Budget For Homeowner Costs

Beyond the costs of purchasing a home, youll likely have expenses related to owning and maintaining your home:

Homeowners insurance

Lenders will require that you carry homeowners insurance, which protects your property in case of damage. The amount will vary depending on your homes value and location. Certain areas that are prone to floods or earthquakes may have higher premiums.

Property taxes

You will also pay property taxes to your local government. This amount is based on the value of the property and land and is used to cover costs such as infrastructure, school, law enforcement, and fire service.

Maintenance and repairs

Maintenance includes the ordinary expenses that come with owning a home, such as painting, taking care of a lawn, fixing appliances, and cleaning living spaces. The average homeowner spent $2,289 a year on maintenance and repairs in 2016, according to Bureau of Labor StatisticsConsumer Expenditure Survey. If youre preparing your home for sale or just curious about general upkeep, review our home maintenance and repair checklist.

The average Homeowners Association fee is $200 to $300 per month for a typical single-family home, according to Realtor.com. This money usually covers shared amenities and services for a community such as a pool or gym, trash removal, snow removal, or maintenance to common areas.

Income Requirements To Buy A Home

Lenders consider much more than just your paycheck when you buy a home. Your debt-to-income ratio and your ability to make mortgage payments are more heavily considered than how much you make. Theyll also consider your credit score and how much you have for a down payment.

A great place to start is to get a preapproval, especially if you arent sure whether you can get a mortgage on your current income. A preapproval is a letter from a mortgage lender that tells you how much money you can borrow. When you get a preapproval, lenders look at your income, credit report and assets. This allows the lender to give you a very accurate estimate of how much home you can afford.

A preapproval will give you a reasonable budget to use when you start shopping for a home. Once you know your target budget, you can browse homes for sale to see what general prices are. Its a good sign that youre ready to buy if you find appealing options at your price range.

So what do lenders look for when you want to borrow? For starters, theyll take a look at your monthly income and your debt-to-income ratio.

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.

You May Like: What Does A Co Signer Do For A Mortgage

The Rules Of Home Affordability

Mortgage lenders use something called qualification ratios to determine how much they will lend to a borrower. Although each lender uses slightly different ratios, most are within the same range. Some lenders will lend a bit more, some a bit less. We have taken average qualification ratios to come up with our three rules of home affordability.

So What Actually Goes Into Your Mortgage

Instead of thinking of the price tag of a home as affordable, look at whether you can afford to borrow the money it will cost and can repay the loan in monthly payments.

First, lets figure out what your ideal mortgage payment will be also known as what youll essentially be paying instead of rent. Aside from the actual mortgage, there are some key expenses that will impact your monthly payments.

Also Check: How Much Usda Mortgage Can I Qualify For

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will generally range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

How To Use The Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be.

As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income.

So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

Also Check: How Much Per 1000 On Mortgage

Can I Use A Mortgage Calculator Based On Income

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Home Affordability By Debttoincome Ratio

Your debttoincome ratio measures your total monthly debts including your mortgage payment against your monthly income. The higher your existing monthly debts, the less youll be able to spend on your mortgage to maintain a healthy DTI.

For example, say you make $50,000 a year and want to stay at a 36% DTI.

In that case, your total debts, including mortgage and any other debt payments cant exceed $1,500. Heres how that affects your home buying budget:

| Annual Income | How Much House You Can Afford |

| $50,000 | |

| $1,000 | $180,406 |

The examples above assume a 3.75% fixed interest rate and 3% down on a 30-year mortgage. Your own rate and monthly payment will vary.

Recommended Reading: Who Has The Best Mortgage Loan Rates

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

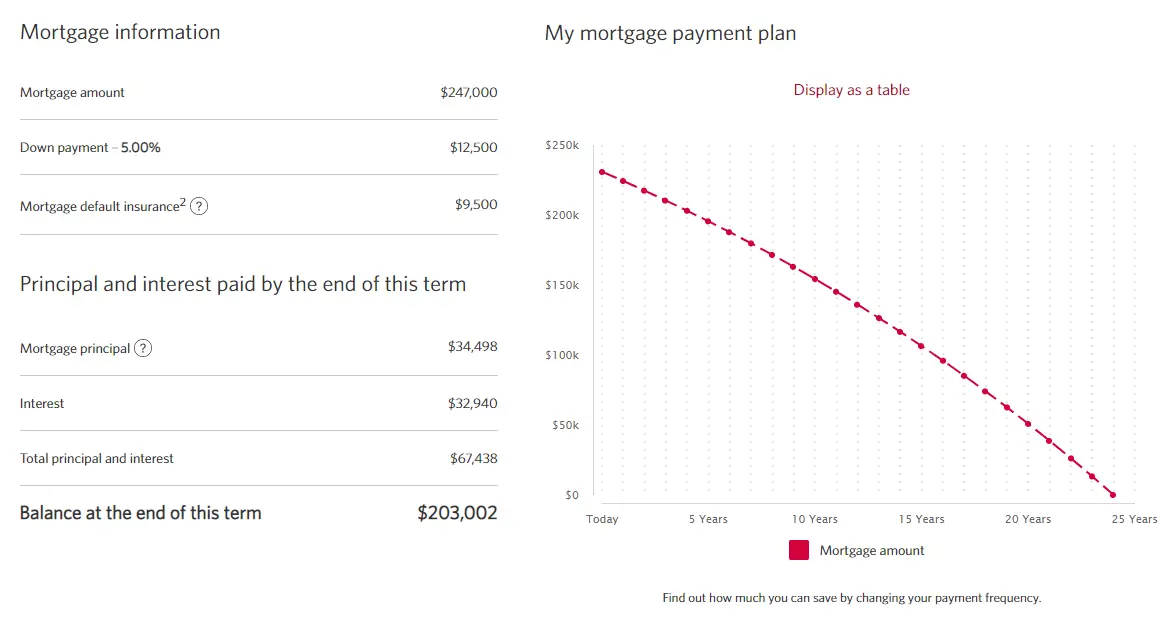

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

How Much House Can You Afford

Modified date: May. 9, 2021

Buying your first home is one of the most important and exciting financial milestones of your life. But before you hit the streets with a realtor, you need to have a good sense of a realistic budget. Just how much house can you afford? You can determine how much house you can afford by following three simple rules based on different percentages of your monthly income.

You May Like: What To Expect When Applying For A Mortgage Loan

Do You Have Enough Income

To afford a home, you must have enough income to cover your mortgage payments as well as your usual expenses and other debt obligations. This is a big deal because it reveals how predictable your finances are, which is crucial in making monthly payments. You have increased chances of securing approval if you have a stable long-term job with high income, which is why lenders verify your employment status.

Apart from evaluating your income, you may also submit any additional proof of income. Note that extra income is only accepted by lenders if it can get funds from those sources for at least three years. Heres a list of eligible sources of additional income:

- Payment from part-time work

- Stocks, bonds, and mutual funds

- Certificates of Deposit

Is 80k A Good Household Income

Is 80k a good salary in USA? And if you look at national average household income 80k is actually pretty high. Nationally median household income was only $56,516 in 2015. The fact is the majority of Americans work their entire life without ever getting close to 80k a year so all things considered its a good salary .

Also Check: Can I Use My Partner’s Income For A Mortgage

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Know Whats Standing In Your Way

Unfortunately, not everyone is financially ready to buy a home. This Mortgage Income Calculator will show some people that buying, at least at this point, is not within their grasp and offer an understanding of what financial obstacles stand in the way.

This calculator may show you that not enough down payment is your problem. Or maybe its too much debt. Perhaps you simply need to earn more to buy the home you want and need. Or, if you reassess your ambitions, can you afford a less-expensive home?

Recommended Reading: How To Recruit Mortgage Loan Officers

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

How Much Should You Be Spending On A Mortgage

According to Brown, you should spend between 28% to 36% of your take-home income on your housing payment. If you make $70,000 a year, your monthly take-home pay, including tax deductions, will be approximately $4,328. So, ideally, if we round that 28%-to-36% rule to one-third of your take-home income, you wouldnt be spending more than $1,442 on your housing payment dont forget, that should include your principal and interest payment, taxes and insurance, any HOA fees, plus PMI or mortgage insurance if you have it.

But if you have no debt, you can stretch up to 40% of your take-home income, which will be devoting about $1,731.20 to your mortgage payment.

Recommended Reading: How To Select A Mortgage Lender

Is 500k A Year Rich

$500,000 a year or higher is a level which I think is considered rich. Anybody who thinks otherwise has no concept of financial reality. Even the government agrees after compromising by raising the income level for when the highest marginal tax bracket kicks in to ~$400,000 from $200,000 back in 2013.

Where You Want To Buy

When it comes to real estate, its all about location, location, location especially when it comes to what you can afford. Every market and even every neighborhood within a market is different, and you can probably find a variety of price ranges where youre looking.

Its also good to keep in mind the property taxes youll be needing to pay depending on the state or city youre looking in and whether theres any additional home insurance youll need .

Read Also: How Much Is The Mortgage On A $300 000 House

Analyze Your Monthly Expenses

When estimating what you can afford, its also important to have a clear view of your monthly expenses. These can be hard to track and will likely vary based on the size of your household and your spending habits. According to the Bureau of Labor Statistics, the average individual has monthly expenditures that include:

- Food: $644

- Internet: $47

- Cell phone: $120

For an individual, these expenses add up to a monthly total of $2,463. Some of these items are discretionary and will fluctuate based on your lifestyle, city, the size of your home, and the size of your family. The goal is to estimate how much money youll need to spend each month after you pay your mortgage and other debts.

How Much Is Homeowners Insurance And What Does It Cover

Homeowners insurance is a combination of two types of coverage:

- Property insurance: protects homeowners from a variety of potential threats such as weather-related damages, vandalism, and theft.

- Liability insurance: protects homeowners from lawsuits or claims filed by third parties for accidents that happen within the home.

In 2019, the average annual cost of homeowners insurance was $1,083 nationwide. The cost of homeowners insurance policy will vary depending on the type of property being insured and the amount of coverage the owner desires. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment.

Recommended Reading: What Do I Need To Become A Mortgage Broker

How Does Credit Affect Your Mortgage Affordability

The first step a lender typically takes upon receipt of a mortgage application is a credit checka request for your credit score and credit report from one or more of the three national credit bureaus .

Lenders typically have a minimum credit score they’re willing to consider when evaluating borrowers. Different lenders have different minimum score or “cut-off” requirements. Lenders use credit scores when deciding whether to offer a loan as well as when determining the fees and interest rates to charge.

In accordance with a widespread industry practice known as risk-based pricing, applicants with the highest credit scores typically are offered the lowest interest rates available. Those with lower credit scores are typically charged higher interest . The basis for this is the fact that individuals with higher credit scores are statistically less likely than those with lower scores to miss payments and require lenders to initiate collections, foreclosure or other loss-prevention measures.

Mortgage lenders often offer numerous loan packages, with different interest rates and fees, targeted to borrowers whose credit scores fall within a specific numerical rangesfor instance, one offer for applicants with credit scores of 800 or better another for those with scores of 720 to 799 and another for those with scores of 650 to 719. These are purely hypothetical examples each mortgage lender sets its own credit score requirements.

What Is A Jumbo Loan

A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices. However, interest rates on jumbo loans are much higher because lenders don’t have the assurance that Fannie or Freddie will guarantee the purchase of the loans.

Read Also: Can I Get A Mortgage With No Credit