Mortgage Points: What Are They And Are They Worth It

Mortgage points can lower the interest rate you pay on your mortgage loan, as well as your monthly payment.

Edited byChris JenningsUpdated October 29, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

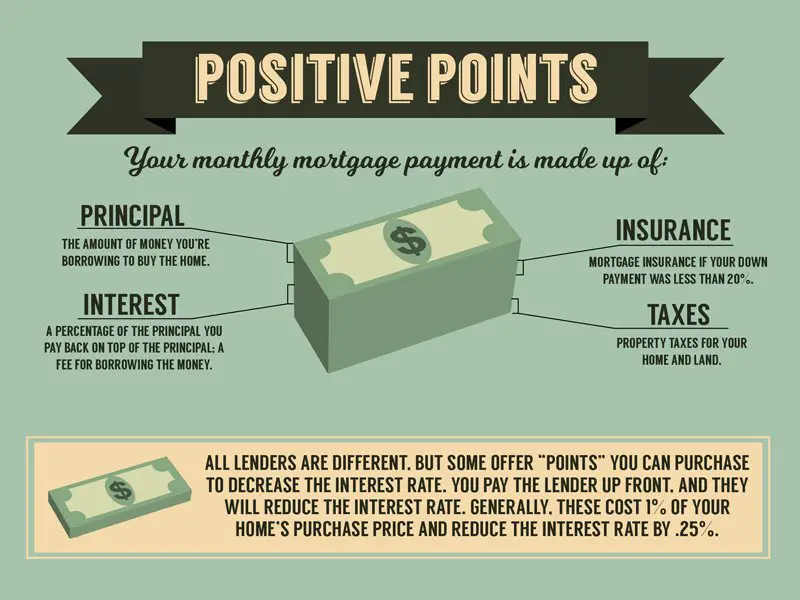

Mortgage points, also called discount points, are an option for homebuyers looking for the lowest interest rate on their loan. They offer a trade-off: Pay an extra fee at closing and get a lower rate over the course of your loan term.

Heres what you need to know about mortgage points:

How To Choose Between Points Or Credits

As with a lot of decisions during the mortgage process, the right choice depends on your personal situation. In this case, it largely depends on one of the first questions your Mortgage Expert will ask you:

How long do you intend on keeping the property that youre purchasing or refinancing?

Like a lot of financial choices, theres a break-even point at the heart of this issue. Most Americans will sell, refinance, or otherwise close within 6 years.

This can change on a case-to-case basis and choosing credits versus points depend on how long you plan on keeping the loan. If youre like most Americans and dont plan on keeping the loan for a long time, credits might make more sense. The upfront savings will outweigh any potential savings down the road. If you know that you will keep the loan for a longer period of time, points might make more sense. Your monthly payment will be higher but the long-term savings will outweigh the cost of points upfront.

Keep in mind that you can also choose the par rate, which is the lowest rate option that comes with no points. If youre unsure about your future plans this might make the most sense.

In addition to time, another factor to think about is how much cash youre comfortable paying upfront. Remember, points mean more money at closing, credits mean less.

Below are three different situations with the same loan amount, and why you might opt for points, credits, or neither with your rate.

What Is The Break

The break-even point is when the interest you saved is equal to the amount you paid for mortgage points. They sort of cancel each other out.

Alright, its time to go back to math class again. Lets calculate the break-even point from our example we used before. To do this, just divide the cost of the mortgage point by the amount youd be saving per month . And there you have it, that answer is the break-even point.

$2,400 / $36 = 67 months

In other words, in 67 months, youd have saved over $2,400 in interestthe same amount you paid for the mortgage point. After reaching the break-even point, youll pocket that $36 each month, which will be the money you save on interest because of the mortgage point you bought.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

How Much Does One Point Lower Your Interest Rate

One discount point usually equals 1% of your total loan amount and lowers the interest rate of your mortgage around one-eighth to one-quarter of a percent. But heads up: the actual percentage change will depend on your mortgage lender.

Is your head spinning yet? Well hang on, were about to do some math.

To help this all make sense, lets break it down. Suppose youre buying a $300,000 house. You have a 20% down payment and are taking out a 30-year fixed-rate conventional loan of $240,000 at a 4.5% interest rate.

To lower the interest rate, you pay your lender for one mortgage point at closing, and assuming that point equals 1% of your loan amount, it will cost $2,400.

$240,000 loan amount x 1% = $2,400 mortgage point payment

After you buy the mortgage point, your lender reduces the interest rate of your mortgage by, say, a quarter of a percent. That takes your interest rate from 4.5% to 4.25%.

This slightly lowers your monthly payment from $1,562 to $1,526which is $36 less a month on a fixed-rate conventional mortgage.

You can use our mortgage calculator to figure the difference between the interest amount with the original rate and the interest amount with the reduced rate over the full lifespan of the loan.

Are you still with us? Okay, good.

Without any mortgage points, youll pay a total of $197,778 in interest. With one mortgage point, youll drop that amount to $185,035which saves you $12,743 in total interest.

| 30-year loan amount: $240,000 |

| $172,486 |

Buy Down Break Even Point Calculator

You dont need a special points calculator to determine the amount of mortgage points being charged. There are three steps to determine if is it worth paying points:

You May Like: What Does Gmfs Mortgage Stand For

What Are Refinancing Points

In short, points are fees paid directly to the lender at closing in exchange for a reduced interest rate,or to cover the fees of creating the loan. Typically, a single refinancing point is equivalent to one percent of the total amount of a new home loan.

For example. if your new loan will be for $200,000, then, one point would equal $2,000.

Points on a mortgage refinance can be used in a number of different ways. Sometimes, they are mandatory a lender requires a borrower to pay a certain number of points at closing. Other times, they are voluntary and may be used to secure more favorable loan terms in this instance, they are called buying down the rate, which can, in turn, lower your monthly mortgage payments.

Most credible lenders, especially those offering 30-year fixed refinance mortgages, will provide the opportunity to points. How can you use them?

Discount Points Versus Origination Points

The two major types of mortgage points are origination points and discount points. Origination points are the lender’s charge for completing the process and getting the mortgage approved and funded. Discount points are upfront payments for lower interest rates. A lender will commonly quote mortgage rates with payments of zero, one or two points. Paying discount points allows the homeowner to buy down the mortgage rate.

You May Like: 10 Year Treasury Vs Mortgage Rates

Why Do We Use Basis Points

Basis points are used to remove any uncertainty when talking about percentage change. To say my commission is usually 10%, but it increased by 10% last quarter is needlessly ambiguous is your commission now 20%, or 11%? This is why we use basic points, so that we know when someone says a 100 basis point increase they mean an increase of 1%.

A Lower Interest Rate Can Save You Money Over The Long Term

With a fixed-rate mortgage, the amount you’ll pay in total for principal and interest remains the same over the entire mortgage term because the interest rate stays the same. So, buying down the rate can save you money if you plan to stay in the property long-term. A small difference in the interest rate can add up to big savings over the 30 or so years you’ll be paying off your mortgage.

Example. If you took out a 30-year, $300,000, fixed-rate loan at 3%, you’d have monthly payments of about $1,265 and pay a total of $455,332 by the time you’ve paid off the loan. But if your interest rate is 2.75%, your monthly payments would be approximately $1,225, and you’d pay a total of $440,900.

With an adjustable-rate mortgage, though, paying points on a mortgage often reduces the interest rate only until the end of the initial fixed-rate period the reduction probably won’t apply over the life of the loan. Some lenders might also allow you to apply points to reduce the margin . So, you could potentially lower the interest rate for longer than just the introductory period.

You May Like: Are Discount Points Worth It

When You Take Out A Mortgage Your Lender Offers You An Interest Rate Based On Several Factors Including Market Rates And Your Credit Profile

Lenders also offer you the opportunity to pay for a lower your mortgage rate by buying mortgage points, sometimes called discount points.

Points are priced as a percentage of your mortgage cost. Each point you buy reduces your interest rate by a certain amount that will vary by lender. Buying points makes financial sense when you stay in your home long enough, because you can save more on interest over time than you paid for the point.

Keep reading to learn how mortgage points work so that you can decide if buying points makes sense for you.

How Do You Calculate Basis Points For Commission

You May Like: Chase Recast Calculator

Are Mortgage Discount Points Worth It

In the above example, the mortgage applicant saves $14 per month for every $1,000 spent on mortgage points. To reclaim the full $1,000 cost of the points, the homebuyer would need to make 71 regular monthly payments. That would take almost six years.

Home finance experts call the time it takes to recover your upfront cost the breakeven point.

Every mortgage loan will have its own breakeven point for buying points.

If you plan to stay in your home beyond the breakeven point and this is key! if you dontthink youll refinance before the breakeven hits, paying points may be a good idea.

The longer you stay in the home beyond the breakeven point, the more youll save because the interest rate reduction continues generating monthly savings as long as you have the loan.

Selling your home or refinancing the mortgage before its breakeven point can make discount points a waste of money. In this case, youd do better to put the money toward your down payment to increase your home equity.

According to Freddie Mac, the typical 30year fixedrate mortgage loan carries between 0.5 and 0.7 discount points.

Adjustablerate mortgages tend to carry fewer points because ARM homebuyers intend to sell or refinance sooner. Points pay off only if you keep the loan long enough to realize savings from the interest rate reduction.

How mortgage points affect APR

But APR also assumes youll hold your loan for 30 years. Very often, you will not, which nullifies the APR math.

What Are Mortgage Points Should You Pay Them

Men sign the house of the contract

When people want to find out how much their mortgages cost, lenders often give them quotes that include loan rates and points.

What Is a Mortgage Point?A mortgage point is a fee equal to 1 percent of the loan amount. A 30-year, $150,000 mortgage might have a rate of 7 percent but come with a charge of one mortgage point, or $1,500.

A lender can charge one, two or more mortgage points. There are two kinds of points:

Discount PointsThese are actually prepaid interest on the mortgage loan. The more points you pay, the lower the interest rate on the loan and vice versa. Borrowers typically can pay anywhere from zero to three or four points, depending on how much they want to lower their rates. This kind of point is tax-deductible.

Origination PointsThis is charged by the lender to cover the costs of making the loan. The origination fee is tax-deductible if it was used to obtain the mortgage and not to pay other closing costs. The IRS specifically states that if the fee is for items that would normally be itemized on a settlement statement, such as notary fees, preparation costs and inspection fees, it is not deductible.

How do you decide whether to pay mortgage points, and how many? That depends on a number of factors, such as:

- How much money you have available to put down at closing

- How long you plan on staying in your house

Distributed by Tribune Content Agency, LLC

Also Check: Reverse Mortgage Mobile Home

Advantages And Disadvantages Of Negative Points

Negative points provide a way for borrowers with little or no money to pay the settlement costs to obtain a mortgage. However, the economics of using negative points depend on the borrower’s time horizon.

If the borrower intends to hold the mortgage for a short period, it can be economical to avoid upfront costs in exchange for a relatively higher interest ratemany mortgages with negative points will carry a higher rate of interest over the life of the loan. If, on the other hand, the borrower intends to hold the mortgage for an extended period, it is probably more economical to pay upfront settlement costs in exchange for a lower interest rate.

What Are Mortgage Points And How Do They Work

1-min read

A mortgage point equals 1 percent of your total loan amount for example, on a $100,000 loan, one point would be $1,000.

Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments .

In some cases, a lender will offer you the option to pay points along with your closing costs. In exchange for each point you pay at closing, your mortgage APR will be reduced and your monthly payments will shrink accordingly.

Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Buying points for adjustable rate mortgages only provides a discount on the initial fixed period of the loan and isn’t generally done.

Read Also: Will Mortgage Pre Approval Hurt Credit Score

What Are Mortgage Origination Points

Mortgage origination points are fees you pay to a lender for the processing of your home loan. These fees are how loan originators get paid.

Each point is 1% of the total loan amount. One point on a $200,000 loan would be a $2,000 charge. Because a single point has a higher total dollar value for a larger loan, you are likely to have more success negotiating smaller origination fees if you have a larger mortgage balance.

You Can Deduct The Full Amount Of Points When Selling Or Refinancing

- Assuming you were deducting mortgage points ratably

- You might be able to deduct the full, remaining amount

- When you prepay, sell or refinance

- But certain restrictions apply

If the mortgage ends early due to a prepayment, refinancing, or foreclosure, you can deduct the remaining amount of the points in the year the mortgage expires.

But if you refinance your home loan with the same lender, the remaining points must be deducted over the life of the new loan.

If you dont itemize your deductions in the year the loan is taken out, you can spread the mortgage points over the life of the loan and deduct in the future when you do itemize deductions.

Keep in mind that you can also deduct any mortgage points paid by the seller of the home, assuming you meet all the requirements listed above.

Note that certain closing costs such as appraisal fees, title and escrow fees, homeowners insurance, and notary fees are not interest, and are therefore not tax deductible.

As always, any tax related questions should be reviewed by a tax professional to ensure their accuracy as guidelines do change often.

Don’t Miss: Reverse Mortgage For Condominiums

Points Are Tax Deductible

The cost of mortgage points does not differ by type. If one lender has a one-point origination fee and one-point discount fee for a certain rate and a second lender has no origination fee and a two-point discount fee, the cost is the same. The one difference for the borrower is that origination-fee points are not tax-deductible and discount points may be tax-deductible. Buying down a mortgage using points will result in interest savings several times greater than the cost in points if the mortgage is paid in full.

Calculate Your Breakeven Point

Youll also want to know how long it takes to recover the upfront cost based on how much you save. To find out when youll break even, divide the cost of the discount points by your monthly savings:

$3,000 / $33 = about 91 months, or 7.5 years

In this example, you would need to stay in your home for at least 7.5 years to cover the cost of the points you buy and start saving money on your mortgage.

Its hard to predict exactly how long youll stay in a home before you buy it, but try to come up with a realistic estimate when comparing mortgage quotes. This can help you make the right decision about whether to buy points.

Read Also: Chase Mortgage Recast Fee

How Much Money Do You Have To Put Down At Closing

If your down payment on a conventional loan is under 20%, you may be required to pay private mortgage insurance , which can cost about 1% of the loan amount annually. In the case of a conventional loan for $150,000, the PMI will cost $1,500 a year or $125 a month.

This is important for clients who are on the fence between paying for mortgage discount points or a larger down payment. If its between discount points and boosting your down payment to 20% or over, youll want to choose the down payment most of the time. Always do the math and consider if your discount points are costing you more or less than your monthly PMI fees.

PMI rates do vary from lender to lender, so this is a question worth asking if youre shopping for a conventional loan. Its also important to know that mortgage insurance guidelines will depend on the type of loan you have .