Mortgage Points Explained In 5 Minutes Or Less

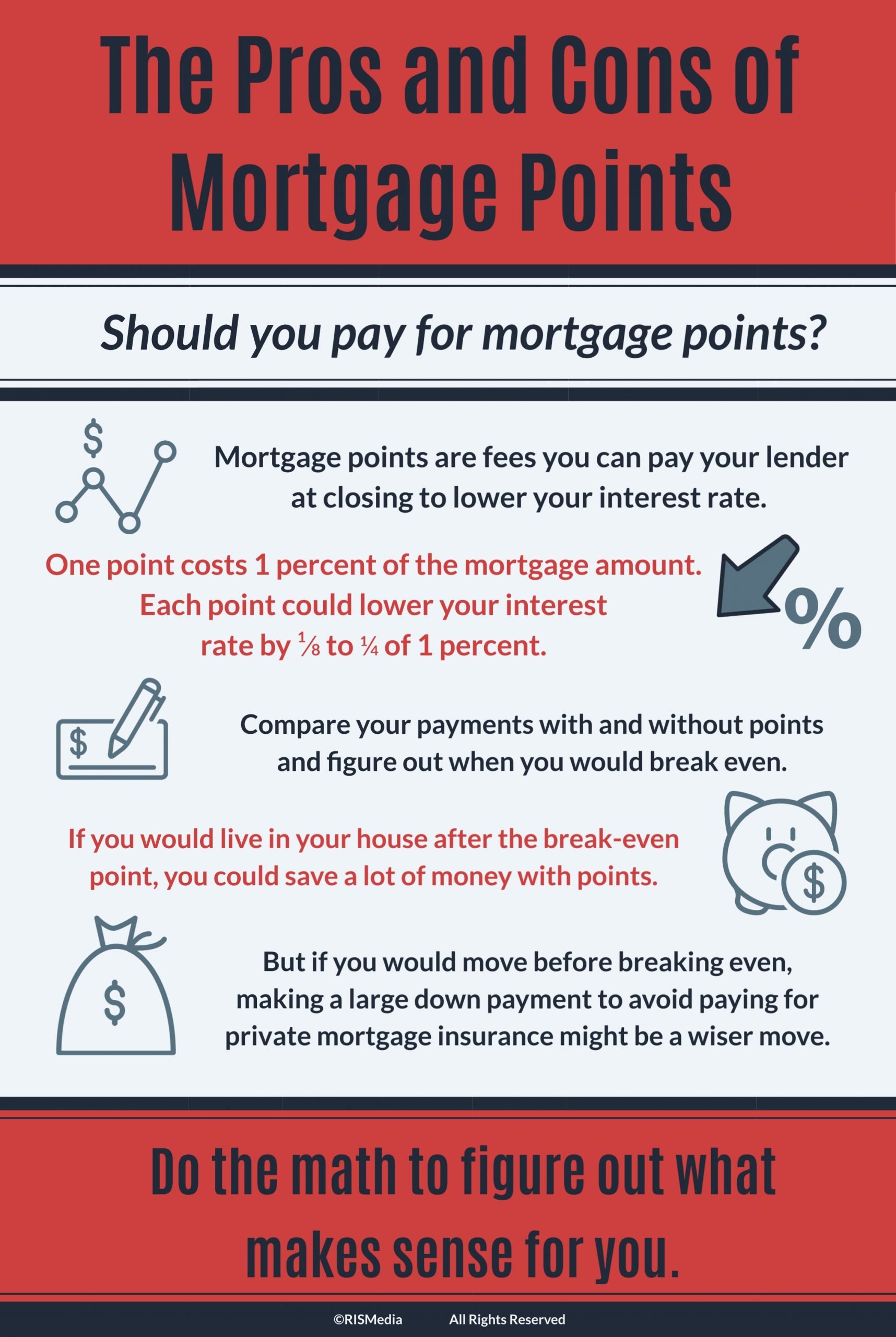

Mortgage points are typically paid at closing to bring down your mortgage interest rate in the long term. Consumers who want to pay less interest overall and who intend to pay off a mortgage loan for many years can often save money with mortgage points.

Whether zero, one, or more mortgage points make sense for you and your mortgage loan depends on a number of factors, including how long you plan to keep your mortgage loan. In this guide, learn how to evaluate mortgage points and decide if they are the best option for your mortgage loan.

How Much Is A Mortgage Point

One point equals 1% of your loan amount. For example, one point on a $300,000 loan would cost you $3,000. Any points you find listed on Page 2, Section A of your loan estimate or closing disclosure must buy you a lower interest rate by law, according to the Consumer Financial Protection Bureau .

Shopping for the lowest rate for the mortgage points you pay is especially important. Lenders set their own interest rate pricing structures, so make sure you collect at least three to five rate quotes to compare.

Should I Pay For Mortgage Discount Points

Paying discount points to get a lower interest rate can be a great strategy. Lowering your rate even just 25 basis points could save you tens of thousands over the life of the loan.

But theres a catch. You have to keep your mortgage long enough for the monthly savings to cancel out the cost of buying points.

Luckily, the math is simple you can find out if points are worth it in just a few minutes. At todays low rates, there are great deals to be had with or without discount points.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

Mortgage Points And Closing Costs Explained

Lisett Comai-Legrand About The Author

A mortgage point is the amount equal to 1% of the mortgage loan amount. For example, lets say that you take out a loan of $400,000, one point will be $4,000. This article explains mortgage points and closing costs, and offers a few tips to avoid paying them.

First of all, there are two kinds of mortgage points:

- Discount Points

Discount Points

Discount points are a type of pre-paid interest, and is given directly to the lender at closing for the reduction of the interest rate on your mortgage loan. So, the more points you pay, the lower the interest rate goes on the loan. You can pay up to 3 or 4 points, depending on how much you want to lower the rate.

Origination Points

An origination point is a fee that is charged by the lender to cover the processing of the loan. This fee is mostly a percentage of the loan amount rather than a fixed dollar amount.

How do you decide how many points you need, and how you should pay for them?

This is dependent upon factors like how much money you have at hand for closing costs and how long you plan to stay in the house. If you are planning to stay in your home for some time, using points to reduce the interest rate may be a better approach. If you are looking for the lowest possible closing rate, then you should opt for a zero-point option on the loan program.

Should You Pay for the Discount Points?

Closing Costs

Closing Cost Charges

Often the following costs are included:

Alternatives To Mortgage Points

There are many alternatives to mortgage points, including refinancing your mortgage when you qualify for a lower interest rate, if your main goal is to save on interest.

Youll pay a lower cumulative amount of interest on your loan if you pay down your mortgage quickly with extra payments, provided that you dont incur any prepayment fees. Paying discount points usually doesnt make sense if this is your plan. You’ll reap more benefits from prepaying interest if youre paying on the loan for a longer term.

Don’t Miss: How Much Is Mortgage On 1 Million

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

What Are The Disadvantages Of 30

The biggest disadvantage of a 30-year fixed rate mortgage is that its more expensive over time than a shorter term loan. Lets compare it to a 15-year fixed rate mortgage as an example. The 30-year fixed mortgage is more expensive not only because the interest rate on a 30-year fixed loan is higher than a 15-year fixed loan, but also because youll pay more interest over time since youre borrowing the money for twice as long. Additionally, spreading the principal payments over 30 years means youll build equity at a slower pace than with a shorter term loan.

You May Like: Reverse Mortgage For Condominiums

When You Take Out A Mortgage Your Lender Offers You An Interest Rate Based On Several Factors Including Market Rates And Your Credit Profile

Lenders also offer you the opportunity to pay for a lower your mortgage rate by buying mortgage points, sometimes called discount points.

Points are priced as a percentage of your mortgage cost. Each point you buy reduces your interest rate by a certain amount that will vary by lender. Buying points makes financial sense when you stay in your home long enough, because you can save more on interest over time than you paid for the point.

Keep reading to learn how mortgage points work so that you can decide if buying points makes sense for you.

The Bottom Line: Mortgage Points Can Save You Money

Though mortgage points and prepaid interest may be right for some borrowers, they dont make financial sense for everyone. To determine whether you can save with discount points, you have to crunch the numbers. Sit down and assess your budget, down payment, loan terms and future plans before you close. Determine your breakeven point and your likelihood of staying in the home to understand if discount points will save you money in the long run when refinancing or buying a home.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: Rocket Mortgage Loan Types

What Are Todays Interest Rates

Current mortgage rates depend in part on what youre willing to pay for your home loan. In general, the more you pay, the lower your interest rate should be.

And remember, the lowest rate isnt always the best deal. A good loan professional should be able to help you sort through your options and choose the lowestcost program for your needs.

Should You Buy Points

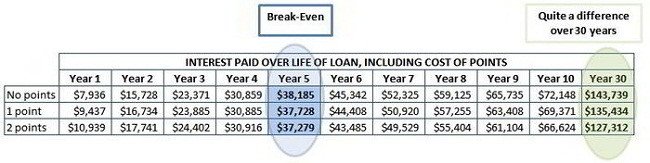

If you can afford them, then the decision whether to pay points comes down to whether you will keep the mortgage past the “break-even point.”

The concept of the break-even point is simple: When the accumulated monthly savings equal the upfront fee, you’ve hit the break-even point. After that, you come out ahead. But if you sell the home or refinance the mortgage before hitting break-even, you lose money on the discount points you paid.

The break-even point varies, depending on loan size, interest rate and term. It’s usually more than just a few years. Once you guess how long you’ll live in the home, you can calculate when youll break even.

» MORE:‘Should I buy points?’ calculator

Don’t Miss: Rocket Mortgage Qualifications

What Are Mortgage Discount Points And Should You Pay For Them

Mortgage lenders earn thousands of dollars every time they close a loan. Although they earn that money in many different ways, one is by charging borrowers upfront fees called points.

Dont want to pay points among your closing costs? And when is it worth paying for points in exchange for a lower interest rate? Read on to find out how mortgage points work.

Is Paying A Loan Discount Fee Is Worth It

Paying a loan discount fee is only worth it for buyers in certain situations. To decide if it is right for you, youll first need to find the break-even point. This is the point at which youll start seeing the benefits of the extra savings eclipse your original upfront investment.

Discount fees become more beneficial the longer that you stay in the house. If you are only planning to live in your new home for a few short years, then it might not be worth it.

You also want to avoid letting your discount fees cut into the amount you put towards your down payment since this also affects how much interest you pay over time.

Are you curious about when youll hit the break-even point if you purchase discount points? Working with one of our home loan specialists can help you decide if this opportunity will benefit you during the home purchasing process.

Recommended Reading: Bofa Home Loan Navigator

What Are The Benefits

Buying discount points lowers your interest rate on the loan. This will make your monthly house payments more affordable. You will pay a little more now to save larger amounts of money down the road.

The amount of savings that you get on the interest rate varies with each lender. On average, you can expect to see the rate lower by about .25% for each point that you purchase. Keep in mind that most lenders place a cap on how many points you can purchase. Usually, you can buy anywhere between one to three points. The idea is to save on interest, but you cant eliminate it entirely.

There may also be potential tax benefits if you choose to purchase points. Loan discount fee payments are considered to be prepaid mortgage interest. Depending upon your tax-filing status and financial standing, this could be tax-deductible.

When Will You Break Even After Buying Mortgage Points

To determine if it’s a good idea to pay for points, compare your cost in points with the amount you’ll save with a lower interest rate and see how long it will take you to make your money back. If you can afford to pay for points, then the decision more or less boils down to whether you will keep the mortgage past the time when you break even. After you break even, you’ll start to save money. The break-even point varies, depending on your loan size, interest rate, and term.

Example. As in the example above, let’s say you get a 30-year loan of $300,000 with a 3% fixed interest rate. Your monthly payment will be $1,265. However, if you buy one point by paying $3,000, and your rate goes down to 2.75%, the monthly payment becomes $1,225. So, divide the cost of the point by the difference between the monthly payments. So, $3,000 divided by $40 is 75, which means the break-even point is about 75 monthsmeaning you’d have to stay in the home for 75 months to make it worth buying the point.

As you can see, the longer you live in the property and make payments on the mortgage, the better off you’ll be paying for points upfront to get a lower interest rate. But if you think you’ll want to sell or refinance your home within a couple of years , you’ll probably want to get a loan with few or no points. Check the numbers carefully before you pay points on a loan because you might not recoup the cost if you move or refinance within a few years.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

Example: How Discount Points Work

Say you arrange a 30-year fixed-rate mortgage in the amount of $200,000 with a 5% interest rate. You want an interest rate of 4.5%, so you pay $4,000 for discount points . Paying for those two points reduces your rate by .5% and brings the rate down to your desired 4.5%. That $4,000 you pay at closing lowers your monthly mortgage payment from $1,073.64 to $1,013.37, which saves you $60.27 each month. You get lower mortgage payments each month, but you pay more at closing. That’s the tradeoff.

On the flip side, “negative” discount points, sometimes called “rebates” or “yield spread premiums,” reduce the amount of cash you need to pay at closing. But then you have to pay a higher interest rate.

Another kind of mortgage points are “origination points” These points don’t have anything to do with the loan’s interest rate. Instead, origination points are fees you pay to the lender in exchange for providing and processing the loan. Another name for origination points is “origination fees.”

What Are Points And Lender Credits And How Do They Work

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years. Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount, whether or not you receive a lower interest rate. Some lenders may also offer lender credits that are unconnected to the interest rate you pay for example, as a temporary offer, or to compensate for a problem.

The information below refers to points and lender credits that are connected to your interest rate. If youre considering paying points or receiving lender credits, always ask lenders to clarify what the impact on your interest rate will be.

Points

Points let you make a tradeoff between your upfront costs and your monthly payment. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

Lender credits

See an example

When comparing offers from different lenders, ask for the same amount of points or credits from each lender.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Should You Buy Discount Points

For lenders, discount points have a distinct advantage: They receive cash up front, instead of having to wait for money in the form of interest payments over time. This can enhance the financial institutions liquidity.

Borrowers also gain benefits from discount pointsthe main one being lower payments over the life of your loan. Basically, you are paying some interest in advanceat the onset of your mortgagein exchange for a decreased interest rate down the road. However, this benefit applies only if you plan to hold onto the mortgage long enough to save money from the smaller interest payments.

For example, a borrower who pays $4,000 in discount points to save $80 per month in interest charges needs to keep the loan for 50 months, or four years and two months, to break even. If the borrower thinks they might sell the property or refinance their loan before 50 months have passed, then they should consider reducing what they pay in discount points and taking a slightly higher interest rate.

Mortgage Loan Discount Points Definition

Discount points, often known as mortgage points or simply points, are a type of prepaid interest offered by mortgage lenders in the United States. One percent of the loan amount is equal to one point. A lender effectively boosts the yield on a loan above the amount of the quoted interest rate by charging a borrower points. Borrowers can offer to pay points to a lender in order to lower the loans interest rate, resulting in a lower monthly payment in exchange for this up-front payment.

Read Also: Requirements For Mortgage Approval

You Could Get A Tax Break

Another upside of discount points is that they can give you a nice tax break, provided you meet certain requirements.

Any interest you prepay on your mortgage is tax deductible on the year you pay it, at least for the first $750,000 you borrow.

However, there are some terms and conditions for that tax break. Make sure you read the fine print and speak with a trusted financial adviser before buying points in the hopes of getting a tax break.

Whats That In Dollars

Say youre getting a 30year, fixedrate mortgage of $300,000 with 5% down.

Someone with the lowest of those APRs would pay around $128,000 in interest over the life of the loan.

But someone whose score is in the 620639 range would pay closer to $218,900 in total interest payments for the same home price. So over time, what might look like a relatively small rate difference can add up to huge savings.

Don’t Miss: Rocket Mortgage Conventional Loan

Who Should Buy Points

People who are likely to keep their current mortgage for a long time. They would have the following attributes:

- Likes the local area and plans to live in the area for at least a half-decade or more.

- Stable family needs, or a home which can accommodate additional family members if the family grows.

- Homebuyer has good credit & believes interest rates on mortgages are not likely to head lower.

- Stable employment where the employer is unlikely to fire them or request the employee relocate.