Local Economic Factors In California

While the West Coast is attractive to many with its long stretches of coastline, warm weather and plethora of exciting cities, it comes at a price: high taxes. California’s taxes are some of the highest in the U.S., with a base sales tax rate of 7.25% and a top marginal income tax rate of 13.3%.

Although the Golden State has high taxes, it does play host to a number of bustling industries. Data from Statista.com shows the state has the second-most Fortune 500 company headquarters at 53, which is only one behind the top state, New York, which has 54 companies.

Some of the most notable employers in the state include Apple, Chevron, Alphabet, Intel, Disney and Oracle. Of course, California is well-known for Silicon Valley, home to many startups and tech companies. Los Angeles, home of Hollywood, is key in the entertainment industry which is another large source of revenue. Theres also a number of military bases in the state in the San Diego area as well as northern California. And for tourism, the wine region of Napa Valley is a huge draw for many out-of-state visitors, as well as native Californians.

In December 2020, the overall unemployment rate for California was 9% compared to the national rate of 6.7%, according to the Bureau of Labor Statistics. However, California’s per capita personal income in 2019 was $66,619, while the national average was $56,490, based on data from the U.S. Bureau of Economic Analysis.

What Type Of Mortgage Is Right For Me

Each situation is different, but here are some guiding principles for each type of mortgage:

- 30-year fixed-rate mortgage – The most common option, typically has a lower monthly payment and your payment doesn’t change.

- 15-year fixed-rate mortgage- Similar to the 30-year fixed-rate mortgage, this option pays off your mortgage in 15 years, saving you money on interest.

- 7/1 ARM – ARM stands for an adjustable-rate mortgage which means your interest rate can fluctuate after 7 years. Generally, this is best used if you know you’ll be in the home for less than 7 years because the interest rate could go up after those 7 years.

- 5/1 ARM – Similar to the 7/1 ARM, but the interest rate can change after 5 years

- FHA 30-year fixed – Best for homebuyers with lower credit scores. Also, a great option if you want to put down a smaller down payment.

- VA loan – 30-year fixed-rate for qualifying veterans and active military. The benefit of this loan is not being required to put any money down and avoiding PMI.

- Jumbo funding – These are for loan amounts that exceed conventional loan limits

What Is The Difference Between A Fixed

The difference between a fixed rate and an adjustable rate mortgage is that, for fixed rates the interest rate is set when you take out the loan and will not change. With an adjustable rate mortgage, the interest rate may go up or down.

Many ARMs will start at a lower interest rate than fixed rate mortgages. This initial rate may stay the same for months, one year, or a few years. When this introductory period is over, your interest rate will change and the amount of your payment is likely to go up.

Part of the interest rate you pay will be tied to a broader measure of interest rates, called an index. Your payment goes up when this index of interest rates increases. When interest rates decline, sometimes your payment may go down, but that is not true for all ARMs. Some ARMs set a cap on how high your interest rate can go. Some ARMs also limit how low your interest rate can go.

Know how your ARM adjusts. Before taking out an adjustable rate mortgage, find out:

- How high your interest rate and monthly payments can go with each adjustment

- How frequently your interest rate will adjust

- How soon your payment could go up

- If there is a cap on how high your interest rate could go

- If there is a limit on how low your interest rate could go

- If you will still be able to afford the loan if the rate and payment go up to the maximums allowed under the loan contract

Read Also: Is An All In One Mortgage A Good Idea

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

What Are Property Taxes

Property taxes are fees collected from homeowners by your local council or city. These taxes fund essential services like garbage collection, snow clearing, and your local fire and police departments. Are school taxes included in your mortgage property taxes? Sometimes Toronto for example has a specific line item in their municipal tax for schools.

Property taxes are calculated as a percentage of your homes assessed value. Theyre paid on a quarterly, semi-annually, or annual basis, depending on the municipality. Your municipality may also break your property taxes down into several different rates. For example, Toronto breaks property taxes down into three parts: city tax, education tax, the city building fund.

Heres an example of the annual property tax you might pay on a home with an assessed value of $400,000 in Toronto.

| Line Item | |

| 0.61477% | $2,459.08 |

The exact of property tax you owe will fluctuate based on your homes value and the municipalitys tax rate.

Read Also: Can You Wrap Closing Costs Into Mortgage

Determining How Much You Can Afford

Financial Leverage & Economic Risks

If you put 20% down on your home that investment is using 5x leverage. If you put 10% down that investment is using 10x leverage. The results of the above calculator can offer a rough idea of max loan qualification, however for most people it is better not to get close to the limit so they have a financial cushion in case of a layoff or a downturn in the broader economy.

When mortgage lenders evaluate your ability to afford a loan, they consider all the factors in the loan, such as the interest rate, private mortgage insurance and homeowner’s insurance. They also consider your own financial profile, including how the monthly mortgage payment will add to your overall debt and how much income you are expected to make while you are paying for the home.

Obtaining Investment Returns

Those who are seeking investment returns will usually obtain higher returns in the stock market & stock investments are much more liquid & easier to sell than homes. Over the longterm real estate generally appreciates only slightly better than the inflation rate across the broader economy. Since 1963 U.S. residential real estate has appreciated about 5.4% per year in the United States. Over the past 140 years U.S. stocks have returned 9.2%.

Duration: Home Loan Amortization

An amortization schedule is how your mortgage lender calculates your monthly payments. Since you are being charged interest over the duration of your loan, your monthly mortgage payment has to be divided among the principal balance and interest. To do this, the lender looks at the original loan balance after your last payment and calculates the amount of monthly interest owed vs. the amount applied toward the principal.

Lets consider an example of a $200,000, 30-year conventional mortgage at 4% interest . Youll notice the sum of the principal and interest payments always equals $955, but disbursement of dollars varies based on how far along you are with repayment.

After a year of mortgage payments, 31% of your money starts to go toward the principal. You see 45% going toward principal after ten years and 67% going toward principal after year 20.

Over 30 years you’ll pay a total of $343,739, again based on an estimated monthly mortgage payment of $955.

Key takeaway:

The more you pay toward the principal, the higher the amount of equity you gain. Equity is a significant asset that is often taken advantage of via a home loan refinance. In this example, equity grows at a slower pace. But keep in mind many loan programs amortize differently. Thats why its imperative to discuss your financial goals with your loan officer during the mortgage process.

Also Check: Can I Get A 30 Year Mortgage At Age 55

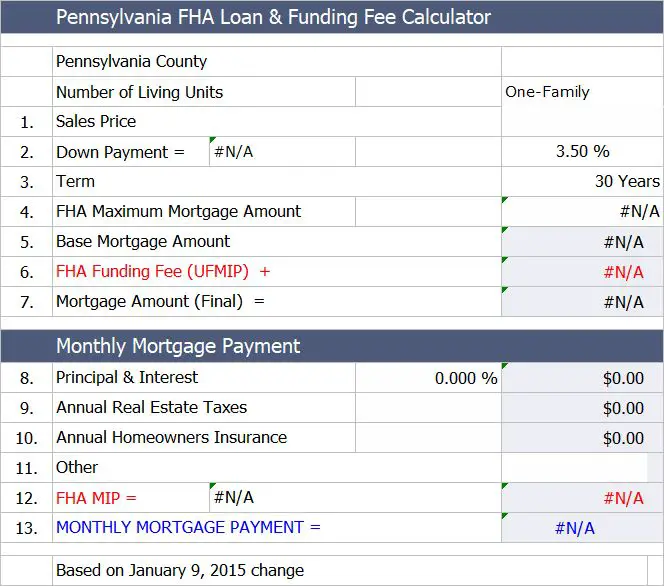

Use This Fha Mortgage Calculator To Get An Estimate

An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium and annual premiums paid monthly.

This FHA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that youre buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $175,000 base loan amount with a 30-year term at an interest rate of 4.125% with a down-payment of 3.5% would result in an estimated principal and interest monthly payment of $862.98 over the full term of the loan with an Annual Percentage Rate of 5.190%.1

How Much Do I Need To Put Down

A down payment of 20% or more will get you the best interest rates and the most loan options. But you dont have to put 20% down to buy a house. There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs that require no money down.

Recommended Reading: What Documents Are Needed For Mortgage Pre Approval

How Can I Calculate My Monthly Mortgage Payment

You can use our mortgage calculator to calculate your monthly payment , or you can do it yourself if you’re up for a little math. Here’s the standard formula to calculate your monthly mortgage payment by hand. To figure out your monthly mortgage payment , plug in the principal , monthly interest rate , and number of months from your loan and solve:

= Number of months required to repay the loan \begin & M = \frac \\ & \textbf \\ & P = \text \\ & i = \text \\ & n = \text \\ \end M=Pwhere:P=Principal loan amount i=Monthly interest raten=Number of months required to repay the loan

Lenders usually list interest rates as an annual amount. To determine the monthly rate, divide the annual amount by 12. So, if your rate is 6%, the monthly rate would be 0.06/12 = 0.005.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

Read Also: What Lender Has The Lowest Mortgage Rates

Why Is Mortgage Interest Not Tax Deductible In Canada

In 2009, a case was brought before the Supreme Court of Canada, wherein two homeowners deducted over $100,000 in interest expenses on their mortgage loan between 1994 and 1996. Unfortunately, upon examination, the Minister of National Revenue cited the deductions as abusive tax avoidance, and had them declared invalid. After the homeowners took legal actions, the Supreme Court sided with the Canadian Government, officially proclaiming that tax deductions could not be made on mortgage interest payments, unless the home is generating an income because you are renting it out.

Local Economic Factors In Colorado

The Centennial State holds the top spot on a number of lists that detail the states with the best economies. Colorado ranks highest for private aerospace employment, and along with strong offerings in high-tech performance, startup activity and STEM-based economy, according to the U.S. Chamber of Commerce and Choose Colorado. Key industries include bioscience, defense and homeland security, energy and natural resources and tourism.

Earnings in Colorado are also strong. In 2019, the per capita personal income was $61,157, according to the U.S. Bureau of Economic Analysis. The national average was $56,490. Looking at unemployment, Colorados December 2020 unemployment rate was 8.4% while the national rate was 6.7%.

Tax rates for Colorado residents arent bad, either. The state levies a 4.63% income tax. Local and municipal governments cant levy additional income taxes, either. However, local governments can set sales taxes on top of the 2.90% state rate, so actual sales taxes will vary across counties and municipalities. Colorado has one of the most decentralized revenue-raising structures in the country, with local governments setting property tax rates and sales tax. Residents are also protected from sharp increases by the 1992 Tabor Act which sets limits on state taxation power.

Don’t Miss: Can I Change Mortgage Companies

Comparing A $2000 Monthly Payment Frequency

| Payment Frequency | |

|---|---|

| $500 | $26,000 |

Monthly, semi-monthly, bi-weekly, and weekly all add up to the same amount paid per year, at $24,000 per year. For accelerated payments, youre paying an extra $2,000 per year, equivalent to an extra monthly mortgage payment. This extra mortgage payment will pay down your mortgage principal faster, meaning that youll be able to pay off your mortgage quicker.

This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments. Selecting between them lets you easily compare how it can affect your mortgage payment, and the amortization schedule below the Canada mortgage calculator will also reflect the payment frequency.

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Don’t Miss: Can You Take Out Two Mortgages

Skip A Mortgage Payment

Many mortgage lenders offer flexible mortgage payment options, such as the ability to skip a payment or to defer your mortgage payments. Most of Canadas major banks allow you to skip a mortgage payment, with the exception of CIBC and National Bank.

Generally, you won’t be able to skip mortgage payments for mortgages that are insured. Having a CMHC-insured mortgage means that your amortization cannot go over 25 years. For insured mortgages, you’ll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future.

Lenders also have conditions in order to be able to skip a mortgage payment. Your mortgage must not be in arrears, and your current mortgage balance must not be more than your original mortgage balance at the start of your term.

How To Calculate House Payment Including Pmi & Taxes

The hassle of a mortgage payment can be increased when you take into account taxes and private mortgage insurance. PMI comes into play when you put down less than 20 percent on a loan. You can calculate your principal and interest, but you won’t know your full monthly payment until you add in taxes and PMI.

Also Check: Can Low Credit Score Get Mortgage

How Our Va Loan Calculator Works

Zillow’s VA loan calculator provides autofill elements to help you quickly estimate your monthly mortgage payment on a new home. Like most home loans, the mortgage payment on aVA loan includes the principal amount you borrowed and the interest the lender charges for lending you the money. Both of which are represented as P& I on the VA loan calculator breakdown. You can also choose whether to includetaxes and homeowners insurance in the total monthly payment amount. Learn more about the details used to calculate your va loan payment using the definitions below.

Is The Interest On Your Mortgage Tax Deductible In Canada

Categories

Federal and provincial taxes are an important part of how our economy functions. They help build Government programs, pay for healthcare, education, and finance the upkeep of our cities, municipalities, and towns. As you live out your years as a Canadian taxpayer, youll start finding various ways you can save money, here and there, during tax season. Youll learn about which expenses are tax deductible, how you can decrease your taxable income, and other such benefits, so you can get ahead in life while still making a contribution to our country.

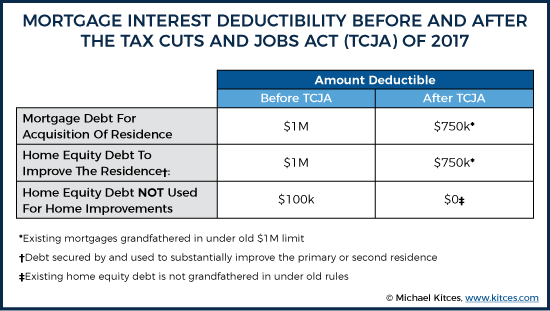

One of the questions we get asked most often is whether or not the interest on your mortgage is tax deductible in Canada? Afterall, our lucky American neighbours are able to declare the interest on their mortgages as a tax deduction. So, why isnt this the same case for Canada? Simply put, thats just not how our tax system works. But the good news is if you should ever decide to sell your principal residence, and you make a profit from the sale, you dont need to pay any taxes on that money. While you might be annoyed that you cant claim the interest on your mortgage in Canada, you will benefit from selling your house, tax-free.

Want to know if youll be able to buy a house if you owe too much in taxes? Read this.

Also Check: Are Current Mortgage Rates Good