How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. When youre ready to apply, compile necessary documentation like income verification and proof of assets and start shopping for the best rates.

Increase Your Credit Score

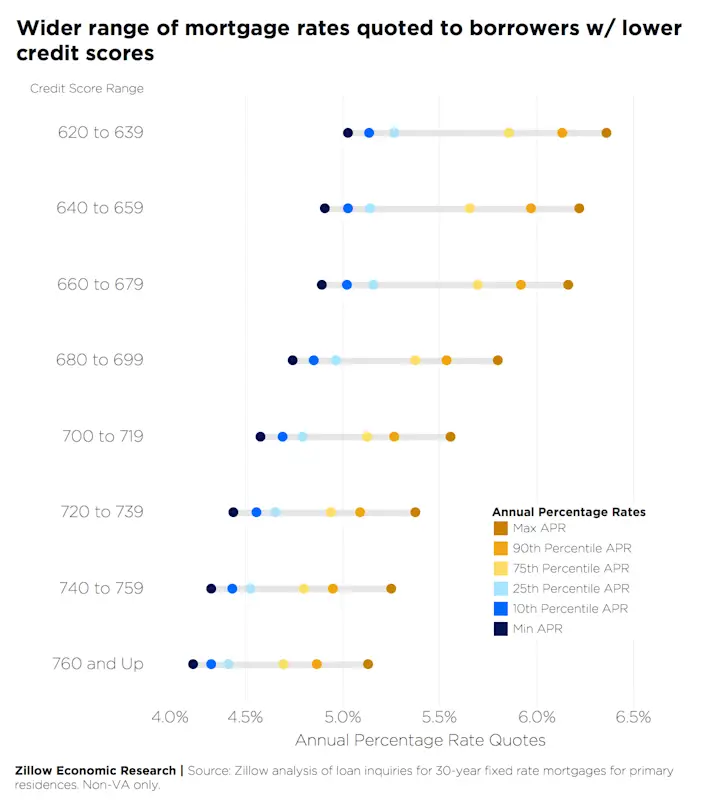

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Don’t Miss: How To Understand Mortgage Payments

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

Monthly Mortgage Payments By Region

The census data we reviewed allowed us to compare mortgage payments across different regions of the country. We found that median payments in 2015 were roughly 35 to 40 percent higher for Northeast and Western states than in the Midwest or the South.

| Region | |

|---|---|

| $75,520 | $180,000 |

While mortgage interest rates were similar for all regions, this did not correlate with similarities in payment amounts. In the wealthiest regions of the country, the Northeast and West, consumers had larger outstanding balances on their mortgages and made higher monthly payments. In the South, where median annual income was the lowest, mortgages had the highest interest rates, leading to payments slightly higher than in the Midwest.

You May Like: How To Purchase A House That Has A Reverse Mortgage

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

What Does Average Represent

The U.S. Census Bureau reports both the mean and the median payment. The mean is the same as average. The median is the middle value in a set of numbers. It divides the lower and higher half of values in the set.

When figuring out a typical monthly mortgage payment, finding the median value can be more useful than finding the average value. Averages can get skewed by extremely high or low values. The median gives a better idea of where the middle is for a broad range of homeowners.

National averages: Looking at averages from another data source, the 2020 National Association of REALTORS Profile of Home Buyers and Sellers, shows a national median home price of $272,500. If we assume a down payment of 10% of the purchase price, we can calculate a loan size of $245,250. Applying current mortgage loan rates, you can estimate the following average monthly mortgage payments:

- $1,700 per month on a 30-year fixed-rate loan at 3.29%

- $2,296 per month on a 15-year fixed-rate loan at 2.79%

First-time homebuyers: The national averages include all homeowners, including those who have built up equity, worked their way up the pay scale and established high credit scores. Those folks are more likely to take on larger loans and get approved for them.

- $1,307 per month on a 30-year fixed-rate loan at 3.29%

- $1,760 per month on a 15-year fixed-rate loan at 2.79%

- $1,077 per month on a 30-year fixed-rate loan at 3.29%

- $1,466 per month on a 15-year fixed-rate loan at 2.79%

Also Check: What Is A Good Dti For A Mortgage

What Determines A Mortgage Interest Rate

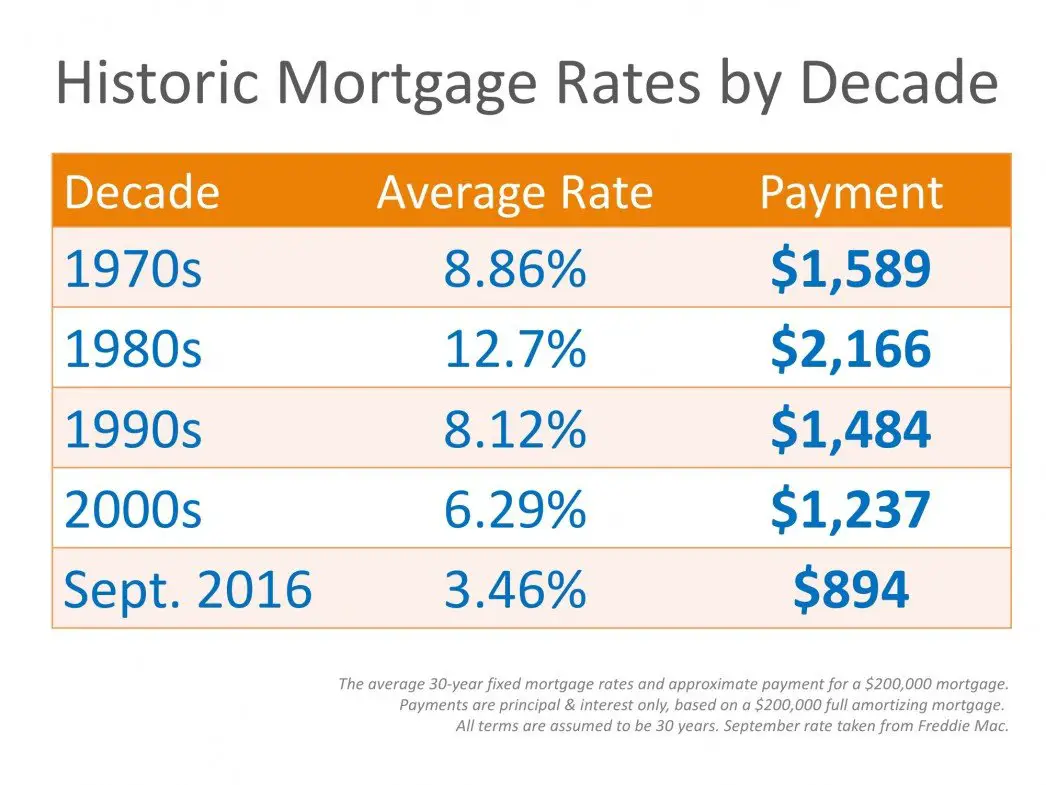

Interest rates are determined by a multitude of factors but are affected mainly by the RBA official cash rate which as of July 2021, is sitting at a historically low 0.1%. The cash rate is the rate charged by the RBA to lend money to banks then, the banks pass this interest rate on to their customers . As demonstrated by lowering interest rates in response to the COVID19 pandemic, the RBAs cash rate is adjusted to complement and strengthen the current economy.

Personal factors will also influence your interest rate, including whether you choose a fixed or variable rate, your loan term, loan amount and your .

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Don’t Miss: How To Determine Ltv Mortgage

Example: How To Calculate Your Minimum Down Payment

The calculation of the minimum down payment depends on the purchase price of the home.

If the purchase price of your home is $500,000 or less

Suppose the purchase price of your home is $400,000. You need a minimum down payment of 5% of the purchase price. The purchase price multiplied by 5% is equal to $20,000.

If the purchase price of your home is more than $500,000

Suppose the purchase price of your home is $600,000. You can calculate your minimum down payment by adding 2 amounts. The first amount is 5% of the first $500,000, which is equal to $25,000. The second amount is 10% of the remaining balance of $100,000, which is equal to $10,000. Add both amounts together which gives you total of $35,000.

What Is The Average Monthly Mortgage Payment In The Us

The average monthly mortgage payment in the United States is $1029*.

This payment eats up 14.84% of the typical homeowners monthly income. That may seem low, but we are looking at homeowners specifically and homeowners tend to have much higher incomes than the general population, as we note later in this piece. When you add in other housing costs such as property taxes, association dues, utilities and maintenance costs, the median cost of housing jumps to $1,491 for homeowners with a mortgage.

On average, first-time homebuyers face higher monthly payments than the national average. According to research from the Urban Institute, in early 2018, first-time homebuyers bought houses worth $245,320 with an average down payment of $22,561, and an interest rate of 4.43%. Given these figures, first-time borrowers faced a mortgage payment of $1,235 21% more than the average homeowner.

Of course, a homeowners actual mortgage costs depend on a variety of factors, including when a homeowner purchased a home, where the home is located and the terms of the loan. Additionally, the affordability of a monthly mortgage payment depends the cost of the mortgage relative to a homeowners income.

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

Whats The Average Mortgage Payment

We dont want to waste your time, so lets get down to business. The median monthly mortgage payment is just over $1,600, according to the U.S. Census Bureau.1 That can vary of course, based on the size of the house and where you live, but thats the ballpark number.

If youre the kind of person who doesnt need to know how we came up with the number $1,600, feel free to skip to the next section. But if you want more detailsincluding how to calculate your own average paymentread on!

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you have a VA loan and pay the funding fee upfront.

Don’t Miss: How Much Interest Do I Pay On A Mortgage

The Caveat: Average Mortgage Payments Don’t Really Matter

Its important to keep in mind that statistics are just broad, overall trends. The truth is, every mortgage payment is unique. Two homebuyers with identical properties can have very different payments, whether theyre across the country from each other or just down the street.

Thats because mortgage payments are based on a whole slew of factors that vary from one buyer to another. Here are just a few of the things that can make one homeowners mortgage payment different than the next:

- Down payment size

| $1,100 | $1,450 |

In this scenario, Buyer A has a stellar credit score of 760. She qualifies for a 3.75% interest rate as a result. And she makes a 20% down payment of $60,000. Not including property taxes and home insurance, shed see a monthly mortgage payment of $1,111.

On the other hand, Buyer B has notsogreat credit . He qualifies for a 4.25% interest rate and puts down just 10% . His mortgage payment would come out to $1,443 .

Thats a difference of $332 per month or $3,984 per year. Buyer B would also see significantly more paid in interest over the life of the loan.

How To Lower Your Monthly Mortgage Payment

Mortgage payments are highly flexible. If youre worried that your home purchase may result in a toohigh monthly cost, there are quite a few ways to lower it and make homeownership more affordable.

You can:

- Apply with a cosignerwho has great credit and a low DTI

- Make a down payment large enough to avoid PMI

To get a feel for what your average monthly mortgage payment could be, check out our mortgage calculator. To get personalized rate quotes, check out the vetted mortgage lenders below.

Don’t Miss: Who Has The Best Mortgage Loan Rates

This Is The Average Us Mortgage Payment Can You Swing It

by Maurie Backman | Updated July 19, 2021 – First published on June 18, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Here’s what the typical homeowner pays each month for a mortgage. Does it sound affordable to you?

Housing is the typical American’s largest monthly expense. And taking on too high a mortgage payment could wreck your finances and lead you to rack up a lot of debt.

But what’s considered too high? The average U.S. homeowner spends $1,067 a month on a mortgage payment, according to the National Association of Realtors. That’s a pretty big jump, however, from the average monthly payment of $995 one year ago.

The reason for that increase? Home prices have soared over the past year as low mortgage rates and limited inventory have pushed buyer demand through the roof. As such, a lot of recent home buyers may have taken on higher payments that are skewing the national average upward — and that’s with mortgage rates being extremely competitive over the past several months.

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

You May Like: What Score Do Mortgage Companies Use

How Much Money Should Mortgage Repayments Be As A Percentage Of Income

The amount of income directed towards your mortgage depends on your loan size, budget, interest rates, income, and more. However, the general rule is 28% of your income should be funnelled into your mortgage. Anything above that amount, the average earner might find their financial situation a little uncomfortable.

However, this is just a general rule, and your finances may allow for a bigger or smaller percentage. So, budget wisely and seek professional financial advice before deciding how much to borrow and how much you can spend on repayments.

How To Get A $150000 Mortgage

Applying for a mortgage isnt as hard to come by as most people think. It just takes a little preparation. Using a tool like Credible puts that $150,000 loan well within reach.

Here are the steps youll want to follow to get a mortgage and buy that dream house:

Credible makes getting a mortgage easy

Also Check: Can You Get A 30 Year Mortgage On Land