Cost Of Mortgage Loan Insurance

The fee you pay for mortgage loan insurance is called a premium. Mortgage loan insurance premiums range from 0.6% to 4.50% of the amount of your mortgage. Your premium depends on the amount of your down payment. The bigger your down payment, the less you pay in mortgage loan insurance premiums.

Find premiums based on the amount of your mortgage:

You can pay your premium by adding it to your mortgage or with a lump sum up front. If you add your premium to your mortgage, you pay interest on your premium. The interest rate is the same rate as youre paying for your mortgage.

Ontario, Manitoba and Quebec apply provincial sales tax to mortgage loan insurance premiums. Your lender cant add the provincial tax on premiums to your mortgage. You must pay this tax when you get your mortgage.

Buy With What You Have

You might not think that a less-than-20% down payment is ideal, but it is possible. If you have your heart set on buying right now, and can manage a 3% or 5% down payment, youd likely be able to find a loan that works for you.

This will mean you have to pay PMI, and youll be paying off a larger loan with more interest over time. But if its possible for you to buy with a smaller down payment, it might be worth crunching the numbers.

Assess Your Home Needs

Ask yourself what you really need from your home. For example, do you plan to start a family? Do you have teenagers who will soon be moving out? These are all important considerations. You need to anticipate not only the stage of life you’re in right now, but also what stage you’ll be entering while in your home.

You May Like: How To Pick The Best Mortgage Lender

Take Advantage Of Savings

The Government of Canada has many incentives for first-time homebuyers. The Home Buyers’ Amount and are just a few to name.

The Home Buyers’ Amount is a provincial sales tax credit valued at $5,000. It is a non-refundable income credit designed to make paying your taxes easier. The Home Buyers’ Amount is available to buyers purchasing a qualifying home.

While many credits like the are not available until after you have purchased a home, they will help alleviate the financial burden of buying a home.

Does A Bigger Down Payment Really Equal More House

Not exactly. This all depends on whether or not you meet all of the other requirements when applying for a mortgage. For example, if dont have a job, then you wont qualify for a mortgage, even if you have $100,000 saved for a down payment.It helps to decide how much you can afford and save by looking at your debt-to-income ratio . Because lets face it, more than likely you have other expenses every month aside from a mortgage payment, like a car loan, student loan, child support, etc. Start by choosing an amount you prefer not to exceed each month on debts. Then combine all of your current debts and expenses plus your potential mortgage payment. If youre uncomfortable with that amount, you should consider looking for less house, even if you have a lot saved.

How much you put down, with all other criteria met, will affect how much you pay each month on a mortgage for the next 15-30 years.

So, if youre saving up for a down payment, keep in mind that ideally at least 20% down will help you get the house you want and avoid other fees, as long as you meet the other requirements such as income, credit, etc. You can also put less than 20% down, but keep in mind you will have mortgage insurance premiums if you do so, which may still fall into a monthly payment amount that youre comfortable with.Finally, if youre having a difficult time saving for a down payment, speak with a mortgage banker about potential grant and down payment assistance programs.

Read Also: Can You Refinance A 30 Year Mortgage

Why Do You Need A Down Payment Anyway

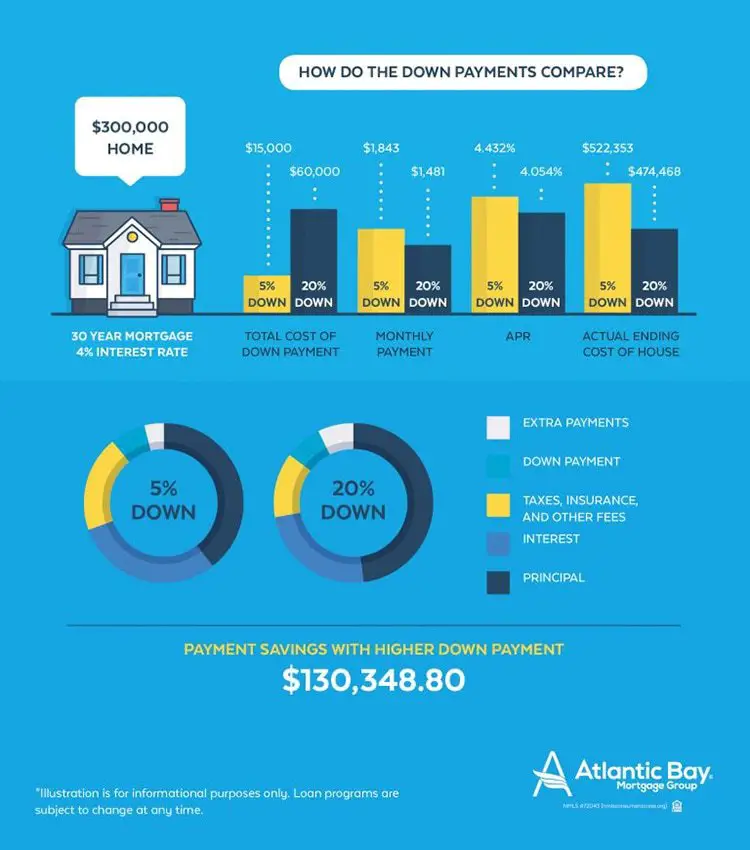

Basically, a down payment is money that you will pay out of pocket for the home youre interested in buying. It also shows lenders, such as Atlantic Bay Mortgage Group, that youre capable of saving money a lot of money at that and it demonstrates that youre serious about this investment.

A down payment is not the only thing that affects your mortgage rate. Things like credit history, income, and current debt affect it too.

Down payments help take the risk off the lender by building trust between you and them, and they reciprocate by giving you better credit terms. So, if you put more money down, theres a better chance of your monthly payments being lower than with a low down payment.

How Much Down Payment To Make When You Buy A House Is A Delicate Balance Of How Much Cash You Can Spare And How Low You Want Your Monthly Mortgage Payments To Be

While shopping around for a home loan, you may notice that putting the customary 20% down isnt necessary for every mortgage. Qualified buyers may be eligible for a government-backed loan with 0% down or a conventional loan with as little as 1% down.

Low down payment options may look attractive if you dont have a lot of money stashed away, but saving up for a large payment has its benefits. Making a larger down payment will mean you have a larger ownership stake in your home from the start. Putting down 20% could also help you avoid having to pay private mortgage insurance on a conventional mortgage and it may help lower your interest rate.

Lets go over how much homebuyers typically put down and when it may be worthwhile to put down 20%.

You May Like: How Much Are Mortgage Payments On 100 000

Disadvantages Of Putting 20% Down

As a homeowner, its likely your home will be your biggest asset. The property may even be worth more than all your other investments combined.

In this way, your home is both a shelter and an investment. And once we view our home as an investment, it can guide the decisions we make about our money.

The riskiest decision someone can make when purchasing a new home? Making too big of a down payment.

Your Down Payment Determines The Amount Of Mortgage Default Insurance You Pay

Your mortgage default insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about mortgage default insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| $377,991 |

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay, under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments and/or debt repayments, for example, to make an informed decision.

You May Like: Can You Get A Mortgage If You Filed Bankruptcy

A Big Down Payment Will Lower Your Rate Of Return

The first reason why conservative investors should monitor their down payment size is that it will limit your homes return on investment.

Consider a home that appreciates at the long-time national average of near 5%.

Today, your home is worth $400,000. In a year, its worth $420,000. Regardless of your down payment, the home is worth $20,000 more.

That down payment will affect your rate of return.

- With 20% down on the home $80,000 your rate of return is 25%

- With 3% down on the home $12,000 your rate of return is 167%

Thats a huge difference.

We must also consider the higher mortgage rate plus mandatory private mortgage insurance which accompanies a conventional 3%-down loan. Low-down-payment loans can cost more each month.

Assuming a 175 basis point bump from rate and PMI combined, we find that a low-down-payment homeowner pays an extra $6,780 per year to live in their home.

With 3% down, and making an adjustment for rate and PMI, the rate of return on a low-down-payment loan is still 105%.

The less you put down, the larger your potential return on investment.

How Can I Minimize Cmhc Insurance Premiums

For example, on a $500,000 home, here are the insurance premiums for various down payment percentages.

| Down Payment | |

|---|---|

| 20% | $0 |

Using a down payment of 20% or more exempts you from paying CMHC insurance. However, mortgage lenders may require you to get CMHC insurance even if you make a down payment greater than 20%, depending on your financial situation. Lenders can still be responsible for CMHC insurance premiums, but they generally pass it on to you by putting it on the mortgage, and that can increase your monthly payment slightly. That is a reason why the mortgage rate that you can get for a 35% down payment is lower than for a 20% down payment, since lenders need to pay less CMHC mortgage default insurance.

Also Check: How Does Filing Bankruptcy Affect Your Mortgage

Put 20% Down To Avoid Pmi

Many lenders will require you to purchase private mortgage insurance if you’re paying less than 20% down, which increases the overall cost of the loan. This additional insurance protects the lendernot youin case you’re not able to make payments on the loan. By paying for mortgage insurance, you’re reducing the lender’s risk which gives them more flexibility to loan money to you.

You’ll typically pay PMI monthly with your mortgage payment until you reach 78% equity in your home, although some mortgages charge PMI as an upfront premium due at closing.

The median down payment was 12% for all homebuyers and 6% for first-time homebuyers, according to a 2020 report from the National Association of Realtors. For first-time homebuyers paying 6%, that would mean a down payment of $18,000 on a $300,000 home.

How A Down Payment Affects Your Mortgage

Buying your first home is exciting and maybe a little scary at first. Thoughts like What loan should I get? or What should my down payment be? and How much home can I realistically afford? start creeping in, which bring you back down to reality. Not knowing the answers to those questions can make the process feel overwhelming. But dont worry once you start figuring out how much you need to save and which loans youre able to get, youll feel much better about the rest of the home buying journey.

Read Also: What Is Mip Mortgage Insurance Premium

How To Tell If You Have Enough Money To Buy A Home

Regardless of the size of the down payment, there are plenty of other costs that come along with homeownership, including monthly mortgage payments, property taxes, and maintenance, among others. Before you make an offer on a house, there are a few financial benchmarks you may want to hit first.

- Having three to six months worth of living expenses saved up in an emergency fund

- Raising your credit score to above 700 to ensure the best interest rate possible

- Having no high-interest debt anything above 5% should be paid off before you buy

- Having an additional 3% to 6% of the home price set aside for closing costs, moving expenses and other miscellaneous fees

The key metric to keep in mind, though, is that your monthly mortgage payment should always be under 30% of your gross monthly income.

For example, if you wanted to purchase a $400,000 home and put down $20,000 for your down payment, you should plan on having an additional $12,000 to $24,000 set aside to cover the closing process. Assuming a 30-year fixed-rate mortgage and a 4.5% interest rate, your monthly mortgage payment with PMI will end up being roughly $2,400 you would need to earn $8,000 a month in gross income to comfortably afford it.

Unfortunately, many Americans currently find themselves in a home that is just too expensive and stretches their budgets too thin. This term is commonly known as being “house poor,” and a recent study from ConsumerAffairs states a staggering 69% of homeowners feel this way.

Do You Have To Put 20% Down On A House

No, in fact the median down payment for first-time home buyers in 2021 was just 6% according to the National Association of Realtors.1 You may have heard that a down payment should be 20% of a homes purchase price, and while it does have advantages, its not necessary.

A Federal Housing Administration Mortgage has a minimum down payment of only 3.5%. Its available to all qualified buyers, regardless of income level. Also, you can buy a home with no down payment if you meet the specific restrictions of a United States Department of Agriculture loan or a Veteran Affairs loan.

Also Check: Should I Pay Extra On My Mortgage Or Refinance

What Is The Minimum Down Payment Required For A Mortgage

Your minimum down payment depends on the purchase price of your property.

- If your purchase price is under $500,000, your minimum down payment is 5% of the purchase price.

- If your purchase price is $500,000 to $999,999, your minimum down payment is 5% of the first $500,000, plus 10% of the remaining portion.

- If your purchase price is $1,000,000 or more, your minimum down payment is 20% of the purchase price.

| Purchase Price | Minimum Down Payment |

|---|---|

| Under $500,000 | |

| 5% of the first $500,000, then 10% of remainder | |

| $1 million and up | 20% |

Low Down Payment Insured Mortgage

Most lenders now offer insured mortgages for both new and resale homes with lower down payment requirements than conventional mortgages-as low as 5%. Low down payment mortgages must be insured to cover potential default of payment as a result, their carrying costs are higher than a conventional mortgage because they include the insurance premium.

Mortgage default insurance is a one time premium paid when your purchase closes. You can pay the premium or add it to the principal amount of your mortgage. Talk to your mortgage specialist to find out which option is best for you

Read Also: What’s An Average Mortgage Interest Rate

Smaller Profit Following The Sale Of Your Home

Building substantial home equity can take a considerable amount of time if your mortgage principal is high relative to your homes appraised value.

Should you sell your home after a brief period, youll realize less profit, if any at all, as most of the proceeds will go toward paying off your mortgage balance and closing costs.

What’s The Minimum You Should Have Saved

Conventional loans, sometimes known as regular loans, typically require a down payment anywhere between 3% and 20%. Anything lower than 20% requires you to pay private mortgage insurance, so thats an increase in your monthly payment to consider when saving for a down payment.Based on your income, credit, and state that you live in, you could qualify for grants and down payment assistance programs that a lender could walk you through.

You May Like: How To Sell A Private Mortgage Loan

Wait To Buy A House And Save

This is the simplest strategy: If youre set on putting down 20%, you can wait it out as you methodically build up your savings account.

The benefit here is that youll be making a solid purchase with lots of equity and no PMI, even if it takes you longer to get there. But if you have an urgent need to buy say, for a job relocation waiting likely wont work for you. And if you wait too long, you might lose your dream house, or end up in a much different real estate market.

Is It Better To Invest Or Put More Down On The House

If you have more than 20% saved up for your down payment, investing some of your savings may be a better option versus putting the extra toward your down payment.

Let’s say you’re purchasing a $300,000 home at 4% APR and you could make a 25% down payment. If you use all the money towards your down payment, your monthly payment would be $1,074, and your total mortgage interest after 30 years would be $161,706.

What if you put 20% down instead and invested the rest? Paying 20% down would mean a monthly payment of $1,145 and total interest of $172,487. If you invested the remaining $15,000 and received an average 10% return, in 30 years, your initial investment would grow to $261,741 without any additional contributions. That more than covers the additional interest you paid by choosing to invest instead of making a larger down payment.

You May Like: Can I Be Added To A Mortgage

Low Down Payment First

Not everyone will qualify for a zero-down mortgage. But it may still be possible to buy a house with no money down by choosing a low-down-payment mortgage and using an assistance program to cover your upfront costs.

If you want to go this route, here are a few of the best low-money-down mortgages to consider.

The Reality Of Down Payments

A recent Freddie Mac survey found that nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.

What most people don’t realize is that you have choices when it comes to your down payment, even the possibility of putting as little as 3% down through Freddie Mac’s Home Possible® or HomeOne® mortgages.

Don’t Miss: How To Negotiate Best Mortgage Rate