Mortgage Rates Are Falling But It’s Still Worth Searching For The Best Deal

After climbing for much of 2018, mortgage rates have been falling since the beginning of the year. The average mortgage APR was recently at 4.28 percent, according to Freddie Mac, compared to a high of 5 percent in 2018.

But just because rates are down doesn’t mean you’re getting a good deal.

Many homebuyers get intimidated by the mortgage process and just go with whatever is easiestusually what their local bank is offering,” says Greg McBride, chief financial analyst for Bankrate.com. “Smart buyers shop around to uncover the lowest offers.

When we shopped around, we found lower rates at various banks. HSBC Bank, for instance, is offering a 30-year fixed-rate mortgage, with an APR of 4.03 percent. Wells Fargo offers an APR of 3.98 percent.Here are the steps you should take to find the lowest-priced loan available.

Compare Up To 4 Providers

Disclaimer

*The products compared on this page are chosen from a range of offers available to us and are not representative of all the products available in the market. There is no perfect order or perfect ranking system for the products we list on our Site, so we provide you with the functionality to self-select, re-order and compare products. The initial display order is influenced by a range of factors including conversion rates, product costs and commercial arrangements, so please don’t interpret the listing order as an endorsement or recommendation from us. We’re happy to provide you with the tools you need to make better decisions, but we’d like you to make your own decisions and compare and assess products based on your own preferences, circumstances and needs.

How Do You Compare Mortgage Rates

If youre in the market for a property, whether youre looking for a first home, refinancing or even seeking an investment property, you can start by comparing home loans with Canstar. You can compare more than 4,000 fixed and variable loans, based on such factors as the loan amount, purpose, loan to value ratio and features, such as offset accounts, redraw facilities, split loan options and more.

Also Check: How 10 Year Treasury Affect Mortgage Rates

What Is A Mortgage Rate Lock

Mortgage rates change daily, and that can be a problem when it can take more than a month to close a refinance loan. The solution offered by most lenders is a mortgage rate lock.

With a rate lock, your interest rate wont change for a set amount of time. If there are delays in closing your loan, and your rate lock will expire before you can complete the refinance, you may be able to get an extension. If that happens, be sure to ask if there are fees for extending the rate lock.

What Factors Determine My Mortgage Rate

Lenders consider these factors when pricing your interest rate:

- Loan term

- Interest rate type

Your . Lenders have settled on this three-digit score as the most reliable predictor of whether youll make prompt payments. The higher your score, the less risk you pose and the lower rate youll pay.

Lenders also look at the amount of your down payment. For instance, if you put 20 percent down, youre viewed as a lower risk, and you might get a lower rate than someone whos financing nearly all of their home purchase. From the lenders viewpoint, the more skin the borrower has in the game, the more likely the mortgage will be repaid on time and in full.

Rolling additional closing costs into the loan affects your mortgage rate as well. With these costs added to what you owe, youll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers might also pay higher rates for jumbo loans mortgages above the limits for conforming mortgages.

Use our mortgage calculator to see how different interest rates, down payments, loan amounts and loan terms would affect your monthly mortgage payments.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

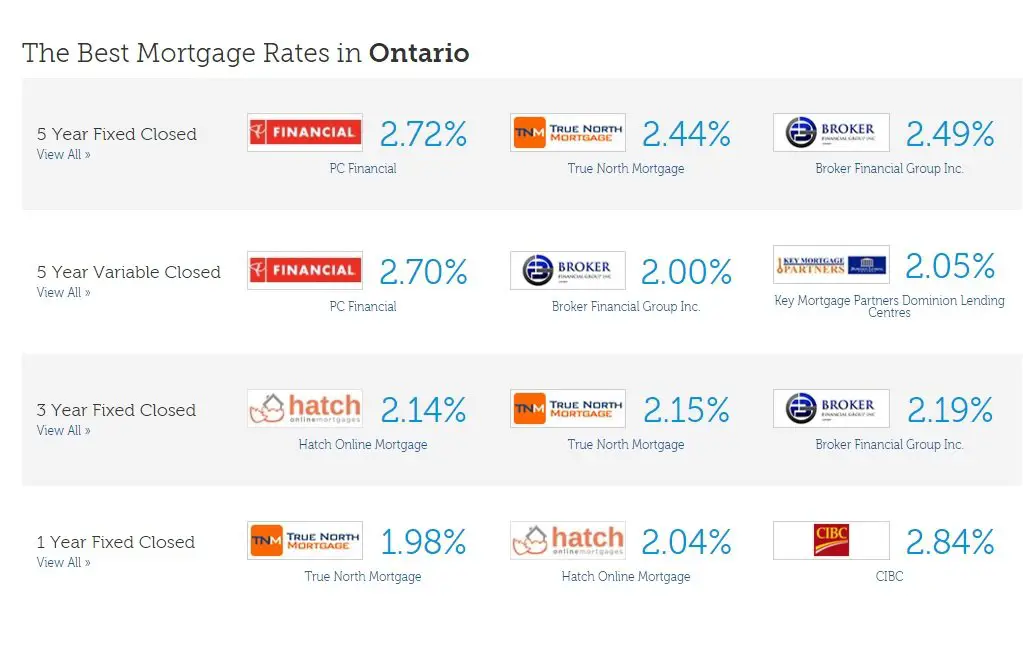

How Lowestratescas Conventional Mortgage Rates Compare To High

On LowestRates.ca., you can obtain a quote for a high ratio mortgage or a conventional mortgage. A conventional mortgage refers to one where the down payment is greater than 20% of the purchase price of the home, whereas a high ratio mortgage refers to a mortgage where the down payment is less than 20% of the purchase price of the home. Weve pulled the average rates from our user database to give you a sense of what youll pay on each type of mortgage. While high ratio mortgages often come with lower rates, this is because homebuyers putting less than 20% down are required to purchase mortgage insurance. Its important to speak with an advisor about which rate structure is right for you.

Are Mortgage Rates Impacting Home Sales

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.

Read Also: How Much Do You Pay Back On A Mortgage

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontos housing marketor inVancouvers housing market. However, you wont have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

Choose A Fixed Or Adjustable Rate Loan

If youre planning to stay in your home for at least a decade, a 30-year fixed rate loanwith relatively low monthly paymentsis your best bet.

If you can afford higher payments and want to dispense with the debt sooner, consider a 15-year fixed. It features a lower interest rate and could save you thousands over the life of the loan.

Another option is to choose a shorter-term adjustable rate mortgage . These mortgages feature lower rates for an introductory period, then a higher rate. On a 7/1 ARM, for example, the rate remains fixed for seven years. After that period, it can adjust annually based on market rates but can only increase a maximum of 5 percentage points above the original rate.

If you’re planning to be in your home for years to come, this may not be the best option, especially since fixed rates are attractive now. You don’t want to be in a position where your adjustable rate mortgage begins to adjust and you’re susceptible to a large payment increase, McBride says.

Also Check: Does Rocket Mortgage Affect Your Credit Score

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process the lender will look at your overall financial profile to determine how much it is willing to let you borrow. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI a lender will allow is 43%. So if you make $5,000 a month your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Read Also: How To Apply For A House Mortgage

Current Mortgage Rates: Today’s Interest Rates

Rate, points and APR may be adjusted based on several factors including, but not limited to, state of property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value and your credit score. Your final rate and points may be higher or lower than those quoted based on information relating to these factors, which may be determined after you apply.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

FHA loans require an up-front mortgage insurance premium which may be financed, or paid at closing and monthly premiums will apply.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

Bank Rates Vs Broker Rates

As you may have noticed, bank mortgage rates are almost always higher than those of mortgage brokers. That is because mortgage brokers have access to rates from multiple banks and credit unions, as well as insurance and trust companies. That means they can essentially “shop around” for you. Brokers also receive discounts from lenders based on the high volume of their business, which they can pass along to you.

As a result, itâs unlikely that a bank will post a lower rate than a mortgage broker. However, if you present the lowest market rate to your bank as part of the negotiation process, they may offer to match it. That said, we donât recommend pitting the banks and brokers against each other to compete for your business. What we do recommend is comparing broker mortgage rates and bank mortgage rates alongside each other, and deciding which offer is best for you.

Don’t Miss: How To Sell A Mobile Home With A Mortgage

Can You Afford A 3% Rate Rise

Another good question to ask yourself before applying for any home loan is whether you can afford to repay higher mortgage repayments if rates were to increase. Statistically, over a 2030-year home loan term interest rates may hike, and you need to be prepared. A good rule of thumb is to test your ability to afford mortgage repayments at least 3% higher. Ideally, you want to try to keep your mortgage repayments under 30% of your income, as paying a higher percentage is considered to be mortgage stress.

Are Low Frills Mortgages Worth It

Restricted mortgages have boomed in popularity the last five years. Lenders realize that consumers want the lowest rate, so theyve tried to strip out features from their mortgages to get the pricing lower. For some borrowers who plan no financing changes for five years, low-frills mortgages may make sense. For most Canadians, the small rate savings isnt worth the much higher potential costs after closing. Those costs can bite you if you break, port, increase or otherwise refinance before your mortgage maturity date. Hence, for the majority of homeowners, its worth the small premium for a full-featured mortgage

Don’t Miss: What Banks Look For When Applying For A Mortgage

Where Can I Get A Mortgage In Canada

There several different places Canadians can turn to get a mortgage. First, its important to identify the difference between a mortgage lender and a mortgage broker.

A mortgage lender lends money to prospective homebuyers directly. They can include a wide range of companies, including banks, trust companies, loan companies, credit unions, caisses populaires and mortgage companies.

A mortgage broker, on the other hand, will not lend money directly to you. Mortgage brokers arrange your transaction by seeking out a lender for you.

While some lenders will only work directly with prospective homeowners, other mortgage products are only offered through mortgage brokers. Since mortgage brokers have access to several lenders at once, they might be able to provide you with a broader range of prospective offers.

LowestRates.ca compares banks, brokers and other lenders all at the same time so you dont have to go through the trouble. And ultimately, we get you the best mortgage rate from one of our trusted partners. Fill out a form to get started.

Canadians facing overheated housing markets, we cant overemphasize the importance of mortgage rate comparison.

How Are Mortgage Rates Set In Canada

Each mortgage lender sets rates based on its own relationship to the prime lending rate. But whats the prime lending rate?

The prime lending rate is influenced by the Bank of Canadas interest rate, which currently sits at 5.04%. Each bank has its own prime lending rate. The prime rate currently sits at 2.95%. Your lender will give you an annual interest rate on your mortgage thats based on the prime rate. When the Bank of Canada raises its overnight rate, it gets more expensive for Canadian banks to borrow money. In response, they raise their own prime rates to cover the additional expense.

Other kinds of loans that are affected by the prime rate include car loans, lines of credit and some credit cards.

When you agree to a fixed-rate mortgage, youll select a rate based on what lenders are offering at the time and youll agree to pay that rate for the duration of your mortgage term. A variable rate, on the other hand, is usually determined by adding or subtracting a certain percentage from the prime lending rate. Each lender will determine this percentage on their own. When the prime lending rate goes up or down, the mortgage rates of homeowners who have variable mortgage rates will also go up or down.

You May Like: How Much Interest Do I Pay On A Mortgage

Will Current Mortgage Rates Save You Money If You Refinance

You should consider refinancing your home loan if your current mortgage rate exceeds today’s mortgage rates by more than one percentage point. Mortgage refinance fees and closing costs would cut into your savings. You also have to consider whether your credit score would qualify you for today’s best refinance rates.

Many online lenders can give you free rate quotes to help you decide whether the money you’d save in interest charges justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could enhance interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments may be higher, but you could save thousands in interest charges over time, and you’d pay off your house sooner.

How Do You Find The Lowest Interest Rates

Comparison tools, such as tables and calculators, may come in handy here and may be able to help you shortlist potential options for your best home loan.

Comparison tables allow borrowers to compare apples with apples. You can filter down the home loan results by your personal situation, loan amount and what you want from the loan . Then, you can view a range of options side by side to better get an overview of which home loans may be more competitive and create a shortlist of options.

A Mortgage Repayment Calculator may also help you narrow down your shortlist by allowing you to view an estimate of what your mortgage repayments may look like with said loan. You can then assess this repayment against your income, or even test the repayments at a higher interest rate to ensure you can afford potential rate hikes.

If you’re feeling overwhelmed by all of the potential home loan options and tools to compare with, it may be worth considering reaching out to a mortgage broker. Brokers may be able to offer financial advice and assist you in the home loan process from start to finish, as well as offer broker-only interest rates not advertised by lenders.

Also Check: Is Citizens Bank Good For Mortgages

Are You An Investor A First Home Buyer Or A Refinancer

The kind of borrower you are will have an impact on the kind of home loan and interest rate youll be offered. For example, owner occupier home loans generally offer lower interest rates than investment home loans, as investors can be seen as riskier borrowers than owner occupiers.

Heres what your home loan needs may be according to the kind of borrower you are: