Apply For A Mortgage With Multiple Lenders

Its a huge mistake to accept thefirst mortgage quote you get.

Many first-time home buyers dontknow it, but mortgage rates arent set in stone. Lenders actually have a lot offlexibility with the interest rate and fees they offer.

That means a lender youre lookingat might be able to offer a lower rate than the one itsshowing you.

In order to get those lower rates, you have to shop around and get a few different quotes. If you get a lower rate quote from one lender, you can use it as a bargaining chip to talk other lenders down.

Shopping around for mortgage ratesalso lets you know whether youre getting a good deal.

For example, a 3.5% rateand $3,000 in fees might sound all right if its the first quote youve gotten.But another lender might be able to offer you 3.0% and$2,500 in fees.

That makes the first offer a lotless appealing but you wont know it until you look around.

Get at least three mortgaeg quotes

Compare personalized rate quotes from at least three lenders to make sure youre getting the best deal. A mortgage broker could help you compare multiple quotes at once.

And make sure youre comparing apples-to-apples quotes. Things like discount points can make one offer look artificially more appealing than another if youre not watching out.

Different down payment amounts, loan terms, loan amounts, andmortgage loan types will skew loan estimates, too.

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas mortgage rate marketplace and our latest state-specific guides.

About the author:

Read More

Get Preapproved For A Mortgage

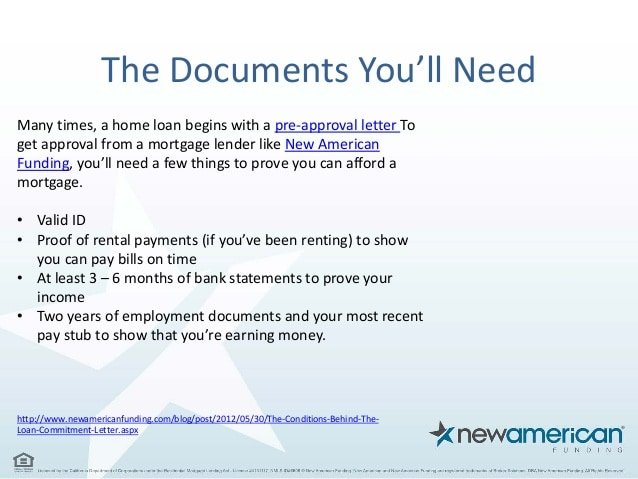

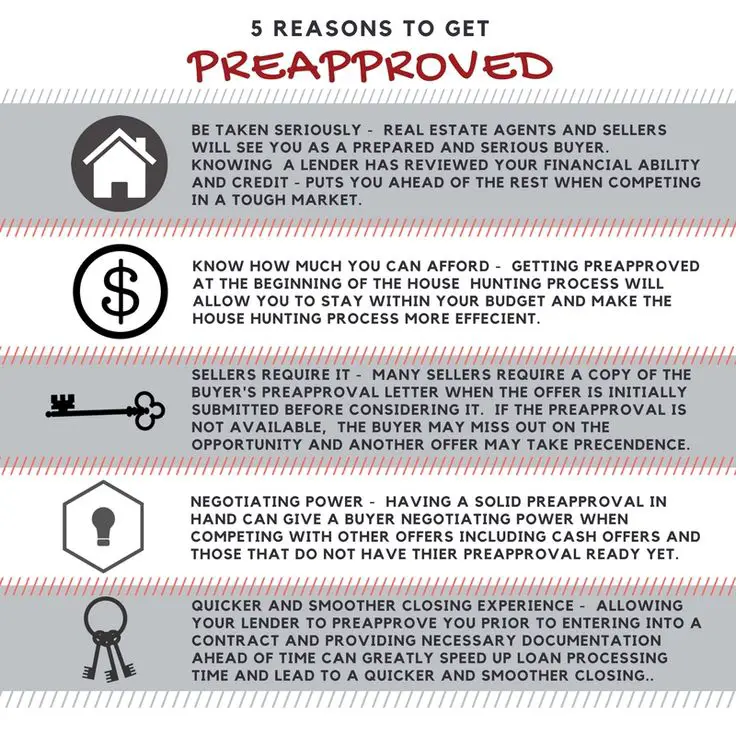

When youre ready to start house hunting, its time to get preapproved for a mortgage. When you apply, your lender will give you a preapproval letter that states how much youre approved for based on your credit, assets and income. You can show your preapproval letter to your real estate agent so they can help you find homes within your budget.

To get preapproved, you need to apply with your lender. The preapproval process typically involves answering some questions about your income, your assets and the home you want to buy. It will also involve a credit check.

Rocket Mortgage® offers the Verified Approval so you can make an offer confidently because youll know how much home you can afford. We verify your credit, income and assets with documentation you provide, such as W-2s, pay stubs and account statements. This strengthens your standing compared to other buyers who may not have such an approval in-hand.

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage

Why Buyers Dont Shop Around For A Mortgage When They Should

The majority of home buyers begin their search by looking online at homes for sale.

Often times, after seeing photos of a home that piques their interest, they contact an agent so they can view the property.

This has become somewhat normal when it comes to buying a new home.

Buyers look at listings first, then contact an agent to view homes, and dont worry about financing until theyre already set on a place.

> > Related:10 steps to buying a home, in the right order

It makes sense that its many peoples instinct is to find a home before they think about a mortgage. That feels natural.

But by shopping before you find a lender, you limit your window to shop around and compare loan estimates.

If theres competition to buy and youre in a time crunch, youre more likely to go with the first lender you find which often isnt the best deal.

Close On Your New Home

Your lender is required to give you your Closing Disclosure, which tells you what you need to pay at closing and summarizes your loan details, three days before closing. Read through your Closing Disclosure and make sure the numbers dont vary too much from your Loan Estimate, which you would have received three days after your initial application.

Once youve reviewed your Closing Disclosure, its time to attend your closing meeting. Bring your ID, a copy of your Closing Disclosure and proof of funds for your closing costs.

Youll sign a settlement statement, which lists all costs related to the home sale. This is when you pay your down payment and closing costs. Youll also sign the mortgage note, which states that you promise to repay the loan. Finally, youll sign the mortgage or deed of trust to secure the mortgage note.

After closing finishes, youre officially a homeowner.

Read Also: How To Find Mortgage Payment

Can You Make An Offer Without Pre Approval

The third reason REALTORS® expect buyers to be pre-approved is so buyers are 100% ready to make an offer when they find the house they really would like to buy. Its simply a matter of being prepared. When a buyer decides to make an offer on a house, that offer is made in writing, using the proper real estate forms. And in Maryland, there are a lot of forms. Should you show the seller your pre approval letter? Yes! Part of the offer includes adding a pre-approval letter from a lender. That letter reassures the seller that the interested buyer has taken the time to consult with a lender, and is qualified to buy their house. Sellers just arent going to risk selling their house to someone who isnt pre-qualified. Its way too risky. If you were selling your house, would you agree to sell it to someone who cant prove they are eligible for a loan? Buyers who cant produce a pre-approval are rejected. A REALTORS® job is to help a buyer buy the house they want, and thats another reason why we ask if a buyer is pre-approved. Making an offer without pre approval just wont work in todays market.

Determine Your Price Point

You can do this yourself using a mortgage calculator on sites like Zillow or Trulia , or you can ask a lender to pre-qualify you for a loan.

The general rule of thumb is to spend less than 30% of your take-home pay on total monthly housing expenses.

But figuring out how much you can realistically afford will come down to your debt-to-income ratio. Chedid recommends your monthly debts, including your housing costs, not equal more than 40% to 45% of your gross monthly income.

You May Like: Is Closing Cost Part Of Mortgage

The Flip Side: Preapproval

Nothing says that you can’t find an agent, then take a deep breath and get preapproved for a mortgage before you start looking for a home. In fact, the agent you select might even urge you to do just that.

The 2017 Zillow Group Consumer Housing Trends Report indicated that 92% of all buyers that year were preapproved and that 83% of those who worked with agents were preapproved. The takeaway is that agents prefer that their clients get preapproved, according to Zillow.

What About Mortgage Prequalifications

As mentioned, obtaining a mortgage prequalification is a much-less-involved process. Basically youll just offer your name, income and employment status and get a budget range of how much a lender is likely to give you. But the lender isnt actually verifying any of that financial information theyre just taking your word for it. So its a place to start, and it can give you an idea of what your budget might look like so you can look at homes in a range where youre liable to get a mortgage. And while that can be helpful to target your search, it doesnt carry the same weight as a mortgage preapproval would.

Thats because with a mortgage preapproval, the lender has done all their due diligence to ensure that the information youre providing is accurate. They need that inside look into your finances to feel confident enough to move forward with the preapproval letter that shows the seller that your offer is solid.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Check Your Credit Score

Make sure you have an idea of what your credit score is before going through the process. To get preapproved for a mortgage, youll need a good credit score. Your FICO score, which is what lenders will look at, is essentially a combined credit pull from the major credit bureaus.

Most lenders normally require a minimum FICO score of 620 or higher to qualify for a conventional mortgage, and a credit score of at least 580 for a Federal Housing Administration loan, although that may no longer hold true amid the pandemic.

Many lenders are now asking for higher credit scores to protect themselves against delinquencies, defaults, and forbearance requests brought on by the economic slowdown. JPMorgan Chase, for example, now requires a and a 20% down payment for new mortgages.

When the lender pulls your credit for preapproval, its considered a hard inquiry. Too many hard inquiries can negatively affect your score, but a single hard inquiry is unlikely to play a significant role in whether youre approved for a mortgage.

Something else to keep in mind: Credit scoring systems treat multiple credit checks related to mortgage preapproval as a single event, so its wise to compare rates from multiple lenders at the same time.

Make A Formal Mortgage Application

Once you’ve had your offer on a property accepted, you should formally apply for a mortgage.

If you’re using a mortgage broker, they will arrange this for you.

The mortgage lender will conduct a valuation on the property you intend to buy. This confirms to them that the property is worth roughly what you intend to pay for it.

The lender will also do a thorough check of the paperwork you’ve provided and your credit record. This search will appear on your credit file.

If a lender turns you down at this stage, it’s worth trying to find out why, and potentially waiting a while before applying to another lender. Making several mortgage applications very close together could significantly damage your credit score.

Don’t Miss: How To Apply For A House Mortgage

An Agent Can Help With The Best Time To Buy

A good agent can also help you figure out whether the time is right for you to buy. You can toss about scenarios about moving to various communities and discuss the pros and cons. You can bounce ideas off your agent. They’ll be your rock, your sounding board, and, hopefully, a person you can trust.

Your agent will walk you through the home-buying process from A to Z and will hold your hand for as long as necessary. They’ll be the most important person in your life until the day you close.

Do A Final Walkthrough

You should do a final walkthrough in your new home before you close, even if youre 100% committed to the property. This time allows you to check and make sure that the seller has made the repairs you requested and cleared out the property.

Walk through the home and make sure the seller hasnt left any belongings. Check your repair areas if you requested them and keep an eye out for pests. You may also want to double-check your homes systems one final time to make sure everything is in working order. If everything looks good, its time for you to confidently move toward closing.

Also Check: What Do I Need To Become A Mortgage Broker

Underwriting Clear To Close

This is what everyone wants to hear. We have final underwriting approval and clear to close. Final underwriting approval means any underwriting stipulations have been satisfied. The earlier this can happen, the better. Next, the file moves to the closing department. So, everyone should feel very good at this point. Yet, its not done yet.

Missing Any Mortgage Fees

Many of the mortgages with the lowest interest rates have application fees.

These fees can cost thousands of pounds but could save you money if they mean you get a much cheaper mortgage.

Work out how much each mortgage costs long term by adding up the monthly payments and the fees to get the total amount. This means you won’t accidentally apply for a mortgage that’s more expensive than you realised.

You May Like: What Does A Mortgage Consist Of

S To Asuccessful Mortgage Application

When you apply for a mortgage,youll be assigned a loan officer to guide you through the application processand paperwork so you dont need to worry about navigating everything on yourown.

As the borrower, your main job isto set yourself up for success.

You want to provide your mortgagelender with the strongest application possible in order to widen your loanoptions and lower your interest rate.

To apply for a mortgage in theright way and improve your chances at getting a great deal, you should:

Heres what you need to know at each stage of the process.

You Could Lose Your Earnest Money

Sometimes, sellers cant or wont wait for you to get your financing sorted. If your seller isnt willing to extend the closing date, you could be in breach of your contract. That could mean the seller is free to keep your earnest money, wash their hands of the deal, and put the house back on the market.

You May Like: How Much Do You Pay Back On A Mortgage

Open And Closed Mortgages

There are a few differences between open and closed mortgages. The main difference is the flexibility you have in making extra payments or paying off your mortgage completely.

Open mortgages

The interest rate is usually higher than on a closed mortgage with a comparable term length. It allows more flexibility if you plan on putting extra money toward your mortgage.

An open mortgage may be a good choice for you if you:

- plan to pay off your mortgage soon

- plan to sell your home in the near future

- think you may have extra money to put toward your mortgage from time to time

Closed mortgages

The interest rate is usually lower than on an open mortgage with a comparable term length.

Closed term mortgages usually limit the amount of extra money you can put toward your mortgage each year. Your lender calls this a prepayment privilege and it is included in your mortgage contract. Not all closed mortgages allow prepayment privileges. They vary from lender to lender.

A closed mortgage may be a good choice for you if:

- you plan to keep your home for the rest of your loans term

- the prepayment privileges provide enough flexibility for the prepayments you expect to make

Find A Real Estate Agent

12 weeks

Of course, you could sign with the first agent you find online, which could take as little as a day, but its smart to take some time when finding a real estate agent. Do some research, come up with questions for potential real estate agents, and check out their specialties and customer reviews. Agents are a great asset that cost you nothing, so find one you feel comfortable with. Trulia can help you connect with trustworthy Premier Agents who know your area and will work hard for you. You can request to be connected with a Premier Agent on any property listing.

Don’t Miss: How Much Is The Mortgage On A $300 000 House

Preapproval Doesnt Guarantee Financing

Getting preapproved isnt the same thing as applying for a loan. A preapproval letter says a lender has seen enough to feel reasonably confident lending a specific amount of money to you not that it will actually grant you a mortgage. Youll still need to follow through with full loan underwriting and processing, in which everything represented to the lender at the outset will be confirmed throughout and up to the closing process.

Preapproval mostly gives you an idea of what kind of mortgage loan youll likely qualify for and is conditional on your current financial and employment situation. It also shows sellers how serious you are about buying a home before making a formal offer. Preapproval isnt guaranteed, says Larry Sprung, founder of Mitlin Financial in Hauppauge, New York, but its a good tool to show the seller that youre serious and have gone through some due diligence.

Make A List Of Needs And Start Browsing

35 days

Take the time to think about the things you absolutely need in your new home as well as the things you want but could do without . Make a list of both and discuss it with your real estate agent. These priorities will help you as you start browsing online for homes that fit the bill. Be prepared to adjust your list as you take stock of whats out there and how much house you can afford.

Again, if youre in a rush, this something that can and sometimes does happen at the same time as Steps 1 and 2, but theres a benefit to hearing your agents advice and taking the time to think things through.

Also Check: What Banks Look For When Applying For A Mortgage

Getting Your Income Wrong

When you fill in details of what you earn, get it right because:

-

Saying you earn more could mean your application is rejected when the lender checks your salary

-

Saying you earn less could mean your lender thinks you can’t afford the property you want

Find out exactly what you earn before you apply. If you get bonuses or commission, enter these separately instead of adding them to your basic salary.

Check if you need to enter your annual or monthly salary to avoid claiming you earn £2,000 a year if this is actually your monthly pay.