So When Is The Best Time To Lock

Mortgage rates tend to open in the lower end of the spectrum on Mondays, and rate movement is more likely to occur in the middle of the week.

The market is so volatile and unpredictable that rates could improve during the middle of the week compared to how markets opened.

This decision can make a huge difference in a buyers financial future, and the best thing to do is research. They will have to make sure they know what can affect rates to spot when a great rate is offered.

There isnt a specific day that anyone can pinpoint, but buyers should lock in their rate with a lender they trust and when they understand the rate, they are being offered. JVM Lending strives to be as transparent as possible with homebuyers during this process and will always provide the lowest rates possible.

Jay Voorhees

Whats A Mortgage Rate Lock

When youre shopping for a mortgage and find the rate which meets your needs, its time to make a lock a commitment to your lender that youre amenable to the rate offered.

At this point, youre entering a contract, of sorts. You agree to accept the rate offered, and the lender agrees to honor that rate for a pre-specified number of days.

The standard mortgage rate lock is good for 30 days. This means that when you lock a loan, the lender will agree to honor your locked rate for a period of 30 days no matter what.

If the mortgage market suddenly worsens, for example, and mortgage rates jump 1/2 percentage point, because of your rate lock, your lender is obligated to honor your original quoted rate.

No matter what.

Now, not all loans will be closed in 30 days. When youre buying a home, for example, it can take 60 days or longer to close. Thankfully, rate locks are available for time frames longer than just 30 days.

Mortgage rates can be locked in 15-day increments, all the way up to 90 days. Beyond 90 days, the increment shifts to 30-day periods, up to 360 days total.

That said, you may not want to make a 360-day lock, even if youre buying new construction not set to deliver for another year.

This is because the longer your rate lock, the higher your mortgage rate will be.

The reason why mortgage rates increase as your rate lock duration increases is that lenders are absolutely committed to giving you your locked rate at closing, but the future is always uncertain.

How Long Does A Mortgage Rate Lock Last

Mortgage lenders commonly offer free rate locks for 30, 45, or 60 days.

Typically, a mortgage rate lock will last at least 30 days. This allows time for the sale of the house to go through, notes Jeff Zhou, CEO of Fig Loans.

But there are options to extend the lock for longer periods up to 12 months for certain loan types at an additional cost.

Often, if mortgage interest rates are the same as your locked rate at the expiration of your lock, you can extend it for free. But some lenders charge a fee to extend no matter what the interest rate is when the lock expires, says Cohn.

You might be charged for a rate lock extension in the form of a separate fee or a slightly higher interest rate.

The further out you push the rate lock deadline, the more expensive it can be.

This is because the lender has to hedge this interest rate exposure, and hedging with an extended rate lock is generally riskier and costlier to the lender, Hackett points out.

In other words, charging more upfront via a loan lock fee reduces the risk that your lender will earn less on your loan if rates go higher by the time you close.

Recommended Reading: What Is Rocket Mortgage Interest Rate

How Do I Get The Best Mortgage Rate

Shopping around is the key to landing the best mortgage rate. Look for a rate thats equal to or below the average rate for your loan term and product. Compare rates from at least three, and ideally four or more, lenders. This lets you make certain youre getting competitive offers. Check with a variety of types of lenders large banks, credit unions, online lenders, regional banks, direct lenders and mortgage brokers. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of trusted lenders.

Interest rates and terms can vary significantly among lenders depending on how much they want your business and how busy they are processing loans. Many lenders staffed up during the refinancing boom of 2020 and in 2021 are lowering their profit margins to keep enough new mortgages in the pipeline. As online and non-bank lenders take an ever-greater share of the mortgage market, expect to see the deals get even better no matter where interest rates go.

Keep in mind that mortgage rates change daily, even hourly. Rates move with market conditions and can vary by loan type and term. To ensure youre getting accurate rate quotes, be sure to compare similar loan estimates based on the same term and product.

Why Is Dti Important

Its important to pay attention to your DTI so you know how much debt you carry compared to your income. When it comes to taking on a mortgage, its not recommended to borrow the maximum amount a lender is willing to lend to you. You dont want to stretch your budget too thin, to account for the other costs of homeownership and the unexpected. Youll want to also account for saving for retirement and contributing to an emergency fund after paying your mortgage and accounting for taxes and payroll deduction.

You can use the NextAdvisor mortgage calculator to determine what your monthly mortgage payment may be based on home value, interest rate, and loan term.

After you figure out a monthly payment you are comfortable with, here is an example of how a lender may calculate DTI:

| Debt Example |

|---|

Read Also: How To Get Assistance With Mortgage Payments

Where Are Mortgage Rates Right Now

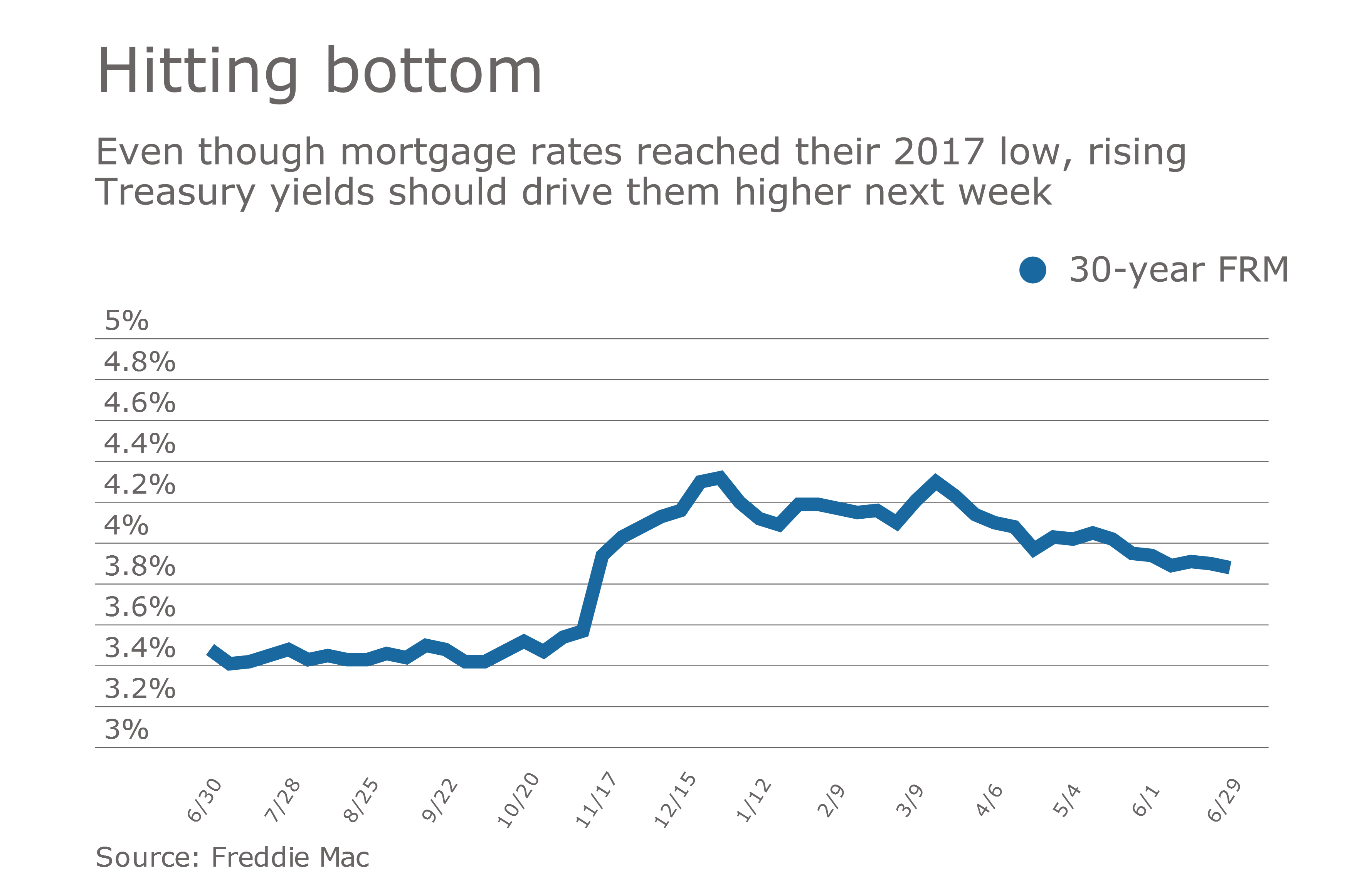

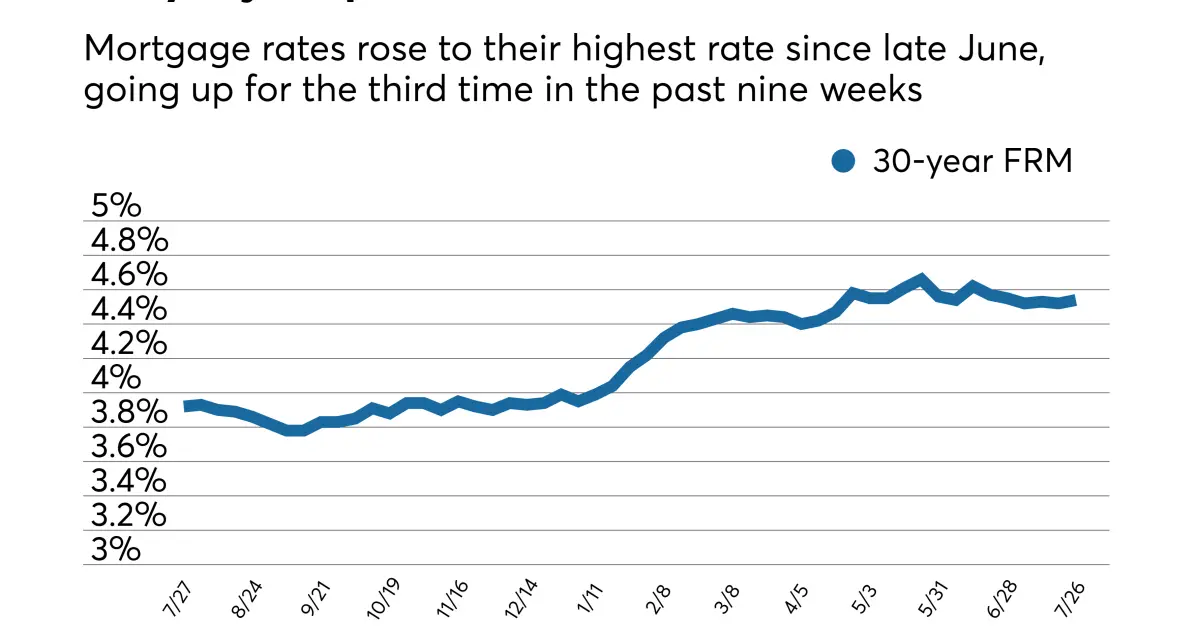

As the real estate market slowed down in 2020, mortgage rates dropped. To the surprise of many industry experts, they fell below 3%, and stayed there throughout the year. Mortgage rates hit their lowest point in January 2021.

The overall trend since then has been a very slow increase. The COVID vaccine and its promise of an end to the pandemic almost certainly influenced this rise. Throughout the first half of 2021, average 30-year fixed-rate mortgage rates hovered around 3%. According to data from Freddie Mac, they rose as high as 3.18% in April before dropping again. The rate last rose above 3% in June. As of the beginning of August, average rates are back in the high 2s.

The rate for 15-year fixed-rate mortgages has remained lower. It hit a high for the year of 2.45% in late March and early April. As of early August, rates look to be in the lower 2s.

What Does It Mean

In case youre not up-to-date on your mortgage and real estate terminology, a mortgage rate lock is a commitment to your lender, telling them that you agree to pay the rate offered to you at that time. Its a contract that you enter and is guaranteed for typically as long as it takes to close your home which is around 30 days but can be extended longer. This is why its so important to lock-in your mortgage rate on the best day possible. It will help you secure a lower rate on your mortgage, thus saving you money in both the short-term and long run.

Recommended Reading: How To Find Mortgage Payment

Compare Todays Best Mortgage Rates

By MoneySense Staff on March 25, 2019

Use the MoneySense Mortgage Rate Finder to help you compare the most current mortgage rates from the Big Banks and brokers instantly.

Once youve found a mortgage you would like to know more about, simply click the Inquire button and fill out the contact form to get an obligation-free call back from a representative of the provider youve selected.

How Some Lenders Can Offer Lower Mortgage Rates Than Others

Its always easier to find the lowest mortgage rates than to find the lowest borrowing cost. Thats because lenders like to add gotchyas to their mortgage agreements. These are surprises that boost your cost of borrowing later. Here are four examples of such pitfalls:

You May Like: How Much Is Mortgage Insurance In Michigan

Mortgage Lock Rate Techniques

Interest rates fluctuate daily. As you’re searching for houses and comparing loans, you’ll see how those interest rates are doing day-to-day. You may notice patterns, such as dips or hikes that last a little while. Use this information and your defined budget to decide when to lock in your mortgage rate.

Another technique is to lock in the mortgage rate early on. Regardless of what the interest rates do, you’ll know what you’re in for. Should interest rates drop dramatically in the future, you may be able to refinance your home to take advantage of the lower rates.

Another tip, whether you’re a first-time homebuyer or refinancing, is to negotiate mortgage rates with your lender.

Factor: Mortgage Vs Refinance

Mortgages on refinances, for example, usually cost more than mortgages for purchases. Thats because refinances are deemed higher risk and because refinances cannot be default insured.

Jargon Buster:Default insurance protects the lender in case you dont pay your mortgage. Insurance is either:

- Optional , or

- Mandatory .

You May Like: How Do I Become An Underwriter For Mortgage

When Is The Best Time To Lock In A Mortgage Rate

Between getting a mortgage pre-approval and submitting your mortgage application, monitor mortgage rates in your area.

Ask your real estate agent and loan adviser for their input, too. If rates are trending upward, it might be a good idea to lock your rate as soon as its offered. If rates are dropping, then you might decide not to use the lock at all.

Learn More: How to Apply for a Mortgage

How Historical Mortgage Rates Affect Homebuying

When mortgage rates are lower, buying a home is more affordable. A lower payment may also help you qualify for a more expensive home. The Consumer Financial Protection Bureau recommends keeping your total debt, including your mortgage, to 43% of what you earn before taxes .

When rates are higher, an ARM may give you temporary payment relief if you plan to sell or refinance before the loan resets. Ask your lender about convertible-ARM options that allow you to convert your loan to a fixed-rate mortgage without having to refinance before the fixed-rate period expires.

Read Also: What To Expect When Applying For A Mortgage Loan

Whats The Best Day Of The Week To Lock Mortgage Rate

There may be certain days of the week that might be better than others to lock in at the lowest rate. The question is, when?

Live mortgage rates tend to be much quieter on Mondays, making the early part of the week a potentially better time to lock in at a lower rate. On the other hand, volatility is more likely to occur in the middle of the week when rates could fluctuate while youre shopping for a mortgage.

That said, rates could still plummet in the middle of the week, allowing you to take advantage of a lower rate and therefore make your mortgage more affordable. But they could also surge, which means youll be paying more if you lock in your mortgage interest rate the wrong time.

Locking in at the right time can mean the difference of tens of thousands of dollars over the life of your loan. That said, its important to get familiar with how mortgage interest rates actually work in order for you to understand how mortgage rates are actually calculated.

If you are offered a great rate for a mortgage and believe rates are expected to increase soon, it might be worth it to consider locking in your rate. Be sure to speak with a seasoned mortgage specialist who can help guide to mortgage interest rates and when it might be a good idea to lock in.

Mortgage Rate Lock: How And When To Lock In Your Mortgage Rate

Dont let a good interest rate be the one that got away. If youre comfortable with the mortgage payment, go ahead and lock your rate.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

As a homebuyer, you always want the lowest possible interest rate on your mortgage and with good reason, too. Even a small rise in interest rates can cause you to pay more in costs over the life of your loan.

But rates fluctuate daily even by the hour so its a good idea to lock in your mortgage rate when you have a good one. Generally, you want to lock in when youre comfortable with the rate and the monthly payment.

Heres what else you should know about a mortgage rate lock:

Also Check: Which Credit Reporting Agency Do Mortgage Lenders Use

Current Mortgage Interest Rate Trends

Mortgage rates were up slightly this last week. The average 30-year fixed rate is 2.88%, up from 2.87% the week prior, according to Freddie Macs weekly rate survey.

Per the survey, 15-year fixed rates increased slightly from 2.18% to 2.19%. And the average rate for a 5/1 ARM moved slightly down from 2.43% to 2.42%.

Overall, mortgage rates are still close to their lowest levels in history.

The lowest 30-year mortgage rate ever was just 2.65%, recorded by Freddie Mac in January 2021. So anyone who can lock in at or near todays mortgage rates is getting a fantastic deal on their home loan.

Also keep in mind that average rates are just that averages. Prime borrowers with great credit and large down payments often get lower interest rates than the ones shown here. And borrowers with lower credit or fewer assets may get higher rates.

When To Lock In A Mortgage Rate

Youre usually given the option to lock your mortgage rate as soon as your refinance is initially approved. However, you may be wondering whether its smart to lock your rate right away or wait to see if rates drop.

To know whether you should lock your rate right away, you may want to do some research to find out how rates have been acting. If rates have been rising, it might be best to lock your rate as soon as youre approved. If rates are on the decline, floating your rate could pay off. Just keep in mind that no one can predict what rates will do. Floating your rate can be risky even a small increase in interest rates can cost you thousands of dollars over the life of your loan.

Read Also: Can Low Credit Score Get Mortgage

If The Debt Limits Not Raised In Time All Bets Are Off

Rates could fall if a new, deadlier COVID variant rakes the globe, or if the United States or an ally gets involved in a military conflict, or if the financial markets are struck by some other shock.

If Congress didn’t increase the debt limit and the country went into default, the effect on mortgage rates would be unpredictable. The United States has never defaulted on its debts.

If U.S. government IOUs lost value and became untradeable, the effect on financial markets could be catastrophic, but we don’t know exactly what that calamity would look like. In a government default, borrowers might find it hard or impossible to get mortgages, and rates might skyrocket temporarily.

It’s also possible that the executive branch would find a workaround that would spare the financial markets from turmoil.

What Is The Best Credit Score To Get A Mortgage

Lenders reserve their most competitive rates to borrowers with excellent credit scores usually 740 or higher. However, you dont need spotless credit to qualify for a mortgage. Loans insured by the Federal Housing Administration, or FHA, have a minimum credit score requirement of 580, although youll probably need a score of 620 or higher to qualify.

To score the best deal, work to boost your credit score above 740. While you can get a mortgage with poor or bad credit, your interest rate and terms may not be as favorable.

Recommended Reading: How Much Mortgage On 200k