How Much Do Mortgage Brokers Make

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A mortgage broker is a licensed professional who gathers borrowers’ financial documentation, compares rates, and connects them with lenders to facilitate a home purchase or refinance an existing mortgage.

Using a broker is entirely optional, and many buyers prefer to just work with lenders directly. However, for borrowers who want guidance from an industry pro, a mortgage broker can be a helpful resource that generally costs a small percentage of the loan amount.

How Much Can An Entry Level Mortgage Loan Originator Make

Related

Mortgage loan originators, also known as loan officers, are responsible for making decisions about issuing mortgages to consumers. They typically have backgrounds in banking and business finance, and, depending on their employer, may take full responsibility for approving a mortgage loan from initial application to final approval and disbursement. The job requires careful attention to detail and a willingness to thoroughly investigate all information provided on applications.

How Much Money Do Brokers Make

Because a broker’s job is commission-based, they are paid by the transaction. So, for example, a broker who charges a 2% rate to close a loan valued at $250,000 would earn $5,000.

Factors like the local real estate market and the broker’s experience level can significantly impact how much they earn. For example, according to ZipRecruiter, the average annual salary for a mortgage broker in Alabama is $61,458, while the average broker in Hawaii makes $81,487.

A qualified mortgage broker must complete 20 hours of coursework and take the SAFE Mortgage Loan Originator Test. This exam consists of 120 questions covering federal law, state laws and regulations, mortgages and mortgage loan origination activities, and ethics.

Don’t Miss: Rocket Mortgage Vs Bank

Mortgage Loan Officer Education Requirements

Since mortgage loan officers analyze the finances and credit of potential borrowers, a good place to start is a bachelors degree in business or finance. During your coursework, youll learn some accounting skills, including the ability to read financial statements.

If you need help getting started, check out these mortgage loan officer scholarships. They can help to cover some of the costs of your education so that you can focus on preparing for your career.

You dont always need a bachelors degree to land a job as a mortgage loan officer. Some banks will hire candidates who have several years of hands-on banking, customer service, or sales experience and are willing to learn on the job.

How To Compare Mortgage Loan Offers

When you apply for a loan, the lender must give you a loan estimatea government-mandated form that details the terms of the mortgage it is offering you. That includes the amount, type, and term of the loan, as well as projected closing costs, your monthly payment, and the annual percentage rate.

You can ask for loan estimates from multiple lenders and compare their offers side by side. But note that loan estimates are typically valid for just 10 days, after which the terms may change. A mortgage calculator can be a good resource to see how different rates affect your monthly payment.

You May Like: Can I Get A Reverse Mortgage On A Condo

Frequently Asked Questions About A Mortgage Loan Officer Salaries

The national average salary for a Mortgage Loan Officer is $43,241 per year in United States. Filter by location to see a Mortgage Loan Officer salaries in your area. Salaries estimates are based on 2495 salaries submitted anonymously to Glassdoor by a Mortgage Loan Officer employees.

The highest salary for a Mortgage Loan Officer in United States is $81,226 per year.

The lowest salary for a Mortgage Loan Officer in United States is $23,020 per year.

How Does A Lender Get Paid

Lendersmoneylendersmake moneylendersmake money

. Just so, how much do mortgage lenders make on a loan?

According to the US Bureau of Labor Statistics , the median pay in 2015 for loan officers of all kinds commercial, consumer, and mortgage was $63,430 per year. The lowest ten percent earned less than $32,870, and the highest ten percent earned more than $130,630. Loan agent compensation varies widely.

Also Know, do loan officers make good money? Loan Officers made a median salary of $63,040 in 2018. The best-paid 25 percent made $92,240 that year, while the lowest-paid 25 percent made $44,500.

Also know, how much profit does a bank make on a mortgage?

The monthly mortgage payment, 6% of $200,000, is $1,199. However, when adding in the origination fee of $4,000 and dividing it out over the 30-year loan, the payments increase by $11.11 per month for a total monthly payment of $1,210. Overall, the homeowner pays an 8% interest rate rather than the perceived 6% rate.

Do loan officers get commission?

Mortgage loan officers typically get paid 1% of the total loan amount. We explore the reasons why loan officer commission is bad for consumers. In return for this service, the typical loan officer is paid 1% of the loan amount in commission. On a $500,000 loan, that’s a commission of $5,000.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

But It Has An Advantage Right

Yes, working for these big banks and credit unions and other higher financial institutions do have an advantage over those working alone pay wise. They might get a small base salary ad some other benefits like insurance and so on. As mentioned earlier, they get provided with clients, so they dont have to start chasing after new businesses or engaging in self-marketing.

If you get to work for a wholesale mortgage lender, the commission is even lower. Sometimes, it can go lower than 10 basis points per loan.

Mortgage Loan Officer Earning Potential

Your earning potential as a Mortgage Loan Officer can increase as you gain experience and develop your career with additional education. Other factors that will impact your earnings as an MLO include the state in which you do business and the fluctuation of the mortgage market. A whopping 36% of full-time MLOs make above the national average salary, earning up to $181,000 per year.

With unlimited earning potential and the chance to gain experience and education as you go, becoming a Mortgage Loan Officer can unlock a lucrative and stable career path.

Also Check: Mortgage Recast Calculator Chase

What Is A Mortgage Loan Originator

Mortgage loan originators, loan processors, and underwriters are all part of a team of mortgage professionals involved in creating a home loan.

One of the most important people in the process is the mortgage loan officer. Or, as theyve become more commonly known, a mortgage loan originator .

A mortgage loan originator typically works for a bank or mortgage lender and helps mortgage borrowers in the application process.

A mortgage originator can help you find the right type of loan, as well as the best mortgage terms for you.

Do You Need A Degree To Become A Mortgage Loan Officer

A person seeking to become a mortgage broker must be at least 18 years old. A bachelor’s degree and some experience in finance and sales is helpful to becoming a mortgage loan officer, but is not required. … All state-licensed loan originators must pass a national exam – required under the SAFE Act.

Don’t Miss: Who Is Rocket Mortgage Owned By

Loan Officer Salary Can Vary Widely

- Similar to a real estate agents salary, a loan officers take home pay can range dramatically

- It all depends on how much you sell/close in a given year

- If youre a top loan officer, you can make a ton of money

- If youre just an average or underperforming LO, expect comparably lower salaries

Wondering how much a loan officer makes an hour? Or what the average mortgage loan officer salary is?

Well, take note that most loan officers do not receive a base salary, only commission, so they are paid for performance. Sales performance.

The median income for a loan officer in the United States was $63,650 in 2016, according to the Bureau of Labor Statistics . That works out to an hourly wage of $30.60 per hour, which isnt terrible by any stretch.

My assumption is that the number wont change a great deal in 2017 or beyond, not that I would focus on the numbers from the Bureau of Labor Statistics anyway.

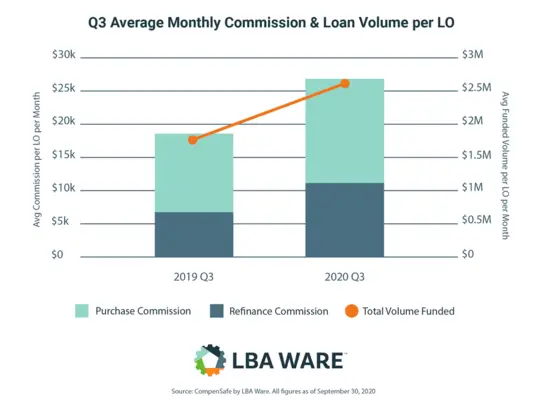

A better gauge might be the quarterly reports from a company called LBA Ware, which has a ton of data on loan officer compensation.

They said the average LO produced 51% more in volume during Q3 2020 versus $1.7M per month in the same period in 2019.

And per-loan commission was 106 basis points in the third quarter of 2020, meaning the average LO made over $27,000 per month.

That works out to over $300,000 annually if theyre able to keep that up consistently.

If you break that down as an hourly wage, it could be very high if loan volume is solid and efficiency is high as well .

Sales Experienceearn +1060% More

The jobs requiring this skill have decrease by 15.46% since 2018. Loan Officers with this skill earn +10.60% more than the average base salary, which is $179,928 per year.

| Number of job openings on Indeed requiring this skill | Change from previous year |

|---|

More critical skills and qualifications that pay well

Recommended Reading: Chase Recast

How Much Do Mortgage Loan Officers Make Per Loan

Although compensation can vary greatly, lenders who provide leads pay less but connect the mortgage to prospective customers while mortgage loan officers that develop and maintain referral relationships and cultivate their own leads can make just under or above 1% of the loan amount. Take a $400,000 mortgage loan and this can translate to $4,000.

Do Mortgage Loan Originators Receive A Commission

Most mortgage loan originators receive a commission on the loans they originate. The size of the commission and how it is calculated differs for each financial institution. Larger banks tend to pay their mortgage loan originators a salary plus a small percentage of the final mortgage amount. Smaller banks might pay a salary plus a percentage of the fees.

You May Like: Can You Do A Reverse Mortgage On A Condo

How Long Does It Take To Become A Mortgage Loan Officer

It depends on your level of education and experience. If you dont have an undergraduate degree or any banking experience, youll need to hit the books for about four years to obtain a bachelors degree.

If you choose not to pursue a bachelors degree, you can spend about two to five years working for a financial institution, honing your skills, learning about the industry, and building relationships with your network.

Even after youve completed your education or gained years of work experience, it can take several weeks or months to become licensed. The amount of time it takes to get licensed depends on whether you pass the NMLS exam with a score of 75% or higher. If you dont pass, you have to wait 30 days to retake the exam. If you score under 75% three consecutive times, you have to wait 180 days to retake the test.

What Does A Mortgage Loan Officer Do

The job requirements of a mortgage loan officer vary with employers. So every employer gets to choose the job description to suit his needs. Even though it is required for a loan officer to get a license, they can work without a professional degree, and the job pays well. The overall job description for a mortgage loan originator is sales.

Recommended Reading: Reverse Mortgage Mobile Home

How To Reduce Monthly Mortgage Payments

Category: Loans 1. How to Lower Monthly Mortgage Payments Experian Aug 28, 2020 Lowering Your Monthly Mortgage Payment When You Buy Consider Refinancing Your Mortgage Remove Mortgage Insurance Payments Recast Your Aug 11, 2021 Refinance your mortgage to a lower rate · Refinance to a longer term

Are Loan Officers Commission Only

Many loan officer positions are paid commission only. The problem is that any loan officer must be paid at least minimum wage for all hours worked. Thus, if in a given pay period, you dont make any commissions so that you dont get paid, this is illegal.

Also Check: Rocket Mortgage Loan Types

Loan Officer Career Advancement

- Its generally a lateral move from one shop to another based on compensation structure

- Other than going from say a junior loan officer to a senior loan officer

- Most LOs just switch companies to get better commissions

- Though it might be possible to open your own shop or become a sales manager as well

Loan officers generally stay in one place and dont advance internally within a company.

They may change their status to Senior Loan Officer, but usually it means very little aside from the fact that theyve been around a little longer than typical loan officers. There could be a bump in compensation levels though.

More likely, loan officers can advance externally if recruited by other companies paying higher commissions, or even a base salary. Or a mega bonus to jump ship.

Those who are able to create and manage a large book of business may wind up with a lot of suitors, and its not out of the realm of possibilities to be offered a six-figure bonus to change companies.

Many loan officers also apply for a brokers license as a means for advancement. And eventually employ their own loan officers, and take a cut off everything they earn.

In that sense, there are a variety of advancement opportunities for successful individuals. Its also possible to shift to the operations side of things if you turn out to be not much of a salesperson.

Avoiding Mortgage Broker Fees

Whether you choose to use a broker or not, getting multiple mortgage quotes is likely to translate to actual savings. According to a 2018 Freddie Mac report, borrowers save an average of $3,000 over the life of the loan by getting at least five quotes from lenders.

So for borrowers who don’t have the time or ability to research loan options independently, the savings delivered by obtaining a range of estimates from a mortgage broker can help offset the broker’s fees. But if a broker’s commission comes out to more than $3,000, you may want to consider switching to someone with a different fee structure.

For example, a broker that charges a 2% rate on a $250,000 loan would receive $5,000, but a broker charging a 1% rate would only receive $2,500. Of course, this is only an average and every case will be different, but calling around to multiple brokers could mean that you’d retain more of your savings from finding the right loan. Borrowers could also elect to bypass the broker entirely.

Many online resources enable home buyers to research loan options themselves and avoid paying mortgage broker fees. Mortgages are not one-size-fits-all, and a borrower’s circumstances can help narrow their search. For example, some lenders specialize in working with first-time home buyers, while borrowers with little saved for a down payment may want to compare lenders that offer FHA loans.

Read Also: Reverse Mortgage For Condominiums

Being A Loan Officer Can Be Really Lucrative

- There are few jobs other than doctors, lawyers, and sports stars

- That pay several hundred thousand dollars a year in salary

- Top loan officers have the potential to make that kind of money too

- And even average ones can make six-figures annually during good years

If a mortgage loan officer gets just one of those deals to go through, it often equates to a huge payday, sometimes as much as a few months salary working a minimum wage job or other lower paying jobs.

So thats the incentive, big money. But there are a number of questions you need to ask yourself before setting out in the mortgage industry as a loan officer.

First and foremost, it is not an easy job. Sure, a mortgage broker or bank may tell you that its simple. And yes, you may not have to work very hard in the traditional sense, or take part in any back-breaking work.

But factor in the stress, the near misses, lost deals, the shots to your ego, and the wheel-spinning and it isnt as effortless as they may make it out to be.

You will see deals fall through and you will waste a lot of time. You will have mental breakdowns as loans slip through your fingers, and brokers and real estate agents scream at you as deadlines close in.

You will undoubtedly make mistakes, which will require a phone call to the borrower to let them know you cant do the deal. It will be embarrassing and unpleasant.

All that aside, lets look at a loan officers typical day, not that any day is ever typical