credit report, down payment, and home value, among other factors. And you wont know which mortgage lender can offer the lowest rate until youve compared personalized rates from a few of them.

Compare todays 5/1 ARM rates

| Program |

|---|

| Rates are provided by our partner network, and may not reflect the market. Your rate might be different. . See our rate assumptions . |

Also Check: What Is The Mortgage Payment For A 150k House