What Does Fixed Vs Variable Mean On A Mortgage

Many mortgages carry a fixed interest rate. This means the rate will not change for the entire term of the mortgage even if interest rates rise or fall in the future. A variable or adjustable-rate mortgage has an interest rate that fluctuates over the loans life based on what interest rates are doing.

What Does A 350% With A 30 Year Fixed Rate Mortgage Mean

We have all heard the ads about how rates are at all-time lows. It seems like the phrases historic and record lows have become the new rubber stamps when it comes to talking about interest rates these days. Mortgages have been around forever. When mortgages started, they had variable rates with huge down payments. As home values continued to increase, the need for lower monthly payments increased and thus, the 30 year mortgage was born. When trying to Google search for when was the first 30 year mortgage, all you get is refinancing links. Shocking!

Although we cant tell you what the actual lowest rate was, we can tell you what was going on in 1951. That year is important to all of us because that is when James B Nutter, Sr. created this company. Here are some examples of what was going on:

Average home price $16,000 Average income $3,515 A gallon of gas $.20 First class stamp $.03 Sliced bacon $.63 per pound

As you can see, things have changed since the good old days but when it comes to interest rates, these are the good old days. We havent seen anything like this. 3.5% is a rate that is so low that it is hard to wrap your head around. If this were a game of limbo, this has to be the bottom notch and only the most flexible people would even try to get under. There is no reason to be sitting on the side lines waiting for rates to get better. How much closer to the floor could we get?

How Long Do I Repay A Fixed

Youll pay back your fixed-rate mortgage over a predetermined term. The most common offering is a 30-year fixed-rate mortgage, which allows you to pay off your home loan over three decades. That might sound like a long time, but the extended timeline allows you to reduce the size of your monthly payment and free up room in your budget.

Another widely available option is a 15-year fixed-rate mortgage. This typically comes with a lower interest rate, but youll need to pay back the loan in half the time. A 15-year fixed-rate mortgage is ideal for borrowers who have the cash flow and want to pay off their home faster at less interest.

Some mortgage lenders let you customize the term, too, between eight and 30 years.

While the term attached to a fixed-rate mortgage is the maximum amount of time you have to repay it, you can also opt to contribute additional money toward the principal to shorten your pay-back period. Just make sure your loan doesnt have a prepayment penalty , and that the extra payments are paying down the principal. You can contact your lender to confirm this.

Read Also: How Much Mortgage Protection Insurance Cost

If Youre Not Keeping The Loan Long Term

Many peoples careers allow them to expect and plan to relocate every so often. For people in this position, an ARM could be a cheaper option than a fixed-rate mortgage. Especially if you know youll have to move in the next 5-10 years.

But even in this circumstance, youll want to run the numbers. With an ARM, youre still responsible for closing costs. Closing costs can be 2%-6% of the loan amount, and for an average home thats thousands of dollars youll pay upfront. If youre only going to be in the home for a year or two it might be cheaper to rent than buy with any type of mortgage.

What Is A Variable Rate Mortgage

Like fixed rate mortgages, variable rate mortgages also have a set term , but they have one big difference: the interest rate can go up and down during your mortgage term. This can happen as often as every month, as its tied to whatever is happening with the rate set by the Bank of Canada.

How does it work? The variable rate is related to the prime interest rate, which refers to the interest rate that a bank offers to their most trusted customers. This preferential rate is based on the Bank of Canadas overnight rate or key interest rate which is the interest rate at which banks get money from the Bank of Canada.

The bottom line: if you choose a VRM, your payment will go up or down depending on what the Bank of Canada does and how your lender reacts with their prime interest rate. While some people think can predict what the Bank of Canada is going to do, the truth is that no one has a crystal ball and can see what interest rates will do over the long term.

You may see banks advertise their variable interest rates as prime minus 0.2% or something similar. This means that you will get 0.2% off of the floating prime interest rate which could go up or down throughout your mortgage term.

Also Check: Can I Get A Mortgage With No Credit

What’s The Difference Between Fixed And Variable Rates

With a fixed rate mortgage, the mortgage rate and payment you make each month will stay the same for the term of your mortgage . With a variable rate mortgage, however, the mortgage rate will change with the prime lending rate as set by your lender. A variable rate will be quoted as Prime +/- a specified amount, such a Prime – 0.45%. Though the prime lending rate may fluctuate, the relationship to prime will stay constant over your term.

What Is A Conventional Fixed

A “fixed-rate” mortgage comes with an interest rate that won’t change for the life of your home loan. A “conventional” mortgage is a loan that conforms to established guidelines for the size of the loan and your financial situation. Conventional loans may feature lower interest rates than jumbo loans, FHA loans or VA loans. Terms of these conventional loans typically range from 10 to 30 years.

Monthly principal and interest payments on a conventional fixed-rate mortgage remain the same for the life of the loan making it an attractive option for borrowers who plan to stay in their home for several years. The alternative to the fixed-rate mortgage is the adjustable-rate mortgage loan, which features lower monthly principal and interest payments during the first few years. While many prefer the security of a fixed-rate loan, an ARM may be a better option – especially if you know you’ll be moving within the next several years.

You May Like: How Much Is Mortgage Insurance In Michigan

Which Loan Is Right For You

When choosing a mortgage, you need to consider a wide range of personal factors and balance them with the economic realities of an ever-changing marketplace. Individuals personal finances often experience periods of advance and decline, interest rates rise and fall, and the strength of the economy waxes and wanes. To put your loan selection into the context of these factors, consider the following questions:

- How large a mortgage payment can you afford today?

- Could you still afford an ARM if interest rates rise?

- How long do you intend to live on the property?

- In what direction are interest rates heading, and do you anticipate that trend to continue?

If you are considering an ARM, you should run the numbers to determine the worst-case scenario. If you can still afford it if the mortgage resets to the maximum cap in the future, an ARM will save you money every month. Ideally, you should use the savings compared to a fixed-rate mortgage to make extra principal payments each month, so that the total loan is smaller when the reset occurs, further lowering costs.

If interest rates are high and expected to fall, an ARM will ensure that you get to take advantage of the drop, as youre not locked into a particular rate. If interest rates are climbing or a steady, predictable payment is important to you, a fixed-rate mortgage may be the way to go.

Knowing Your Mortgage Interest Rate

Before you even apply for a mortgage, you have to get preapproved. That means going to your bank, telling them you have the intent to buy a home, and submitting some basic information about your credit and finances. Once youâre preapproved, youâll get a loan estimate document, which, in addition to your mortgage amount and any up-front costs, will also list your estimated interest rate.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Preapproval is the first step in the mortgage process. After you lock down a home you like, you need to get approved. Before the mortgage is official, youâll receive a closing disclosure, which lists your actual mortgage amount and interest rate. Once you sign, these become what you have to pay.

You May Like: What Banks Look For When Applying For A Mortgage

What Is A Closed Mortgage

In contrast, a closed mortgage has rules about how much you can pay down on your mortgage. If you pay down your mortgage before the term ends, your lender will charge you a hefty penalty.

It may feel like youre locked in with a closed mortgage but remember that most lenders allow you to make pre-payments up to a certain amount annually. This allows you to pay a certain percentage of the original mortgage amount without penalty. Meanwhile, full payoff requires that you pay a penalty unless you wait for your maturity date. So, if you suddenly find yourself swimming in cash, a pre-payment on a closed mortgage can still be a good option.

Interest And Other Loan Charges

Interest is only one component of the cost of a mortgage to the borrower. They also pay two kinds of upfront fees, one stated in dollars that cover the costs of specific services such as title insurance, and one stated as a percent of the loan amount which is called points. And borrowers with small down payments also must pay a mortgage insurance premium which is paid over time as a component of the monthly mortgage payment.

Don’t Miss: What Are Mortgage Underwriters Looking For

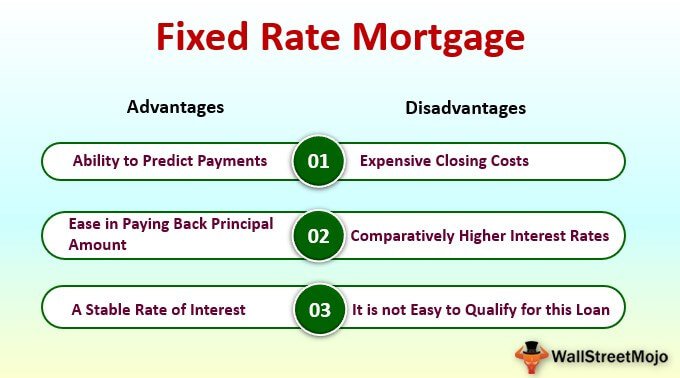

Is A Fixed Rate Mortgage Right For You

Just because a fixed rate is the most popular option doesnt mean its the right loan for your situation.

Homeowners who plan to sell or pay off their mortgages in five-to-ten years might consider an adjustable-rate mortgage, or ARM.

An ARM loan is fixed for a certain period of time, then starts adjusting based on the current market. For instance, a 5-year ARM stays at a very low rate for five years, then can go up or down. Fixed period options are many: typically 3, 5, 7, or even 10 years.

The initial fixed period for ARMs is very low.

The homeowner that chooses a conventional ARM loan could cut their rate by upwards of 0.75% or more. That could save the homeowner $9,000 in interest over five years.

The average mortgage is around 7 years old when it is either refinanced or the home is sold. So, for a buyer or refinancing homeowner that doesnt plan to keep the mortgage long, an ARM could be better than a fixed rate.

It Might Not Be The Right Loan For You

A 30-year fixed-rate loan might not match up with your other life goals. Maybe youd like the end of your loan term and your retirement to coincide. This might mean you want a 20-year loan term, not 30. Is your goal to have the house paid off before sending your child off to college? These are important things to consider when you choose a loan term.When deciding what loan terms and options are right for you, think about how much of a monthly payment you youre comfortable with. Also consider what current interest rates are like, and the length of the loan term you want. Your mortgage will be able to guide you through the process, and explain the different options available for your financial situation. A 30-year fixed-rate mortgage loan might be the right loan option to get you into the home of your dreams.

You May Like: Should I Refinance My 30 Year Mortgage

Are There Any Fees Associated With Remortgaging

If youre remortgaging your home by switching provider before the term of your mortgage ends, you might pay some fees.

Early repayment charge

To end a fixed-rate mortgage and transfer to a variable policy, you might pay an early repayment charge. Your lender calculates this by taking a percentage of either the:

- Original loan you borrowed

How To Calculate Fixed

The actual amount of interest that borrowers pay with fixed-rate mortgages varies based on how long the loan is amortized . While the interest rate on the mortgage and the amounts of the monthly payments themselves dont change, the way that your money is applied does. Mortgagors pay more toward interest in the initial stages of repayment later on, their payments are going more into the loan principal.

So, the mortgage term comes into play when calculating mortgage costs. The basic rule of thumb: The longer the term, the more interest that you pay. Someone with a 15-year term, for example, will pay less in interest than someone with a 30-year fixed-rate mortgage.

Crunching the numbers can be a bit complicated: To determine exactly what a particular fixed-rate mortgage costsor to compare two different mortgagesits simplest to use a mortgage calculator.

You plug in a few detailstypically, home price, down payment, loan terms, and interest ratepush the button, and get your monthly payments. Some calculators will break those down, showing what goes to interest, to principal, and even to property taxes theyll also show you an overall amortization schedule, which illustrates how those amounts change over time.

Recommended Reading: How To Get A 15 Year Fixed Mortgage

Should I Lock In My Mortgage Rate Now

Its impossible to know what direction mortgage rates will go from day to day. Thats why a mortgage rate lock is such a useful tool because it protects you if rates go up. And with interest rates so low right now, you should lock in your rate as soon as you can.

When you lock in your rate, ask your lender how long the lock will last. A rate lock can be good for anywhere from 30 to 60 days, which typically will give you enough time to close before the lock expires. If you want to extend the rate lock, ask about fees as many lenders charge a fee for extending a rate lock.

Usage Throughout The World

The United StatesFederal Housing Administration helped develop and standardize the fixed rate mortgage as an alternative to the balloon payment mortgage by insuring them and by doing so helped the mortgage design garner usage. Because of the large payment at the end of the older, balloon-payment loan, refinancing risk resulted in widespread foreclosures. The fixed-rate mortgage was the first mortgage loan that was fully amortized precluding successive loans, and had fixed interest rates and payments.

Fixed-rate mortgages are the most classic form of loan for home and product purchasing in the United States. The most common terms are 15-year and 30-year mortgages, but shorter terms are available, and 40-year and 50-year mortgages are now available .

The mortgage industry of the United Kingdom has traditionally been dominated by building societies, whose raised funds must be at least 50% deposits, so lenders prefer variable-rate mortgages to fixed-rate mortgages to reduce assetâliability mismatch due to interest rate risk. Lenders, in turn, influence consumer decisions which already prefer lower initial monthly payments. Nationwide Commercial recently issued a 30-year fixed rate mortgage as bridging finance.

You May Like: Does Chase Allow Mortgage Recast

What Are The Differences Between Fixed

The question of whether you should opt for a fixed-rate mortgage or an ARM depends on a few different factors.

With an ARM, you will likely pay a lower interest rate during an introductory period, which can vary in length. After the fixed-rate introductory period, your rate on an ARM can adjust up or down, depending on market conditions.

The Bottom Line: A Fixed

Ultimately, the type of mortgage you choose will depend on your own financial situation, and what youre comfortable with. If youre ready to get started with the mortgage process, you can begin your application online with Rocket Mortgage.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Read Also: What Is A Good Dti For A Mortgage

How Interest Rates Are Determined

The interest rate is usually just a little higher than the yield of the 30-year Treasury bond at the time the mortgage is issued. Investors buy mortgages on the secondary market when they are looking for something that provides more of a return than Treasurys without adding too much risk. That’s how Treasury notes affect mortgage rates.

Interest rates have generally been on the decline since 1985. One reason is that the Federal Reserve has kept inflation under control since then. That’s led to low rates on Treasury bonds. As a result, the interest rates on 30-year fixed-rate mortgages have been below 7% since March 2002. As of Sept. 11, 2020, the average 30-year fixed mortgage rate is 2.86%, which is an all-time low.

The chart below illustrates the change in interest rates between 15-year and 30-year fixed-rate mortgages, spanning the year 2000 up until today.

While average mortgage rates are at all-time lows as of September 2020, it’s important to remember that the interest rate you receive on your specific mortgage will be based on your credit score, income, and other financial details.