What Fees Or Charges Are Paid When Closing On A Mortgage And Who Pays Them

When you are buying a home you generally pay all of the costs associated with that transaction. However, depending on the contract or state law, the seller may end up paying for some of these costs.

Even if you dont pay the mortgage closing fees directly out of pocket, you might end up paying them indirectly. Sometimes, you can negotiate with the seller for a credit towards your closing costs, but the seller will usually require you to pay a higher price for the home in order to cover the costs of this credit.

Youre still paying for these coststhey are just paid through your loan instead of paid out of pocket. The lender may also offer to give you a credit to help with your closing costs. This credit isnt free either. Typically, the lender will either increase your loan amount to cover these costs, or charge you a higher interest rate in exchange for the credit.

Common closing fees or charges may include:

Remember To Budget For Insurance Costs At Closing

As youre building your strategy to afford the purchase of your home and are gathering the funds required for closing, make some time to connect with your American Family Insurance agent. Youll find theyre experts in crafting a homeowners policy that fits the needs of your budget and your new home.

What Is A Good Faith Estimate

If you apply for a reverse mortgage, you will receive a form called a Good Faith Estimate. A GFE gives you some basic information about your loan, which is meant to help you understand the cost of the loan, compare offers and make an informed decision. Lenders are required to give you a GFE within three business days after receiving your application and any other required information. You cant be charged any fees, except a credit report fee, before you receive a GFE and tell the lender you want to proceed with the loan.

Youll also receive a Truth-in-Lending disclosure, which gives you information on the costs of your credit. You should receive a disclosure when applying for the loan and a final disclosure prior to closing.

The law also required GFEs for regular mortgages until 2015. For most types of mortgages, a form known as the Loan Estimate took the place of the GFE on October 3, 2015. This three-page form gives you details about your loan, including the monthly payment, estimated interest rate and total closing costs. The lender must also provide this form within three business days of receiving your application. You should also receive a five-page document called a Closing Disclosure at least three business days before closing on your mortgage loan.

If you apply for another type of loan, such as a HELOC, you wont receive a GFE or Loan Estimate, but you should get a Truth-in-Lending disclosure.

Can All Mortgage Companies Such As Banks Lenders And Mortgage Brokers Offer A No Closing Costs Mortgage

No. Most mortgage companies set the backend yield on their rates so high that there is not enough credit available from the rate to offer a no closing costs mortgage.

For example, the average closing costs and pre-paids associated with buying a home is about 3% of the purchase price. Since the rates typically yield no more than 5% on the backend of the loan there is not enough credit available to cover the closing costs if the lender has set to make 3-5% yield. Thus, only low priced mortgage companies which have set their yield at 2% or lower can do a no closing cost mortgage.

When Does A Seller Pay Closing Costs

There are some closing costs that sellers almost always pay themselves. These include real estate agent commissions, prorated real estate taxes and transfer taxes. In certain cases, sellers may also pay the cost of a home warranty and fees for any associations that their property belongs to.

In addition to these items, there are other costs that sellers may also pay, such as real estate commissions and title preparation fees. Ultimately, though, its all a matter of negotiation between buyer and seller.

If, on the other hand, youre refinancing your home, youll be responsible for all closing costs.

Cash Outlays Required Before Your Mortgage Closes

- Home Inspection Fee. It is highly recommended that you contract a home inspection as a condition of your Offer to Purchase. A home inspector will assemble a report on the condition of the home for a fee of around $500, depending on the complexities of the inspection.

- Deposit. A deposit that counts towards your down payment is required when you make an Offer to Purchase. A deposit shows the seller youre serious and committed to buying their property. It signals that you have the financial means to make the purchase and youre comfortable taking on some level of risk until the deal closes. Unlike your down payment, there is no minimum required amount for the deposit.

What Are Closings Costs

Closing costs are things that have to be paid in order to close on your home, like property taxes, homeowners insurance, title search fees, appraisal fees, etc.

Services completed and costs involved in the loan process need to get paid. All of those fees and expenses are lumped together under the umbrella of closing costs.

Now, although they are called closing costs, you may be asked to pay for them as the action happens such as the home inspection or the appraisal.You may be able to negotiate as part of your sales contract that the seller of the property cover some or all of your closing costs , but it doesnt hurt to be prepared for them and understand them.In general, you can expect to see between 2-6% of your purchase price in closing costs. Because each state has different requirements, some items mentioned below may not apply to your specific situation. Things like transfer taxes, mortgage insurance, and title insurance are not flat-rate type costs. Be sure to ask your loan officer for more information on these items.

What Does It Mean To Roll Closing Costs Into Your Loan

Including closing costs in your loan or rolling them in means you are adding the costs to your new mortgage balance.

This is also known as financing your closing costs.

Financing your closing costs does not mean you avoid paying them. It simply means you dont have to pay them on closing day.

If you dont want to empty your savings account at the closing table and if your rate is low enough that youll still save financing your closing costs over the term of your mortgage might be a good strategy.

But the big downside is that you end up paying interest on your closing costs, which makes them more expensive in the long run.

So if youre able to pay closing costs in cash, thats typically the best move.

What Are Typical Closing Costs

Closing costs typically range from 36% of the homes purchase price. Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000. Closing fees vary depending on your state, loan type, and mortgage lender, so its important to pay close attention to these fees.

Homebuyers in the U.S. pay, on average, $5,749 for closing costs , according to a 2019 survey from ClosingCorp, a real estate closing cost data firm. The survey found the highest average closing costs in parts of the Northeast, including the District of Columbia , Delaware , New York , Maryland , and Pennsylvania . Average closing costs in Washington State were also among the highest. The states with the lowest average closing costs included Indiana , Montana , South Dakota , Iowa , and Kentucky .

A lender is required by law to provide you with a loan estimate within three business days after receiving your mortgage application. This key document outlines the estimated closing costs and other loan details. Though these figures might fluctuate by closing day, there shouldnt be any big surprises.

Full List Of Mortgage Closing Costs

Mortgage closing costs fall into three categories: lender fees, third-party fees, and prepaid items.

Here are specific closing costs included in each category, along with the typical cost for each one.

Mortgage lender fees

These are fees charged by the lender or broker to underwrite,process, and close your loan. They include:

- Origination feeor broker fee The lender or brokers fee to set up the loan. This is your lenders profit

- Discount fee Also called mortgage points or discount points, this is an OPTIONAL closing cost that reduces your mortgage interest rate

- Processing fee May be included in the origination fee. This is the cost to source and process your documents and put together your loan file

- Underwriting fee The cost for the underwriter to review and verify the information on your loan application

- Administrative fees Miscellaneous lender charges. Likely included in the origination fee

- Lock-in fee, application fee Many lenders do not charge application fees or fees to lock your rate. In some states, application fees are illegal. You should be able to find a lender without these fees

- Loan-Level Price Adjustments For conventional loans backed by Fannie Mae and Freddie Mac, LLPAs are charged for higher-risk loans . These are typically paid via a higher rate, NOT an upfront fee. But its important to know what they are

Third-party fees

Prepaid items

Prepaid items arecosts of homeownership for which you pay upfront when you close the loan.

Property Taxes Annual Fees And Insurance

Property taxes: Buyers typically pay two months worth of city and county property taxes at closing.

Annual assessments: If your condo or homeowners association requires an annual fee, you might have to pay it upfront in one lump sum.

If your condo or homeowners association requires an annual fee, you might have to pay it upfront.

Homeowners insurance premium: Usually, your lender requires that you purchase homeowners insurance before settlement, which covers the property in case of vandalism, damage and so on. Some condo associations include insurance in the monthly condo fee. The amount varies depending on where you live and your homes value.

» MORE: Mortgage payment calculator with taxes and insurance

Should You Roll Closing Costs Into Your Mortgage Balance

When deciding if you should roll your closing costs into your mortgage, it’s important to understand the financial consequences of such a decision. Rolling your closing costs into your mortgage means you are paying interest on the closing costs over the life of the loan. For example, say your closing costs are $10,000 and your mortgage has an interest rate of 4% over a 30-year term. Your monthly mortgage payment would increase by almost $48 per month, and you would pay $17,187 over the term.

Alternatively, your lender may give you the option to increase your mortgage interest rate in exchange for a credit that reduces your closing costs. Known as premium pricing, the lender will credit you a percentage of your loan amount to reduce your out-of-pocket expenses at closing. Let’s say you have a $300,000 mortgage and you qualify for a rate of 3.875%. In exchange for an increase in your rate of 0.125%, the lender may give you a credit of 1% or $3,000. The increase will cost just over $21 per month and $7,753 over the life of the loan.

The increased mortgage balance used to cover your closing costs increases the LTV, narrowing the cushion between your loan amount and the value of your home. If you want to take out a home equity line of credit later on, there will be less equity to utilize. A higher LTV also means that your net benefit will be proportionally lower when you sell your home.

Ask The Seller To Contribute

If you live in a buyers market, your seller might be willing to help you cover your closing costs. This is a win-win situation for you and the seller.

You get to pay less at the closing table and your seller gets a faster home sale. Make sure you understand how much your seller can contribute based on your loan type and request a concession.

How Much Are Closing Costs

Typically, closing costs average 3% 6% of the purchase price. So, if youre taking out a $200,000 mortgage on a house, you might pay $6,000 $12,000 in closing costs.

Most buyers pay closing costs as a one-time, out-of-pocket expense when closing their loan.

If you need help with closing costs, check with state or local housing agencies to find out what may be available. Many offer low-interest loan programs or grants for first-time buyers. Another option is to take lender credits where you take a slightly higher interest rate in order to pay off the costs over the life of the loan rather than upfront.

Youll pay higher closing costs if you choose to buy discount points, but the trade-off is a lower interest rate on your loan.

Whats Included In Closing Costs

Closing costs includejust about every upfront fee to purchase or refinance a home, except for thedown payment.

Theres a long list of closing costs, all of which are itemized on the standard Loan Estimate youll get from any lender. But the main fees to be aware of are:

- Origination fee or broker fee A fee the lender or broker charges for its services. This fee can be heavily negotiated, as it is mainly paying for lender overhead and adding to its profit

- Mortgage points or discount points OPTIONAL upfront fees paid to directly lower your mortgage rate. The lender is not allowed to use these funds for overhead or profit

- Processing and/or underwriting fee A fee charged to pay for the lenders employees who gather documentation, coordinate with third parties like appraisers, and manually look at the file to approve the loan

- Title search and title insurance Fees paid to check historical records and make sure the property can be legally transferred to you

- Escrow fees Fees paid to a third-party escrow company that handles funds and facilitates the home sale

- Home appraisal Fee to evaluate the homes fair sale price or refinance value

- Prepaid taxes and insurance Generally you pay six months to a year of property taxes and homeowners insurance in advance when you close

Government-backed mortgages also require an upfrontinsurance premium or guarantee fee. This covers all or part of the cost forthe federal government to insure your loan.

Gst On New Home Purchases

Remember how I mentioned that land transfer taxes didnt apply to newly built homes? Well, that doesnt mean that you can escape paying tax when closing on new construction. Far from it, actually. New home purchases are subject to GST . If the home builder has included the GST into the purchase price, you may finance this amount with the mortgage. If not, it becomes part of your closing costs.

Lets say you live in BC, and youre purchasing a brand new condo for $600,000. With a GST of 5%, youll be responsible for paying $30,000 upfront.

You may be able to claim a partial GST rebate on your income tax, depending on the purchase price of the property and whether or not its your primary residence.

What Are Closing Costs

Closing costs are the final costs that borrowers in Canada must pay at the closing of their loan to finalize the mortgage agreement and take possession of the home that has been purchased. Such mortgage closing costs are made up of fees that are paid over and above the actual home price that the buyer and seller have agreed to.

The next section of this article will go into more detail as to specific closing costs for the buyer and what each fee in the closing cost total pays for. At this point, you should know that closing costs include things such as attorney fees, taxes, home appraisal charges, mortgage insurance and so on. Mortgage experts advise home buyers in Canada to expect to pay 12.5 percent of their home purchase price in closing costs, although homeowners who are required to buy mortgage insurance are likely to pay up to 5 percent depending on how much insurance they require. Obviously, it is a good idea to have as much saved as possible so that you are ready for any eventuality at your loans closing. Aiming for savings that total 2.5 percent of your homes purchase price will help ensure that you have enough money for your closing costs.

Whatlenders Will Let You Roll Closing Costs Into The Mortgage

Most lenders will allow you to roll closing costs into yourmortgage when refinancing.

Generally, it isnt a question of which lender that may allow you to roll closing costs into the mortgage. Its more so about the type of loan youre getting purchase or refinance.

When you buy a home, you typically dont have an option to finance the closing costs. Closing costs must be paid by the buyer or the seller .

But with a refinance, many lenders will allow you to roll the closing costs into the loan provided you still meet lending criteria after doing so.

So What Are All Of These Itemized Closing Costs

Excellent question. After all, Loan Estimates and Closing Disclosures are 35 pages long and theyre an alphabet soup of fees, taxes, and jargon thats only familiar to people in the real estate industry. Whats more, there are different tax and insurance regulations from state to state, and some use different terms for the same types of charges. The kind and number of itemized fees you could see on a LE or CD can also vary dramatically. For this reason, its challenging to find a detailed list that explains what each and every one of these fees mean.

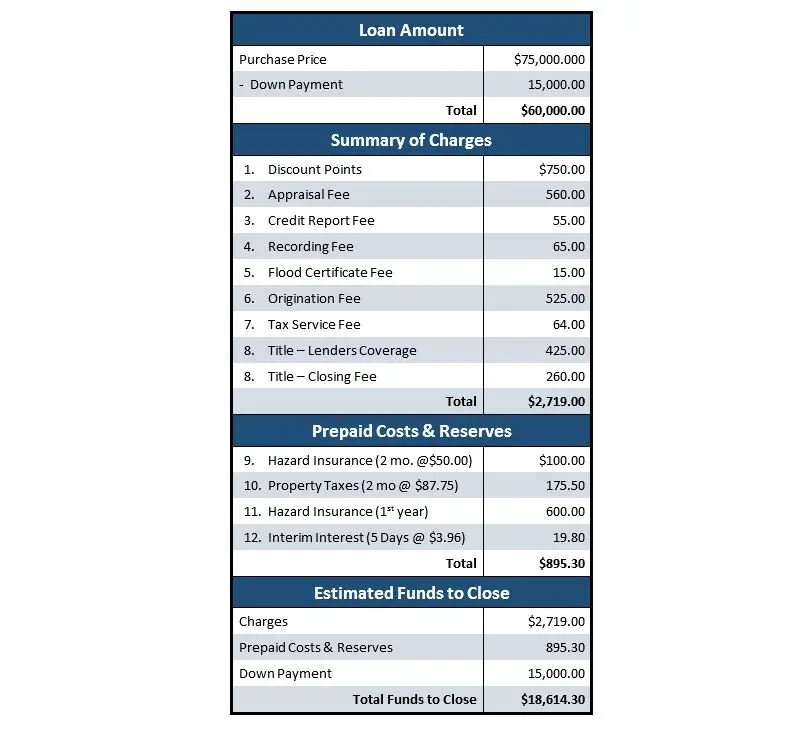

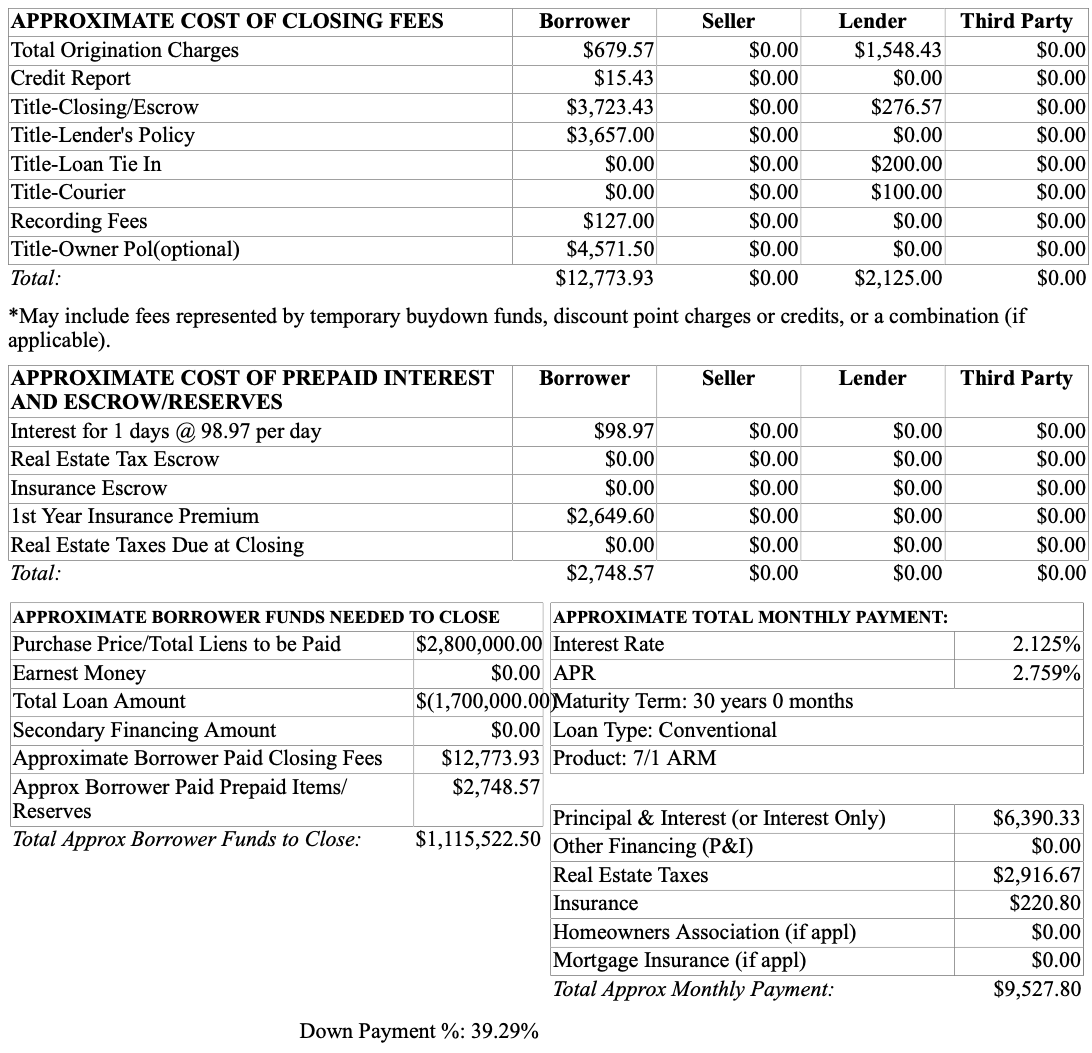

Page 2 of your LE or CD divides all your closing fees into two categories: Loan Costs, and Other Costs. Loan Costs are charges for services provided to the lender so that they can accurately process the loan. Other Costs include taxes, prepaid costs, initial escrow payments, and other itemized costs.

At the end of this article we explain the most common closing fees and charges. Theyre broken down into the same sections as your LE or CD so you can easily follow along.

- If theres a fee on your loan estimate thats not listed below, your loan consultant or processing expert will be able to explain it for you.

- If you need more information about the itemized fees on your Closing Disclosure, your closing expert can help you.

Better Mortgage is committed to eliminating unnecessary fees wherever possible and not passing on costs to our customers. Youll see how our Loan Estimates compare when you start the process.