Average Cost Of A Mortgage Refinance: $3398

By: Lyle Daly | Updated Nov. 9, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The average cost of a mortgage refinance is $3,398. Closing costs on a refinance depend on quite a few factors, including the mortgage lender, the location of the home, and the amount being refinanced. On average, homeowners can expect to spend about 1.3% of the loan amount in refinancing costs.

Keep reading for the latest numbers on mortgage refinances, including trends in 2021, the different costs involved, and how to get a better deal when you refinance.

Advantages Of Cost Of Refinancing

- Reduction in the interest rate of the mortgage. Combine with an increased credit score, people can procure loans at lower rates. It impacts monthly payments as well.

- Many people refinance in order to obtain money. It can be used for various purposes like purchasing a car, reducing credit card debt, etc. This can be done by taking equity out of the home.

You Want To Get Rid Of Pmi

Private mortgage insurance protects your lender in the event that you default on your loan. Most lenders require PMI if you have less than 20% down on your loan at closing. You may refinance and cancel your PMI if you now own more than 20% equity in your home.

Its a little different with FHA loans, which are backed by the Federal Housing Administration and protect your lender if you happen to default on your loan. You must pay for mortgage insurance throughout the life of your FHA loan if you had a down payment of less than 10%. Many people who buy a home with an FHA loan refinance to a conventional loan after they reach 20% equity and remove their monthly insurance requirement.

Read Also: How To Get A 15 Year Fixed Mortgage

Closing Time: Know Your Rights

When you apply for a mortgage you will receive a form known as the GFE or Loan Estimate. These forms get their power because by law, lenders must disclose fact of their offers reasonably accurately. They must reissue a new GFE or Loan Estimate within three business days if there is a material change to your file. When you lock your rate, for example, or if you choose a different loan. At closing, either the GFE is reconciled to the Settlement Statement , or the Loan Estimate is reconciled to the Closing Disclosure. The lender must refund cost increases to the borrower. The final GFE or Loan Estimate must be provided to the borrower no later than three business days prior to closing.

The law classifies charges into three categories: those that can’t vary from disclosures at all, those that can vary within predetermined ranges, and those with no limits on variability.

Charges That Cannot Increase

Charges that Cannot Increase > 10%

- Required settlement services that the lender selects, such as the appraisal

- Title services, lender’s title insurance or other required services *

- Government recording charges

Charges That Can Increase Without Limit

- Title services, lender’s title insurance and required settlement services the borrower can choose **

- Owner’s title insurance and other non-required services **

- Initial deposit for borrower escrow account

- Daily interest charges

- Homeowner’s insurance

About the Author

Can I Refinance My Mortgage With No Closing Costs

A no-cost mortgage refinance means that you do not pay certain fees at closing. It does not mean that you do not pay fees at all, however. Your lender may be willing to pay your loan settlement costs in exchange for charging you a higher interest rate on your mortgage loan.

Another option to help lower mortgage refinance closing costs is via a no-cash refinance. In this situation, the loan settlement costs are incorporated into the mortgage loans balance, and you pay for them over time.

Also Check: Who Owns American Pacific Mortgage

How Do You Calculate If You Should Refinance

Evaluate whether you should refinance your mortgage by calculating how much you can save each month as well as the total cost of refinancing. Then, calculate your break-even point to determine how long it will take to recoup those costs. Finally, consider whether you plan to stay in your home long termif not, the cost of refinancing may not be worth it.

Mortgage Interest Rate Vs Apr

When comparing offers, make sure you look at the difference between the interest rate and the annual percentage rate . The interest rate is what youll pay on the principal loan, while the APR includes the interest rate, other mortgage fees, and some closing costs. When looking at APRs, ask the lender what fees are included in the APR calculation so you can be sure youre making an apples-to-apples comparison.

You May Like: What To Expect When Applying For A Mortgage Loan

Refinance To Lower Your Mortgage Rate

To determine if you can save money with a lower mortgage rate, use our calculator to compare the monthly interest savings against the cost to refinance. As most mortgage brokers and lenders will cover your legal costs, the main cost you need to worry about is your break of mortgage penalty, or prepayment penalty. This penalty is charged by your lender for breaking your mortgage contract early and is based on your original contract date, current mortgage balance, mortgage rate, and other factors.

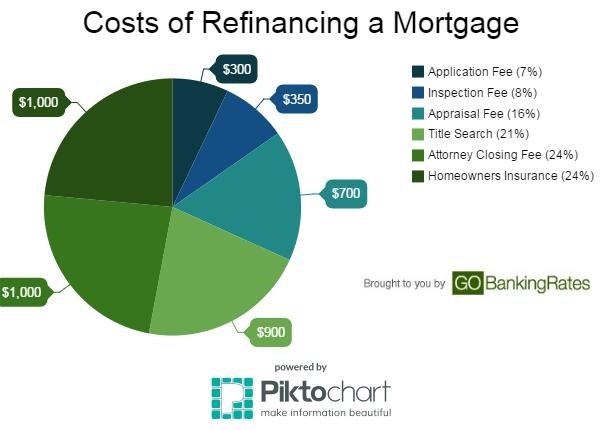

What Makes Up The Costs To Refinance

Lending money comes with the risk that the borrower may default on payments. Refinancing charges help lenders defray the risks involved. There are a variety of different fees that lenders might charge, including:

- Loan origination fee. This is a fee paid to the loan officer who ushers the loan application through the process.

- Loan application fee. The loan application fee is a general fee for filing the paperwork with the lender.

- Recording fee. Home loans are a matter of public record. Some communities charge recording fees to add this information to the public record.

- Attorney fees. If the lender requires an attorney to review the paperwork, they may charge a fee for it.

- Appraisal. The appraisal fee is paid to the appraiser or appraisal company that comes to the home to determine its value.

- Loan underwriting fee. The underwriting fee is another fee charged to the borrower for the processing of the loan application.

The list above is not comprehensive, nor do all lenders charge the same fees. Call around to find out how much a refinance would cost with various lenders. Ask them to list all closing fees and estimate the approximate closing costs. Many lenders allow closing costs to be rolled up into the loan amount, but if a lender requires you to pay the closing costs up front, you’ll need to know that.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How Often Can I Apply To Refinance My Mortgage

While you should only ever refinance your home with good reason, there are no rules that limit how often you can refinance. Lenders, however, will typically set a limit. Keep in mind that your credit report will be pulled each time you refinance, and when this happens too frequently it can negatively affect your credit score. Since your credit score is also a factor in a lenders decision to approve your refinancing, a lower score would also lower your chances of approval.

Find The Best Rates For Refinancing Your Mortgage

The costs of refinancing a mortgage can add up quickly, so its important to research which lenders offer the most competitive interest rates and fees. To find the best refinancing terms, start by looking at your current lender. Likewise, if you already have a relationship with another bank, it can likely streamline the application process and provide more favorable terms.

If youre getting a conventional mortgage, nationally chartered or community banks are usually the best places to start. Shop around at a variety of large banks, local banks and credit unions to ensure you get the best terms for your needs and credit history. Also keep in mind that if you want to refinance quickly, you may want to consider an alternative lender, like an online non-bank companyalthough this generally comes with a higher interest rate.

To get the best refinancing rates, pay attention to these factors before applying:

You May Like: What Is The Mortgage Rate For Bank Of America

Minimizing The Cost Of Refinancing

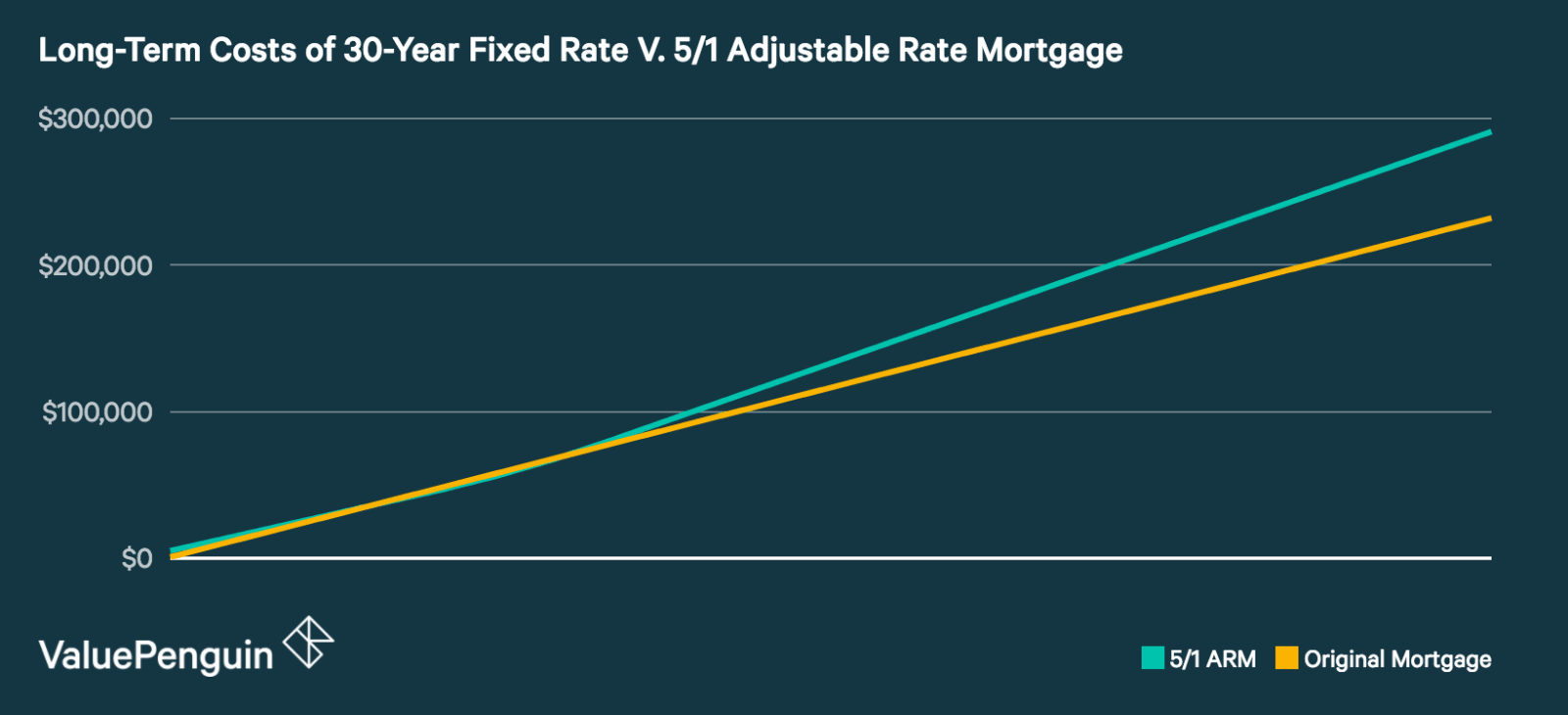

Theres a way to make refinancing much less expensive over the long term. But it often involves some short-term pain.

You can refinance to a shorter term. So, instead of getting a new 30-year FRM, you move to a 15-year or 20-year one. Some lenders pretty much let you pick your own term, so, in our example, a 25-year term isnt out of the question.

Take this route, and youll pay way less interest over the lifetime of your loan and will be mortgage-free that much sooner. As an added bonus, a shorter-term loan typically comes with a lower mortgage rate.

Fees Included In Refinance Closing Costs

Refinancing closing costs aren’t just one fee there are several expenses that make up closing costs. Much of the money you pay during closing goes to cover administrative fees for the bank, while another significant part of the fee goes to taxes.

Here’s a list of fees you can expect to see in your refinance process, along with estimates of of what each will cost according to data from the Federal Reserve and ClosingCorp.

Don’t Miss: Can You Wrap Closing Costs Into Mortgage

Cost Of Refinancing Formula

It is the summation of closing costs and fees wherever applicable.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Cost of Refinancing

Scenario 1: Closing costs and various fees are involved.

Cost of Refinancing Formula = Closing cost +

Scenario 2: Closing costs are borne by the lender and various fees are involved.

Cost of Refinancing Formula = Escrow & Title Fees + Points + Taxes + Appraisal Fees + Lending Fees + Insurance Fees + Credit Fees etc.

Assess Whether To Buy Mortgage Points

If you want to lower your closing costs, consider whether buying mortgage or discount points is worth it. While buying points lowers your interest rate, its usually best only when you expect to own the home for a long time and dont plan to refinance again even to pay for a major renovation later on. You can use Bankrates mortgage refinance calculator to help determine whether its worthwhile to buy points when refinancing.

Don’t Miss: Who Benefits From A Reverse Mortgage

Individual Circumstances Are More Important Than Current Mortgage Rates

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

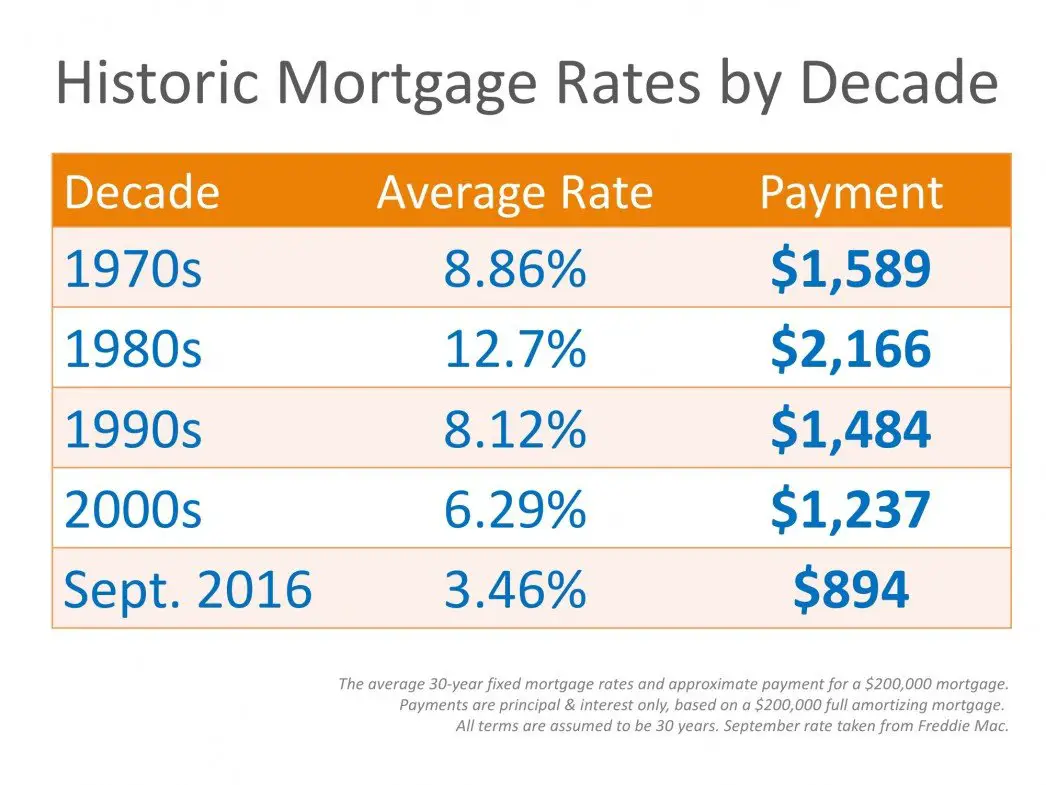

While many homeowners may be incentivized to restructure their finances by low mortgage interest rates, the decision to refinance your mortgage should be made based on your personal financial circumstances this week’s mortgage rates should not be the deciding factor on whether or not you refinance.

There are nine key considerations to review before applying for a home refinance.

How To Calculate The Break

One significant factor that can help determine when to refinance a mortgage is the break-even point. The breakeven period refers to how long you have to remain in the home after the refinance to make back what you spent in refinancing fees and closing costs.

While you may see a drop in your monthly payments immediately after refinancing a mortgage, it will take some time for the savings to offset what you spent to refinance. The refinance calculator break-even point is an objective way to determine if the refinance makes financial sense.

The shorter the break-even point, the quicker youll make your money back. Conversely, the longer the break-even point, the longer it will take to recoup the expense of the refinance. If you need to move or sell your home before the break-even point, you would have lost money.

You May Like: Does Mortgage Insurance Pay Off My House If I Die

Should I Refinance If Interest Rates Are Low

When interest rates fall, the possibility of getting a lower mortgage rate is a strong reason to consider refinancing if you need additional funds. A reduction in your mortgage rate could lead to significantly lower monthly payments.

However, you must factor in the costs of ending your current mortgage, including any prepayment charges, as well as how long you expect to live in your home. Only then can you determine whether its worthwhile to refinance at a lower rate.

How Our Mortgage Refinance Calculator Works

To use our refinance calculator, youll need to enter details about your current mortgage and the potential new loan. Once you put in the information, the refinance calculator will show you what you stand to save each month and your potential lifetime interest savings.

Our mortgage refinance calculator also factors in refinance fees. Youll even see your break-even period, which is how long youll need to remain in your home to recoup the refi costs.

Also Check: Who Uses Equifax For Mortgages

What Are Todays Refinance Rates

Just like rates for homebuyers, mortgage refinance rates are low across all loan types right now, including rateandterm and cashout refinances.

Its a great time to lock in a low interest rate on your new loan, and many homeowners can choose to refinance with no closing costs.

Check your refinance options to see if a refi is worth it for you at todays rates.

Read Next

Benefits Of Refinancing A Mortgage

There are several reasons why you may want to refinance your mortgage. Here are the ways you can benefit from refinancing:

Reducing the interest rate: A lower interest rate can save you a considerable amount on your mortgage. If mortgage rates have dropped since you bought your home, or if you now have a better credit score, you may qualify for a lower interest rate when you refinance. It’s worth keeping an eye on mortgage refinance rates to potentially get a better deal on your home loan.

Lowering the monthly payment: If your mortgage payment has become difficult to manage, a smaller payment amount could help. Refinancing is a way to lower your monthly payment. You could secure a lower payment if you refinance at a lower interest rate. Another option is extending the term of the loan for a smaller payment amount, although you generally pay more overall this way.

Going from an adjustable- to a fixed-rate mortgage: Adjustable-rate mortgages typically have lower starting interest rates than fixed-rate mortgages, but their rates can also go up and start costing you more money. To avoid this, you can refinance an ARM with a fixed-rate mortgage to get a stable rate.

Don’t Miss: Is Citizens Bank Good For Mortgages

Fannie And Freddies Streamline

Savings may be smaller but still worthwhile if you have an existing mortgage with either Fannie Mae or Freddie Mac. They both have refinancing products that permit simplified documentation as well as allowing you to refinance a large proportion of your homes market value.

But, again, these arent available if you need a cash-out refinance. And, for these, you must stay with Fannie or Freddie while being free to switch to a different lender.

Closing costs will vary dramatically depending on the specifics of your refinance.

Here are the fees and costs that those refinancing commonly incur:

- Origination or underwriting fee. 0-1% of the loan amount. What the lender charges for setting up the loan.

- Discount points. 0-2% of the loan amount. These are optional and allow you to purchase a lower mortgage rate. People who plan to keep their loan forever may choose to pay more money upfront to get a super low rate.

- Application fee. $300-500. These are rarer nowadays but you may still find them.

- Appraisal fee. Probably $400-$1,000 for an average property. Appraisal fees can be much more depending on the size and location of your property.

- The cost of pulling your credit report.

- Flood determination fee. $20. This evaluates the likelihood that your property is susceptible to flooding.

- Flood monitoring fee. $40. This pays for continuing checks on flood-map updates.

- Tax monitoringand tax status research fees. $150-$225. This makes sure you stay current with property taxes.

What Is Conforming Loan

Category: Loans 1. Conforming Loan Limits | Federal Housing Finance Agency Conforming Loan Limits Fannie Mae and Freddie Mac are restricted by law to purchasing single-family mortgages with origination balances below a specific Aug 13, 2021 Conforming loans are mortgages that are under certain dollar amounts known as

Recommended Reading: What Is The Effect Of Paying Extra Principal On Mortgage

Closing Costs Are Usually 2 To 5 Percent Of Your Loan Amount

The average cost to refinance your your mortgage is generally 2 to 5 percent of the remaining amount left on your loan. It also depends on where you live.

“If you live in a relatively rural location with low property rates, you’re going to pay less than someone living among million-dollar homes,” says Cliff Auerswald, president of All Reverse Mortgage. While the amount varies based on location and loan amount, the average closing cost of refinancing your mortgage is about $5,000 according to Freddie Mac.

“For example, you can expect your closing costs to be around $2,000 to $6,000 for a $100,000 mortgage refinance,” says Leonard Ang, GEO of iPropertyManagement, an online guide for real estate investors, landlords, and tenants. You can use this mortgage refinance calculator by Freddie Mac as a starting point to calculate your estimated refinancing costs.