Why Is Having A Mortgage Commitment Letter Upfront So Important

Having the letter indicates to real estate agents and home sellers that youre a serious buyer. It also shows that you can afford the home and have already started the mortgage process. It can also help assure the seller that there could be fewer hiccups down the road. Because of these reasons, this letter can be especially helpful in a sellers market, when competition among buyers is particularly high.

When Should You Apply For Mortgage Preapproval

A mortgage preapproval is one of the first and most essential steps toward buying a home. It is wise to understand how much house you can afford before you start shopping. Therefore, you might want to get prequalified for a mortgage as you start looking at homes. Then, when you feel ready to put an offer on a home, you can get preapproved for a mortgage. This way, you will avoid preapproval expiration if you decide to shop around for a while.

Therefore, a borrower should apply for a mortgage preapproval when they are actively in the home buying process, but not so far in advance that they run the risk of their preapproval expiring. If you are unsure if you should get a mortgage preapproval letter, you may want to have a conversation with a mortgagor you trust. They will help you with a prequalification to help you start the home buying process and get a good idea of what you can afford. Then, when youre ready to put an offer in on a home, you can get a preapproval.

At True North Mortgage Your Pre

- FREE, no obligation, and stress-free

- Easy and convenient â apply online, over the phone, through our chat, or at a store location

- Handled by a highly-trained broker for a better mortgage experience

- Kept on secure servers for your privacy

- Guaranteed to be your best interest rate for up to 120 days

- Fast â our user-friendly short form takes only 9 minutes to complete

Our True North Mortgage Brokers are knowledgeable, friendly and easy to get a hold of â real people who care about getting your best mortgage fit.

To start the process, you’ll need to provide accurate information and supporting documentation, and we’ll walk you through the rest.

Read Also: What Does A Mortgage Payment Consist Of

Types Of Mortgage Loan Commitment Letters

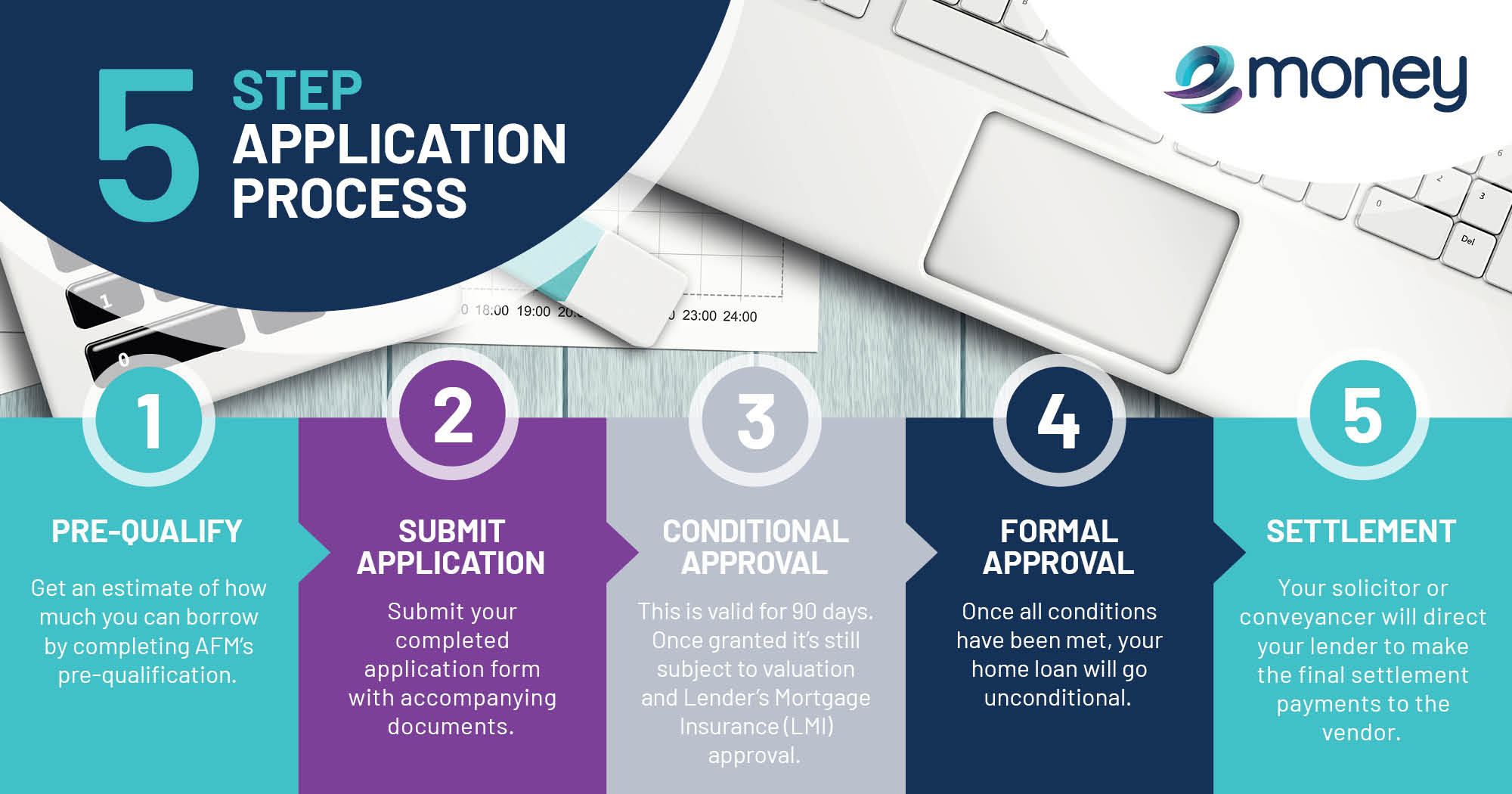

There are two types of commitments: conditional and final.

Conditional commitment letter approves the borrower for a certain loan amount, as long as certain conditions are met. This type of commitment letter may contain the following pieces of information:

- Lenders name

- List of conditions that must be met before final approval

- Amount of days preapproval is valid

A final mortgage commitment is when the conditions have been met and the lender promises to lend you the specified amount. This letter typically contains the following information:

- Lenders name

- Statement of approval for loan

- Type of loan

- Commitment expiration date

Shop For Homes During The Preapproval Period

When you receive your preapproval letter, itll probably say its good for 30 to 90 days. Since thats a relatively short period, youll probably want to wait to get preapproval letters until youre ready to start seriously shopping for a home. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval.

Also Check: How To Calculate Your Mortgage

Get A Prequalification Or Preapproval Letter

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount.

This document is based on certain assumptions and it is not a guaranteed loan offer. But, it lets the seller know that you are likely to be able to get financing. Sellers frequently require a prequalification or preapproval letter before accepting your offer on a house.

What To Do If You Cant Get Preapproved

If you cant get a preapproval, try to find out from the lender why you were denied. If its an issue you can remedy, like an error on your credit report thats causing the lender to reject your application, you can address that right away and seek a preapproval again when its resolved.

If you have too low of a credit score or other financial roadblocks preventing you from being preapproved, you can work to improve those areas, too. Raise your score by making payments on time and paying down your debt load, for example, or lower your debt ratio by finding a way to increase your income. Depending on your situation, this could take time, but itll go a long way.

Some lenders have very stringent qualifying criteria, so another option is to work with a different, more flexible lender. If youre an account holder with a local bank or member of a credit union, these institutions might be more willing to work with you to get you preapproved.

You May Like: How To Apply For A Home Mortgage

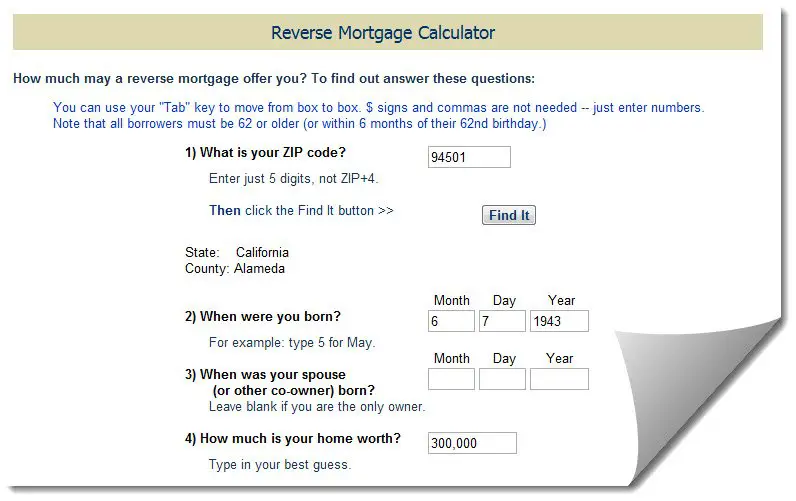

Calculate Your Loan Prequalification And More

When figuring out how to qualify for a home loan, it helps to determine your ability to qualify. Thats why we put together this loan prequalification calculator. So, whether youre trying to qualify for a home loan or an auto loan, make sure you even qualify. Just bear in mind that this loan prequalification calculator is in no way a guarantee. It is, however, a good starting point in figuring out if you can get pre-approval for a home loan.

Can You Get Denied After Being Pre

Yes, you can get denied for amortgage loan even after being pre-approved for it. There are a number ofreasons this could happen.

For example, after your pre-approval, newnegative information could appear in your credit history, dropping your scorebelow the lenders qualification guidelines.

Or, ifyou lostyour job prior to closing on the loan, youd likelybe denied. Thats because the lender can no longer verify youll be able tomake your payments.

And common mistakes could affectyour pre-approval, too like running up too much credit card debtbefore the loan closes.

Basically, anything thatsignificantly impacts your financial picture between your pre-approval andloan closing could change yourmortgage eligibility.

Also keep in mind that apre-approval typically happens prior to finding a home. As such, your new homemust also be approved by the lender.

For example, the loan amount cant exceed the homesappraised value. And if youre getting an FHA or VA mortgage, the new home mustmeet government safety standards. The presence of lead paint in an older home,for example, could derail the home-buying journey.

You May Like: How Soon You Can Refinance Your Mortgage

See How Much Home You Can Afford To Help Narrow Your Search

Buying a home is an exciting time, but it can also be overwhelming as you look for the perfect home to fit your needs. One step that can be beneficial is to prequalify for your loan, so you know how much house you can afford.

Its always a good idea to get prequalified with a mortgage lender before you start shopping for the home you want. But if you want to start house-hunting and arent quite ready to contact a lender, you can prequalify yourself.

What Happens If The Rate Lock Or Commitment Expires

If your interest rate lock expires before you close on the loan, there may be a price adjustment on the loan. If the commitment expires before you can close, you may need to resubmit documents and go through another credit approval to get a new mortgage commitment. This could result in a delay in the process and may change your loan terms, like how much you pay each month or how much you qualify for.

Also Check: How To Go About Getting Pre Approved For A Mortgage

Understanding What A Prequalification Is

A mortgage prequalification is something you work through with a lender or bank. Going through the process will help the lender determine if you have the necessary criteria in terms of income, credit, and debt. It can be an eye-opening step to not only deem if you are ready to buy, but how much you can actually spend.

What Are The Benefits Of Having A Mortgage Pre

Qualifying for a mortgage pre-approval has several benefits:

Recommended Reading: What Does A Commercial Mortgage Broker Do

How A Mortgage Calculator Helps You

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Using NerdWallets mortgage calculator lets you estimate your mortgage payment when you buy a home or refinance. You can change loan details in the calculator to run scenarios. The calculator can help you decide:

What Is Mortgage Preapproval

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check. If youre preapproved, youll receive a preapproval letter, which is an offer to lend you a specific amount, good for 90 days.

You May Like: How To Get Out Of Mortgage Insurance

Prequalify For Mortgage Online

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

FHA loans require an up-front mortgage insurance premium which may be financed, or paid at closing and monthly premiums will apply.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

All home lending products except IRRRL are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

Home lending products offered by JPMorgan Chase Bank, N.A.

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Research Lenders For Your Credit Band

Not every lender will be a good fit for you, so search around for lenders that work with borrows who have similar credit profiles to your own. Some lenders lend to borrowers with borrowers with fair or bad credit, but keep in mind that your loan terms may not be so favorable. With a high APR, it would be more costly to borrow a personal loan. Bad credit borrowers could also consider borrowing from a credit union, which may offer better terms than a traditional bank.

Other lenders specialize in borrowers with good or excellent credit. By shopping around for a loan offer with the lowest possible APR for their financial situation, good-credit borrowers may be able to save money on interest over the life of a loan.

Also Check: What Is Mortgage Insurance Based On

What Should I Get Preapproved

In todays housing market, it will be almost impossible to get a seller to consider your offer unless you have a mortgage preapproval . There are simply too many buyers for sellers to be willing to take a chance on one who hasnt at least talked to a lender about getting a mortgage.

Another important reason to get preapproved: It gives you an idea of how much home you can afford based on how much money a lender is prepared to let you borrow. This can save you time during house hunting by eliminating properties out of your price range.

Your Mortgage Lender Completes The Pre

Once youve filled out yourpre-approval application, turned in your documents, and paid your applicationfee , your work is done. The last step, underwriting, is upto your lender.

Most lenders use a universalautomated underwriting system to pre-approve customers for home loans.AUS is a technology-driven underwriting process that provides acomputer-generated loan decision.

In other words: You dont have towait for a human underwriter to read through all thosedocuments and approve or deny you.

Don’t Miss: Is 680 Credit Score Good Enough For Mortgage

How To Calculate A Mortgage Payment

Under “Home price,” enter the price or the current value . NerdWallet also has a refinancing calculator.

Under “Down payment,” enter the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe.

On desktop, under “Interest rate” , enter the rate. Under “Loan term,” click the plus and minus signs to adjust the length of the mortgage in years.

On mobile devices, tap “Refine Results” to find the field to enter the rate and use the plus and minus signs to select the “Loan term.”

You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you dont wish to use NerdWallets estimates. Edit these figures by clicking on the amount currently displayed.

The mortgage calculator lets you click “Compare common loan types” to view a comparison of different loan terms. Click “Amortization” to see how the principal balance, principal paid and total interest paid change year by year. On mobile devices, scroll down to see “Amortization.”

Important Legal Disclosures & Information

Borrower must satisfy pre-approval conditions outlined in commitment letter. Final loan approval and amount are subject to verification of loan data, property appraisal and underwriting conditions.

All borrowers must satisfy all conditions outlined in a commitment letter issued in connection with an application for mortgage credit. Final loan approval and amount are subject to verification of loan data, property appraisal and underwriting conditions. Program terms are subject to change.

Final loan approval and amount are subject to verification of loan data, property appraisal and underwriting conditions.

Refinancing at a longer repayment term may lower your mortgage payment, but may also increase the total interest paid over the life of the loan. Refinancing at a shorter repayment term may increase your mortgage payment, but may lower the total interest paid over the life of the loan. Contact us to discuss the option that best meets your needs.

Carrier fees for data usage may apply.

PNC is a registered service mark of The PNC Financial Services Group, Inc. . All loans are provided by PNC Bank, National Association, a subsidiary of PNC, and are subject to credit approval and property appraisal.

BBVA is a registered trademark of BBVA, S.A. and is used under license.

Recommended Reading: Are Mortgage Rates Going Down Again

How You Can Improve Your Prequalification

You can get prequalified for a bigger mortgage by improving on your credit score if thats the factor that is holding you back. Some of them can be simple fixes such as paying down balances and any open collections. If your credit is suffering from repeated late payments or bankruptcy, you may have to wait for some time for improvement. If income is holding you back, you can try ways to increase your income or improve your debt-to-income ratio by paying down your debts.

How To Get Prequalified For A Mortgage

Getting prequalified for a mortgage typically involves self-reporting basic details about your finances to a lender. Depending on the lender, you may have to visit a branch to complete the prequalification process. However, many lenders now offer online prequalification. If youre trying to get prequalified for a mortgage, youll likely have to provide information about your:

Recommended Reading: How To Determine Ltv Mortgage

Determine Your Down Payment

It helps to know how much you can provide as down payment before you start looking for a home. The size of your down payment may have an impact on the amount you get pre-approved for. Plus, down payments of less than 20% of the purchase price of a home require mortgage default insurance, whereas down payments that are 20% or above may not.

How Quickly Can You Get A Mortgage Pre

Timing is everything when youre buying or refinancing a home. Of the many advantages that online pre-approval offers, speed is one of the biggest. Because they rely on outdated processes, traditional lenders can take days to issue a mortgage pre-approval. With Better Mortgage, online pre-approval lets you get started right away and kick-off your homebuying or refinance in as little as 3 minutes. Use your laptop or your mobile device to upload financial documents and keep everything organized in a streamlined dashboard.

Working with a digital lender means you can log in and upload your documents anytime, anywhere. At Better Mortgage, we use bank-level security to process pre-approvals, so your data is always kept safe and secure. After you submit your initial documentation, our online tools will instantly match you with great mortgage options. From there you can use your pre-approval letter to start shopping for homes in your price range.

Recommended Reading: How To Get A Mortgage With Poor Credit