Can I Get A 150000 Mortgage For A Second Home

The short answer is yes, and there are many reasons someone might want a second home. It could be for business, holiday home or a home for a family member to live in .

The main thing the lender will consider is whether you can afford the repayments on top of your existing mortgage. They take a stricter view of second home mortgages as they are deemed to be higher risk.

Youll also need to consider additional costs such as stamp duty, maintenance, council tax and utilities.

To help guide you through the potential pitfalls, talk to one of the advisors we work with. Theyre experts in getting the best deal for second homes.

Calculate How Much Home You Can Afford

Before applying for a mortgage, you can use our calculator above. This provides a ballpark estimate of the required minimum income to afford a home. To understand how this works, lets take the example below.

Suppose the house youre buying is priced at $325,000. The loan is a 30-year fixed-rate mortgage at 3.5% APR. To get rid of PMI, you decided to make a 20% down payment, which is $65,000. With a 20% down, this reduces your principal loan amount to $260,000.

To qualify for the loan, your front-end and back-end DTI ratios must be within the 28/36 DTI limit calculator factors in homeownership costs together with your other debts. See the results below.

- 30-Year Fixed-Rate Loan

| Minimum Required Income Based on 36 Back-end DTI | $98,083.87 |

*When you use the calculator, you can adjust the DTI limits as needed for when a lender accepts higher DTI ratios.

Based on the results, the minimum required annual salary based on the 28% front-end DTI limit for a $260,000 mortgage is $66,107.84. But note that this does not factor in your other debt obligations. Other debts are included when you calculate based on the 36% back-end DTI limit. This results in a minimum required salary of $98,083.87.

How Much Of A Home Loan Can I Get

A home loan is another term for a mortgage. Every lender will make a decision on how much you can borrow based on your income. Unfortunately, How much can I borrow? doesnt have a straightforward answer. If your income is solely a basic income then usually this will mean that you will be able to lend more. Your deposit amount will also massively make a difference. The bigger the deposit you have will increase the amount you could borrow and as well as getting you lower interest rates and lower mortgage payments. So get saving as much deposit as is possible for you and your situation. Start by writing down your income and outgoings and see what you can easily cut to start saving.

Can I purchase a buy to let property or rent my old property out?

Look no further for great buy to let mortgage advice. We are property specialists and know the recipe for a successful buy to let mortgage company and advice. Lenders calculate your investment to make sure financially makes sense. They will check your affordability and look at such things as financial commitments, outstanding loans, bank statements, current mortgage, basic salary and other income. Lenders will also take into account fees such as agent fees and legal fees and then borrow based on the overall affordability.

We always strive to provide mortgage advice that helps guide you to save money and make your buy to let rental income is an overall profitable investment

Read Also: What Are Mortgage Rates Based On

Can I Get A Mortgage For 250000 Summary

Higher value mortgages i.e. a 250,000 mortgage are more common these days due to the increases seen within property prices over recent years. As discussed, there are strict criteria that will need to be met before a lender would agree to offer high-value mortgages.

As with any financial decision, it is highly recommended to seek mortgage advice before making a commitment, ensuring that all terms and conditions are fully understood.

Independent advisors will also have access to the whole of the market, rather than just high street lenders and therefore will often be able to compare a wide range of options across an array of lenders.

It is worth noting that all secured lending will have consequences to owned assets if the repayments are not kept up. These include, but are not limited to, an impact on a persons credit score and in worst cases, repossession.

Call us today on 01925 906 210 or contact us. One of our advisors can talk through all of your options with you.

Further reading:

How Much Can I Afford To Borrow

Knowing how much you may be able to borrow is one thing, but knowing how much you can comfortably afford and being confident in your ability to keep up with your repayments is another. This is why youll need to carefully go through your outgoings, making sure to use a mortgage repayment calculator so you get an idea of what your repayments could be and whether you could absorb them in your current salary.

Bear in mind that if youre moving to a bigger property there could be additional expenses to pay, and if youre moving from rented accommodation into homeownership, your outgoings could change again, and thats before we even get to the additional costs of moving . This means its vital to go through everything in advance to make sure youre prepared for the impact on your finances.

Once youve tallied everything up, you can make a decision about the kind of mortgage you can comfortably afford. Though make sure to be realistic its generally recommended that no more than 28% of your household income should go on housing expenses, so if your final total is above this level, it may be worth reconsidering.

Recommended Reading: Does Usaa Have Mortgage Loans

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

How Much Money Do I Need To Buy A House For The First Time

As of October 2021, the median home price in the U.S. is around $404,700. Assuming a 20% down payment, you would need $80,940 for a down payment, plus several thousand more for closing costs and fees to your lender, realtor, lawyer, and title company. Still, no set amount is required and home prices vary state-to-state and city-to-city. Its all dependent on what youre looking for in terms of size and type of property, neighborhood, amenities, and any other details specific to your situation.

Don’t Miss: What Is An Origination Fee On A Mortgage Loan

How Much Do I Need To Earn To Get The Mortgage Im Looking For

We are constantly asked, how much do I need to earn to get the amount of mortgage Im looking for? The answer to this is not that straightforward, hence why it can be difficult for people to establish exactly how much they can borrow. The reason for this is that all lenders use their own criteria to assess income and affordability.

The advisors we work with are experts and are whole of market, so even if youve been declined or have bad credit, they will be able to give you the right advice for your circumstances.

The following topics are covered below…

What Size Mortgage Can I Get And How Much Can I Borrow

You may be wondering ‘how much mortgage can I get?’ Finding the right size of mortgage you can get before you start house hunting is a sensible move to help you set your budget.

How much you can borrow with a mortgage is determined by a number of things: how big your deposit it how much you earn your credit score and your current debts, to name a few. You can use an online mortgage calculator to quickly get some guidance on how much you could borrow.

Whilst many first time buyers may want to get the biggest mortgage they can, it’s important to think critically about how much you’re borrowing and how much your mortgage will cost you.

Crucially, make sure you don’t overstretch yourself. Try to ensure that your budget can handle increases in interest rates so you won’t struggle if your repayments become more expensive. So how big a mortgage can you get?

Read Also: How Much Are Monthly Payments On A 200 000 Mortgage

How Much Income Do I Need For A 200000 Mortgage

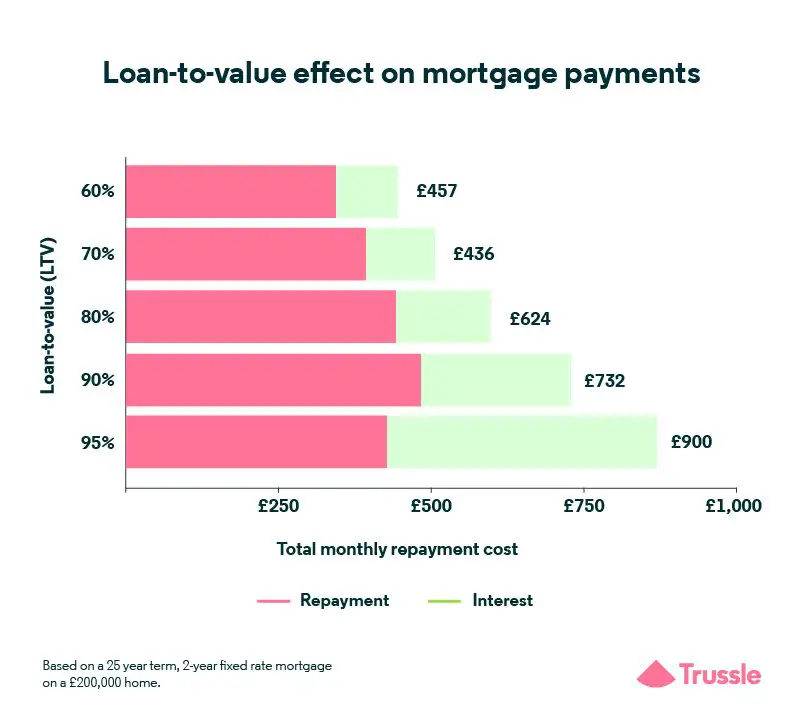

Lets say your ideal home is worth £225,000 and youre able to put up a £25,000 deposit. For a £200,000 mortgage youll need to earn a minimum of £44,500, though to be more comfortably offered this level of mortgage youd probably need to earn closer to £50,000 or above. Its also worth noting that this mortgage would equate to a loan-to-value of 88.9% in this scenario, which means first-time buyer mortgage dealswould be your best bet.

Need to work out your LTV, use our LTV calculator.

How Much Do I Need To Earn To Get A Mortgage Of 150000

See roughly what you can afford in our guide below or get started with a broker who can calculate your affordability, and give personalised advice

Author:Pete Mugleston– Mortgage Advisor, MD

We often hear from customers who have their heart set on a property which would require a £150,000 mortgage, and the first thing they want to know is how much theyd need to be earning to get one.

Jump to our calculator journey to establish what you can borrow, the costs and which of the best deals youll qualify for.

Some may have been , while others are unsure because they have some bad credit history. The good news is that the brokers we work with are experts when it comes to finding the best deal for your circumstances, even if youve had bad credit in the past.

Here we answer that question and outline the typical eligibility and affordability checks you will also need to pass to land a home loan of this size.

The following topics are covered below…

Recommended Reading: Can I Get A Mortgage Before I Sell My House

Other Factors That Affect Getting A 250000 Mortgage

Several other circumstances may help determine whether or not you can borrow the full 4.5 times your income. These are:

Youll need a good history of borrowing and repaying money. Find out what can affect your credit score and how to improve it.

Lenders prefer borrowers to have steady, predictable sources of income. This means it can be harder if youre self-employed, or in a profession considered to be less secure or more risky. Find out about getting a mortgage if youre self-employed.

Age

There is no set age limits on mortgages, but lenders tend to have their own cap, sometimes as low as 55. A steady sufficient income for the next 20+ years can be difficult to prove if youre in your late 50s or older.

How Lenders Assess What You Can Afford

Mortgage lenders base their decisions on whats known as the loan-to-income ratio the amount you want to borrow divided by how much you earn.

The most you can borrow is usually capped at four-and-a-half times your annual income

Have you had mortgage advice?

You can get advice directly from a lender who will discuss their own products, or from a broker wholl be able to look at mortgages from a range of providers.

Read Mortgage advice: should you use a mortgage adviser? for details of where to get advice.

You May Like: How To Calculate Upfront Mortgage Insurance Premium

What Monthly Expenses Do You Have

! Please enter an amount less than }.

Estimate your monthly expenses such as groceries, transportation, child care, insurance, shopping, media and regular contributions to savings.

Please do not include rent or housing expenses.

If you’re buying a home with a spouse, partner, friend or family member, include their monthly expenses as well.

If this amount is higher than your monthly income before taxes, please contact us to discuss your options.

Step 6 of 6

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: What Does A Mortgage Consist Of

What Is The Minimum Down Payment On A House

There is no law or rule for a universal minimum down payment, but the more you pay upfront, the lower your monthly mortgage payments, the lower the interest rate you will qualify for, and the less likely you will be to have to pay mortgage insurance or other fees. Generally, however, 3%-5% would be the absolute minimum, and only for certain borrowers.

Income Is A Significant Part Of Deciding How Much You Could Borrow

Income is crucial for determining how big a mortgage you can have. Traditionally, mortgage lenders applied a multiple of your income to decide how much you could borrow. So, if you earn £30,000 per year and the lender will lend four times this, they may be willing to lend £120,000.

When it comes to households with two incomes, some lenders offer a choice:

The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second person’s income is £15,000 a lender might offer 4x the first income, plus the second income or

A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they are willing to lend. This is something that has become particularly strict following mortgage regulations introduced in 2014.

If part of your income is comprised of a bonus or overtime, you may not be able to use this, or if you can, you may only be able to use 50% of the money towards what the lender deems as your income. All income you declare in your mortgage application will need to be proven usually through you providing your latest pay slips, pensions and benefits statements.

Also Check: How Much Net Income Should Go To Mortgage

How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

Great To Hear Because I Found My Dream Home It Costs Way More Than I Make In A Year Though

Well, how much more exactly? Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross annual salary. And some say even higher. There are a ton of variables, and these are just loose guidelines. That said, if you make $200,000 a year, it means you can likely afford a home between $400,000 and $500,000.

Read Also: What Does The Bank Need For A Mortgage

How Much Income Do I Need For A 350k Mortgage On A Buy To Let

While your income will be taken into account when applying for a buy to let mortgage , lenders typically decide on how much to lend you based on the amount of rental income youll be able to achieve on the property.

Lenders will expect you to be able to achieve between 25% and 45% more than your mortgage payment, assuming the mortgage is on an interest-only basis, in rent.