Amortization Schedule For An $800k Mortgage

Amortization for a mortgage shows the process of paying both the interest and principal off on a mortgage. Initially, you will pay mostly interest on your $800k mortgage and eventually pay mostly principal.

An amortization schedule shows each payment towards a mortgage until the predetermined term ends.

How Much Would A Mortgage Be On A 800000 House

Below, you can estimate your monthly mortgage repayments on a $800,000 mortgage at a 3% fixed interest rate with our amortization schedule over 15- and 25- years. At a 3% fixed-rate over 15-years, youd pay approximately $5,517.51 monthly. Over the course of a year, thats a total of $66,210.12 in mortgage payments.

Mortgage Calculator With Taxes And Insurance

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Also Check: Which Bank Is Best To Get A Mortgage

Mortgage Down Payment Calculator 2021

A down payment is a lump sum payment made when you purchase a home. The difference between the purchase price of the home and your down payment will become the amount of your mortgage.

The minimum down payment required depends on your home’s purchase price. The down payment amount that you make will also affect yourmortgage interest rateand smaller down payments can come with additional costs.

Note: In Ontario, the CMHC premium is subject to an additional 8% HST.

What Is Mortgage Affordability

Mortgage affordability refers to how much youre able to borrow, based on your current income, debt, and living expenses. Its essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term affordability is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but its important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Also Check: How Much Would A Million Dollar Mortgage Cost

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

How Much Would An $800k Mortgage Cost

So you are thinking about getting an $800k mortgage but want to know what exactly it will cost you.

There are many aspects to consider when applying for an $800,000 mortgage. This includes the down payment, monthly payments, interest rate, and mortgage length.

A 15-year $800k mortgage could save you a considerable amount of money compared to a 30-year mortgage when taking interest into account.

Below you will find how much you could expect to pay each month with various interest rates. On top of that, you will also find the different down payment options explained in detail so you can choose the best way to go about getting an $800,000 mortgage.

This post may contain affiliate links. For more information, see our disclosure policy.

Don’t Miss: How Long Does It Take To Get A Mortgage Commitment

Things You Should Know

1 Conditional approval requires a credit check and confirmation of the details provided in your application.Other conditions may also apply depending on the nature of your application.

The calculator is intended as a guide only and is not to be considered as an offer of finance by Westpac nor is it a recommendation or opinion in relation to the relevant products. It does not take into account your personal financial situation or goals. Calculated figures are based on the accuracy of the information entered.

Interest rates are subject to change without notice.Westpac’s home loan lending criteria and terms and conditions apply. An establishment charge may apply. A low equity margin may apply. An additional fee or higher interest rate may apply to home loans if the application is accepted but does not meet the standard lending criteria.

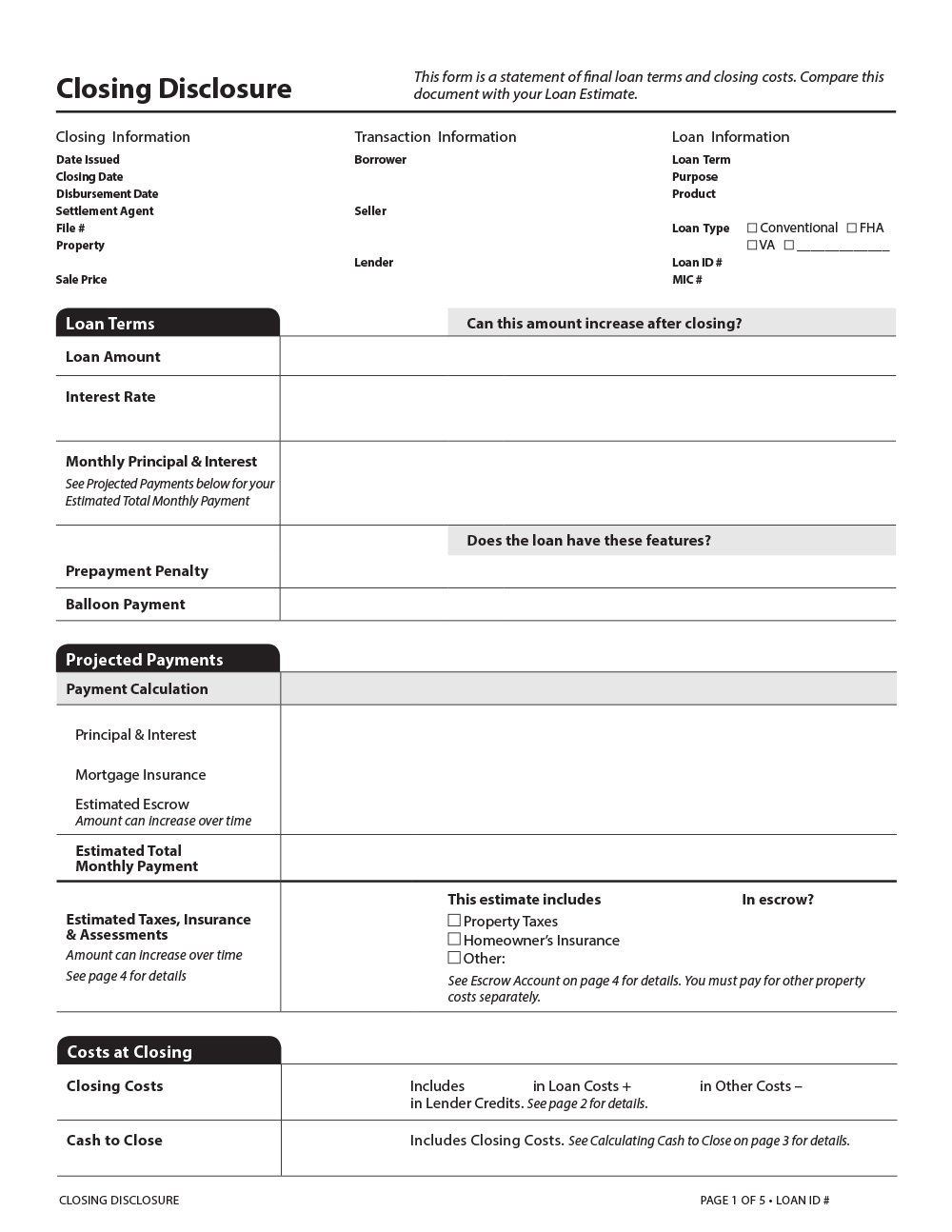

Documents and fees

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

Read Also: Who Has The Best Mortgage Loan Rates

How Do Interest Rates Affect Mortgage Repayments

Over the life of your loan, your interest rate will fluctuate in line with changes made to the official cash rate, or at the discretion of the lender. Any fluctuation in the interest rate impacts your mortgage repayments. If your interest rate is increased, youll be paying more interest on your loan while if your rate is cut, youll pay less.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Don’t Miss: How Are Interest Rates Calculated On A Mortgage

How Does Amortization Work On A$ 800 000 Mortgage

Amortization means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance. Estimate your monthly loan repayments on an $800,000 mortgage at a 4% fixed interest with our amortization schedule over 15 and 30 years.

$800000 House At 400%

| $2,133 |

Mortgage Tips

- Get a free copy of your to make sure there are no errors which might negatively affect your credit score.

- Shop around. Make sure to get multiple mortgage quotes. Over 30 years, a difference of 0.25% in APR might end up being over $10,000 in extra payments!

- Bigger down payments are better. You can often qualify for a mortgage with as little as 3.5% down. But, unless your down payment is at least 20%, you will likely have to pay Private Mortgage Insurance . This can add significant cost to the price of the mortgage.

Can I afford a $800,000 house?

Traditionally, the “28% rule” means a person should not spend more than 28% of their pre-tax income on total housing costs.

Let’s assume that taxes and insurance are 2% of the house price annually. Here’s how much you’d have to make to afford a house that costs $800,000 with a 4.00% loan:

| % Down |

|---|

Also Check: Can You Write Off Points On A Mortgage

Can You Afford A 80000000 Mortgage

Is the big question, can your finances cover the cost of a £800,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £800,000.00

Do you need to calculate how much deposit you will need for a £800,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

How Much Does Cmhc Insurance Cost

Your CMHC insurance cost is calculated as a percentage of your purchase price. The exact percentage depends on your down payment amount and decreases for larger down payments. Insurance premiums range from as low as 0.6% of the total mortgage for down payments of 35% or more, to as high as 4.00% of the total mortgage for down payments of 5%.

Using aCMHC insurance calculatorcan help you determine the cost of CMHC insurance premiums that will apply to you, along with applicable sales tax. Provincial sales tax is added to insurance premiums in Ontario, Quebec, Manitoba, and Saskatchewan.

Don’t Miss: How To Get Out Of Mortgage Insurance

Did You Know A Smaller Down Payment Can Lead To A Lower Mortgage Rate

Mortgages with a down payment of less than 20%, orhigh-ratio mortgages, usually have lower mortgage rates than low-ratio mortgages with a down payment of 20% or higher. This is because borrowers will pay for mortgage insurance , which offsets most of the risk to the lender. As a result, lenders often offer thelowest mortgage ratesfor low or minimum down payment mortgages.

Whats Your Working Situation

Generally, in order to gain approval for a £800,000 home loan, you will need to prove that you are in stable employment and earning enough to cover the repayments. Applicants who are self-employed, or those who have more complicated or inconsistent income structures, will need to produce more comprehensive proof of earnings, along with at least two years worth of accounts that have been checked and verified by a chartered accountancy firm.

Recommended Reading: How Often Do You Pay Your Mortgage

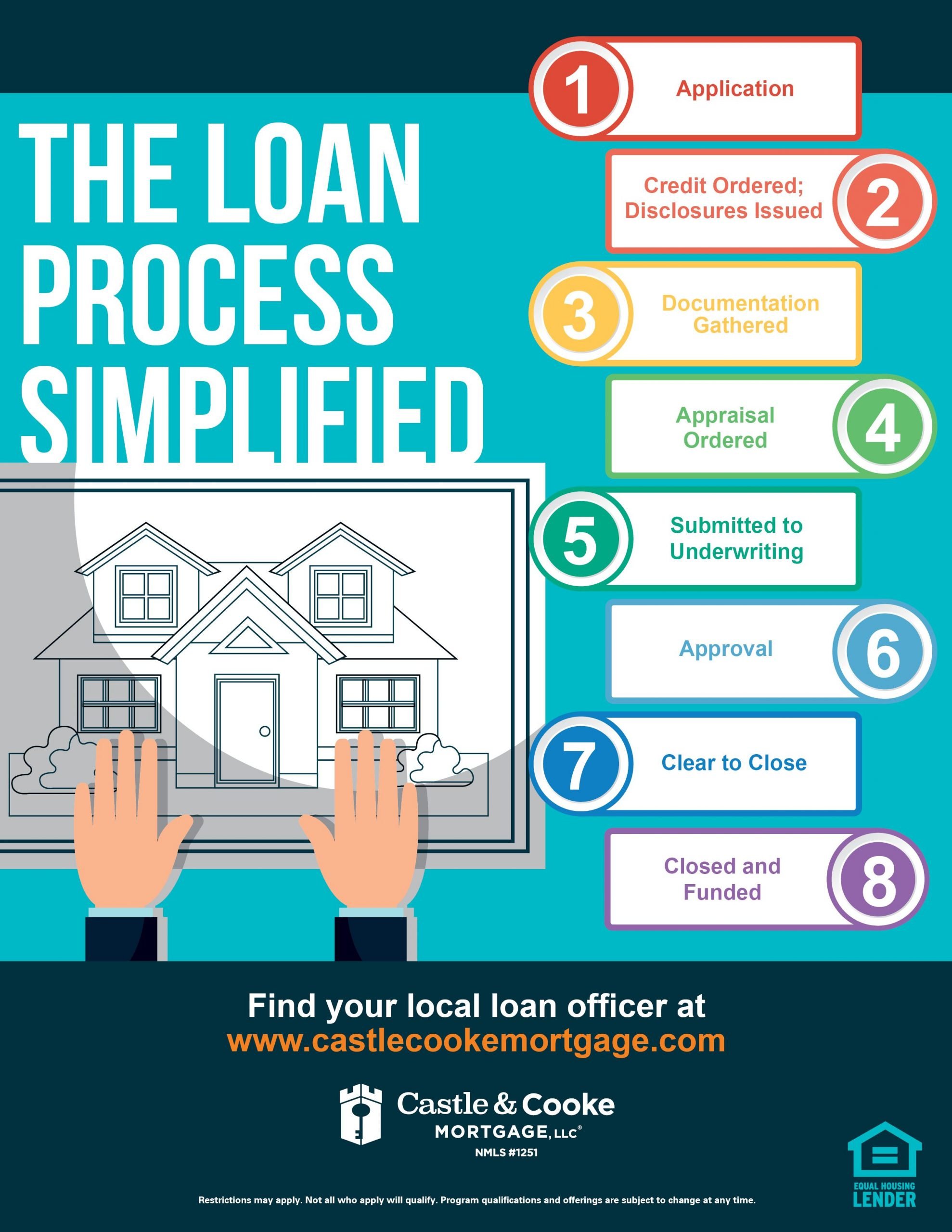

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

What Is A Minimum Down Payment

A down payment is the amount of money you put towards the purchase of a home. Your lender deducts the down payment from the purchase price of your home. Your mortgage covers the rest of the price of the home.

The minimum amount you need for your down payment depends on the purchase price of the home.

If your down payment is less than 20% of the price of your home, you must purchase mortgage loan insurance.

Table 1: The minimum down payment based on the purchase price of your home| Purchase price of your home | Minimum amount of down payment |

|---|---|

| $500,000 or less |

|

| $500,000 to $999,999 |

|

| $1 million or more |

|

If youre self-employed or have a poor credit history, your lender may require a larger down payment.

Normally, the minimum down payment must come from your own funds. Its better to save for a down payment and minimize your debts.

Also Check: How Do You Know If You Can Get A Mortgage

Your Down Payment Determines The Amount Of Cmhc Insurance You Pay

Your CMHC insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about CMHC insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| Total Payments over 25 Years | $402,726 | $377,991 |

|---|

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments, and/or debt repayments, for example, to make an informed decision.

Your Total Interest On An $800000 Mortgage

On a 25-year mortgage with a 3% fixed interest rate, youll pay roughly $335,789.20 in interest over the life of your mortgage. Thats almost half of what you borrowed in interest.

If you instead opt for a 15-year mortgage, youll pay roughly $193,151.29 in interest over the life of your mortgage or just over half of the interest youd pay on a 25-year mortgage.

-

See how much you’d pay in total interest based on the interest rate.

Interest $664,939.56

You May Like: Can You Add A Name To A Mortgage

Your Down Payment Influences The Home Price You Can Afford

Because the minimum down payment in Canada is 5%, this benchmark is used to determine your maximum affordability. Ignoring your income and debt levels, you can infer your maximum purchase price based on the size of your down payment. Because the minimum down payment is a sliding scale, the calculation depends on whether your down payment is more or less than $25,000.

If your down payment is $25,000 or less, your maximum home price would be: down payment amount / 5%. For example, if you have saved $25,000 for your down payment, the maximum home price you could afford would be $25,000 / 5% = $500,000.

If your down payment is $25,001 or more, the calculation is a bit more complex. You can find your maximum purchase price using: down payment amount – $25,000 / 10% + $500,000. For example, if you have saved $40,000 for your down payment, the maximum home price you could afford would be $40,000 – $25,000 = $15,000 / 10% = $150,000 + $500,000 = $650,000.

Naturally, as your affordability is also a function of your income and debt levels, you should visit our mortgage affordability calculator for a more detailed analysis.

Why Should I Use A Mortgage Repayment Calculator

A home loan is the biggest expense most people will ever have. Thats why its important to use a mortgage repayment calculator to work out how much your potential home loan repayments could be before applying for a loan, so you know how much you can afford to borrow.

A home loan repayment calculator can help you compare the costs of taking out a home loan and give you an idea of what your monthly repayments could be. Having an understanding of what your monthly repayments could be can help you to work out whether the loan is something you can afford, and what the total cost of the loan will be over the full loan term.

Also Check: What Does The Bank Need For A Mortgage

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Many Times Annual Salary For Mortgage