Learn More About Mortgages In The Uk

How do mortgages work in the UK?

Buying a home or land is expensive. A mortgage is a financial product that helps people purchase their own home or land.This is especially true for a first time buyer, as it might be the only route onto the property ladder.

The minimum credit score for a mortgage

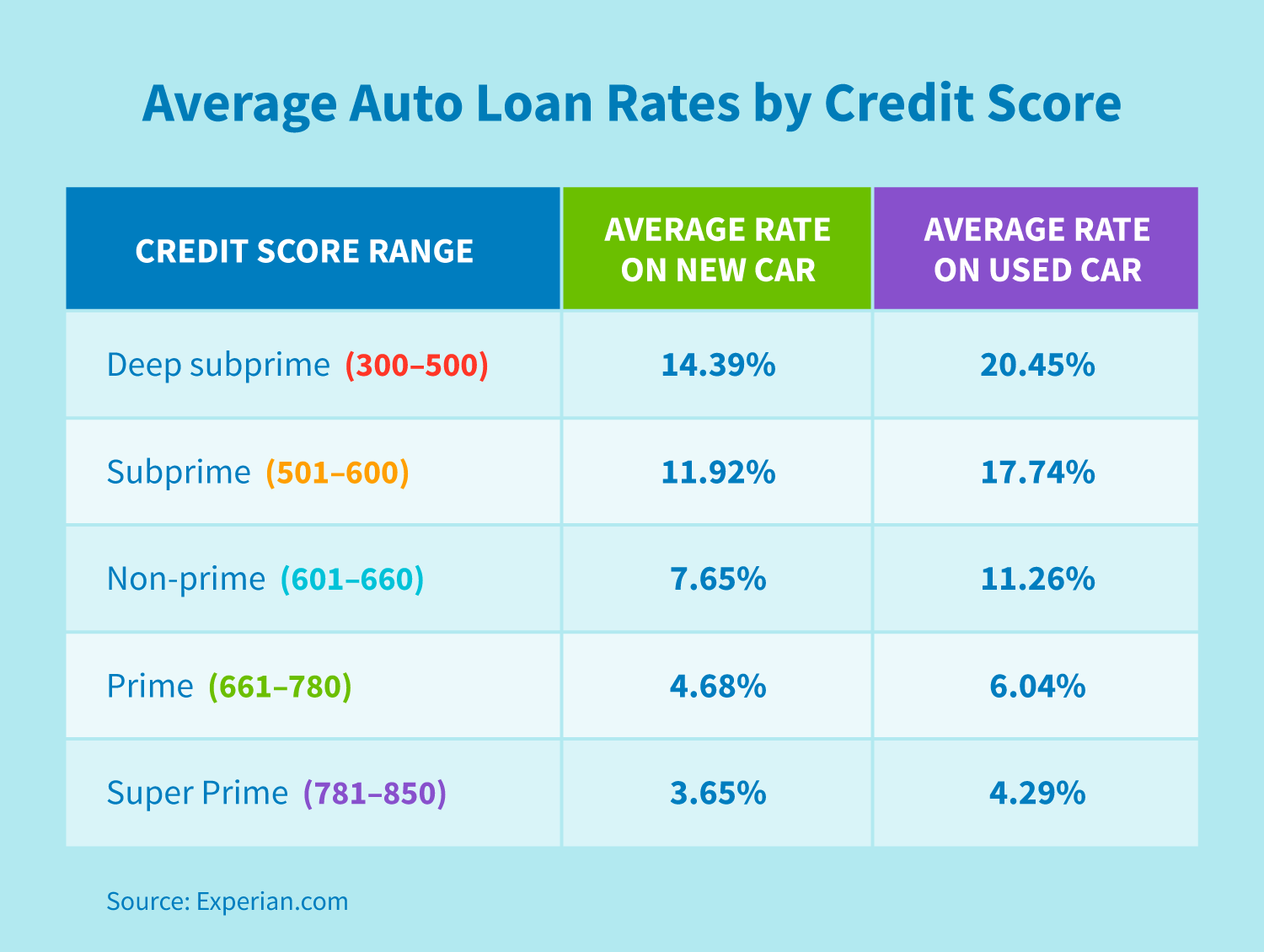

ou can still be approved for a mortgage to buy a property if you have a poor credit score. However, someone with a poor credit score will probably have a higher interest rate than someone whose credit score is good. Buyers with a low credit score may also need to pay a bigger deposit.

fixed term Contract Mortgages

A fixed term contract is a way of describing certain types of employment. If your current employment contract is due to end after a certain period of time, or after a specific piece of work is complete, you are likely on a fixed term contract.

how long does a mortgage application take?

After sending off the final application waiting for the decision can be frustrating. Many prospective homeowners ask how long does it take? but the truth is the mortgage approval process is always different for each customer.

how long does conveyancing take?

The entire conveyancing process will normally take anywhere between 8-12 weeks, however you should be prepared for this to take much longer depending on your circumstances and wider factors. This articles explores what the timescale involves.

Mortgages if You are bankrupt

what stops you getting a mortgage?

IVA Mortgage

Can You Get A Joint Mortgage If One Person Has Bad Credit

Maybe. Remember that although it may be tempting to try applying for a mortgage with just the person who has a great credit score, most lenders will not allow this.

The first thing that a lender will consider is your relationship. If you are married, you will have to apply jointly for a mortgage. The mortgage lender will look at each credit score and credit report and make a decision based on your joint credit file.

Lenders consider your income, outstanding credit, employment status, ages, marital status, whether you have joint bank accounts and credit cards, and your experience buying property .

When you apply, you may be able to provide written reasons for your problems that have damaged your credit score. This can help your application when your credit score is bad.

Lenders are more concerned if one applicant has a low credit score due to:

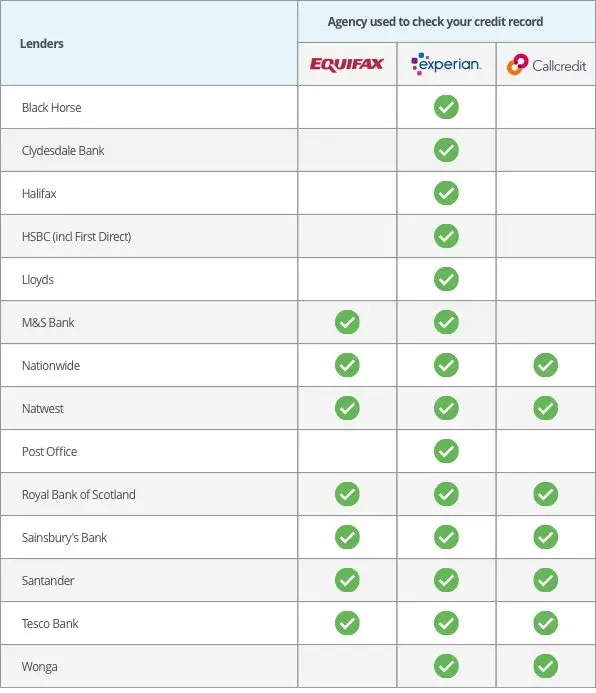

Maybe. It depends on which of the credit reference agencies are being used, as well as the mortgage lender.

If you have a credit score between 561 and 720 with Experian , this is considered a poorer credit score than normal. With this Experian credit score you can get mortgages. But, you will likely have to pay high interest rates.

However, if you check your credit score with Equifax or TransUnion and it is 600, then you are in a fair or good position for applying for a mortgage.

Remember that each mortgage company also has its own lending policy. Some lenders will be more or less concerned by different aspects of your credit profile.

Lenders Can Use Equifax For Debt Recovery Information

The financial data that Equifax holds can help with debt recovery.

If you cannot afford to make your repayments then your creditors may run a check through Equifax.

The credit referencing agency may have insights into your income and your debt levels. This data can prove to lenders that you cannot afford to pay.

Also, your creditors may be able to offer a fair repayment plan if they know that you are in financial difficulty.

Information held by Equifax can be used to check if you are defaulting on your payments elsewhere, or only with one creditor. It can also show if you are applying for more credit elsewhere.

Equifax can make a prediction, based on your current behaviour. They can tell lenders if you might end up filing for bankruptcy, or become insolvent as a result of your debt levels.

Recommended Reading: Is 3.99 A Good Mortgage Rate

How The Two Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person.

But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989.

Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game.

The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

According to VantageScore reports, there were approximately 10.5 billion VantageScores used between June 2017 and June 2018.

Why Is My Credit Score Different On Different Websites

Just like lenders and other companies, CRAs may calculate your score in different ways or using different information. So, there isnât a single, universal credit score.

The Experian Credit Score is the UKâs most trusted rating* â a good Experian Credit Score is likely to mean you have a good credit score with companies. Itâs based on information in your Experian Credit Report, and runs from 0-999. The higher it is, the better your chances of getting credit at the best rates.

*Most trusted based on 46% of 995 respondents. ICM Unlimited survey May 2020.

Recommended Reading: How Much Is Mortgage Insurance In Michigan

What Is A Credit Score

The term “credit score” usually refers to a FICO score. FICO stands for the Fair Isaac Corporation, the company that developed the most commonly used credit scoring system. With FICO, everyone is assigned a score ranging from 300 to 850. The higher the number, the better the credit.

Your credit score takes several things into account including current debt, payment history, new credit and types of credit.

Your credit score is important because it’s one of the key factors lenders look at when deciding whether to offer you a loan.

How Can You Improve Your Credit Profile

If youre looking to get on the property ladder, move up the ladder or re-mortgage, there are some steps you can take to ensure you are in a good position prior to applying for finance.

- Check your credit report with all three agencies. Ensure that there are no discrepancies, or items you dont agree with. If there is, talk to the credit reference agency straight away.

- Be aware of your expenditure prior to making the mortgage application. Putting a monthly budget in place and sticking to it. Always try to save and have a surplus at the end of each month.

- Make sure you make all your monthly payments and settle bills on time. If you can, clear all credit card debt each month or pay more than the minimum payment on credit card balances.

- Try not to increase your debt or borrowing prior to a mortgage application and if you can, reduce it.

Remember that a good credit score does not mean that you will be a guaranteed mortgage but it does help. Equally, there are often mortgages available for those with less than perfect profiles but as you might expect, they will cost you more.

To discuss your options, do get in touch. I can be contacted directly on or by email at .

Article Updated: 08/04/2020

Read Also: How To Market Yourself As A Mortgage Loan Officer

The Critical Score Is The Middle Score

Each of the three major credit bureaus, Experian, Equifax and TransUnion, keeps a credit file on every person who has ever paid a bill or taken out credit. Lenders use these scores to calculate your risk of defaulting on a mortgage loan. Since each agency may report a slightly different score, lenders take the middle score of the three. For example, if your scores are 680, 710 and 660, lenders will use the middle score of 680 to assess your loan eligibility.

How To Monitor Your Credit Reports

Since the mortgage industry looks at all three credit reports and scores, you may want to consider a paid credit monitoring service that pulls more comprehensive data than a free version would.

The best credit monitoring services offer triple-bureau protection, looking at your information across all three .

Experian IdentityWorks Premium monitors all three of your reports to make you aware of activity including score changes, new inquiries and accounts opened in your name, changes to your personal information and suspicious activity detected. Plus, youll regularly receive updates to your FICO Score.

-

$9.99 to $29.99 per month

-

Experian for Plus plan or Experian, Equifax and TransUnion for Premium plan

You May Like: What Is A Good Dti For A Mortgage

Why Is It So Important To Get A Low Interest Rate On My Mortgage

You probably already know that a lower interest rate means a smaller monthly payment. But do you know just how big of an effect a smaller monthly payment can have?

Lets look at an example. According to the U.S. Census Bureau, in March 2018 the average sales price of a new home sold in the United States was $366,000. If you were to go to the closing table with a 20% down payment and opted for a 30-year fixed-rate mortgage, heres how much it would cost you over time depending on your interest rates.

| $3,408 | $102,183 |

In this example, boosting your credit before you get a mortgage could save you $284 per month, $3,408 per year, and $102,183 over the life of your loan! What would you do with all of that extra cash?

Pro tip: Use our to learn more about what could impact your credit scores.

Your Mortgage Credit Score Might Not Be What You Expect

Many home buyers dont realize they have more than one credit score. And the score a mortgage lender uses may be lower than the one you see when you check it yourself.

Finding out late in the game that you have a lower mortgage credit score could be an unwelcome surprise. You might end up with a higher interest rate and/or smaller home buying budget than youd planned.

So before you apply, its important to understand how lenders look at credit and what score you need to qualify.

You May Like: Who Is Rocket Mortgage Owned By

Which Lenders Use Which Fico Scores

With the exception of the mortgage market, which is heavily regulated, lenders can generally choose which FICO score they use when running a credit check. However, they tend to use certain versions depending on the kind of credit for which youre applying. Heres a look at the most common FICO scores used for each type of credit.

Why Are Fico Scores So Important

Your FICO® Scores are important because they determine your mortgage eligibility. Based on your credit score, your lender will regulate how much money you will receive and how long you must pay them back at a given interest rate.

Having a good FICO® Score is even more important because it will help you save a lot of money. It will also make you eligible to qualify for a wider variety of mortgage options. Later we will talk about what is considered a good score and how you can build your current score.

Don’t Miss: How Much Is The Mortgage On A $300 000 House

Equifax Credit Report & Score

For £7.95 per month, you can receive full access to your credit report. There is a 30-day free trial for new customers.

You will be able to see your credit record in detail. It will show what accounts you have open. It may also show closed or paid accounts, and which lenders have checked your file recently.

This option includes automatic alerts if there are any significant changes to your credit file.

Also included is Equifax WebDetect.

If your personal information is being shared on the internet, you are at risk of becoming a fraud victim. WebDetect can help you to act quickly, by alerting you if your information is shared.

How The 3 Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

- Equifax

- Transunion

- Experian

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge.

There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

You May Like: Does Rocket Mortgage Affect Your Credit Score

Why Are There Different Fico Scores

When you apply for credit, whether its your first credit card or a second mortgage, lenders need to decide whether youre enough and likely to repay the money. To do this they check your credit scores or get credit reports from one or more of the major credit bureaus: Equifax, Experian, and TransUnion. Each has its own credit score that is developed by FICO, and these scores are calculated based on your credit history and other information that goes into your credit report.

There are also multiple versions of FICO scores, reflecting the evolution of the credit market and consumer behavior since the scores first became a tool for lenders back in 1989. Just in terms of the amount of credit we use, theres been a big increase over the past few decades, with consumer borrowing rising by approximately 15% over the last four years. A typical borrower today probably would have been considered a higher credit risk under older methods of calculating credit scores.

FICO has rolled out 10 versions of its base score over the years, and most of them are still in use by lenders to some extent. Lenders can choose from the following base versions:

- FICO 2

- FICO 9

- FICO 10 and 10T

Improving Your Credit Score

Making payments on time. This includes credit card payments, rent, debt payments, utilities, and any other monthly bills or payments. Lenders often consider past behavior to be an accurate predictor of future behavior and generally want to avoid lending money to individuals with a history of missed payments .

Keeping credit utilization ratio below 30%. Lenders generally like to see a . Its an indicator that the borrower can effectively manage their credit.

Being selective when opening new credit accounts. Opening a new credit card or borrowing a new loan generally involves a hard credit inquiry , and too many hard credit inquiries can have a negative impact on the applicants score . So while having a diverse mix of credit can improve someones credit score, opening a number of new accounts may be counter-productive .

One of the biggest takeaways is that consistency is key for those trying to change their credit score. Credit scores arent likely to improve overnight, but sticking with a long-term plan can help repair a borrowers credit over time.

Don’t Miss: Who Can Get A Fha Mortgage

Which Credit Bureau Will Your Lender Pull From

All you have to do is ask!

Your lender should be more than willing to tell you which bureau they plan to use when pulling your report. Once you have this information, you can pull your file to see how you will come across it.

Concerning the Fair Credit Reporting Act, this should only create an inquiry on one of your reports if it shows up across the board, you might be able to dispute its removal. If the inquirys effect on your credit score concerns you, remember that a single inquiry will not hurt your score by more than five points, and it will have zero effect after two years.

Interestingly, you might want to consider this variable when shopping for the best rates and highest card limits. Some consumers are unfortunate enough to have a staggering score difference between bureaus.

If your credit rating is 10 points or higher at one of the bureaus, then it would make sense to shop for financing through lenders that pull from there. Most lenders are fixed to a single bureau, so it will not be hard to manipulate your loan application results this way.

That said, some lenders will pull your credit report from multiple bureaus. Sometimes this is done to gather missing details, but its standard practice for many lenders.

What Is A Credit Report

If you are 18 or more, your credit report is a profile of your personal credit history or credit file over the last six years. It includes information on mortgages and mortgage payments, loans, overdrafts, credit and store cards, mobile phone contracts and sometimes, utilities. It will show how you have managed the credit, including if you have missed payments or defaulted on loans.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Whose Score Will Lenders Use

When you make a joint mortgage application, lenders could be evaluating as many as six credit scores — three for each of you. While most lenders consider the applicant with the highest monthly income as the primary borrower, they often take the lowest middle credit score of both borrowers as their benchmark. While frustrating, this is just another example of conservative lending policy.