When To Consider Loan Recasting

In some cases, if you make a large enough mortgage payment, your lender might offer to recast your loan. If youre not aware of this, you may actually ask your lender for recasting.

Mortgage recasting is when you pay a large amount toward your principal balance, which is then reamortized to reflect the remaining balance. Basically, your lender recalculates the remaining balance into a new amortization schedule. You might want to consider recasting if you happen to have large funds from inheritance pay or a windfall from a side-business.

Under the law, only conforming conventional loans can be recasted. This excludes government-backed loans such as FHA loans, USDA loans, and VA loans. Majority of jumbo loans also do not qualify for recasting. To be eligible for recasting, you must have a pristine record of timely mortgage payments and enough lumps sum funds.

Homeowners usually recast their loan to reduce their monthly payment. Like refinancing, recasting decreases overall interest charges. However, it retains your original repayment schedule and interest rate. This means if you have 25 years left to pay, your monthly payment will be lower, but your loan term will still be 25 years. It does not actually shorten your payment term. But its worth it to have lower monthly payments.

To give you a better idea, heres an example below. Lets say you received an inheritance payment worth $200,000. If you happen to have a new loan worth $300,000, you can try recasting.

Types Of Mortgage Interest

When you use a mortgage to buy a house, the lender charges interest. Interest is the price you pay to borrow money. Even a small difference in the interest rate could be the difference between paying or saving tens of thousands of dollars over the life of your mortgage. Your mortgage interest rate will fluctuate over time. That is because you and your lender renegotiate your interest rate every time you renew your mortgage term.

There are a few different ways a lender can charge interest on your mortgage. Understanding the different types of mortgage interest rates is one of the most important parts of becoming a homeowner.

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

Also Check: Are Home Mortgage Rates Going Down

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how big your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a one million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Other Ways To Pay Off A Mortgage Early

Paying off a mortgage early requires you to make extra payments. But there’s more than one way to pay off the mortgage early:

-

Add extra to the monthly payments, as discussed in this article.

-

A structured way to add extra: Divide your monthly principal payment by 12, then add that amount to each monthly payment. You end up making 13 payments, instead of the required 12 payments, every year.

-

A variation of the above tip: Deposit one-twelfth of the monthly principal payment into a savings account each month, then use that money to make a 13th payment.

-

Pay half a mortgage payment every two weeks. You make 26 half-payments, equivalent to 13 full payments a year. If you want to try this, first make sure your mortgage servicer is set up to receive biweekly payments.

-

Make a lump-sum payment toward the principal. You might do this after receiving a bonus, inheriting money or winning a lottery prize any time a large sum lands in your checking account. Coordinate with your servicer to ensure that the money goes toward reducing principal.

-

Refinance to a shorter term. If you can refinance with a lower interest rate, for a shorter term, it’s a win-win. For example, you could refinance a 30-year mortgage into a 15-year loan. The monthly payments will almost certainly be higher, and you’ll pay closing costs, but your overall interest expense will be dramatically lower.

You May Like: Is It A Good Idea To Pay Off Your Mortgage

Fixed Rate Mortgage Penalty Interest Rate

For fixed-rate mortgages, lenders usually use the greater of three months of interest or an interest rate differential . Each lender has their own IRD calculation. The interest rate that they use for their IRD is usually based on either their current advertised mortgage rates or their posted rates, which can often be much higher.

| Advertised Rate IRD |

|---|

| SimpliiLaurentian |

Paying Off Your Mortgage: What To Expect

From the moment homeowners sign onto a mortgage, they often look forward to the day they pay it off. As tempting as it is to save on interest rate payments and pay off your mortgage early, its important to look at your financial health to avoid becoming house rich and cash poor.

Still, the day will come when you make that last mortgage payment. Usually, people pay off their existing mortgage in one of three ways:

- When they sell their home.

- When they make their final payment to pay off the loan.

Lets break down some common questions about the payoff process. Parts of the process are the same for every lender, while other details are specific to Rocket Mortgage®.

Read Also: What Is Needed For Mortgage Application

Pay Off Your Mortgage Or Grow Your Wealth: Which Is Best

The choice often comes down to whether you have retirement savings or not. The younger you are, the more you should focus on retirement savings.

Later, when compound interest has grown your wealth, you could make extra payments toward your home loan principal to build equity quickly.

If your retirement portfolio is in good shape, try to make extra mortgage payments early to reduce the principal youre paying interest on.

What Is The Difference Between An Open

The major difference is the penalties associated with aclosed-term mortgage. With an open-term mortgage you can pay off the entire mortgage amount whenever you want. You still have to pay your principal and interest amounts every month but you can make additional payments without having to pay a prepayment penalty . These benefits are great but most people usually opt-in for a closed-term mortgage agreement for a couple reasons. First, an open-term mortgage usually has a higher set interest rate. And since most individuals don’t plan on paying off their mortgage early, they decide to go for the lower closed-term rate.

That being said, a closed-term mortgage is one that you take out for a specified amount of time. In Canada, the standard term is about 5 years. As mentioned, the main difference with a closed-term mortgage is you don’t have the freedom to payoff your principal when you want. Some closed-term agreements allow you to pay off 10%-20% of principal once a year but outside of that, you will have to pay your lender a penalty fee for doing so.

Recommended Reading: How Much Is A Habitat For Humanity Mortgage

Saskatchewans Regulations Taxes And Fees

Although many mortgage regulations in Canada are the same across the country, each province has their own mortgage rates, taxes and fees. Unlike most provinces, Saskatchewan, there is no land transfer tax like in many other provinces. There is however a small land title fee to be paid with your closing costs

Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

Recommended Reading: How Much Income For A 600k Mortgage

How Much Of A Down Payment Do I Need

In Canada, the minimum down payment requirement is 5% for houses under $1 million. However, borrowers who put down less than 20% require mortgage default insurance, which is added to your mortgage balance and accumulates interest. Mortgage default insurance makes your mortgage more expensive. Also, your mortgage interest rate is heavily influenced by the size of your down payment. The larger the down payment the better. Try to provide at least 20% to avoid expensive mortgage default insurance. There is no maximum down payment, more is usually better. It will help you secure a better rate, your mortgage balance will be lower, and you will pay your mortgage off faster while saving on interest charges.

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Recommended Reading: What Is Verifiable Income For A Mortgage

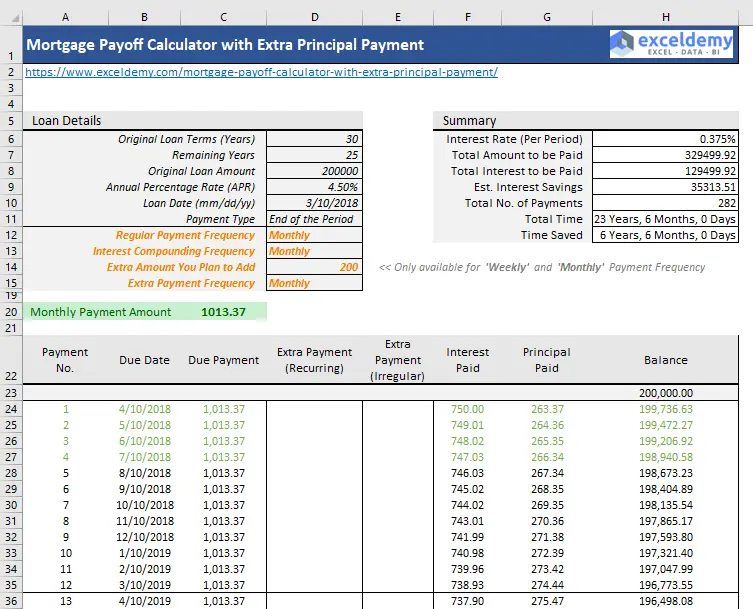

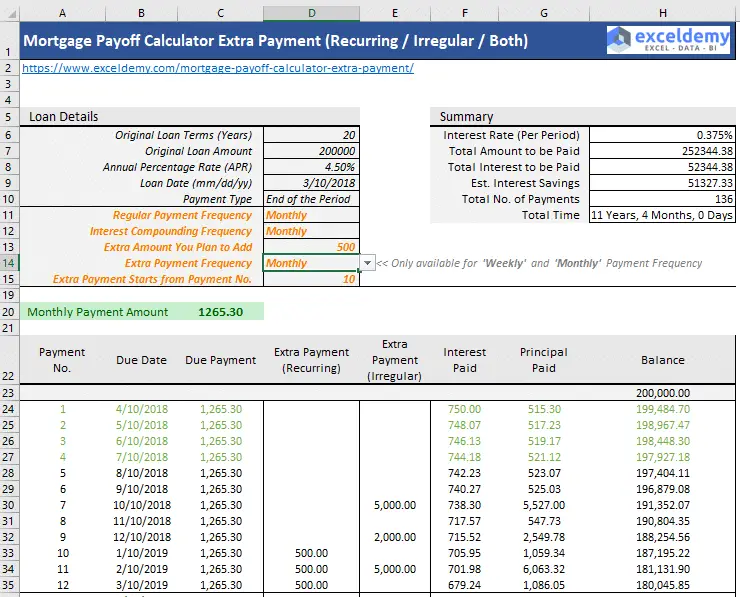

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgage’s payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids’ college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.

How Is My Mortgage Interest Rate Determined

The posted rate is just a benchmark. Your actual mortgage interest rate is determined by your credit score, unique financial situation, and market conditions. The higher your credit score, the better your mortgage interest rate will be. The amount of debt you have compared to your income will also impact your rate. The lender will also take into account the property price and the size of your down payment. The larger your down payment, the lower your mortgage interest rate will be. Conventional mortgages, where the borrower provided at least a 20% down payment, often get a better rate than high-ratio mortgages with down payments less than 20%. Open mortgages with no pre-payment penalty typically have significantly higher rates than closed mortgages. And fixed interest rates are historically higher than variable interest rates.

Don’t Miss: Why Are Mortgages So Hard To Get

What Are The Reasons For Breaking A Mortgage

Some scenarios:

- The current interest rate on your mortgage is 4.2% and you have 2-years left on your 5-year fixed rate before you have to renew. You do some research and your bank is currently offering 3.1% on a 5-year fixed rate. Because of current events, you suspect that you won’t be able to get this low rate a few years from now. You do the math and it looks like you’ll save more money in the long run if you switch now.

- You have a variable rate mortgage and you notice the rates are as low as you have ever seen them. So to lock in this new low rate you decide to switch to a fixed rate mortgage.

- You have come into a large sum of money and want to use it to pay off $200,000 of your mortgage principal but can’t because this amount is much higher than what is allowed in your mortgage contract. Thus, you must break your mortgage agreement to proceed.

- You cannot afford your current mortgage monthly payments. The solution would be to get a new mortgage with a longer amortization period so the monthly payments are reduced.

- You have a accumulated a significant amount of credit card debt that is accruing interest at a rate of 19.99%. Your financial advisor strongly suggests consolidating your high interest credit card debt into your mortgage by taking equity out your home and refinancing.

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Recommended Reading: Can You Do A Quit Claim Deed With A Mortgage

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed â The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment â The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage â The remaining number of years until you want your mortgage paid off.

- Principal â The amount of money you borrowed to buy your home.

- Annual Interest Rate â The percentage your lender charges on borrowed money.

- Mortgage Loan Term â The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction â A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required â The extra amount of money you’ll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings â How much you’ll save on interest by prepaying your mortgage.

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Read Also: How To Make A 30 Year Mortgage A 15

When To Consider Refinancing

Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. But other than that, it can help you obtain lower interest rates. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. If you have a 30-year mortgage, you can refinance to a 15-year mortgage with reduced interest. Moreover, it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage , and vice versa. But dont forget: It should be done early enough into the loan term.

Heres when its good to refinance from a 30-year to 15-year term:

- If interest rates are low

- If you have a qualifying or high credit score

- If youve paid your loan for just a couple of years

- If you are not planning to move out of the house

- If you are able to make higher monthly payments Refinancing to a shorter term makes your monthly payment higher even with a reduced interest rate. This yields significant interest savings.

Moreover, refinancing is taking out a new loan to replace your old one with more favorable terms. This means you need to go through all the credit checks and paper work. It requires a high qualifying credit score , with the best rates going to consumers with 740 credit scores. On top of this, you must shoulder many fees, including inspection, recording fees, origination fees, and housing certifications.

Refinancing is not ideal under the following circumstances:

Whats the Ideal Interest Rate to Refinance?