Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

What Is The Principal Payment

There are two basic components of a loan: the principal and the interest. So, what is the principal and interest payment? Essentially, a principal payment is a payment that goes toward the repayment of the original amount of money borrowed in a loan. Interest, on the other hand, is a fee you pay to borrow the funds, typically calculated as an annual percentage of the loan. So, when you make a principal payment, youre reducing the amount of loan that youre due to pay back, but not the amount of interest thats charged on that loan.

What Are The Standard Interest Rates For Personal Loans

Actual interest rates will vary depending on an applicants credit score, repayment history, income sources and the lenders own standards. Interest rates also vary with market conditions, but for 2019 the interest rates for personal credit ranges from about 6% to 36%.

If we compare the average interest rate of personal loans to other forms of financing, we can see they have rates below that of a credit card, though charge a bit more than most secured forms of financing. The big benefits of personal loans for those who take them is they are unsecured and the approval type is typically faster than other forms of financing.

| Financing Type |

|---|

Don’t Miss: Does Mortgage Modification Affect Credit Score

Using A Mortgage Calculator

You can find mortgage calculator tools on many banking and financial information websites that will do these computations for you, such as this loan amortization calculator from Credit Karma. You’ll normally just have to plug in your total balance, interest rate and monthly payment to find how much is going to interest. Some calculators may also tell you how much you will pay in interest over the life of the loan and how much you can save by paying more than your required monthly payment.

Remember that some loans have prepayment penalties if you pay them early, so make sure you understand the particular terms of your loan.

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

- Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

- Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

- Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

- Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

- Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

You May Like: What Is Needed For Mortgage Application

S To Calculating How Much A Mortgage Payment Would Cost You Every Month

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

- You can calculate a monthly mortgage payment by hand, but its easier to use an online calculator.

- Youll need to know your principal mortgage amount, annual or monthly interest rate, and loan term.

- Consider homeowners insurance, property taxes, and private mortgage insurance as well.

More often than not, a homeowner who borrowed money to buy a house is making one lump-sum monthly payment to their mortgage lender. But while it may be called the monthly mortgage payment, it includes more than just the cost of repaying their loan and interest.

For many of the millions of American homeowners carrying a mortgage, the monthly payment also includes private mortgage insurance, homeowners insurance, and property taxes.

Its possible to estimate your total monthly payment by hand using a standard formula, but its often easier to use an online calculator. Either way, heres what youll need:

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Read Also: Why Do I Pay Escrow On My Mortgage

How A Mortgage Calculator Can Help

Buying a home is the largest purchase most people will make in their lifetime, so you should think carefully about how youre going to finance it. Setting a budget upfront long before you look at homes can help you avoid falling in love with a home you cant afford. Thats where a simple mortgage calculator like ours can help.

A mortgage payment includes four components that together are known as PITI : principal, interest, taxes and insurance. Many homebuyers know about these costs but are not prepared for are the hidden expenses of homeownership. These include homeowners association fees, private mortgage insurance, routine maintenance, larger utility bills and major repairs.

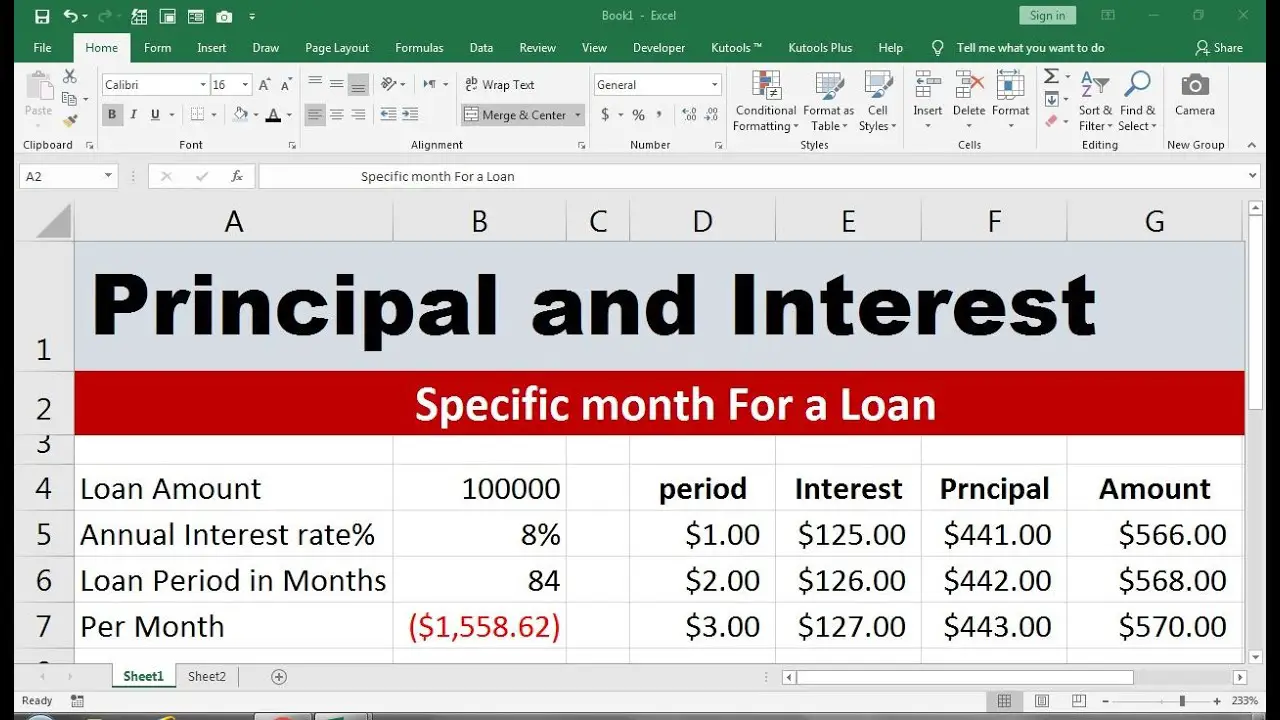

How To Use The Loan Amortization Calculator

With HSH.com’s mortgage payment calculator, you enter the features of your mortgage: amount of the principal loan balance, the interest rate, the home loan term, and the month and year the loan begins.

Your initial display will show you the monthly mortgage payment, total interest paid, breakout of principal and interest, and your mortgage payoff date.

Most of your mortgage loan payment will go toward interest in the early years of the loan, with a growing amount going toward the loan principal as the years go by – until finally almost all of your payment goes toward principal at the end. For instance, in the first year of a 30-year, $250,000 mortgage with a fixed 5% interest rate, $12,416.24 of your payments goes toward interest, and only $3,688.41 goes towards your principal. To see this, click on “Payment chart” and mouse over any year.

Calculate

The effect of prepayments

Now use the mortgage payment calculator to see how prepaying some of the principal saves money over time. The calculator allows you to enter a monthly, annual, bi-weekly or one-time amount for additional principal prepayment.To do so, click “+ Prepayment options.”

You may also target a certain loan term or monthly payment by using our mortgage prepayment calculator. Of course you’ll want to consult with your financial advisor about whether it’s best to prepay your mortgage or put that money toward something else, such as retirement.

Loan amount

Interest rate

Loan term

Starting month/year

Payment chart

Read Also: How Do Mortgage Appraisals Work

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

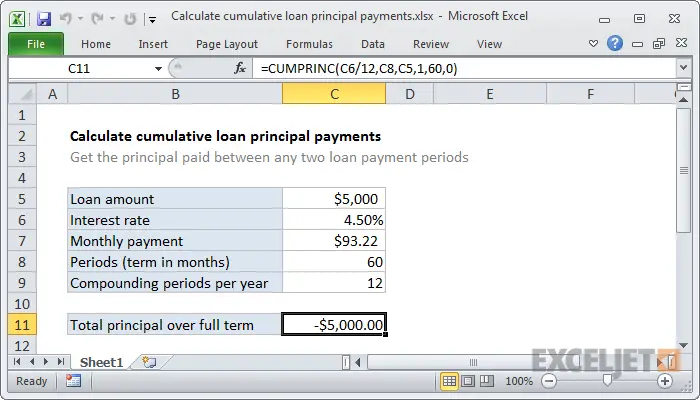

Calculating Your Businesss Monthly Principal Payments

If your business is dealing with loan repayments, understanding how to calculate your principal is likely to be beneficial. After all, according to a study we conducted, 21% of borrowers say that not knowing how much they need to pay is the most likely cause of their missed payments. So, how do you calculate your scheduled principal payments?

Theres a relatively complicated formula you can use, which is as follows:

a / / = p

Note: a = total loan amount, r = periodic interest rate, n = total number of payment periods, p = monthly payment).

If youre looking for an easier way to work out your principal payments, a principal payment calculator may be the way to go.

You May Like: How Is Home Mortgage Interest Calculated

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

Calculating Interest On A Car Personal Or Home Loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, youâll have paid off both interest and principal.

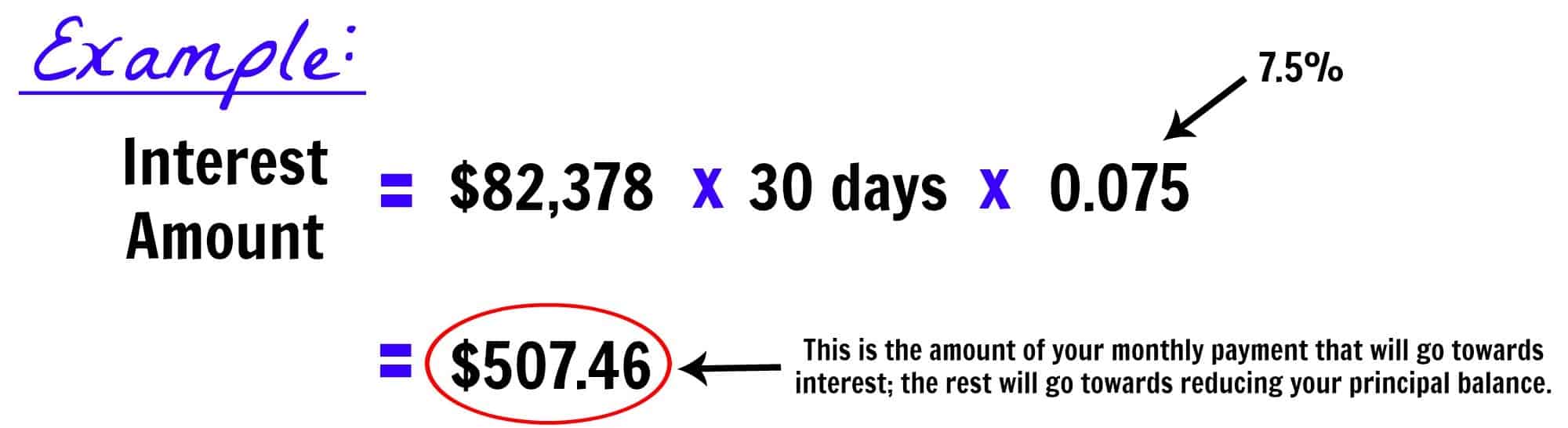

You can use an interest calculator to work out how much interest youâre paying all up, or, if youâd rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments youâll make in the year . So, for example, if youâre making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

Because youâve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this:

Also Check: What Is Mortgage Rate Vs Apr

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

Mortgage Payment Calculator With Taxes And Insurance

Use this PITI calculator to calculate your estimated mortgage payment. PITI is an acronym that stands for principal, interest, taxes and insurance. After inputting the cost of your annual property taxes and home insurance costs, you’ll see the full impact of your monthly payment on your household budget. Fill in the blanks and hit “view report” to see the payment schedule, which shows how much of your payment goes toward interest, and how much toward principal. Because the amount of interest is determined by the balance owed, over time the interest remitted with each payment decreases, with more of your monthly payment going toward principal.

Also Check: Should You Buy Down Mortgage Rate

Breakdown Of Mortgage Payments

Its important to understand your mortgage payment structure so that you can find ways to save money. Let’s take a look at mortgage payments and their payment breakdowns.

Your mortgage principal balance and your mortgage interest will change during your mortgage term, but something that doesn’t change is your monthly payment amount. Your selected amortization period determines your monthly payment amount which will be fixed for the duration of your term. When you first get a mortgage, most of your monthly payment will go towards interest. You havent had time to pay down your mortgage balance yet, and so when interest is charged, youll need to pay interest on a higher mortgage balance.

As time passes by and your balance decreases, there is less balance remaining for interest to be charged. This reduces the proportion of interest charged compared to your monthly payment. The amount remaining can then go towards paying down your mortgage balance further. This is similar to compound interest but in reverse.

- Mortgage Principal Balance: $500,000

- Mortgage Rate: 2.50% fixed for the entire amortization

| 15 Year |

|---|

The Bottom Line: Keep Track Of Your Principal And Interest

Your monthly mortgage payment has two parts: principal and interest. Your principal is the amount that you borrow from a lender. The interest is the cost of borrowing that money.

Your monthly mortgage payment may also include property taxes and insurance. If it does, your lender holds a percentage of your monthly payment in an escrow account.

Your mortgage payment usually stays the same every month. If you choose a mortgage with an adjustable interest rate or if you make extra payments on your loan, your monthly payments can change.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

You May Like: What Is Loss Mitigation Mortgage

Make Extra Principal Payments Monthly

There are pros and cons to choosing to make extra principal payments instead of refinancing.

Positives include:

- Save on interest by reducing principal and years paid on loan

- No additional closing costs for refinancing

Negatives include:

- No savings on interest rate

- Need for self-discipline

- Eliminates fewer years on total mortgage when compared to a 15-year refinance

Overall, making additional principal payments can be a win-win if you are disciplined enough to make the additional payments on a regular basis. If you can pay an extra $100 per month towards principal on a $100,000, 30-year mortgage, the average time shaved from the loan is nine years.

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Read Also: What Is Mortgage Insurance For Fha Loan

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

Recommended Reading: How Much Do You Pay Back On A Mortgage