How Do I Calculate Monthly Mortgage Payment In Excel

Calculate the monthly payment. To figure out how much you must pay on the mortgage each month, use the following formula: = -PMT. For the provided screenshot, the formula is -PMT.

Most cap the amount you can borrow at 4x 4.5x your annual income. For a £350,000 mortgage, this would mean that you would need to be earning a minimum of £87,500 £77,778 a year.

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Using An Online Mortgage Calculator To Figure Out Your Monthly Payments

Using California mortgage calculators is a great way to get an idea of how much you can afford to borrow. If your financial situation and a few other variables change, you may use these calculators to see your loan possibilities.

A mortgage calculator can help you figure out how much you can borrow to buy a new home. There would be nothing like it if you didnt need a mortgage to purchase a property. You must, however, make sure that all of your money is not spent when you need one. You may use these tools to figure out how much youll need to put down as a down payment on a house based on the valuation of the property and your current financial situation. If youre a genius with numbers, you may have difficulty comprehending the math involved in a mortgage. In a circumstance like this, a calculator comes in handy.

Recommended Reading: Bofa Home Loan Navigator

Mortgage Interest Payment Calculator Tools

One way to find out how much interest you’ll owe in a given month, over the life of the mortgage or during other time periods is to use a mortgage interest payment calculator, such as the mortgage and interest calculator provided by Nerdwallet. These are computer programs that you can find on numerous financial news and information sites. Some mortgage lenders may also provide one on their websites.

To use one of these tools, follow the instructions to enter your current mortgage principal amount and annual interest rate. Find these numbers in your mortgage documentation. Then, follow the instructions to calculate your monthly, annual or lifetime interest payments.

If you’re putting any confidential information into a mortgage amortization calculator, make sure that you trust the organization running it and that you’re confident that you don’t have any malware on your device. Only enter the data in a secure place where nobody is looking over your shoulder.

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

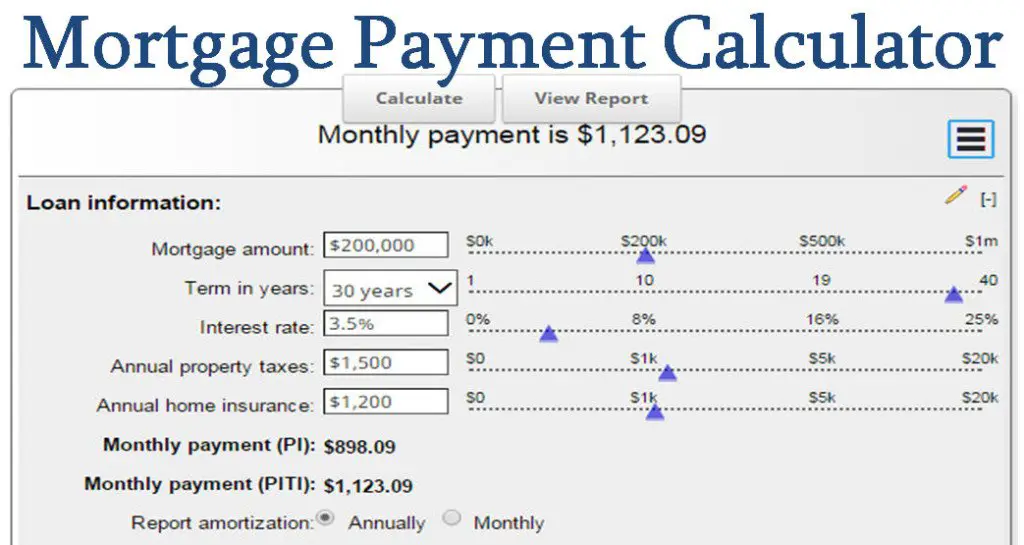

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Typical Costs Included In A Mortgage Payment

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, youll have an additional policy, and if youre in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the homes purchase price, youll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

What Other Factors Determine How Much House I Can Afford

Beyond the price you offer to pay and the amount you have for a down payment, there are other expenses involved in home-buying, as well, including:

- , which can include recording fees or transfer taxes in your location as well as fees charged by your lender and lawyer

- , which often have to be set aside in escrow and are added to your monthly mortgage payments

- Homeowners insurance, which also can be paid through escrow

Recommended Reading: Rocket Mortgage Loan Requirements

How Much Mortgage Can I Afford

To figure out how much house you can afford and estimate the loan amount you will be approved to borrow, youll need to know the following: your monthly household income before taxes your down payment amount and how much you pay towards debt each monthsuch as car payments and credit cards. This will help you and your loan officer determine your debt-to-income ratio .

Total Debts / Monthly Income = DTI

Mortgage lenders use your DTI to determine how much you can afford to borrow. Typically, youll want your DTI below 36%. Add all your monthly debts and divide them by your gross monthly income .

Heres an example:

You pay $500 a month total for your car and student loans and gross $4000 a month in pay. Use the formula: $500 / $4000 = 12%. That is your current debt to income ratio! If you want to know how much house you can afford take the typical DTI ratio and subtract your current DTI ratio which leaves you with 24%. Multiply that percentage by your gross monthly income . Ideally, you would want to keep your monthly mortgage payment below $960 to maintain the ideal debt-to-income ratio. To learn more, and get preapproved, contact your mortgage loan officer.

There are six different mortgage types you should consider when shopping for a home loan.

So Whats Your Budget For A Home Loan

Before signing on the dotted line for a new home, this is a critical question to ask before signing on the dotted line. Many of you may already know how much you can spend, while others may not. If youve never used a mortgage calculator before, you may not realize that they may assist you to combine several pieces of data to come to a conclusion. Changing the interest rate gives you a number that you may use to evaluate your alternatives.

A variety of outcomes may be obtained by just altering the values of the figures. It is now possible to assess the impact of these changes on your monthly revenue. In this approach, you may acquire the most affordable pricing possible. Its common to be perplexed about how much to spend for a house when youre trying to buy one. It is possible to obtain a better price on a property if you are well-informed and have done your homework. While some of you may believe that you cant afford to spend more than a particular amount, you can. Using these online tools, you can figure out how much you can afford to pay each month and how fast you can finish paying off your mortgage.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

How Do I Calculate My Mortgage Payment In Excel Canada

Re: Excel formula for a mortgage payment for a Canadian Mortgage

What is the formula for calculating a 30-year mortgage? Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

How much income do you need for a $350 mortgage? A $000k mortgage with a 350% interest rate over 4.5 years and a $30k down-payment will require an annual income of $ 86,331 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

Find Out How Much House You Can Afford

Understanding the limits of your budget is crucial before you engage with any lending institution. Doing so will help you remain realistic and avoid a risky purchase even if its your dream home that could backfire in the future.

To find out how much house you can afford, youll need to input your down payment amount, state, credit score, and preferred home loan type.

Youll also need to indicate either your desired monthly payment amount or your gross monthly income and monthly debts. The latter two are used to determine your debt-to-income ratio, which plays a large role in whether youll qualify to borrow in the first place.

Most lenders and calculators evaluate affordability with the 28/36 rule, which establishes that your housing expenses and total debt should not be more than 28% and 36% of your total pre-tax income, respectively. To calculate this, multiply your monthly income by 28 or 36 and then divide it by 100.

For example, with a $4,500 monthly income, you should spend no more than $1,260 on monthly housing expenses. The formula to calculate this would be x = ÷ 100, where a is your monthly income .

The simplest way to pay off your mortgage faster is by making larger or more frequent payments towards your loan principal. For example, you could make biweekly payments or one extra lump sum payment per year.

You can also refinance to a shorter-term mortgage, which will raise your monthly payments in exchange for a home loan that you can pay off faster.

Read Also: Can You Do A Reverse Mortgage On A Condo

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That’s because salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

Mortgage Calculator: How To Calculate Your Monthly Payments

See Mortgage Rate Quotes for Your Home

There are quite a few factors that go into the calculation of your mortgage expenses, but most homebuyers like to begin by determining their monthly payments and the lifetime cost of the mortgage. Calculating these two figures is a good first step toward understanding all of your other expenses.

Recommended Reading: Chase Mortgage Recast Fee

How Is Income Calculated For A Mortgage

To calculate income for a selfemployed borrower, mortgage lenders will typically add the adjusted gross income as shown on the two most recent years federal tax returns, then add certain claimed depreciation to that bottomline figure. Next, the sum will be divided by 24 months to find your monthly household income.

Why Shouldn’t You Pay Off Your House Early

1. You have debt with a higher interest rate. Consider other debts you have, especially credit card debt, that may have a really high interest rate. Before putting extra cash towards your mortgage to pay it off early, clear your high-interest debt.

How can I pay my house off in 10 years? Expert Tips to Pay Down Your Mortgage in 10 Years or Less

Also What is the principal amount? The principal is the amount due on any debt before interest, or the amount invested before returns. All loans start as principal, and for every designated period that the principal remains unpaid in full the loan will accrue interest and other fees.

What is principal amount with example?

In the context of borrowing, principal is the initial size of a loan it can also be the amount still owed on a loan. If you take out a $50,000 mortgage, for example, the principal is $50,000. If you pay off $30,000, the principal balance now consists of the remaining $20,000.

Read Also: Reverse Mortgage For Condominiums

Understanding Mortgage Interest Rates

When you take out a mortgage to buy a home, you are borrowing money backed by the home’s price. Naturally, the lender won’t allow you to borrow money for free. To make money, the lender charges interest that accrues over the life of the loan. The amount that you borrowed in the first place is known as the principal on the mortgage.

On a fixed-rate mortgage, this interest rate will remain the same for the term of the loan, whether that’s 20 years, 30 years or longer. For an adjustable rate mortgage, the rate will change based on prevailing interest rates at various intervals.

Either way, you should be able to find your current interest rate in your mortgage paperwork or through your bank’s online lending site. You can also check to see if your mortgage statement specifies how much of the current month’s payment is attributed to interest. If it doesn’t, you can make that calculation yourself.

How To Make Extra Payments On My Mortgage

There are two primary strategies for making extra payments on your mortgage:

- Biweekly mortgage payments

- Extra monthly payments

With biweekly mortgage payments, you make a payment toward your mortgage every two weeks. If you pay half of your minimum payment with each payment, youll always make your minimum monthly payment.

However, there are 52 weeks in a year and just 12 months. Over the course of a year, youll make 26 biweekly payments which would total the amount of 13 monthly payments. In effect, you make an extra monthly payment each year. The extra money goes toward reducing principal, helping you pay the loan off more quickly.

You can also choose to make pay more toward your loan balance each month. For example, if your loans minimum payment is $2,000, you can set up a monthly payment of $2,200.

Each month, the extra $200 will pay down the principal of your loan and help you pay it off more quickly.

You May Like: How Does Rocket Mortgage Work

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Read Also: Monthly Mortgage On 1 Million

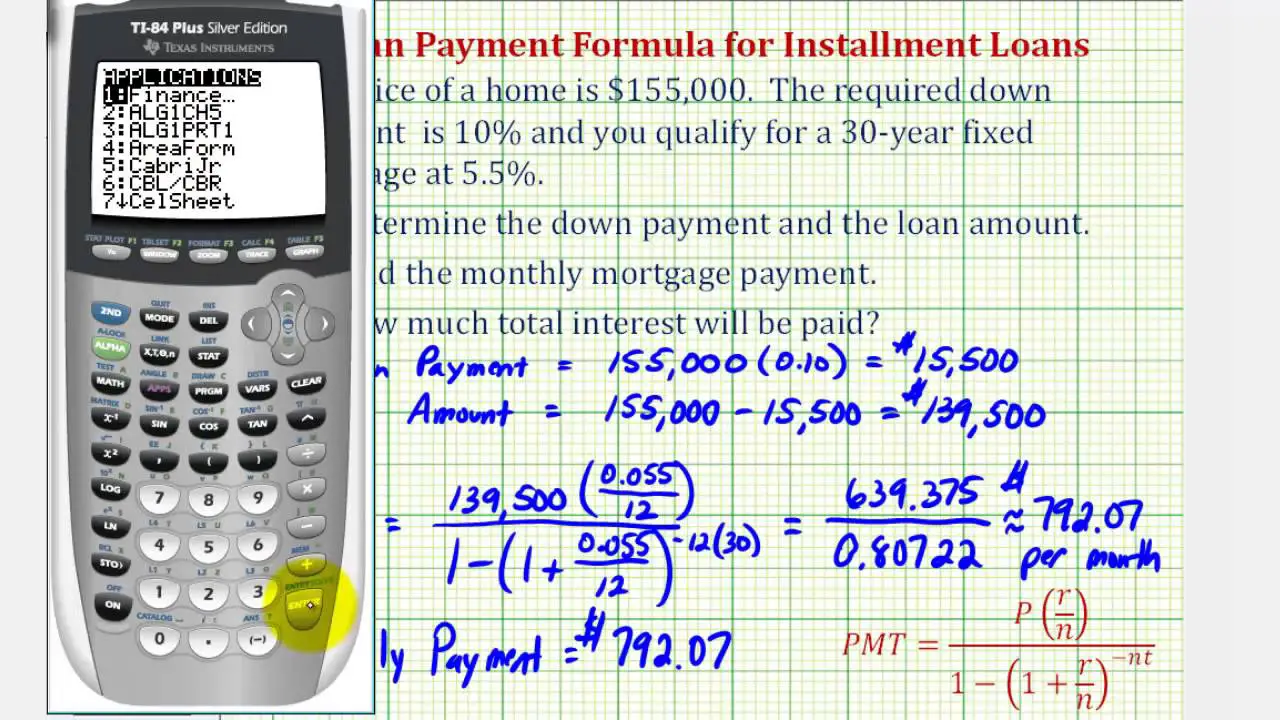

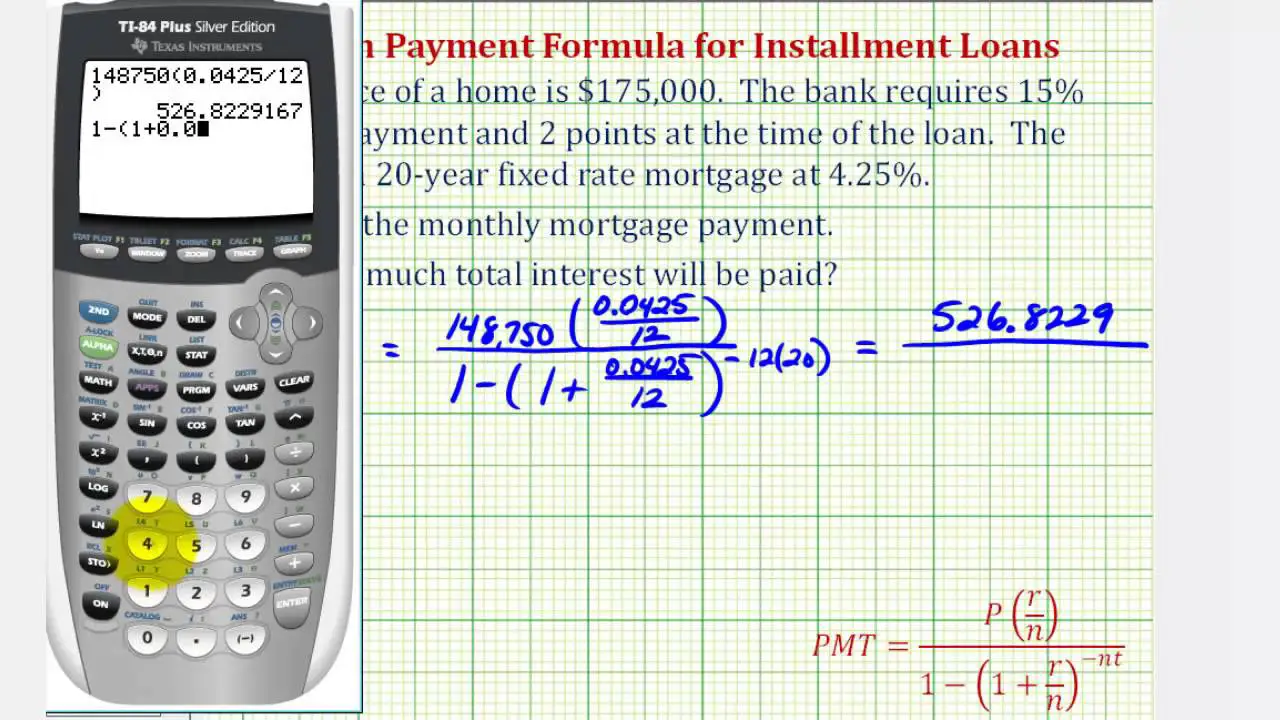

How To Calculate Mortgage Payments Manually

In these easy steps, you can learn to determine your mortgage payment by hand. Get a piece of paper and a pen, and follow through!

But first, note down the mortgage principal and interest formula, which is:

M = P /

Start by naming the values in the above formula:

| Principal P |

| Interest rate I |

| Number of periods N |

To figure your mortgage payment, start by converting your annual interest rate to a monthly interest rate by dividing by 12.

Next, add 1 to the monthly rate.

Third, multiply the number of years in the term of the mortgage by 12 to calculate the number of monthly payments youll make.

Fourth, raise the result of 1 plus the monthly rate to the negative power of the number of monthly payments youll make. Fifth, subtract that result from 1. Sixth, divide the monthly rate by the result. Last, multiple the result by the amount you borrowed.

Lets do it with numbers now.

For example, say you borrowed $265,000 on a 15-year mortgage at 4.32%.

Start by dividing 0.0432 by 12 to find that the monthly rate equals 0.0036.

Next, add 1 to 0.0036 to get 1.0036.

Third, multiply 15 years by 12 payments per year to find that your loan consists of 180 monthly payments.

Fourth, raise 1.0036 to the negative 180th power to get 0.5237.

Fifth, subtract 0.5237 from 1 to get 0.4763. Sixth, divide 0.0036 by 0.4763 to get 0.00755826.

Finally, multiply 0.00755826 by $265,000 to find your monthly payment will be $2,002.93.