What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

How Much Does It Cost To Leave Mortgage Early

Mortgage early repayment charges are charged as a percentage of the outstanding mortgage balance usually between 1% and 5%. The charges are often tiered which means they reduce with each year of the deal.

Can you pay off mortgage after fixed term? You can usually also pay off your entire mortgage or switch to another deal without incurring an early termination fee. Since the rate is variable, theres a chance it might go down. If this happens, your monthly mortgage repayment may also go down.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

My Monthly Payments Will Be

If you take out a $200,000 mortgage payment at 5.000% for 30 years, your monthly mortgage payment would be $1,073.64.

The payments on a fixed-rate mortgage don’t change over time. The loan over the repayment period. This means that the proportion of interest paid vs. principal repaid changes each month. As the loan amortizes, the amount of monthly interest paid decreases while the amount of principal repaid increases.

Note: Principal and interest are usually only a portion of the monthly payment made to your bank. Most lenders also require payments for and property taxes, too. Those payments get dropped into an escrow account so the bank can automatically make the annual insurance and property tax payments on your behalf when the bills come due.

How Much Does A 200 000 Mortgage Cost

Monthly payments on a £200,000 mortgage At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £954.83 a month, while a 15-year term might cost £1,479.38 a month. Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

You May Like: Reverse Mortgage For Mobile Homes

Can I Buy A House If I Make 25k A Year

HUD, nonprofit organizations, and private lenders can provide additional paths to homeownership for people who make less than $25,000 per year with down payment assistance, rent-to-own options, and proprietary loan options.

Is a mortgage 3 times your salary?

Is a mortgage 3 times your salary? Not necessarily. Most lenders offer eligible borrowers mortgages based on 3-4.5 times their income, but others go higher than this, under the right circumstances. You can read more about this in our guide to income multiples.

What is the average mortgage payment? State-By-State Average Mortgage Payments

| State |

|---|

| $190,846 |

Nov 19, 2021

Can I buy a house making 25k a year? HUD, nonprofit organizations, and private lenders can provide additional paths to homeownership for people who make less than $25,000 per year with down payment assistance, rent-to-own options, and proprietary loan options.

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Also Check: How To Select A Mortgage Lender

Also Check: How Much Is Mortgage On A 1 Million Dollar House

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

How Fast Can You Pay Off 50000 In Debt

In order to pay off $50,000 in credit card debt within 36 months, you need to pay $1,811 per month, assuming an APR of 18%. While you would incur $15,193 in interest charges during that time, you could avoid much of this extra cost and pay off your debt faster by using a 0% APR balance transfer credit card.

You May Like: Can You Do A Reverse Mortgage On A Condo

Mortgage Loan Calculator For Refinancing Or Home Purchase Payments

Get estimates for home loan payments to help you decide what you can afford.

This simple Mortgage Loan Calculator enables you to calculate what your monthly mortgage payments will be – including the principal, interest, property taxes and home insurance . The result you get will be relevant for a wide variety of different mortgage types. It will also display your projected repayment schedule, taking into account your principal loan amount, interest rate, and any additional prepayments you intend to make

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Why Should I Use A Mortgage Calculator

You May Like: Recasting Mortgage Chase

What Is The Average Monthly Payment On A 250 000 Mortgage

Monthly payments for a $250,000 mortgage. Where to get a $250,000 mortgage. Monthly payments for a $250,000 mortgage.

| Annual Percentage Rate |

|---|

| $1,054.01 |

Jan 5, 2022

Hereof, How much is a 250 000 mortgage A month UK? What are the monthly payments on a £250,000 mortgage? At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £1,193.54 a month, while a 15-year mortgage might cost £1,849.22 a month.

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

Read Also: Monthly Mortgage On 1 Million

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

Is $5000 A Lot Of Credit Card Debt

Lots of people have credit card debt, and the average balance in the U.S. is $6,194. About 52% of Americans owe $2,500 or less on their credit cards. If you’re looking at $5,000 or higher, you should really get motivated to knock out that debt quickly. The sooner you do, the less money you’ll lose to interest.

Also Check: Who Is Rocket Mortgage Owned By

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

At What Age Should My House Be Paid Off

If you want to find financial freedom, you need to retire all debt and yes that includes your mortgage, the personal finance author and co-host of ABCs Shark Tank tells CNBC Make It. You should aim to have everything paid off, from student loans to credit card debt, , OLeary says.

Why you shouldnt pay off your house early?

Paying off a mortgage early can free up cash flow and save a lot of money on interest payments. But investors shouldnt view their mortgage in a vacuum. Putting extra money toward a mortgage can be seen as part of an overall investment plan.

Does paying off mortgage early affect credit score? If youre wondering how much paying off your mortgage early affects your credit score, the answer is: not much. Once your mortgage is paid in full , it shows up on your credit report as a closed account in good standingassuming youve been making on-time payments.

You May Like: Does Rocket Mortgage Service Their Own Loans

Monthly Payments For A $200000 Mortgage

Monthly mortgage payments always contain two things: principal and interest. In some cases, they might include other costs as well.

- Principal: Principal is money that goes directly toward whittling down your balance.

- Interest: This is what you pay to actually borrow the money. The amount youll pay is reflected in your interest rate.

- Escrow costs: If you opt to use an escrow account , youll also have your property taxes, mortgage insurance, and homeowners insurance rolled into your monthly mortgage payment, too.

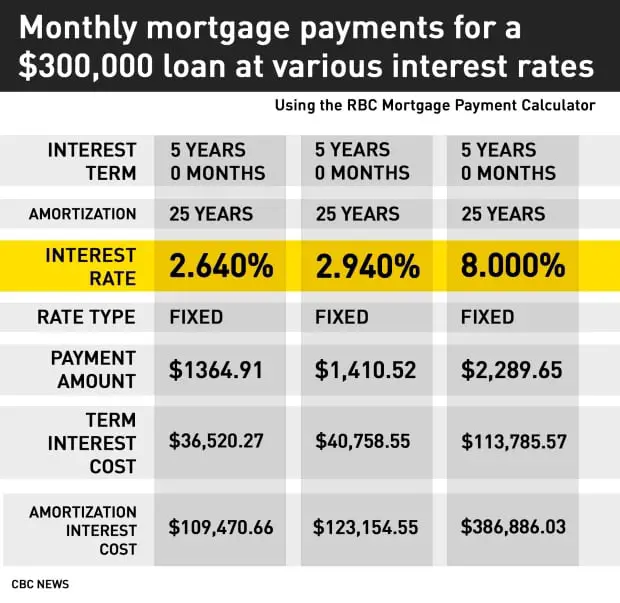

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance.

But these can vary greatly depending on your insurance policy, loan type, down payment size, and more.

Credible is here to help with your pre-approval. Answer a few quick questions below to get started.

Heres a more detailed look at what the total monthly payment would look like for that same $200,000 mortgage:

| Interest rate |

|---|

Check out: 20- vs 30-Year Mortgage: Is an Unusual Option Right for You?

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

Recommended Reading: Chase Recast Calculator

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1