Mortgage Rates Are Related To Bond Prices

Mortgage rates are also closely tied to bonds, specifically 10-year U.S. Treasury bonds. When investors are fearful and make the jump to bonds, the increase in demand for bonds causes their prices to rise and their yields to fall. The 10-year Treasury bond yield is a benchmark for most other consumer interest rates, including mortgage interest rates. When bond yields fall, in general, so do mortgage rates, auto loan rates, credit card rates, etc. It may not be an immediate drop, but consumer rates usually follow bond yields.

Mortgage loans themselves are often turned into bonds. Most mortgage lenders sell their loans to the secondary market, where they are bundled together and turned into mortgage-backed securities. When there are plenty of mortgage bonds on the market, demand is lower and interest rates will be lower. And if demand increases and there are fewer mortgage bonds available, interest rates will climb.

What Is Apr How Is It Different From My Interest Rate

Whether your mortgage interest rate is variable or fixed, it will come with a percentage interest rate to be paid. While this is clearly useful, you should also pay attention to the Annual Percentage Rate you will be paying. The APR is a more accurate measure of how much you will be paying, as it measures the interest rate, closing costs, and possibly discount points. These costs can add significantly to your payments.

Should I Lock In My Rate

Rates can change constantly, and it may not be smart to lock in your rate based on a bet on the state of the market. As a borrower, you can lock in a loan after the initial loan approval. Many borrowers choose not to lock in the loan until they have found a home to purchase. Depending on the rate lock period, they need the time to close on the house. If you lock in a rate for 30 days and the house takes 35 days to close, you may end up paying extension fees just to reserve the same rate. Longer rate locks may also cost mortgage points. Talk to your lender and ask questions about when you should close, or lock in a rate.

Also Check: How To Recruit Mortgage Loan Officers

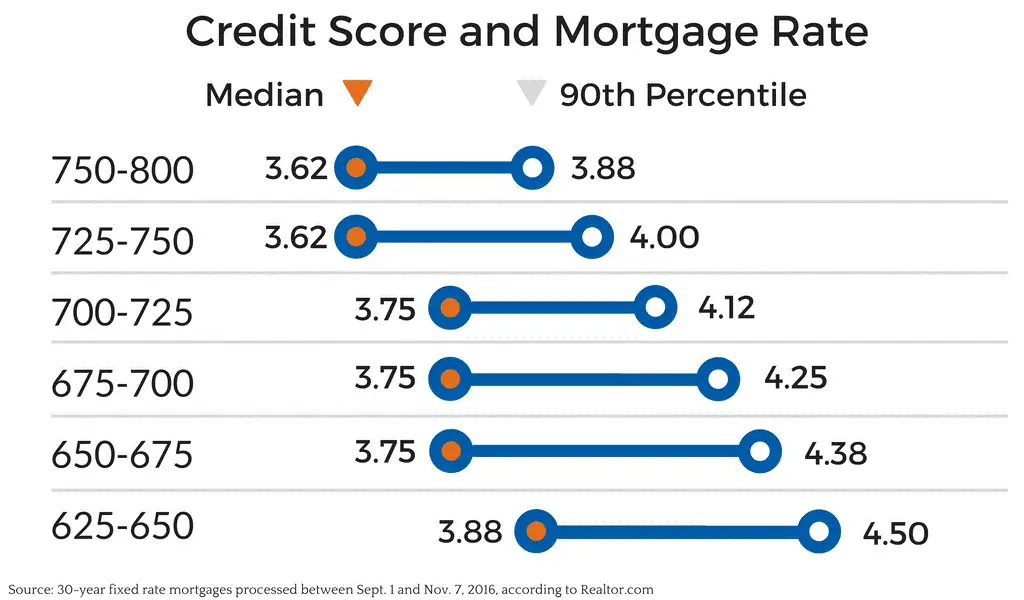

How Your Lender Sets Your Interest Rate

Lenders set the interest rate for your mortgage. They consider factors to help them determine your cost.

These factors can include:

- the length of your mortgage term

- their current prime and posted interest rate

- if you qualify for a discounted interest rate

- the type of interest you choose

- your credit history

- if youre self-employed

Lenders typically offer higher interest rates when the term length is longer. Its not always the case.

How Are Interest Rates Determined

The interest rate is the amount charged on top of the principal by a lender to a borrower for the use of assets. The interest rate charged by banks is determined by a number of factors, such as the state of the economy. A country’s central bank sets the interest rate, which each bank uses to determine the range they offer.

When the central bank sets interest rates at a high level, the cost of debt rises. When the cost of debt is high, it discourages people from borrowing and slows consumer demand. Also, interest rates tend to rise with inflation.

Also Check: What Do I Need To Become A Mortgage Broker

The Ontario Housing Market: Things To Know

- Homes in Ontario typically cost above $675 000, which is higher than the national average.

- Residential property prices are expected to see steady gains, in part due to a growing demand for homes in Toronto and the greater Toronto region.

- The federal government has taken steps to make homeownership more affordable for certain first-time buyers whether in Ontario or nationally by introducing the First-Time Home Buyer Incentive.

- Before you start searching for your home, its important to consider how much debt you can take on. Enter your details to find out how much you might be able to borrow.

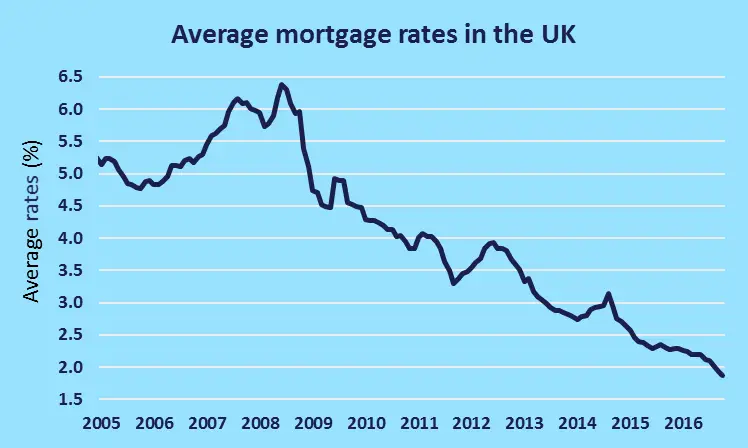

Where Rates Are Expected To Go In 2022

Most economists agree that mortgage rates will end 2021 in the low 3% range. However, thats where the agreement ends. Some experts think rates will jump above 4% next year while others are expecting a more modest increase in 2022. Heres what economists are saying:

- The Mortgage Bankers Association predicts long-term rates to hit 4% by 2022 and top out at around 4.3% by the end of next year.

- PNC expects the 30-year fixed mortgage rate to increase from around 3.05% currently to around 3.2% by the end of this year, and 3.4% by the end of 2022.

- Freddie Mac forecasts the 30-year fixed mortgage to hit 3.4% by the fourth quarter of 2021 and 3.7% by the end of 2022.

- The National Association of Realtors predicts rates will get to 3.3% by the end of 2021 and average 3.6% in 2022.

Recommended Reading: Can Non Permanent Resident Get Mortgage

Which Mortgages Come With The Lowest Interest Rates

Generally, the interest rates on fixed-rate mortgages will be higher than those on offer from variable deals.

This is because you’re paying a bit more for the security of knowing what your repayments will look like every month.

The same thinking applies with longer fixed-rate deals of five years or more. The lender is taking on a bigger risk by offering these deals as rates in the wider market might rise during that time, so a longer-term fixed rate will often be higher than a shorter-term one.

In September 2019, we analysed Moneyfacts data to find the average interest rates for each mortgage type. See the table below for the results.

The Refi Explosion Has A Major Effect On Rates

The simple answer is that markets are not functioning as they normally do. COVID-19 stoked market demand for safe-haven asset classes like Treasuries, driving down yields. Mortgage rates have also declined since the first COVID-19 cases were reported on Dec. 31, but rates didnt drop as sharply as T-note yields.

There are two reasons for this:

- Lenders are struggling to keep up with demand from people who want to refinance their mortgages to cut their interest payments

- The downstream investors who hold bundles of bonds backed by mortgages are worried about churn due to high refinance activity.

First, lets look at demand.

Refinance applications rocketed last week, up 79 percent from the week before, taking up 76.5 percent of the total share of mortgage applications, according to data from the Mortgage Bankers Association, or MBA. Refinance applications were up 479 percent on a year-over-year basis.

Typically the spread would be around 1.8 basis points, and now its 2.5 basis points and higher this is symptomatic of a refi wave, says Mike Fratantoni, MBA chief economist.

The recent rush of borrowers hoping to refinance has overwhelmed lenders to the point where many are deterring new business by raising rates, as we saw this week. Thus, lowering mortgage rates makes little sense for lenders as they struggle to digest the business they already have.

Recommended Reading: What Is A Mortgage Modification Agreement

Its Just Math: Mbs Prices And Mortgage Rates

The price an investor pays for an MBS determines its yield. Yield refers to the relationship between the MBS price and interest paid. If an MBS has a price of $100 and a 4.0 percent coupon rate, its yield is also 4.0 percent.

$4 / $100 = .04 or 4.0 percent.

What if investors become worried about inflation and dont want 4.0 percent MBS? The price falls. If it drops to $75, the buyers still receive $4 a year in interest, but their yield increases to something more acceptable.

$4 / $75 = 5.33 percent.

And if the economy weakens and investors really want 4.0 percent MBS? Its price will rise when demand is strong. If the price increases to $110, its yield drops.

$4 / $110 = 3.63 percent.

Note that this is a simplified illustration. MBS prices also incorporate the amount of risk associated with a pool of loans those with mortgages allowing lower credit scores, for example, may be priced lower and have higher yields because of increased default risk.

Mortgage Rate Forecast For 2021 And 2022

Wondering if mortgage rates are going up or down in 2021 and the year after? Wonder no longer.

The following table provides 2021 mortgage rate predictions for the 30-year fixed from well-known groups in the industry, along with a 2022 estimate.

Take them with a grain of salt because theyre not necessarily accurate, just forecasts for future rate movement.

| Mortgage Rate Predictions |

Don’t Miss: What Does A Co Signer Do For A Mortgage

What’s Going On With Bond Yields Right Now

Increases in Canadian bond yields are suddenly afoot, after the past few weeks of a downward trend.

With more hawkish tones just recently emanating from the U.S. and other global banks â the 10-year benchmark bond yield suddenly topped up to 1.33% on September 23, 2021, with 5-year yields up to 1.03% the next day.

After the 5-year bond yield hit record lows in 2020 , and a slow recovery in the first-half of 2021 to around 0.90%, this latest sharp increase have experts wondering if the lowering of 5-year fixed mortgage rates last week by Canadian lenders was premature.

And, because rising bond yields often lead to a rise in fixed mortgage rates, there’s already wide speculation that Canadian lenders will increase their rates in line with the latest bond yield activity.

Read more here: Bond yields are up, and fixed rates are already following.

There are still many volatile factors that may affect rates and investments this year and next, including stimulus reduction, rising inflation, labour and housing shortages, U.S. Feds indicating a coming rise in their prime lending rates, and keeping a close eye on China’s response to the Evergrande situation â so we wait, and watch.

What Are Mortgage Rates Based On

When a lender closes on a mortgage, that mortgage is often packaged with other mortgages and sold as a bond. These bonds are sold to an investor . The interest on a mortgage is effectively paid out as the yield on a mortgage-backed security bond. Because of this, mortgage backed securities and other indicators like U.S. Treasury bonds can be used to predict how mortgage rates will change.

You May Like: How Long Is The Mortgage Process

When Mortgage Rates Affected Treasurys

The 2008 financial crisis forced Treasury rates low. It was one of the few times that mortgage rates affected U.S. Treasury rates, rather than vice versa. The crisis began as investor demand for mortgage-backed securities rose. These securities are backed by the mortgages that banks loan. Rather than hold them for 15 years to 30 years, the banks sell the mortgages to Fannie Mae and Freddie Mac. These two government-owned companies bundle them together and sell them on the secondary market, where hedge funds and large banks buy them as investments.

As investors went crazy for mortgage-backed securities, it ultimately led to the worst recession since the Great Depression. The financial crisis showed that many mortgage-backed securities were risky. They contained high and undisclosed levels of subprime mortgages. When home prices fell in 2006, it triggered defaults. The risk spread into mutual funds, pension funds, and corporations that owned these derivatives. That created the financial crisis and recession.

Amid this downturn, investors all over the world fled to ultra-safe Treasurys. Their demand then allowed the U.S. government to lower interest rates on Treasurys.

Fed Funds Rate And Adjustable

Treasury yields only affect fixed-rate mortgages. The 10-year note affects 15-year and 30-year conventional loans.

For adjustable-rate mortgages , it’s the fed funds rate that has the most impact. The fed funds rate is the rate banks charge each other for overnight loans needed to maintain their reserve requirement. It influences both LIBOR and the prime rate, two benchmarks used in pricing adjustable-rate loans. The Fed has lowered the target for the fed funds rate to a range of 0%-0.25% just two times in history, once amid the 2008 financial crisis and once in March 2020.

You May Like: Can I Get A Mortgage With No Credit

Mbs Means Mortgage Backed Securities

Most mortgage lenders dont keep the loans they fund. They sell them to investors. A lender might make a $100,000 home loan, for example, which will ultimately yield $150,000 in payments, and sell it to investors at a discount say, $125,000.

This allows the lender to take its profit and turn around and fund another mortgage. The investors pay $125,000 for the right to collect $150,000 over time.

However, most investors dont buy an entire individual mortgage. That would be risky and expensive.

Instead, they buy shares in pools of similar mortgages sort of like buying shares in a mutual fund comprised of several similar companies. This allows them to invest smaller amounts with less risk.

These shares in pools of mortgages are called MBS, or mortgage-backed securities. The process of combining loans into pools and then breaking the pools into shares is called securitization.

Like bonds, MBS are sold in $100 increments, and their prices rise and fall continuously as demand for them increases and decreases.

Strong Bond Market Means Lower Mortgage Rates

Bonds are long-term, low-risk investment products. Corporations can issue private bonds but Treasury bonds issued by the federal government are much more well known. When you buy a bond, you give the government a set amount of money per bond. The bond then accrues two types of interest: fixed interest and inflation interest.

The fixed interest on a savings bond follows the same model as the fixed interest on a mortgage loan. Every year on May 1 and November 1, the U.S. Treasury announces a fixed rate for new loans. Youll earn that percentage of interest on the loan if you buy one before the next interest rate announcement. Your bond also accumulates additional interest to keep up with inflation rates. Once your bond reaches the end of its term, you get your original money back plus whatever the bond gained in interest. You can also buy and sell bonds on the secondary market like stocks.

Bond prices and mortgage interest rates have an inverse relationship with one another. That means that when bonds are more expensive, mortgage rates are lower. The reverse is also true when bonds are less expensive, mortgage interest rates are higher.

At first glance, this might seem like an illogical correlation. When interest rates are higher, more people will want to buy bonds why dont higher interest rates push bond prices up? To understand, lets look at the supply and demand of the secondary bond market.

Find out what you can afford.

Don’t Miss: Can You Refinance Your Mortgage

What Is An Apr

The annual percentage rate, or APR, shows you more than just the interest rate on your loan. It also includes many of the fees you pay on any mortgage or refinance. While your mortgage interest rate is the biggest long-term cost associated with a home loan, its not the only expense to pay attention to. Anytime you take out a mortgage, there are upfront fees known as closing costs. This can include fees paid to the appraiser and home inspector, as well as loan origination fees, and discount points. All of these costs add up, and can easily be anywhere from 2% to 5% of the loan amount.

These initial costs can vary significantly by lender. So if youre comparing loan offers based only on the interest rate, you could end up paying more fees than necessary. This is why understanding APR is important. If one loan has higher broker fees, that will be reflected in the APR, but not the interest rate. So the APR gives you a better idea of the total cost of the mortgage.

Shopping For A Mortgage

If you are shopping for mortgage right now your best bet would be to lock into the best fixed rates while they’re still at such record lows. By securing a low rate today you could save yourselves thousands of dollars during the life of your mortgage. However, there’s no need to panic rates are not going to skyrocket overnight. Take your time when choosing the rate, the bank and the term that works best for you and your family. Watch the bond markets carefully as they are best indicator of were interest rates are headed in the short to medium future.

Also Check: Can You Sell House Before Paying Off Mortgage

Freddie Macs Weekly Mortgage Rate Survey

Below are Freddie Macs average mortgage rates, updated weekly every Thursday morning.

This should give you a decent idea of current mortgage rates, though as mentioned, theyre just averages and your rate may vary considerably depending on the many factors mentioned above.

The data is collected Monday through Wednesday, so they arent necessarily going to match up with todays mortgage rates if rates increased or fell from then until now. Consider this a starting point:

| Loan Program |

-Mortgage rates are currently trending UP–

* signifies a record low

Since 1971, Freddie Mac has conducted a weekly survey of consumer mortgage rates.

These are average home loan rates gathered from banks and lenders throughout the nation for conventional, conforming mortgages with an LTV ratio of 80 percent .

Note that these averages dont apply to government home loans like VA loans or an FHA mortgage.

The numbers are based on quotes offered to prime borrowers, those with high credit scores, meaning best-case pricing for the most part.

I believe the property type in the survey is for a one-unit primary residence as well, so expect a rate rise if its a vacation home or rental property, or multi-unit property.

Freddie uses HMDA data to establish regional weightings in five regions of the country, then aggregates that market data to compute a national average for their weekly rate update.

During the week ending January 7th, 2020, 30-year fixed mortgage rates hit new all-time lows.