How Long Are You Required To Pay For Mortgage Insurance

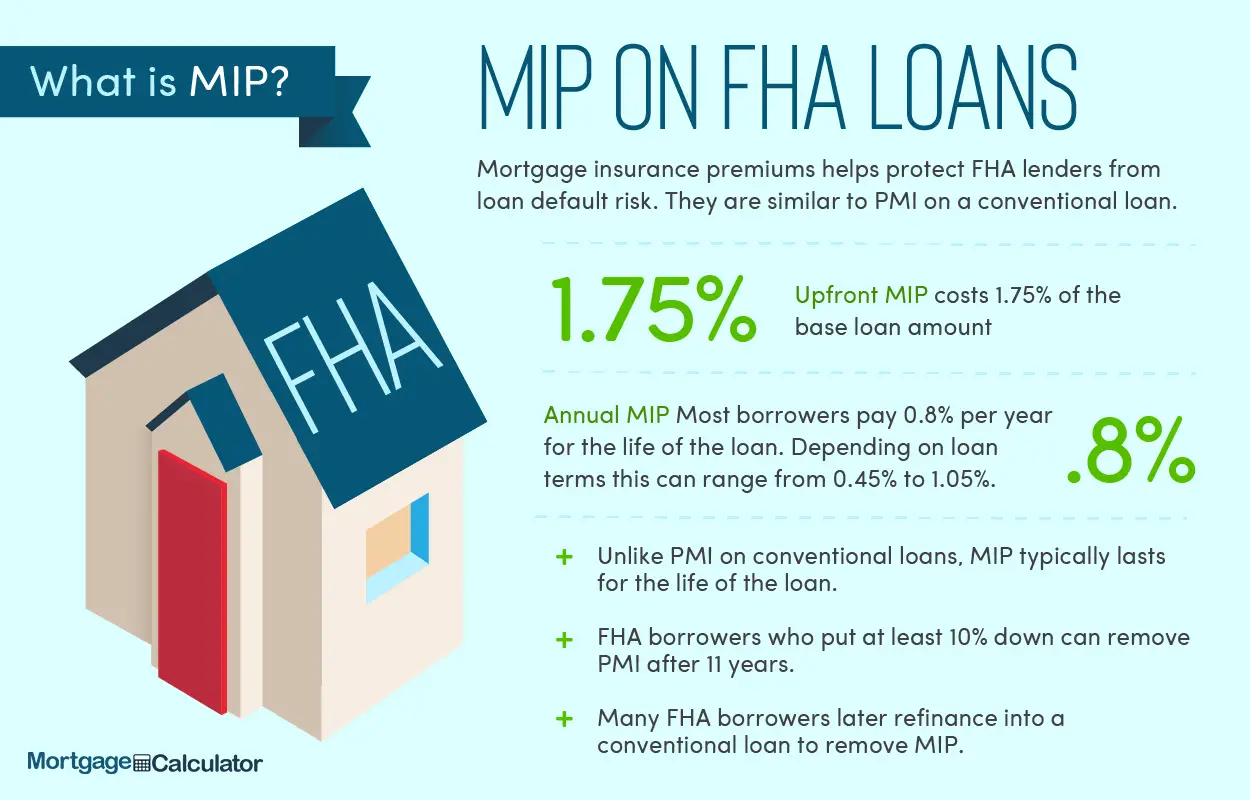

One more important difference between MIP and PMI is the length of time you are required to pay it. If you buy a house today with an FHA loan, you will be required to pay mortgage insurance premiums for at least 11 years. If you make a down payment of less than 10%, you will need to pay MIP throughout the life of the loan. Homeowners with FHA loans sometimes refinance to a conventional loan to stop paying mortgage insurance premiums.

With a conventional loan, you only need to pay for private mortgage insurance until your home equity reaches 20%. Then you can request your lender cancel your PMI payments. Learn more about how to remove PMI from your mortgage.

How To Keep Insurance Costs Down

The most effective way to lower your insurance costs is to raise your credit score. Lenders reward high credit scores in two important ways: lower interest rates and lower mortgage insurance. By tweaking your score, you could shave off hundreds of dollars from mortgage insurance.

Consider this scenario: a person in North Carolina with a credit score between 740 and 759 who buys a home at the states median listing price of $369,000 and puts 3.5% down. That borrower will pay just 0.70% in PMI compared to the 1.65% that a borrower with a score between 640 and 659 living in the same state will pay. The person with the lower score will pay more than double in PMI, or just over $489 per month, compared to the higher score borrower who pays about $207 per month.

| $5,875.40 | $489.62 |

Another way to lower PMI costs is through higher down payments, says Linda McCoy, board president at the National Association of Mortgage Brokers, or NAMB.

But for first-time homebuyers, large down payments can be challenging, especially when you factor in other costs.

The more you put down, the lower the PMI, McCoy says. But many buyers can barely come up with a small 3% or 5% down payment for the conventional first-time home buying programs plus pay their closing costs.

How Much Do You Have To Pay

The FHA uses a formula to determine set the cost of mortgage insurance premiums. This formula is based on, among other things, the amount of the loan, the amount of the down payment and the number of years the mortgage lasts.

The easiest way to estimate your monthly MIP is to use an online calculator. The FHAs online Whats My Payment calculator. Youll need to input the following information:

- Purchase price

- Loan term

- State in which the home is located

The calculator spits out an estimate for your total payment based on that information. As part of that it gives you the dollar cost of your FHA mortgage insurance premium.

For instance, for a loan on a $250,000 California home with a 3.50% down payment, 4.25% interest rate and 30-year term, the calculator estimates youll make a total payment of approximately $1,615 each month. Of that, approximately $170 is the monthly mortgage insurance premium.

The up-front mortgage insurance premium uses a simpler formula of 1.75% of the loan amount, or $1,750 for each $100,000 of the base loan amount. The FHA calculator also gives you this figure. On the previous example the UFMIP is approximately $4,200.

You can either roll the cost of the UFMIP into the loan and add it to the base loan amount, or you can pay it up front. Regardless, all FHA loans require an up-front mortgage insurance premium.

Don’t Miss: What Is A 5 1 Arm Mortgage

How To Avoid Paying Ufmip

If you want to avoid paying the additional cost that is a UFMIP, youll need to apply for a conventional mortgage that is not backed by the FHA. This means making a larger down payment, sometimes 20% or more of the homes purchase price. However, doing so will also help you avoid paying AMIP, which can add up over the course of your loan term.

Pay Down Your Current Mortgage Balance

If you’re planning to refinance your home but the current LTV is over 80%, consider paying off more of your mortgage balance first. If your mortgage servicer doesn’t penalize you for prepayments, you can consider paying off more of your mortgage right away. Otherwise, you may have to wait until you’ve made a few more monthly payments.

You May Like: Can I Use My Partner’s Income For A Mortgage

How Is Fha Mortgage Insurance Calculated

There are two components to FHA mortgage insurance or MIP. The first is the upfront mortgage insurance premium of 1.75% of the loan amount. That needs to be paid at closing.

As an example, if your purchase price is $243,500 and your loan amount is $235,000, then your upfront mortgage insurance premium at closing will be $4,112.50

The upfront mortgage insurance premium needs to be paid on all FHA loans except the following:

- FHA Streamline Refinances

- Loans on Indian lands

- Loans on Hawaii Home Lands

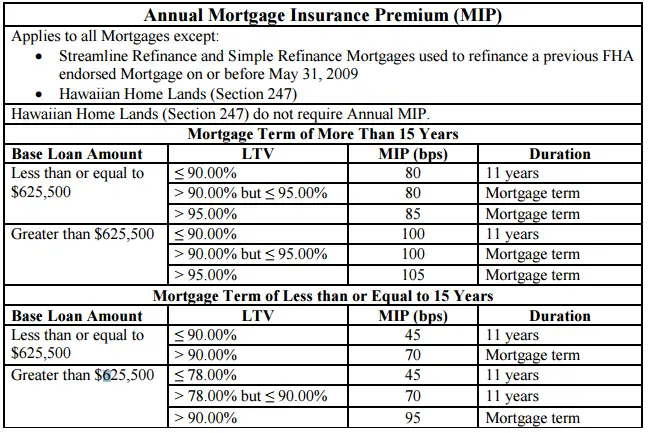

The second portion is the annual FHA mortgage insurance premium which is divided by 12 and added to your monthly mortgage payment. The calculation of this payment will vary based upon the loan amount and your down payment amount or loan to value ratio .

Example: Loan amount of $235,000 + 96.5% LTV + 30 yr fixed loan

- $235,000 X .85% = $1,997.50

- $1,997.50 Divided by 12 = $166.46

- $166.46 is added to your monthly mortgage payment

You can see from the chart below, the loan amount is less than $625,000, the LTV is greater than 95% and the mortgage term is greater than 15 yrs. So, the rate used for the MIP calculation is .85%

Total FHA Mortgage Insurance Premium in the example above = $4,112.50 plus $166.46 per month

Tip the more money you put down on the home, the lower your MIP rate will be that is used to calculate your monthly insurance premium. This could save you a lot of money over the life of your loan

Enter The Zip Code Where You Plan To Buy A Home Currently The Ufmip Rate Is 175 Of The Amount Of Your Fha Loan

How to calculate monthly mortgage insurance premium. If youre interested in buying a home Private Mortgage Insurance and learning more about how to. For example assuming a 1 percent MIP on a 200000 loan with only 5 percent down payment 195000. FHAs Annual Mortgage Insurance Premium MIP The annual premium is divided by 12 and that amount is added to the borrowers monthly mortgage payment.

On the previous example the UFMIP is approximately 4200. Divide by 12 and round to nearest cent for Monthly MIP. Multiply the loan amount by the mortgage insurance premium rate for the annual.

The FHA upfront mortgage insurance premium is 175 of the loan amount. To calculate the rate takes the rate of insurance and multiply it by the value of the loan. The most common way for mortgage insurance to be paid is as a monthly premium rolled into your mortgage paymentMany buyers do not realize that there is also an option to pay the premium as a single lump sum upfront called single-payment mortgage insurance.

Determine the monthly payment Divide this number by 12 for 12 months then add the number to the monthly mortgage payment to see what your total monthly payment will be. Upfront MIP 175 Annual MIP. Of that approximately 170 is the monthly mortgage insurance premium.

UFMIP is equal to 175 of the loan amount. Since March 17 2017 the followingCMHC premiumsapply in most situations. 53080 1 00225 5191198 round to 51912.

Monthly Fixed Expenses Budgeting Budget Planning Budget Calculator

Recommended Reading: What’s The Average Mortgage Payment

Choose A Different Government Loan Type

If you really want to avoid MIP payments, you may want to consider another type of government loan.

You may be buying a home in a rural area and have a median FICO®Score of 640 or higher. In that case, why not consider a USDA loan? Unlike an FHA loan, USDA loans dont require a down payment. You also dont need to pay PMI or MIP with a USDA loan. Instead, you pay a monthly guarantee fee thats less expensive than the FHA monthly premium.

On the other hand, you might want to consider a VA loan if youre a current or former member of the armed forces or a qualifying spouse. To qualify for a VA loan, youll need a median FICO®credit score of at least 620 and a DTI ratio of 60% or less. Theres no down payment requirement for a VA loan. You also dont have to pay any type of monthly mortgage insurance on a VA loan. Instead, youll pay a one-time VA funding fee and the home must be your primary residence. Veterans receiving VA disability benefits and surviving spouses of veterans who passed in the line of duty or as a result of a service-connected disability are exempt from the funding fee.

Contact a Home Loan Expert to learn more about these FHA loan alternatives and to find out whether you qualify.

Advantages And Disadvantages Of Fha Mortgage Insurance

Here are some of the advantages of FHA MIP:

- Premiums are set FHA mortgage insurance premiums dont fluctuate according to credit score.

- Easier to qualify FHA mortgage insurance helps borrowers who might not otherwise qualify for a conventional loan. With MIP, the FHA is able to absorb more risk and therefore extend loans to less-creditworthy borrowers.

- Lower down payment With the insurance, borrowers with a credit score of 580 and up can put down as little as 3.5 percent on an FHA loan. Those with scores between 500 and 579 can put down as little as 10 percent.

Here are some of the disadvantages of FHA MIP:

- Adds to overall loan cost The upfront and annual costs of FHA mortgage insurance increase both your total loan amount and monthly payment.

- Difficult to get rid of Generally, there are only a couple of ways out of paying for FHA mortgage insurance you can either refinance into a conventional loan or pay off your mortgage in full.

Don’t Miss: What Day Of The Week Are Mortgage Rates Lowest

The Mip Refund Chart Explained

The MIP refund chart is at your disposal when you get to calculating your FHA MIP refund. The chart shows the percentages of your refund based on the time that has passed after closing on the loan.

|

Months After Closing |

|

| 36 |

For example, you bought a $250,000 house fifteen months ago, and your upfront mortgage insurance premium was $4,375 . Should you choose to refinance now, you are eligible for a 52% refund, which comes down to $2,275. The longer you wait to refinance, the lower the refund amount will be.

Fha’s Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers weren’t able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage.

Changes in FHA’s MIP apply only to new loans. Borrowers who’ve closed their loans don’t need to worry that their MIP will get more expensive later.

- Company

Don’t Miss: Can You Apply For A Mortgage Before Finding A House

How To Request An Fha Mip Refund With Donotpay

DoNotPay can help you request a MIP refund. Getting a MIP refund on your own can be quite taxing because you have to deal with all the calculations and numbers, but thats why DoNotPay is here for you. You can go to our website and request a refund not only for MIPs but for other services as well.

DoNotPay will help you request your refunds seamlessly in just a couple of clicks. Heres what you have to do:

Once youve gone through the steps, DoNotPay will handle the rest of the process. A request for a refund will be sent to your bank automatically. You will also receive a letter with the ins and outs of VISA and MasterCard, which could prove useful for building evidence for your case.

Why Do I Have To Pay Mortgage Insurance Premium

Mortgage insurance is paid if you as a borrower were to make a down payment of less than 20 percent on your home loan. It is paid by you, but is used to protect the lender from losses if you were to default on the loan. When it comes to the FHA, borrowers must pay a mortgage insurance premium, or MIP, on the home loan.

You May Like: Can You Sell House Before Paying Off Mortgage

Private Mortgage Insurance Companies

MGIC Mortgage Guaranty Insurance Corporation

MGIC is a subsidiary of MGIC Investment Group and it provides private mortgage insurance to lenders of home mortgages across the U.S. The company offers primary coverage and pool insurance. Primary coverage gives the opportunity to people to become homeowners with less than 20% down payment and protects the lender against default. Pool insurance covers losses that are bigger than claim payments in the case of default. MGIC currently operates in all the states of the U.S., Puerto Rico, and Guam. MGIC is one of the largest private mortgage insurance companies which has more than 20% share in the market of PMI providers.

Radian Guaranty Inc.

Radian Guaranty Inc is the primary subsidiary of Radian Group. The subsidiary is in the business of providing private mortgage insurance to lenders and offers various mortgage, real estate, and title services. Radian Guaranty Inc. provides PMI on first-lien mortgage accounts and pool insurance. Currently, Radian works with more than 3,500 residential lenders to make homeownership possible for Americans. Its revenues account for half of the total revenues of its parent company.

Essent Guaranty Inc.

National Mortgage Insurance Corporation

Piggyback Mortgages And Pmi

Some lenders recommend using a second piggyback mortgage to avoid PMI. This can help lower initial mortgage costs rather than paying for PMI. It works like this: You take out a first mortgage for most of the homes purchase price . Then you take out a second, much smaller mortgage for the remainder of the homes purchase price, less the first mortgage and down payment amounts. As a result, you avoid PMI and have combined payments less than the cost of the first mortgage with PMI.

However, a second mortgage generally carries a higher interest rate than a first mortgage. The only way to get rid of a second mortgage is to pay off the loan entirely or refinance it into a new standalone mortgage, presumably when the LTV reaches 80% . However, these loans can be costly, particularly if interest rates increase from the time you take out the initial loan and when youd refinance both loans into one mortgage. Dont forget youll have to pay closing costs again to refinance both loans into one loan.

Don’t Miss: How To Find Total Interest Paid On A Mortgage

What You Should Know

- If you put less than a 20%down paymenton your conventional mortgage, you are required to pay for private mortgage insurance

- Private mortgage insurance protects the lender in the case that you are not able to make yourmortgage paymentsand thus default on the loan

- PMI rates range, on average, from 0.55% to 2.25% of the original loan amount

- Your PMI premiums can be removed once you build 20% equity in your home

- There are different types of PMI, which include borrower-paid mortgage insurance, lender-paid mortgage insurance, single premium mortgage insurance, and split-premium mortgage insurance

- Government-backed loans such as FHA-loans require mortgage insurance premiums

How Do You Calculate Mortgage Default Insurance

To understand how mortgage default insurance is calculated and paid for quickly, watch the video below. Scroll down further for more details on the calcultions.

Let’s say you just purchased a home for $300,000 and made a $40,000 down payment. Your mortgage default insurance premium would be calculated as follows:

You May Like: Does Navy Federal Sell Their Mortgages

Apply For An Fha Refinance Before Your Refund Expires

With current interest rates at historic lows, many homeowners who purchased a home less than three years ago bought when rates were higher than what is available now. That means its likely that a refinance could reduce your monthly payment.

If this is you, it may be good to refinance your current FHA loan into a new FHA refinance loan now before your refund expires.

Tim Lucas

Editor

How To Get Rid Of Fha Mortgage Insurance

Paying for FHA mortgage insurance for 11 years or longer might sound like a drag, but the expense doesnt have to last forever.

Many borrowers use FHA loans as a stepping stone that can help them reach the dream of homeownership, says Gary Acosta, co-founder and CEO of the National Association of Hispanic Real Estate Professionals. From there, they take steps to improve their credit scores and acquire more equity in their homes so they can refinance out of their FHA loan into a conventional loan with better terms.

The FHA is a wonderful starter loan but, at some point, it can also be beneficial to refinance out of it for lower monthly payments, including no or PMI, Acosta says.

Its also possible to get out of FHA mortgage insurance by paying down your mortgage, but that can take a significant amount of resources to do. Before paying off your loan, make sure to weigh the financial pros and cons.

Read Also: How To Apply For A House Mortgage