Joint Tenancy Means Equal Shares

Joint tenancy is appropriate only when each joint tenant owns the same percentage of the property. Thus, you and your partner can each own 50% of the house, or three people can each own one-third. But if you own 60% of a house and your partner owns 40%, joint tenancy won’t work. In that case, you’ll be tenants in common.

However, having one person provide most or even all of the down payment doesn’t mean you can’t be joint tenants. As long as you agree to own the house equally, joint tenancy will work fine. This can be accomplished if the person making the down payment gifts a half interest to the other or, more typically, if the more affluent partner agrees to lend the other his or her half of the down payment. If this is your plan, make sure that the loan is documented in a promissory note or a written agreement, as in some states a joint tenant has no right to a reimbursement unless the owners have a written agreement.

How Do You Borrow Money Against Land

While it’s possible to borrow against vacant land, it’s usually not easy. Banks like to make loans against collateral that not only has value, but can be easily converted into cash for them. Given this challenge, you may need to look at a different lender than the one you’d otherwise use for most types of loans.

How much does it cost to develop land for a house?

The average cost per square foot ranges between $1.28 and $2, so a half-acre lot of land could cost as much as $40,000 to prepare.

How do I start developing land?

Top 7 Tips for Developing Raw Land Have a Plan for Your Land. Know the Downside of Investing in Land. Prepare Yourself for Potential Drawbacks. Know the Total Cost of Your Purchase. Know When to Develop. Don’t Be Afraid to Hire Professionals. Choose a Good Location and Research the Property.

Should I buy land then build later?

Buy the land. On one hand, buying land first and building later provides more time to save funds for your home’s construction though if you are currently renting a home it can be a financial squeeze to juggle rent payments while also managing the repayments on a land loan.

Was this information helpful?

Seeking A New Mortgage

If you want to add another name to your mortgage, consider a new loan with another lender. For one, a new mortgage lender may offer you and your co-borrowers incentives when you apply for a mortgage loan on your current home. Mortgage lenders are competitive and a new lender may provide lower interest rates and discounts if you take a new mortgage out for your current home. Before getting rid of your old mortgage loan, though, check it for prepayment penalties.

Recommended Reading: What Were Mortgage Interest Rates In 2006

What Happens If Your Name Is On The Deed But Not The Mortgage

It is generally okay to have two names on title and one on the mortgage. If your name is on the deed but not the mortgage, it means that you are an owner of the home, but are not liable for the mortgage loan and the resulting payments. If you default on the payments, however, the lender can still foreclose on the home, despite that only one spouse is listed on the mortgage. So while you are not legally obligated to pay the mortgage, someone must pay it to avoid foreclosure. Other issues may arise in this case, such as the unnamed spouse being unable to take tax deductions on interest paid.

What Credit Score Is Needed For A Land Loan

Borrowers with between 500 and 570 will need to pay 10% down, while those with scores 580 and above may be eligible for the 3.5% down payment. Remember that lenders have their own requirements for eligibility, so their standards can be higher than HUD’s.

What you need to know about buying land? Here are the do’s and don’ts of buying vacant land: Do work with a pro who knows land. Do consider the value of homes in the neighborhood. Do take utilities and road access into account. Do consider incentives. Don’t expect to get a loan. Don’t skip the survey or environmental tests. Don’t talk to the neighbors.

Don’t Miss: Who Has The Best Mortgage Loan Rates

Can Three Names Be On A Mortgage

Yes. Because the mortgage is an agreement between you and the bank, you can list as many people on it as you would like. In reality, however, lenders typically see only two applicants for mortgages. The more people you add, the more complex and expensive it will be as each individual will need to be approved.

Adding Your Beneficiary As A Joint Owner With Rights Of Survivorship

If you own property in your name alone but want to pass it to your spouse outside of probate court when you die, you may wish to add your spouse to the title as a joint tenant with rights of survivorship.

In contrast to owning property as tenants in common, ownership structured as joint tenants with rights of survivorship means you each own an undivided interest in the property. When one joint tenant dies, ownership of the entire parcel passes to the remaining joint tenants.

Before you add adult children or others as joint owners, talk to a tax professional or an estate planning attorney to evaluate the potential pros and cons. There may be disadvantages that outweigh the potential benefit you hope to achieve.

Because of the complexities involved in real estate, you might be better off working with a licensed attorney in your jurisdiction who is knowledgeable about estate planning and real estate transactions, rather than trying to navigate the process yourself. Doing so may cost more, but it will provide you with peace of mind that your assets have been set up properly and as you wish.

This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the expression of author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

Protect your loved ones.

Don’t Miss: Will Mortgage Pre Approval Hurt Credit Score

How To Change Ownership Of Your Help To Buy Home

How you can add, remove or replace one or more homeowners, with a process known as a Transfer of Equity.

- From:

Making changes to your equity loan or mortgage

Before you make any changes to your equity loan or repayment mortgage, you need to understand how those changes may affect you. You should think about getting independent financial advice.

If you are paying monthly interest or management fees, you should keep making these payments.

Youll need to settle any outstanding payments, or set up a payment plan with us, before we can continue with your request to change ownership.

Domestic Partners And Taking Title To A Home

In some cities, counties, and states, unmarried couples can register as domestic partners some employers also provide benefits to registered domestic partners. Domestic partner registration won’t have any impact on who holds title, nor on any claim a non-owner might have, based on contributions to a partner’s property. The only effect it might have is on transfer taxes in some cities or counties. Check with your local County Recorder if this is an issue for you.

You May Like: How Much Mortgage 200k Salary

Contact Your Lender Before Changing The Title

If you plan to transfer a share in your property or renegotiate any mortgage, the first step is to contact your lender. Your lender will assess the financial situation of both parties and may or may not give you consent. If approval is given, your lender will most likely lodge all the documents.

- Both involved in the property have rights to the property, so each individual would have a claim on the property regardless of whose names appear on the deeds.

- Adding a long term partner. By adding a partner onto the mortgage, you will both get fair rights if the property is sold. If you initially purchased the property, it’s wise to protect your investment under a tenants in common arrangement. Speaking to a solicitor will help this process run smoothly.

Tenants In Common Get What You Deserve

If your partner will eventually invest 20% of the propertys value, while youre investing 80%, then you can arrange it so youll get the same shares back if you decide to sell the property. Of course, the slicing of the pie can get more complicated, but thats just the general principle.

As mentioned, you can define share of the property at the outset, which I think is the fairest way of doing it- you get back what you put in.

Disclaimer: I’m just a landlord blogger I’m 100% not qualified to give legal or financial advice. I’m a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Like this post? Then maybe you should so you receive more like it! You can also find me on and join .

About the Blogger

Hi. I’m a Landlord blogger I inconsistently share my useful and useless thoughts on Landlord life. I’ve been in the game for over a decade, but it feels a lot longer.

I try my best to help others as much as possible. Sometimes I’m successful.

To cleanse your sins, feel free to read more about me and my blog. If you like what I do, you may want to consider supporting my addiction .

Don’t Miss: Does Bank Of America Do Mortgage Loans

How To Add A Name To A Mortgage Title

Generally, the only way to add another persons name to any type of mortgage document is to refinance the loan. Some states use deeds of trust instead of mortgages to finance real estate transactions. In states in which you sign a deed of trust, also referred to as a mortgage, you are transferring the title to the property to a third-party trustee to hold as security until you pay off the loan in full. Lenders usually require that you add a co-borrowers name to the property deed before refinancing the mortgage.

Is It Hard To Get A Loan For Land

Land loansdifficultloansloanland

Is it better to buy land or house? Buying a vacant lot is an important and complex decision, just like any real estate purchase. If you buy a house, it’s probably so you can live in it but with land, you could choose to build your own house, use the property as a long-term investment or even to start up a business.

Read Also: Can You Get A Mortgage While In Chapter 13

I Am Getting A Divoce With A Mortgage In My Name Only What Happens

If the home was acquired before the marriage, it may potentially be individual property and not subject to division. If it was obtained during the marriage, however, it will generally always be community property despite whose name the mortgage and deed are in. Both spouses should reach an agreement in the separation agreement.

How To Add A Beneficiary To A Mortgage Deed

Regardless of its value, real estate may be a significant part of your overall estate. As you consider who you want to inherit your home and other real property after you die, it’s important to consider both the various methods of transferring ownership to someone else and the potential implications of those methods.

Adding a beneficiary to a mortgage deed may not be possible in every state, although some states have enacted legislation allowing transfer-on-death deeds. With these, the property passes to your named beneficiaries, subject to any outstanding mortgage.

Other options include passing your real estate to one or more named beneficiaries through your will, adding beneficiaries as tenants in common, or adding them as joint tenants with rights of survivorship.

You May Like: What Lender Has The Lowest Mortgage Rates

Will I Pay Stamp Duty

In some cases, may not be applicable when adding your partner to your property title. This is mainly for married, de facto and same sex couples.

Youll have to fill in an exemption form in order to take advantage of this exemption. You can obtain the form your state office of revenue or your state government website.

Carefully read the exemption requirements for your state. The devil is in the detail!

The definition of a partner is something that can vary between states. Particularly for de facto couples.

Before the exemption is realised, you must meet a number of conditions which can change from state to state. This is why its best to always check with your lender before adding in someones name to your property title.

You can learn more about stamp duty and exemptions from your state government website:

Joint Tenancy Is Often A Poor Substitute For A Will

Taking title to a house in joint tenancy is an effective way to pass it on to the survivor without going through probate . However, if you own a home by yourself, and want your partner to get it when you die, it’s rarely a good idea to change the title to a joint tenancy just to achieve this result. Here’s why.

First, by putting the house in joint tenancy, you immediately gift one-half of it to your partner, which may have tax consequences. Also, if you later split up, in most states you have no right to get that half back. Second, if your partner incurs debts, creditors can attempt to collect from his or her share of the equitysomething that wouldn’t be possible if the house were still in your name alone.

If you want your partner to get the house when you die, it is far better to make a will or living trust stating that desire. Then, if circumstances change, you can simply change the will or trust. For more on wills and trusts, see Nolo’s Estate Planning section,

Read Also: How To Recruit Mortgage Loan Officers

Do Both Owners Names Need To Be On A Mortgage

No you can have only one spouse on the mortgage but both on title. Both owners of the home, typically being spouses listed on the deed, do not have to both be listed on the mortgage. Remember that the mortgage does not indicate who the owner of the home is, so not being listed on the mortgage will have no effect on your ownership of the home.

In certain situations, having one spouse on the mortgage and both on the deed is ideal. This is oftentimes the case where one spouse has very poor credit, such that listing that spouse on the mortgage will result in a much higher interest rate than simply listing the other spouse alone. Listing only one spouse on the mortgage may save significant interest over the long term.

There are numerous other reasons to list only one spouse on a mortgage. Common reasons include:

- Income Requirements If including both spouses would cause the couple to fail the income requirements, perhaps because he or she has not had an income in the past few years, that spouse may be best left off the loan application.

- Timing It is oftentimes quicker to approve one spouse on a loan than both when time is of the essence.

- Limiting Credit Score Impact If there is a foreclosure and only one spouse is listed on the mortgage, only his or her credit score will be affected.

- Pending Divorce The spouses are pending divoce and one wishes to buy a home without the other.

Can I Take My Partner Off The Mortgage

Much like a husband cannot leave his wife out of his will, a spouse cannot take another spouse off of a mortgage. This is because the mortgage is an agreement between the spouses and the lender. If there is a default on the mortgage, the lender will look to both spouses for repayment. Removing one spouse means that the lender has one less avenue of collection. Because of this, a spouse can be taken off a mortgage only if the mortgage lender agrees or by refinancing the mortgage.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

How To Add An Owner To A Mortgage Deed At Closing

When you close on a home, you have no idea what the future will bring. Whether you stay in the house for a few years or a few decades, your circumstances will likely change. If you later get married or find a life partner, adding someone to a mortgage without refinancing isnt possible, but you can add someone to your deed.

TL DR

You cannot name additional parties on your mortgage loan, but you can add someone else to the property deed.

How To Add Someone To Your Mortgage

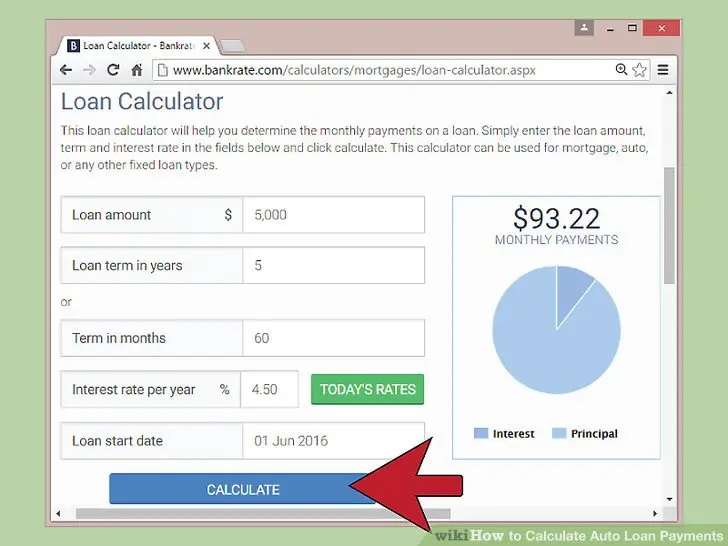

This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status. This article has been viewed 277,085 times.

Many people wish to add someone to their mortgage with a major life change, most commonly marriage. If you and your spouse are living together and sharing the rest of your expenses, why shouldnt you bear the legal and financial responsibilities of homeownership together? Unfortunately, your lender will probably not make it easy for you to do this. Moreover, it might not be in your best interests. If you do decide to go down this path, make sure you are armed with the right information.

Don’t Miss: How To Sell A Mobile Home With A Mortgage