How Much Income Do I Need For A 150k Mortgage

You need to make $46,144 a year to afford a 150k mortgage. We base the income you need on a 150k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $3,845.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

Apply For A 150000 Mortgage

To find out more about our range of £150,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

Can I Get A 150000 Mortgage On A Unique Property

If the property doesnt have standard construction then there are fewer lenders to choose from as they see them as higher risk.

These include:

There are specialist lenders who will consider some of these types of properties and if you have your heart set on that yurt or castle, talk to one of the expert advisors we work with first.

Recommended Reading: Does Chase Allow Mortgage Recast

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

Can I Get A 150000k Mortgage With No Deposit

There are 100% mortgages available, but these are often limited to family mortgages where a family member, usually parents, deposit the equivalent of the deposit into an account with the mortgage lender as security. After an agreed period of time and certain criteria have been met, they can get their money back.

If youre having trouble raising a deposit, there are also government Help to Buy schemes and to consider.

You May Like: What Does Gmfs Mortgage Stand For

Where To Get A $150000 Mortgage

Traditionally, getting a mortgage loan would mean researching lenders, applying at three to five, and then completing the loan applications for each one. Youd then receive loan estimates from each that breaks down your expected interest rate, loan costs, origination fees, any mortgage points, and closing costs. From there, you could then choose your best offer and move forward with the loan process.

Fortunately, with Credible, theres a more streamlined way to shop for a mortgage. Simply fill out a short form, and you can compare loan offers from all of our partners in the table below at once.

How Much Would A 100000 Mortgage Cost Per Month

This would depend on the term of the mortgage and the interest rate youre paying, but if we take a typical 25-year mortgage at a rate of 2.5%, your monthly repayment on a £100,000 mortgage would be £448.62. You can find more repayment scenarios by heading to our mortgage repayment calculator.

Cookies

Read Also: How Much Is Mortgage On A 1 Million Dollar House

Your New Mortgage Repayments

To work out your exact monthly payment for your new mortgage, you need to know the rate you’ll be applying for. But if you haven’t even started looking yet, use our Mortgage Best Buys tool to benchmark a realistic rate.

Then have a read of our Cheap Mortgage Finding, which’ll give you a FULL rundown of how to find and apply for a top mortgage. Once you know your rate:

- Use our mortgage calculator to find out your monthly repayment. You can adjust the mortgage term up and down to see the difference it makes to your monthly payment, as well as the total amount you’ll repay over the entire mortgage term.

Your mortgage payment’s an ongoing cost, but hopefully you’re remortgaging to a cheaper deal. And remember, your first payment’s likely to be higher than your normal monthly payment as you pay interest in the month you get the mortgage, as well as for the upcoming month.

Looking for more mortgage help?

We’ve got lots of other helpful guides:

- Remortgage Guide. Free guide which has tips on when remortgagings right, plus how to grab top deals.

- Cheap mortgage finding. How to find the top deal for you.

Homeowners Insurance By State And Neighborhood

Much like the cost of living, homeowners insurance also varies widely depending on the state where you live.

Areas with regularly-occurring natural disasters will naturally have higher premium rates to offset the risk of property damage.

For example, the most expensive state for homeowners insurance is Louisiana, which comes in with an average annual premium of $1,967.

Louisiana routinely faces tropical storms and hurricanes that can damage homes.

By contrast, the cheapest state for homeowners insurance is Oregona state with considerably fewer natural disasterswith an average annual premium of $659.

If youre considering buying a home, think carefully about where youll be living.

Even if the cost of living in your area is cheaper, the homeowners insurance may be pricier due to the year-round risk of natural disasters, such as flooding and tornadoes.

A search for homeowners insurance for a $200,000 home with a $1,000 deductible and $300,000 liability in Eureka, California comes out to a $725 premium.

This amount contrasts with the $833 premium for a home of the same price in the suburbs of Los Angeles.

Even within cities, properties may have higher or lower premium rates depending on the neighborhood.

Neighborhoods that have higher theft rates might also have higher premium rates due to the greater perceived risk of property damage.

THE SIMPLY INSURANCE WAY

You May Like: Can You Get A Reverse Mortgage On A Condo

Your Debt And Salary Limit What You Can Afford

Besides showing you how much income you need to afford the home you want, this calculator also shows how your debts can compromise your chance for a mortgage. You can see how paying down debts directly affects your buying power. The fewer debts you have, the more of your salary can go toward the home, allowing you to afford a more expensive property. At the same time, more debts mean less money available, based on your current salary, to pay for – and qualify for – the home you want.

You can use this calculator to visualize how a higher or lower salary could change your ability to afford the home of your dreams. What if you got a raise? Or took a weekend job? You can vividly see how you could afford different homes with more income, or less.

Mortgage Fees You Might Have To Pay

- Application fee : Some lenders charge a small fee when you submit your application. This is also sometimes bundled with the origination costs.

- Attorney fee : In some states, you bring your own attorney to the closing table in other states, you dont. If not, the lender might need to consult an attorney to look at closing documents or contracts.

- Flood certification : This tells the lender if the home is in a flood zone.

- Homeowners title insurance : You arent required to take out a title insurance policy for yourself, but its highly recommended. If any liens were missed during the title search, you will be on the hook for any costs to clear them unless you have this insurance.

- Origination or processing fee : This fee covers the cost to prepare your mortgage. Sometimes you wont be charged this fee at all. Make sure to read your Loan Estimate and Final Closing Disclosure carefully to see if/where you are being charged.

- Points :Points are lender fees paid to reduce your interest rate. These are different from origination points, which are just another way of presenting mortgage origination fees.

- Underwriting fee : This fee is paid to your lender to cover the cost of researching whether or not to approve you for the loan. Some lenders bundle together the underwriting with origination fees or processing fees.

- Wire or courier fees : If documents need to be sent overnight or money needs to be wired, youll pay these fees at closing.

Don’t Miss: Who Is Rocket Mortgage Owned By

Can You Afford A 15000000 Mortgage

Is the big question, can your finances cover the cost of a £150,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £150,000.00

Do you need to calculate how much deposit you will need for a £150,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Don’t Miss: Rocket Mortgage Payment Options

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

What Are The Common Costs Of Selling Your Home Yourself

The advantage of For Sale By Owner is saving the commission a real estate agent would cost. This is usually between 5-6% of a homes value. For many homeowners selling through a realtor, the commission is their biggest expense. Often, sellers agents split costs of the commission with buyers agents.

Can I Get A 150000 Buy

Yes, of course, but the rules can be different for buy-to-let mortgages, so its important to know a few things before you start.

Some mortgage providers will expect you to put down a higher deposit of around 25%, although others will accept 15% subject to other criteria. You may also find that certain providers insist on minimum income requirements around £25k is standard although affordability come down to whether the forecast rental income will cover the mortgage repayments by 125-130%.

There are also lenders who will only offer you a buy to let deal if you have owned and lived in your own home from at least six months, but specialist providers may consider first-time buyers subject to other criteria being met.

The majority of buy to let mortgages are set up on an interest-only basis, so see the section below for examples of what the monthly payments on a £150,000 mortgage might be.

Read Also: Rocket Mortgage Launchpad

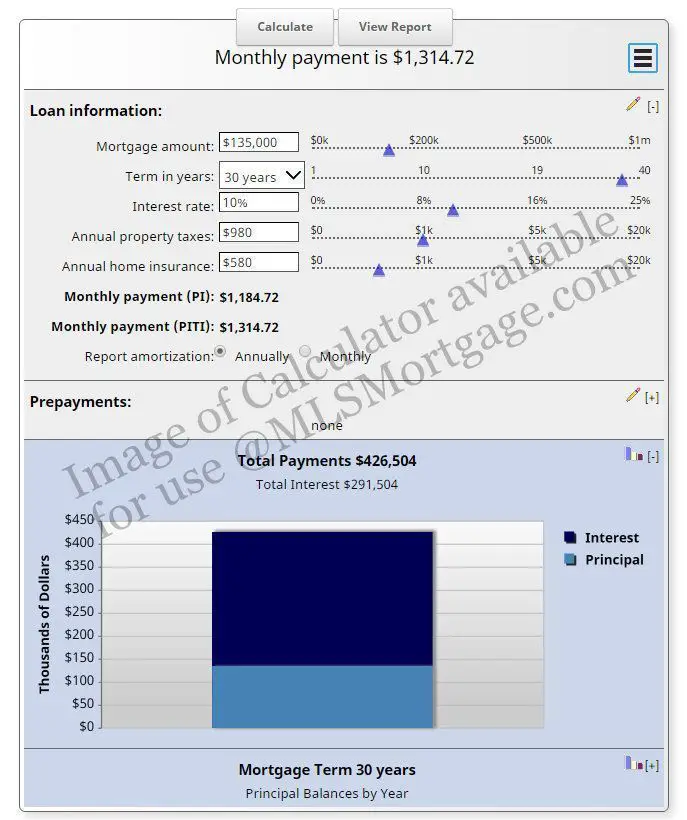

How Does The Mortgage Repayment Calculator Work

Your Mortgages mortgage calculator considers a variety of factors to determine how much your regular repayments will be over the loan term.

While there are many factors that can influence this calculation such as changes in interest rates, a decision to refinance, or using a redraw facility, the calculator will still be able to give you an estimate of how much your regular repayments could be and the total interest paid over the life of the loan.

By changing the interest rate, loan term, and repayment frequency fields, you can compare how these differences can impact your repayments.

Disclaimer: The results yielded by the calculator assume no changes in interest rates over the loan term. This means whatever interest rate you use will be applied for the whole loan term.

Why Is Adopting A Loan Repayment Strategy Important

As you can see from some of the earlier examples, even small changes to your repayments can save you thousands of dollars in the long run. A saving of just 0.25% on your home loan will make a giant dent in the total interest paid over 30 years or switching to bi-weekly or fortnightly payments can decrease the amount of time it will take to pay off your loan.

Small adjustments can lead to major changes, so testing different options in the mortgage repayment calculator is worth the effort. And while its still best to speak to a professional, which you can do for free here, this calculator is an ideal starting point. You can also try testing our Borrowing Power Calculator to have an idea of how much you can afford to borrow.

Also Check: Requirements For Mortgage Approval

Using Our Mortgage Calculator

Our mortgage calculator can help you determine how much you might be able to borrow based on your salary. Just input your annual income and guaranteed overtime together with that of the second applicant, if youre applying for a joint mortgage and youll be shown the minimum and maximum you may be offered. Remember though that income isnt the only factor lenders will take into account when determining how much youll be able to borrow, so this should purely be used as a guide.

Once you have an idea of the maximum amount youll be able to borrow, you can start to compare different mortgages Our mortgage charts allow you to search for a mortgage based on your circumstances, giving an overview of the products available and helping you narrow down the options. You may want to speak to an independent broker for a more personalised look at the products available, too.