Canceling Mip On Fha Loans

Depending on when you applied, FHA guidelines may allow for MIP to be canceled if you:

- Applied between January 2001 and June 2013: Please contact us when you meet all three of the following conditions, and we will review your loan for MIP removal eligibility:

- Applied after June 2013: If your original loan amount was less than or equal to 90% LTV, MIP will be removed after 11 years.

- Closedbetween July 1991 and December 2000

- Closed before December 28, 2005 on a condo or rehabilitation loan

- Applied after June 2013 and your loan amount was greater than 90% LTV

What Is Fha Mortgage Insurance

An FHA mortgage insurance premium is an additional fee you pay to protect the lenders financial interests in case you default on your FHA loan. FHA borrowers are required to pay two mortgage insurance premiums: one upfront at closing, and another annually for as long as you repay the loan, in most cases.

By comparison, conventional loans with less than 20 percent down come with private mortgage insurance , charged every year until you have at least 20 percent equity in your home. This is different from FHA mortgage insurance, which doesnt have the same equity cutoff.

You might also encounter mortgage protection insurance , which is not a requirement for an FHA loan or any other kind of mortgage. MPI is similar to disability or life insurance in that it pays your mortgage if you become disabled, lose your job or pass away.

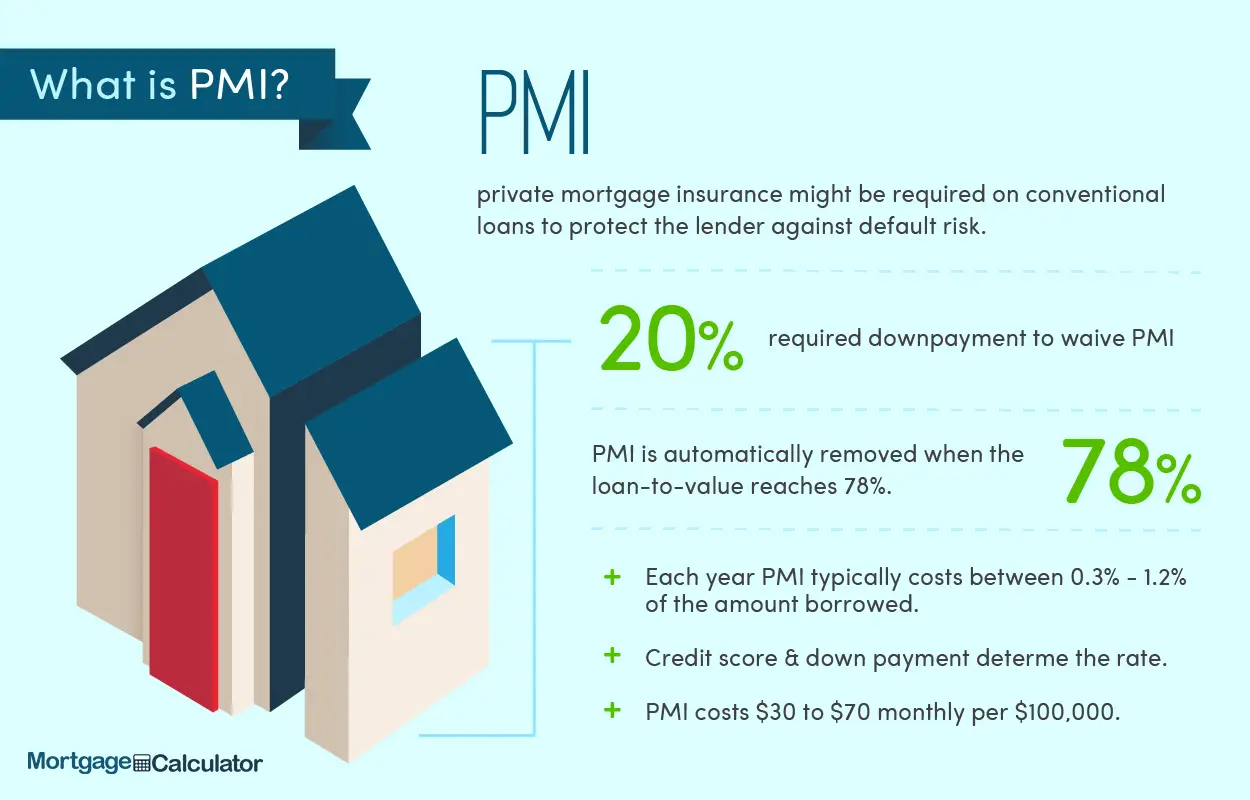

When Is Pmi Required

You may have to pay for PMI if you’re purchasing a house or refinancing your mortgage. Lenders may require PMI on certain loans if:

- Your down payment is less than 20%. Most conventional lenders require a down payment of at least 20% of the purchase price. You can calculate your down payment percentage by dividing the amount you plan to put down by the lesser of the market value or purchase price of the home. If you can’t afford to put down at least 20% on a purchase, you may have to pay for PMI.

- For refinance loans, your loan-to-value ratio is over 80%. If you’re refinancing your current mortgage, most conventional lenders require an LTV ratio of 80% or less to avoid having to pay for PMI. You can calculate your LTV ratio by dividing your new mortgage amount by the market value of your home. If your LTV is over 80%, you may need PMI.

Read Also: What Is Excellent Credit Score For Mortgage

What Is Mortgage Protection Insurance

Mortgage protection insurance is basically what it sounds like: life insurance thatâs designed to protect your family from burdensome mortgage payments if the primary breadwinner is no longer around to provide an income.

Mortgage protection insurance is broadly similar to term life insurance in how it works. You buy a policy, pay regular premiums, and at the end of the policy term, your coverage ends. If you die during the term of the policy, a death benefit is paid out to your beneficiaries.

However, mortgage protection insurance has a few key differences from term life insurance: your family members arenât your beneficiaries and the death benefit amount decreases over time.

Can You Cancel An Mip Policy

In the past, you could dump your MIP once you reached at least 20% equity in your home. But the housing crisis changed a lot of things, including insurance on FHA loans. Now, you must maintain the MIP for the life of the FHA loan.

Because of this, theres only one option if you want to cancel your MIP: You can refinance your FHA loan to a conventional loan. Its important to note that if you dont have 20% equity in your home, youll still have the requirement of carrying private mortgage insurance until you reach that threshold.

You May Like: Is It Better To Get Mortgage From Bank Or Broker

When Can Icancel Pmi

PMI cancellation should happen automatically when your loanbalance falls to 78% of your homes original purchase price.

However, you may be able to cancel PMI a little sooner when you reach the 80% threshold by contacting your loan servicer.

Keep in mind that these rules apply only to conventionalloans. Mortgage insurance works differently for subsidized loans such as USDAand FHA mortgages.

FHA mortgage insurance premium

FHA loans, backed by the Federal Housing Administration, requiretheir own type of mortgage insurance. This is known as mortgage insurance premium,or MIP.

MIP charges two separate fees: an upfront payment and anannual one

- Upfront mortgage InsurancePremium costs 1.75% of the loan amount. It can be paid at closing butmost home buyers roll it into the loan balance

- Annual mortgage insurance premium costs 0.85% of the loan amount per year, split up into 12 installmentsand paid monthly with the mortgage payment. This is due the life of the loanunless you put at least 10% down. In that case, the MIP payments will cancelafter 11 years

Of course, a homeowner could refinance out of an FHA mortgageto get rid of their MIP payments. If the homes loan-to-value ratio has fallenbelow 80%, refinancing into a conventional loan could help eliminate MIP lateron.

USDA and VA loans

USDA loans also charge both an upfront and ongoing mortgageinsurance fee. However, USDA mortgage insurance rates are slightly lower, witha 1% upfront fee and 0.35% annual charge.

Cost Versusbenefit Of Private Mortgage Insurance

Todays homeowners are buildingwealth like few times in history.

According to the Federal HousingFinance Agency , home values in the third quarter of 2020 were upmore than 7% from the same period one year prior.

The typical U.S. homeowner isearning $13,000 per year.

Whats more, home value appreciation is nothing new. FHFA says home prices have increased by about 5% per year since 2012. And home values have increased every quarter dating back to 2011.

That means arenter who bought the average home four years ago has gained morethan $40,000 in home equity to date. Some have earned muchmore six figures in some cases.

Whats surprising, then, isadvice saying you should buy a home only when you have a 20% down payment.

Putting 20% down is less risky thanmaking a small down payment, butits also costly.

Even strong opponents of mortgageinsurance find it hard to argue against this fact: PMI payments, onaverage, yield a huge return on investment.

PMI return oninvestment

Home buyers avoid PMI because theyfeel its a waste of money.

In fact, some forego buying a homealtogetherbecause they dont want to pay PMI premiums.

That could be a mistake. Data fromthe housing market indicates that PMI yields a surprising return on investment.

Imagine you buy a house worth $233,000 with 5%down.

The PMI cost is $135 per monthaccording to mortgage insurance provider MGIC. But its not permanent. It dropsoff after five years due to increasing home value and decreasing loanprincipal.

Read Also: What Would The Mortgage Be On A 500 000 House

Mortgage Life Insurance Rates

Mortgage life insurance rates change from year to year. But the table below gives you an example of mortgage life insurance premiums based on TDâs rates in 2020. This table shows the monthly mortgage life insurance rate based on age at the time of application and mortgage amount.

| Age | |

|---|---|

| $1,000,000 | $300 |

As you can see, the mortgage life insurance rates increase as your age and mortgage amount increase. For example, if youâre 30 years old and your mortgage is $250,000, youâll pay $25/month for mortgage life insurance.

However, if youâre 30 but have a $500,000 mortgage, youâll pay $50/month. Similarly, if you have a $250,000 mortgage but youâre 40 years old, youâll pay $52.50/month.

Federal Housing Administration Loan

If you get a Federal Housing Administration loan, your mortgage insurance premiums are paid to the Federal Housing Administration . FHA mortgage insurance is required for all FHA loans. It costs the same no matter your credit score, with only a slight increase in price for down payments less than five percent. FHA mortgage insurance includes both an upfront cost, paid as part of your closing costs, and a monthly cost, included in your monthly payment.

If you dont have enough cash on hand to pay the upfront fee, you are allowed to roll the fee into your mortgage instead of paying it out of pocket. If you do this, your loan amount and the overall cost of your loan will increase.

Don’t Miss: What Does A Commercial Mortgage Broker Do

How Is Mortgageinsurance Calculated

Mortgage insurance is alwayscalculated as a percentage of the mortgage loan amount not the homes value orpurchase price.

For example: If your loan is$200,000, and your annual mortgage insurance is 1.0%, youd pay $2,000 formortgage insurance that year.

Since annual mortgage insurance isre-calculated each year, your PMI cost will go down every year as you pay offthe loan.

For FHA, VA, and USDA loans, the mortgage insurance rate is pre-set. Its the same for every customer .

Conventional PMI mortgage insurance is calculated based on your down payment amount and credit score.

Typically, the ongoing annual premiums for mortgage insurance are spread across 12 monthly installments. You simply pay it each month as part of your regular mortgage payment.

Calculatingmortgage insurance by credit score

The following chart compares cost differencesbetween the three major types of mortgage insurance, based on a $250,000 loanamount, and varying credit levels.

Next Steps: Dont Drain Your Bank Accounts To Escape Pmi

While paying PMI each month or as a lump sum each year is no financial joyride, homeowners should be careful not to make their finances worse by hustling to get rid of PMI.

Most financial experts agree that having some liquidity, in case of emergencies, is a smart financial move. So before you tap your savings or retirement funds to reach that 20 percent equity mark, be sure to speak with a financial adviser to make sure youre on the right track.

There seems to be a philosophical aversion to PMI on the part of many buyers that is misplaced, McBride says. As long as youre not taking an FHA loan, youre not married to the PMI. You can drop it once you achieve a 20 percent equity cushion, which may only be a few years away depending on home price appreciation. But do not feel the need to use every last nickel of cash to make a down payment that avoids PMI, only to leave yourself with little in the way of financial flexibility afterwards.

With additional reporting by Jeanne Lee

Also Check: Can You Mortgage A House You Own

Your Pmi Rights Under Federal Law

Homeowners who pay for PMI should be aware of their rights under the Homeowners Protection Act. This federal law, also known as the PMI Cancellation Act, protects you against excessive PMI charges. You have the right to get rid of PMI once youve built up the required amount of equity in your home. Lenders have different rules for cancelling PMI, but they have to let you do so.

Before you sign a mortgage with PMI, ask for a clear explanation of the PMI rules and schedule. This will enable you to accurately track your progress toward ending the PMI payment. If you feel your lender is not following the rules for eliminating PMI, you can report your complaint to the Consumer Financial Protection Bureau.

Why Lenders Require Mortgage Insurance

Mortgage insurance protects your lender in the event that you stop making your mortgage payments and default on the mortgage.

If the house goes into foreclosure, it will be sold at auction, and it may not attract a high enough price to cover the remaining balance of the mortgage. Mortgage insurance helps make up the difference to the lender.

You May Like: What Is The Mortgage Rate In Florida

Mortgage Insurance Protects The Lender Not You

Mortgage insurance, no matter what kind, protects the lender not you in the event that you fall behind on your payments. If you fall behind, your credit score may suffer and you can lose your home through foreclosure.

There are several different kinds of loans available to borrowers with low down payments. Depending on what kind of loan you get, youll pay for mortgage insurance in different ways:

Understanding Mortgage Insurance Premium

FHA-backed lenders use mortgage insurance premiums as a tool to protect themselves against higher-risk borrowers. Since FHA loans come with a down payment as low as 3.5% with a as low as 580, default is a key concern.

FHA mortgages require every borrower to have mortgage insurance. Conversely, conventional loans only need private mortgage insurance policies if the down payment amount is less than 20% of the property’s purchase price. Each FHA loan requires both an upfront premium of 1.75% of the loan amount and an annual premium of 0.45% to 1.05%. Payment of upfront premiums is at the loan issuance. Determination of the exact yearly cost comes from the term of the loan, amount borrowed, and loan-to-value ratio.

Each month, the loan’s payment amount will reflect the annual premium divided by 12 months along with the principal payment. Other charges usually added to the monthly fee include escrow amounts for property taxes and homeowner’s insurance coverage.

Read Also: What Is The Usual Mortgage Interest Rate

Us Department Of Agriculture Loans

The USDA offers several attractive loan programs. Most are limited to rural areas, and to people who have average or below-average income. If you live outside of an urban or suburban area, it pays to learn if you qualify for a USDA loan.

USDA Loan Insurer

Guaranteed by the U.S. Department of Agriculture, USDA loans do not require a down payment. USDA loans are designed to encourage rural development.

USDA Loan Insurance Cost

USDA loans have an upfront fee and annual fee. The upfront fee is 2 percent of the loan amount. The annual fee, paid monthly, is 0.4 percent of the loan amount. USDA fees are lower than FHA fees.

Private Mortgage Insurance For Conventional Loans

Unlike FHA loans, not every person who buys a house with a conventional loan is required to pay for mortgage insurance. If you make a down payment of 20% or more, you do not need to pay for PMI. If you make a down payment of less than 20%, you will mostly likely be required to pay for private mortgage insurance by your lender.

The cost of PMI is affected by factors like your credit score and the amount of your down payment. The cost can vary from borrower to borrower and generally runs between 0.5% and 2% of the loan amount of the mortgage.

There are similar requirements when you refinance a conventional loan. You need to have 20% home equity or you will most likely be required to pay for private mortgage insurance.

Don’t Miss: How To Go About Getting Pre Approved For A Mortgage

What Is Pmi How Private Mortgage Insurance Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Buying a home usually has a monster obstacle: coming up with a sufficient down payment. How much you put down on a conventional mortgage one that’s not federally guaranteed will determine whether you’ll have to buy PMI, or private mortgage insurance.

Typically a lender will require you to buy PMI if you put down less than the traditional 20%.

Department Of Veterans Affairs

If you get a Department of Veterans Affairs -backed loan, the VA guarantee replaces mortgage insurance, and functions similarly. With VA-backed loans, which are loans intended to help servicemembers, veterans, and their families, there is no monthly mortgage insurance premium. However, you will pay an upfront funding fee. The amount of that fee varies based on:

- Your type of military service

- Your down payment amount

Read Also: What Credit Agency Do Mortgage Lenders Use

Federal Housing Administration Mortgage Insurance

Mortgage insurance works differently with FHA loans. For the majority of borrowers, it will end up being more expensive than PMI.

PMI doesn’t require you to pay an upfront premium unless you choose single-premium or split-premium mortgage insurance. In the case of single-premium mortgage insurance, you will pay no monthly mortgage insurance premiums. In the case of split-premium mortgage insurance, you pay lower monthly mortgage insurance premiums because you’ve paid an upfront premium. However, everyone must pay an upfront premium with FHA mortgage insurance. What is more, that payment does nothing to reduce your monthly premiums.

As of August 2020, the upfront mortgage insurance premium is 1.75% of the loan amount. You can pay this amount at closing or finance it as part of your mortgage. The UFMIP will cost you $1,750 for every $100,000 you borrow. If you finance it, youll pay interest on it, too, making it more expensive over time. The seller is permitted to pay your UFMIP as long as the sellers total contribution toward your closing costs doesnt exceed 6% of the purchase price.

With an FHA mortgage, you’ll also pay a monthly mortgage insurance premium of 0.45% to 1.05% of the loan amount based on your down payment and loan term. As the FHA table below shows, if you have a 30-year loan for $200,000 and you’re paying the FHA’s minimum down payment of 3.5%, your MIP will be 0.85% for the life of the loan. Not being able to cancel your MIPs can be costly.