Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

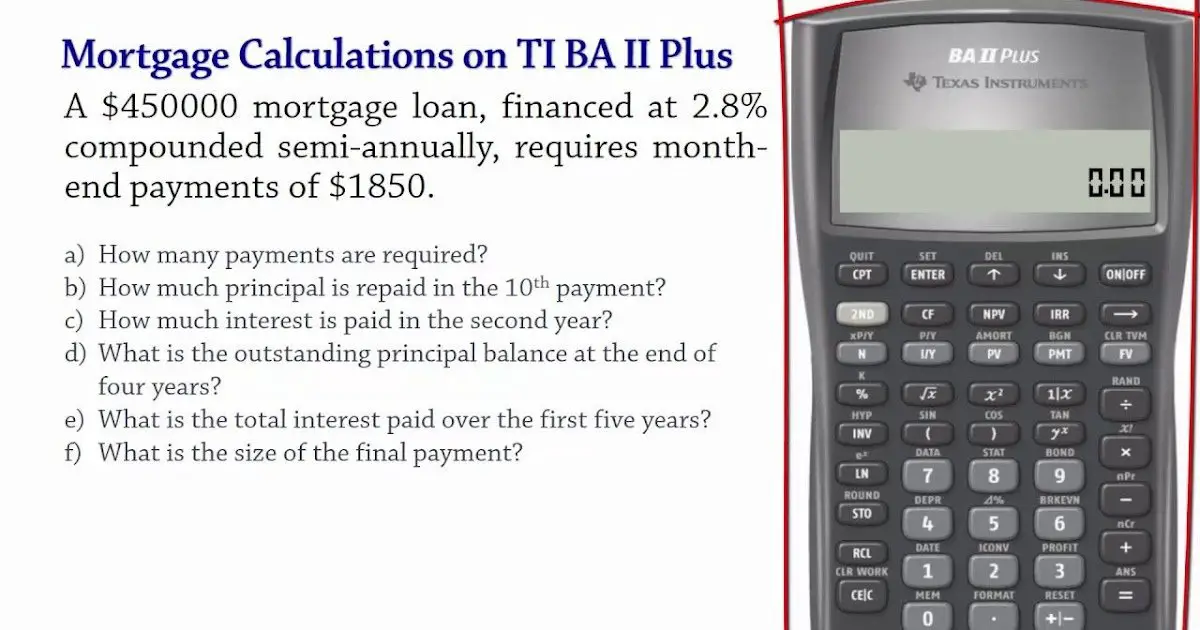

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Mortgages For The Self

Being self-employed is certainly not a barrier to home-ownership, but you may need to look for a specialist lender to get the best rates on a £200,000 mortgage. More conventional lenders often look at self-employed applicants as non-standard, and thus higher risk.

You can read more about self-employed mortgages guide.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Read Also: How Much Mortgage Protection Insurance Cost

What Are The Different Loans And Programs For First

While the 28/36 rule applies most conventional mortgage lenders, certain programs designed to help first-time homebuyers, veterans and certain low-income home buyers allow some exceptions:

- Mortgages backed by the Federal Housing Administration, known as FHA loans, are designed to help first-time homebuyers qualify for mortgages and allow back-end DTIs of up to 43%.

- Mortgages known as VA Loans, issued through the U.S. Department of Veterans Affairs, are geared toward veterans, service members and qualifying spouses, and allow back-end DTIs of 41%.

- The maximum back-end DTI allowed on USDA Loansmortgages issued under guidelines set by the U.S. Department of Agriculture to help low-income borrowers buy homes in certain rural areasis 46%.

- State and national programs designed to assist with homeownership may be able to help if you’re having trouble meeting the down-payment requirements for a loan, or if your income falls below the level needed to secure some conventional loans.

The factors that determine the amount of a monthly mortgage loan, including your credit score and history and down payment amount, along with your monthly non-housing debt expenses, play a major role in determining how much income you’ll need to afford a mortgage. Understanding DTI and the 28/36 rule can help you anticipate your needs and plan for the mortgage-application process.

If you need to improve your DTI, there are two things you can do:

Monthly Payments On A 200000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £954.83 a month, while a 15-year term might cost £1,479.38 a month.

Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

-

See your monthly payments by interest rate.

Interest

Recommended Reading: How To Purchase A House That Has A Reverse Mortgage

Ontario Mortgage Regulations Taxes And Fees

Most taxes and fees are set at the provincial, or even municipal level. In Ontario, purchasers are responsible for obtaining Ontario mortgage rates, paying the provincial sales tax for CMHC insurance, and covering Ontario land transfer taxes.

For those purchasing in Toronto, a second set of municipal land transfer taxes apply in addition to the state tax, as well as an overseas speculation levy for properties in the Golden Horseshoe.

The Mortgage Payment Calculator In Action

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

If you switch from monthly to accelerated weekly payments, for example, you’ll increase your repayment frequency from 12 monthly payments to 52 weekly payments. That can shave two years and 10 months off your mortgage, versus monthly payments .

Similarly, if you switch from monthly to an accelerated bi-weekly payment schedule, youll increase your repayment frequency from 12 monthly payments to 26 bi-weekly payments. This means youll make a payment every two weeks. That too adds up to one extra monthly payment over the course of a year. As with accelerated weekly, accelerated bi-weekly payments shave about two years and 10 months off your mortgage, versus monthly repayment.

Recommended Reading: Are Online Mortgage Calculators Accurate

Monthly Payments On A $200000 Mortgage

What is each mortgage payment made up of?

- Principal payment. This goes towards the amount you borrowed from the lender . As you gradually pay off the amount you borrowed, you will be paying interest on a smaller loan amount, so your interest payments will slowly reduce.

- Interest payment. This is the cost to borrow from the lender. The higher your principal and the higher your interest rate, the more interest youll need to repay.

$948.42$1,931.21

Monthly payments by interest rate

| Interest |

|---|

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

Also Check: Can A Mortgage Include Renovation Costs

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

Read Also: How Much Mortgage On 200k

Which Payment Schedule Is Right For Me

While it will depend on your specific situation, here are some general guidelines:

- Most people choose to synchronize their mortgage payments with their monthly or bi-weekly paycheck. This will make it easier to budget.

- More frequent mortgage payments will slightly lower your term and lifetime mortgage cost. Accelerated payment frequencies are also available.

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Also Check: How To Select A Mortgage Lender

What Happens If You Skip A Payment

Skipping a mortgage payment doesn’t mean that the lender is giving it to you for free. Skipping a payment just means that you’ll be paying it back later. When you skip a mortgage payment, interest that would have been charged would be added to your mortgage balance instead of being paid off. This increases your mortgage balance, which means that you’ll be paying interest on your added interest.

If you dont repay the skipped mortgage amount plus accumulated interest, then youll be paying interest on the interest for the rest of your mortgages amortization. This could make skipping a mortgage payment a very costly option to take. Fortunately, many lenders allow you to repay your skipped payments without any prepayment penalties.

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

Recommended Reading: How Much Is Mortgage Insurance In Michigan

Mortgage Payment Frequency Example

Let’s compare mortgage payment frequencies by looking at a $500,000 mortgage in Ontario with a 25-year amortization, and assume that it has a fixed mortgage rate of 1.5% for a 5-year term.

The monthly mortgage payment would be $2,000. Now, lets see how much it would be with semi-monthly, bi-weekly, and weekly mortgage payments.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Read Also: Does Rocket Mortgage Affect Your Credit Score

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Also Check: Can You Get A Second Mortgage With Bad Credit

Whats My Minimum Down Payment

Yourminimum down paymentdepends on the purchase price of your property.

- If your purchase price is under $500,000, your minimum down payment is 5% of the purchase price.

- If your purchase price is $500,000 to $999,999, your minimum down payment is 5% of the first $500,000, plus 10% of the remaining portion.

- If your purchase price is $1,000,000 or more, your minimum down payment is 20% of the purchase price.

If youreself-employedor havepoor credit, your lender may require a higher down payment.

Considerations Before Committing To A Mortgage

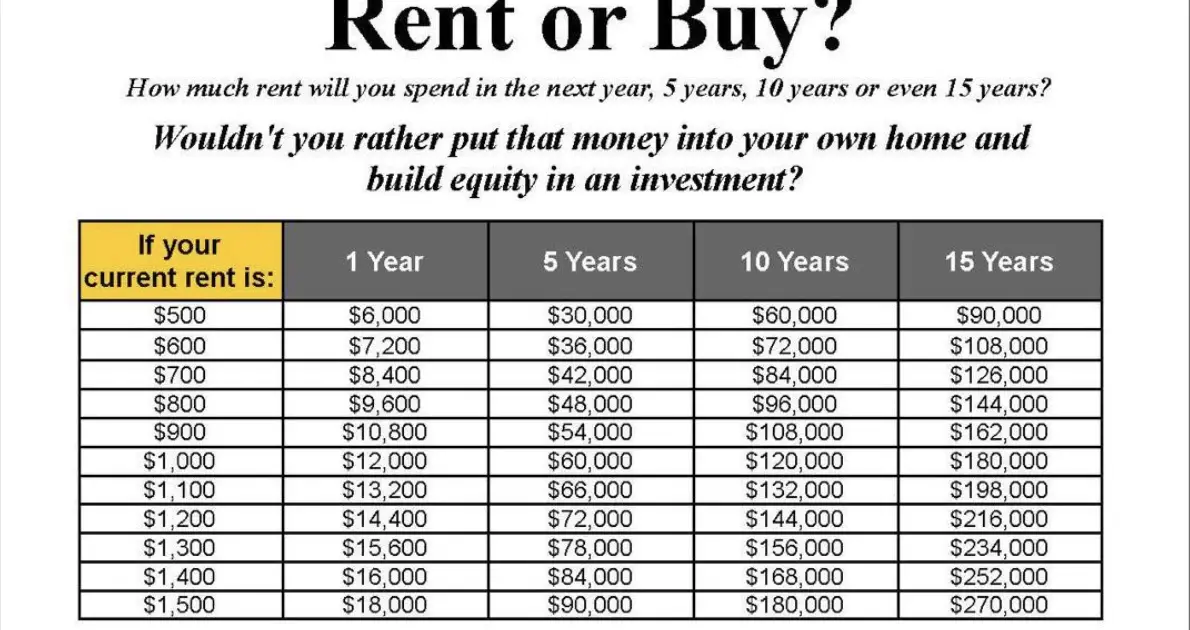

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Don’t Miss: What Does A Mortgage Consist Of