Financial Protection After A Quitclaim

When a quitclaim deed results from a court order, the judge normally also includes instructions for refinancing the property and handling all outstanding debts. It is in both parties best interest to get the mortgage and any liens transferred into one persons name, usually by refinancing. For the person who is signing the quitclaim deed, it is a way of making sure he is no longer responsible for those debts. For the person retaining ownership of the property, it insures that it wont be foreclosed on due to the absent persons failure to pay.

References

Use Them To Remove Title Defects

Quit claim deeds are also commonly used to remove title defects or clouds. Clouds often arise when a title search reveals that the property was improperly transferred. For instance, maybe a previous owner failed to follow the correct legal requirements and format for the deed. Other times a cloud may arise when someone may have an unexpected interest in a property, possibly a grantor transferred property without their spouses consent, who also had an interest. In this case, the spouse who still has a possible interest may be asked to execute a quit claim deed to relinquish any right to the property that he or she may have.

Can I Legally Quitclaim Deed My Home To Another Person While Im Still Paying Off My Mortgage

I want to transfer my property to a family member. We know all of the land characteristics and dont need to run a title check. Can I legally quitclaim deed my home to another person while Im still paying off my mortgage?

What is a Quitclaim?

A quitclaim deed can transfer rights and interests to another party quickly. You can use it when you know all of a propertys characteristics and dont want to waste money on a title check. The seller transfers his interests to the buyer .

If the buyer and seller are brothers and want to transfer property without paying unnecessary fees, they can use a quitclaim deed. This is a fast and easy method for property conveyance.

Assets not Liabilities

A quitclaim will transfer your home equity to the other party, but not your mortgage. The quitclaim deed transfers assets, not liabilities. Therefore, you better know what you are doing.

Besides the home equity, what rights are you transferring? You are transferring the right to use the property while timely mortgage payments continue to be made.

Bank Foreclosure Rights

The bank holds your mortgage. If you miss a payment, it can claim the entire property through foreclosure. Most banks do not allow you to quitclaim deed a property with a mortgage on it. Why?

The financial lender made the loan to you, not the other party. Therefore, they have no real financial relationship with the other party. They have rights over you, not the other party.

Getting Bank Permission

You May Like: How To Get A Mortgage At 21

Quitclaim Deeds Can Be Complicated Legal Documents They Are Commonly Used To Add/remove Someone To/from Real Estate Title Or Deed

The quitclaim deed is a legal document used to transfer interest in real estate from one person or entity to another . Unlike other legal conveyance deeds, the quitclaim conveys only the interest the grantor has at the time of the deed’s execution and does not guarantee that the grantor actually owns the property.

Without warranties, the quitclaim deed offers the grantee little or no legal recourse against the seller if a problem with the title arises in the future. This lack of protection makes a quitclaim unsuitable when purchasing real property from an unknown party in a traditional sale. It is, however, a useful instrument when conveying property from one family member or spouse to another, and it is commonly used in divorce proceedings or for estate planning purposes.

Title companies may require a person to execute a quitclaim document in order to clear up what they consider to be a cloud on the title prior to issuing title insurance. Similarly, prior to funding a loan, lenders may ask someone who is not going to be on a loan, such as a spouse, to complete and record a deed quitclaiming their interest.

Changing Owner Names On Property

When filling out a Georgia quitclaim deed form to change a name on a property, you need to include:

- the propertys legal description

- the county the property is located in

- the date of transfer

- the name of the grantor

- the name of the grantee

Usually, quitclaim deeds are used to change the owners name on title.

This could be in the event of a name change during, say, a marriage.

In this case, the owner would be the grantor and the grantee.

Recommended Reading: How To Pay 15 Year Mortgage Off Early

They Are Great For Transfers To Subsidiaries

As alluded to above, quit claim deeds are an excellent vehicle for land transfers to business subsidiaries and parent companies. Because the parties already trust each other , the relative ease of drafting, executing, and filing a quit claim deed makes it an effective way to handle such transactions.

When To Use An Interspousal Transfer Deed Vs Quit Claim Deed

Interspousal transfer deeds can be used to avoid tax liability when transferring property. When title to property is transferred, the county may impose a transfer tax and may reassess the value of the property which could result in higher property taxes. However, an interspousal transfer deed is a special kind of transfer that is exempt from transfer taxes and ultimately a cost-effective method of transferring property between spouses.

Quit claim deeds are very simple and use a form that is easy to find online or at office supply stores. However, with a quit claim deed one spouse may give up rights to certain property but not necessarily liability for any mortgage or lien on the property. A problem could arise if one spouse is awarded the marital home in a divorce and the other spouse uses a quit claim rather than interspousal transfer deed to transfer his or her interest. The spouse that gives up his or her interest to the house may still be responsible for one-half of the mortgage debt because their liability can’t be transferred through a Quit Claim Deed.

Read Also: What Is The Best Mortgage Loan Company

Can You Make A Quit Claim Deed In Florida After Death

You cannot make a quitclaim deed effective after your death. Once you fully execute a quitclaim deed, the intended effect is immediate .

However, a lady bird deed can often achieve the same goal. With a lady bird deed, the grantor keeps the property during the grantors lifetime, with title transferring to a grantee upon the owners death.

Quit Claim Deeds And Mortgages

Your mortgage may contain a due on sale or due on transfer clause stating that if the real property is transferred or sold, the mortgage becomes accelerated. This means the entire amount is due. This is called an acceleration clause.

When the mortgage was first assigned to the property, the loan was based on several factors, such as income, credit, and the property’s value. When a transfer to an LLC is instigated, it triggers the acceleration clause.

The 1982 Garn-St. Germain Depository Institutions Act, which provides exemptions from the enforcement of accelerations clauses, regulates the two clauses. The law provides exemptions from enforcement of acceleration clauses, which includes transfers to trust and transfers on death. A mortgage with an acceleration clause does not in any way hinder or prohibit the transfer. However, it does give the lender the option to accelerate.

While there is nothing in place that requires the sale to be reported, it is recommended that you consult with a lawyer. It is also recommended that approval from the lender be requested. This should not pose a problem the collateral is not in jeopardy since your name is still on the mortgage, not the LLC.

In legal terms, the LLC has not assumed the debt. If there was any risk to the lender, they may opt to accelerate the mortgage. This would include payments on the note not being made, and the lender’s ability to foreclose due to default is in jeopardy.

Don’t Miss: How Big A Mortgage Can I Get With My Salary

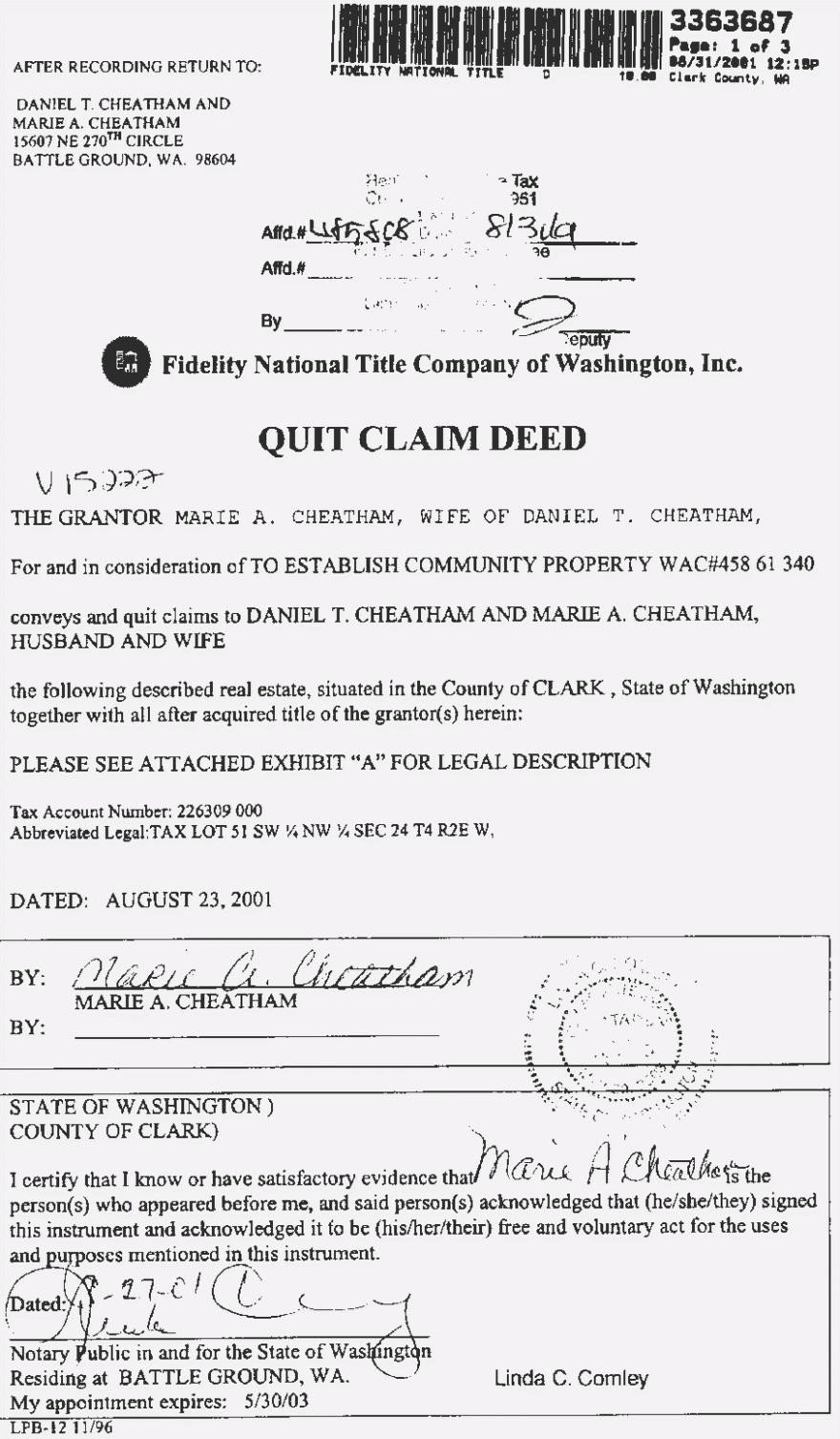

What Is A Quitclaim Deed Form

A quitclaim deed form is a legal document that puts in writing that the grantor releases their ownership rights of a property to the grantee. Typically, these forms will have the grantor and grantees name, the legal description of the property, how much is being paid for the property , the parcel number , the person preparing the document, any witnesses overseeing signing of the document and the notary publics signature.

You can typically find free templates online though, to be sure, you can consult an attorney before signing the form to ensure it has all necessary information and is appropriately formatted in your area. Once complete, youll need to register it with the county clerks or county recorders office. In addition to consulting a legal professional, its also a good idea to check with your local county office to make sure youve complied with their rules and regulations.

Once the quitclaim deed is signed by the grantor and accepted by the grantee, its considered legal and effective. However, some counties in the U.S. require that the grantee sign as well again, at your local office.

Can You Quit Claim Deed A Property With A Mortgage

mortgagequitclaim deedmortgagedoesmortgagequitclaim deedwillpropertywillmortgage

. Keeping this in consideration, what happens to mortgage after quit claim deed?

If there is no mortgage, there is of course no way for the quitclaim deed to affect the mortgage. In some cases, the grantor does have a mortgage while filing a quitclaim deed. The new owner will have the title of the property, but the original grantor will still be liable for the outstanding mortgage.

Similarly, why would you use a quit claim deed? Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse’s name to the title or deed, or when the owners divorce and one spouse’s name is removed from the title or deed.

Secondly, can you buy a house with a quit claim deed?

Still, it’s possible for a grantor to have a mortgage and file a quitclaim deed. In these cases, the grantor remains legally responsible for the mortgage, even after ownership is transferred to the grantee. A quitclaim deed transfers ownership, but it doesn’t have anything to do with debts or claims on the property.

Will a quit claim deed hold up in court?

A quitclaim deed is a legal instrument that transfers the grantor’s legal interest in a piece of real property to another person . If a quitclaim deed is challenged in court, the issue is whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Read Also: How Do I Qualify For A Zero Down Mortgage

You’re Still Responsible For Taxes

Once youve signed a quitclaim deed, you wont accumulate new tax debt, but you are responsible for taxes that were due as of the day you signed the deed. If you dont pay, the property tax authority in your area can take legal action and force you to pay. The property may be sold to pay any back taxes, but you can also be sued for the debt. To minimize your tax liability, file the signed deed with your county recorder immediately, so that theres no question about when you signed.

Selling A Home With A Quitclaim Deed

Selling a home with a quitclaim deed is perfectly legitimate. However, if you understand the problems it creates for re selling the home, you can quickly see why it can create problems for the buyer in the future. You may truly own the property, and it may be free of liens and encumbrances. However, future title companies may not be willing to simply take your word for it.

It may be several years later before the buyer who obtained the quitclaim deed needs to sell the property. Does the current owner or title company still have a way to contact the prior seller? How do they verify the legitimacy of the sale? It not, this could create significant challenges for the latest owner to obtain title insurance selling the property.

You May Like: Can You Apply For A Mortgage Before Finding A House

How To Be Removed From A Mortgage

There are very few ways to be removed from a mortgage without paying it off One way, is to work with the bank to attempt a Deed in Lieu. A Deed in Lieu, is a special deed that transfers ownership of the property to the bank. In a Deed in Lieu, the borrower gives the lender the home, and the lender removes the borrowers mortgage. However, a Deed in Lieu does not provide any of the guarantees regarding protection from liens and encumbrances. For this reason, many lenders are hesitant to accept Deeds in Lieu.

Quitclaim Deeds Can Create Clouds On Title

However, what happens when theres a deed without a title company stamp recorded between the current sale and the previous title companys insurance policy? Whos going to insure around this unknown deed? What happens when title companies encounter these situations? Often, they require the sellers to sign affidavits to release the title company for claims relating to the unknown deed. Or, in some cases they may not be willing to insure the property transfer. When this happens in the middle of your transaction, you may need to find a different title company.

Years ago I was involved in selling a property owned by a very complicated trust agreement. We were in the middle of escrow, when I received a call. The title company we were using said they couldnt complete the transfer because of language in the trust. We had to change title companies in the middle of escrow to a company that understood the trust agreement.

Read Also: How Do Mortgage Brokers Make Money

Repercussions Of A Quitclaim Deed

Grant deed with title company stamp

Because quitclaim deeds can be so easily created, and recorded by anyone, they can be problematic. Normally, deeds recorded by title companies have a stamp identifying the title company responsible for creating and recording the deed. However, if a Joe Public decides to use a quitclaim deed to transfer ownership and not use a title company? This will indicate the lack of title insurance for the transaction. This doesnt mean the deed is invalid, but it raises red flags to attorneys and title companies.

When a title company issues title insurance to a buyer, they follow strict rules regarding the creation of the deed. Because this process is managed by the title company, they are willing to offer the buyer insurance protecting the buyer from title problems. The title company will verify the current owner in addition to checking for any recorded liens against the property.

How Does A Quitclaim Deed Affect Your Mortgage

A quitclaim deed is a document that transfers legal ownership and interest of a property from one person to another . Unlike a warranty deed, a quitclaim deed does not offer assurances that the land in question is free from claims.There is no warranty on the status of the property title the grantee simply takes legal possession of whatever interest the grantor had in the property at the time of the transfer. Therefore, the deed offers almost no buyer protection. A quitclaim deed may or may not affect your mortgage depending on how the parties use the deed.

Recommended Reading: What Documents Do I Need To Get A Mortgage

What Are Quitclaim Deeds

Quitclaim deeds can be a quick way to transfer interest in real property. For instance, if you want to transfer property between family members, a quitclaim deed could be the way to go. They cant be used in a traditional real estate sale, however.

Find out more about what a quitclaim deed is today, then decide if one is right for your situation.

What Is The Purpose Of A Quitclaim Deed

Quitclaim deeds are common in inter family transfers of real estate. They common when family members want to avoid the costs of title insurance or attorney fees. Theyre also commonly used when moving property in and out of a trust, such as during a bank refinance. Banks typically do not loan to trusts. Most banks require property ownership be under the name of real persons. So, before the bank will lend the funds, trustees may use a quitclaim deed to move the property ownership to a real person. Then, after the bank loan is completed, the trustee uses a quitclaim deed to move the property back into the trust.

Quitclaim deeds may also be used to transfer ownership between spouses, or ex spouses in the case of divorce. However, an inter-spousal grant deed is more common. In the event of a couples divorce, either of these deeds might be used to transfer the home entirely to one or the other.

You May Like: Are Mortgage Interest Rates Going Up

Transferring Property After Divorce

Often as part of a divorce judgment or marital settlement agreement, one ex-spouse must transfer or quitclaim their marital property to the other ex-spouse. This transferring of property is frequently done via a quitclaim deed.

The quitclaim deed transfers all interests that one spouse has in the property to the other spouse. In doing so, the transferring spouse complies with the terms of the divorce judgment.

Regardless of which spouse prepares the deed, the deed must be signed by the transferring spouse. The receiving spouse does not need to sign it.