How Much Does The Average Mortgage Broker Make In Annual Salary

How much does the average mortgage broker make in an annual salary?

Mortgage brokers generally arent paid an annual salary, they are paid based on commissions. If the mortgage broker works under someone else within someone elses business then this is going to be skewed because theyre likely going to get maybe a base salary and then paid commissions on top of that, that is going to be much smaller.

Generally speaking, a mortgage broker is probably going to make somewhere in the $60,000 to $70,000 per year. With mortgage brokers who are not as active and are not as good making somewhere around the $30,000 to $40,000 mark.

Mortgage brokers who are amazing and who do a really good job, well truthfully the skys the limit. But you are probably looking maximum of somewhere around a $100,000 or $120,000 or something like that.

So I hope that explains to you, how much a mortgage broker makes. Mortgage brokers do a lot of work and I really appreciate what they do, there is so much paperwork that they do, they also give you access to so many different lenders.

I always recommend that people go to a mortgage broker. See a mortgage broker first to try and get your loan, because they can help you get the loan that best suits you. If you want to deal directly with my mortgage broker, then go here and fill out your details to get a free consultation.

DISCLAIMER No Legal, Financial & Taxation AdviceThe Listener, Reader or Viewer acknowledges and agrees that:

How Much Does A Mortgage Broker Make And Why Does It Matter

Learning how much a mortgage broker makes is typically a good first step before entering the industry. It helps you determine whether your expected salary meets your expectations. Even once you are an established independent mortgage broker, it is wise to stay up-to-date with your industry peers average annual income.

Being aware of the average salary for mortgage brokers can help you determine how much room for growth you have. For example, suppose you notice that you are on the lower side of the average salary. In that case, you may use this as an encouragement to make changes to increase your salary, such as improvingcommunication with clients. You may also want to use the information to decide on your ideal work-life balance, based on the knowledge of what your salary could be if you spent much more time on work than life.

But how much does a mortgage broker make?

Average Mortgage Broker Salary

As with any profession, earnings tend to increase based on years of experience and the amount of time dedicated to the profession on an ongoing basis. There are mortgage brokers who earn well above the annual salary of doctors and lawyers. On average, however, mortgage brokers make about $100,000 per year. But, in order to earn this salary in provinces with lower mortgages, such as Atlantic Canada, mortgage brokers have to close more deals than their equivalent in British Columbia, for instance.

You May Like: What Is A Va Mortgage Rate

Focus On More Expensive Loans

Since independent mortgage brokers are paid via commissions that are a percentage of the loan, facilitating loans with higher values results in higher commissions. Therefore, you could try to increase your earnings by focusing on higher-value loans. Focusing on these loans will likely require attracting a slightly different clientele.

Benefits Of Having A Mortgage Broker

- Saves Time and Effort. Applying for a property loan through a mortgage broker saves you a lot of time and effort doing the same things they do with very little favorable results. Most of the time, they would already have the information that you would need to secure that much needed real estate loan.

- Access Better Loans. Mortgage brokers work directly with financial institutions and they would have access to otherwise unknown deals and working with them gives you the right access. Financial institutions sometimes have a codependent relationship with brokers as these independent contractors can give them clients that they cannot always reach.

- Save Some Money. While there is that upfront commission based fee, most loans that you can get from a mortgage broker would have lower interest fees as compared to the same loan which you applied for yourself. Dealing with known brokers allows the bank to be more generous with their loans, if only by a little.

Also Check: How Much Do I Have Left On My Mortgage Calculator

No Commission Mortgage Brokers

There are some brokers that simply charge a fee for their services instead of earning a commission from the lender.

Any upfront commission is paid back while trail commissions are paid back to you each month as mortgage rebates or cash back payments.

Sounds great but theres a catch.

So far the majority of these business models have gone bust as they are not financially-viable.

With the cost of compliance and processing so high, profit margins are already quite slim.

Bank Vs Broker: Which Should You Choose

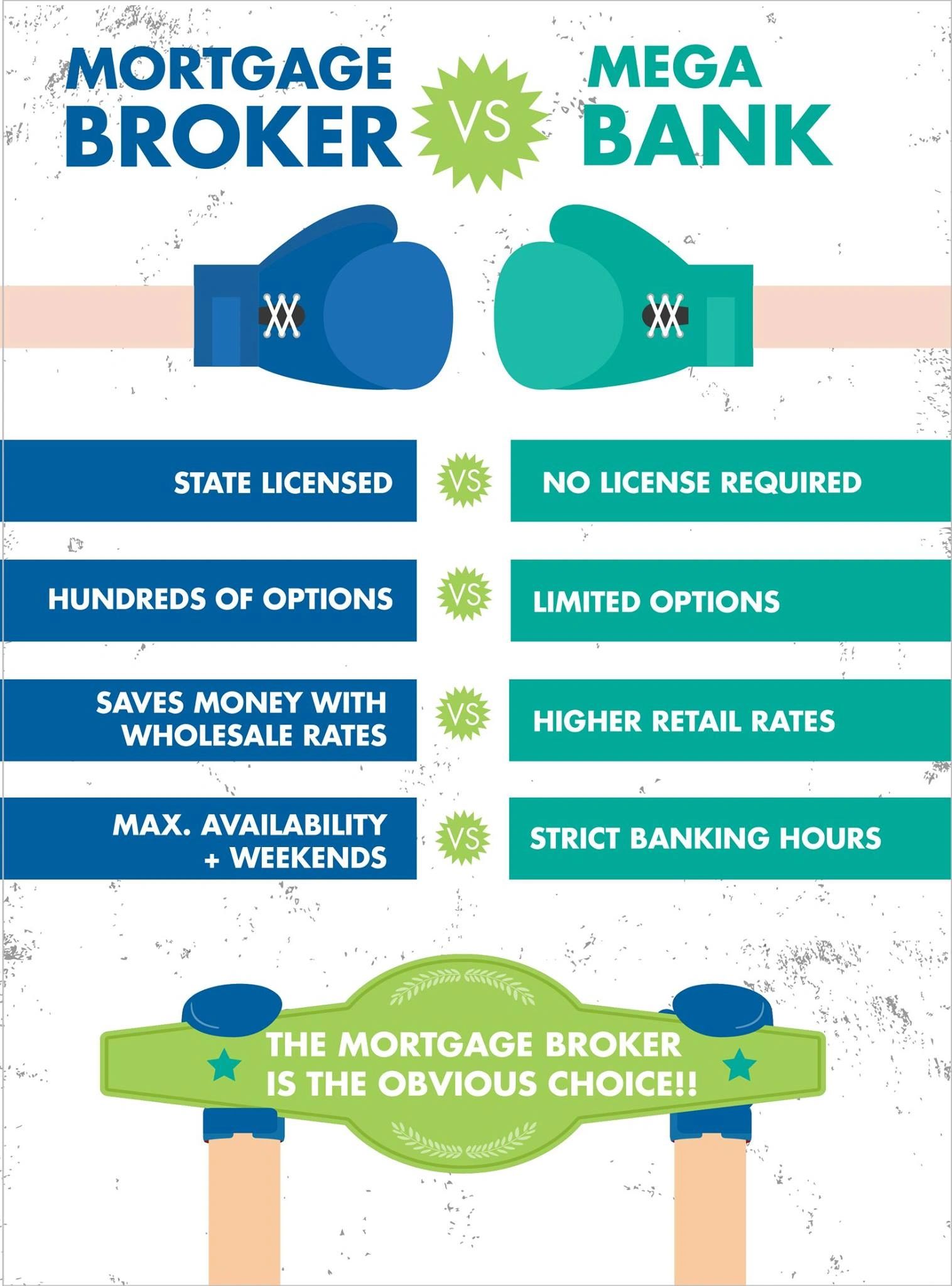

The number one differentiator is that mortgage brokers offer choice. They have access to multiple product lines from a wide variety of lenders including banks, credit unions and trust companies. In contrast, bank specialists can only offer you a mortgage from their one product line. More choice from brokers means youll be matched with the best product and rate catered to your unique financial situation. And if you happen to be self-employed or have credit blemishes, mortgage brokers can still help you, because they have access to specialized lenders as well.

Your mortgage broker will also get lenders competing for your mortgage again at renewal or anytime you need to renegotiate your mortgage. Its your brokers job to guide you through every step of the homebuying and mortgage processes. And that means staying on top of your ever-changing needs as a homeowner.

Mortgage brokers must also be licensed and adhere to strict government rules and regulations. And, in order to keep their licence, theyre required to take continuing education and relicensing courses to ensure theyre best able to advise on your ideal mortgage solutions. Bank mortgage specialists arent licensed. They can start working for a bank and begin selling mortgages with zero financial training or experience.

Also Check: Do Medical Collections Affect Getting A Mortgage

How Does A Mortgage Broker Compare To A Bank

As far as pay is concerned, the bank’s mortgage specialist might receive a salary, plus commission and/or bonuses for the mortgages they fund. A mortgage broker is only paid when your mortgage is funded, so they are invested in your approval.

Some mortgage brokers could be incentivized to work with lenders who pay the highest amounts. If they do this, you might not be getting the best mortgage for you. You need to understand how a mortgage broker is paid so that you can ask the right questions.

Before your mortgage is final, the mortgage broker is required to present a borrower disclosure form that explains the following:

How the broker is paid

How many lenders they have worked with the last year

If any lender was responsible for more than 50% of their business

If the mortgage broker also acted as a lender

If there are any potential conflicts

Some Lenders Do Not Work With Mortgage Brokers

This is an increasing trend since 2008, as some lenders are finding that broker-originated mortgages were more likely to go into default than those sourced through direct lending. By working through a broker, you may not have access to these lenders, some of whom may be able to offer you better mortgage terms than you can get through the broker.

You May Like: Can I Have A Co Signer On A Mortgage

When Does A Mortgage Broker Get Paid

Usually, the commission payment comes through within a few weeks of your mortgage closing, depending on the lender and how fast the brokerage can process payment.

Remember, a mortgage broker only gets paid after your closing day. There is no salary or hourly pay for the time spent on mortgage applications that don’t get approved and funded.

Submitting The Application For Approval

It is your mortgage brokers responsibility to provide the lender with information that accurately reflects your circumstances. They must submit it in a timely manner so that the lender can make an appropriate decision regarding your approval and meet any financing deadlines.

Once the lender has agreed to advance the loan, your broker will fulfil the lenders documentation conditions, arrange the appraisal and coordinate the closing with your lawyer or closing agent.

Before signing on the dotted line, make sure you fully understand all the terms and conditions of your mortgage contract. Answering such questions is a brokers most important function given that restrictive terms can cost you after closing.

Don’t Miss: How Much Second Mortgage Can I Afford

How Do Mortgage Agents Make Money

Meanwhile, a mortgage broker generally gets paid a commission or finders fee from the lender for arranging a mortgage. The fee may range from 0.5% to 1% of the mortgage, but could be lower or higher. Some brokers may charge a broker fee to the borrower in addition to the commission they are paid from the lender.

Continue Your Education On Mortgage Lending

Once you have your mortgage broker license, its your responsibility to keep up on the latest developments on mortgage lending in your area.

To keep your license current, youll be required to take a certain number of hours of continuing education courses each year. Its similar to what accountants, doctors, and lawyers go through, and it ensures that you can do your job accurately and will give your clients the most up-to-date mortgage loan information.

Brokering mortgages is a job that demands constant attention to the changing real estate and lending landscape.

Recommended Reading: Can You Get A Mortgage On A Foreclosed Home

Choose Bluepoint Mortgage As Your Lender

Getting the best connections means working with the best in the industry. For everything you need in a mortgage lender, Bluepoint Mortgage is your #1 choice. We are one of the largest and fastest-growing wholesale mortgage lenders in the nation, and we know what it means to start and close a deal quickly and efficiently. We have the resources, contacts, and experience to earn the title of #1. Learn more about Bluepoint Mortgage or contact us today.

How Much Do Mortgage Brokers Make No Salary Means The Sky Is The Limit

Mortgage Q& A: How much do mortgage brokers make?

If you happen to use a mortgage broker to obtain your mortgage, you may be wondering how they get paid and what they make.

Mortgage brokers essentially work as middlemen between borrowers and banks/lenders, so they can actually be paid by either party.

Just to be clear, this article is about how much mortgage brokers make on the home loans they originate, not how much they make in the way of salary.

Of course, brokers typically arent paid a salary, so if we know what theyre making per loan, well have a decent idea as to what they might take home each year as well depending on annual volume.

But you have to consider their costs to operate as well, which will vary based on how large their shop is, if they employ loan officers, how much they spend on advertising , and so on.

You May Like: What’s An Average Mortgage Interest Rate

Mortgage Broker Vs Loan Officer

Mortgage brokers are financial professionals who work with a number of lenders to offer a wide range of loan programs to consumers. These brokers match borrowers with specific lenders and loan programs that best meet their needs for a fee or commission.

A loan officer, on the other hand, works for an individual bank or other direct lender and can only sell mortgage products offered through that institution. For this reason, mortgage brokers give clients access to a much broader array of lendersincluding lesser-known institutions that may offer more favorable terms than well-known, brick-and-mortar banks.

What Are Todays Mortgage Rates

Todays rates depend on lender efficiency, policy, desired profit margins and other factors. It really doesnt matter what a lenders policies are or how much it pays its loan agents. What matters is the bottom line deal it offers you.

Popular Articles

Resources

Recommended Reading: How To Calculate Self Employed Income For Mortgage

Mortgage Brokers Use An Aggregator

Mortgage brokers also tend to work with an aggregator which is someone that brings all the lenders together for the mortgage broker to access. Now, those aggregators will also take a cut themselves and how much of a cut that aggregator takes, varies from aggregator to aggregator.

So you have got a lot of different varying factors that will determine how much your mortgage broker takes home at the end of the day.

Qualifying For A Mortgage

When qualifying for a mortgage, your broker may request:

- A letter of employment and/or tax returns

- Bank statements

- Proof of assets or investments

- Details of your other debts and monthly obligations

- The amount of down payment you have

- Information about the property you wish to purchase

This list is far from comprehensive, but it gives you an idea. For a full list of requirements, check with your broker.

You May Like: How Much Mortgage For 60000 Income

How You Get There

The big money in mortgage brokering wont come from being complacent in your own ability, as previously mentioned. Moving up in the world requires dedication to your craft. Finding new clients to work with is a constant game of making connections and following up with them. Learn to talk with people, learn to respond timely, and learn to demonstrate your capability. The industry as a whole is fiercely competitive, and becoming the person people want to choose is a matter of putting your image foremost in their mind. If raw charisma cant get you there, then sometimes being in the right place at the right time is the best avenue.

What Fees Do Mortgage Brokers Charge

A broker fee is a fee charged by a broker to execute transactions or provide their services. Brokers charge broker fees for a multitude of service, such as consultations, delivery, purchases and negotiations.

The pricing models from one broker to the next can be very different, so you should ask about, or research, the costs before you agree to use your mortgage broker and you should ask for their prices in writing.

Below are the different pricing models that brokers operate with.

Short for time? Heres a quick video overview of mortgage broker fees and how they work between different brokerages.

You May Like: How To Become A Certified Mortgage Underwriter

So Whats Your Earning Potential

To give you a better idea of your earning potential, a broker working for us settling $3.5 million a month could see them earn $204,104 per annum, taking into account the next four years of income they will receive in trail.

Settling $5.5 million per month could see them earn $320,734 per annum.

Note that the trail income earned from that years work wont be received in that year.

There can be differences between lenders in the tiered remuneration structure for both upfront and trail commissions.

Check out the for more information.

If you would like to know more about becoming a mortgage broker at Home Loan Experts, please email .

Top 50 Highest Paying States For Mortgage Broker Jobs In The Us

Weve identified nine states where the typical salary for a Mortgage Broker job is above the national average. Topping the list is Massachusetts, with Hawaii and Connecticut close behind in second and third. Connecticut beats the national average by 4.7%, and Massachusetts furthers that trend with another $5,278 above the $77,202.

Significantly, Massachusetts has a very active Mortgage Broker job market as there are several companies currently hiring for this type of role.

With these nine states paying on average above the national average, the opportunities for economic advancement by changing locations as a Mortgage Broker appears to be exceedingly fruitful.

You May Like: What Does A Co Signer Do For A Mortgage

Aspects Of How Much A Mortgage Broker Makes Job Growth Trends

Various sources agree that a mortgage brokers job is experiencing growth, although there is not much data from this year. The Bureau of Labor Statistics previouslyanticipated an increase in 11% demand for mortgage brokers from 2016 to 2026. Considering we are less than halfway through that period, this figure is still relevant and optimistic.

The 10-yearestimate two years later, from 2018 to 2028 for loan officers, which is a related field to mortgage brokers but not identical, was 8%. Since loan officers and mortgage brokers frequently work together, their job growth is typically tied. This prediction is also encouraging for mortgage brokers.