Build An Emergency Fund

You may have extra money now, but are you on a stable financial footing? Roughly 25% of Americans wouldn’t be able to cover an unexpected $400 expense with cash or cash-like payments. If that describes your situation, you might be better off putting extra money toward an emergency fund.

As mentioned above, your home’s equity isn’t easily or quickly tapped into. Its wise to keep at least three to six months’ worth of living expenses in a safe place, just in case the unexpected happens. If you prefer to be extra cautious, save even more. Doing so allows you to absorb financial surprises without going into debt or making drastic sacrifices. Once you have a healthy emergency fund, you can feel more confident in your decision to pay down the mortgage.

Is It Better To Pay Lump Sum Off Mortgage Or Extra Monthly

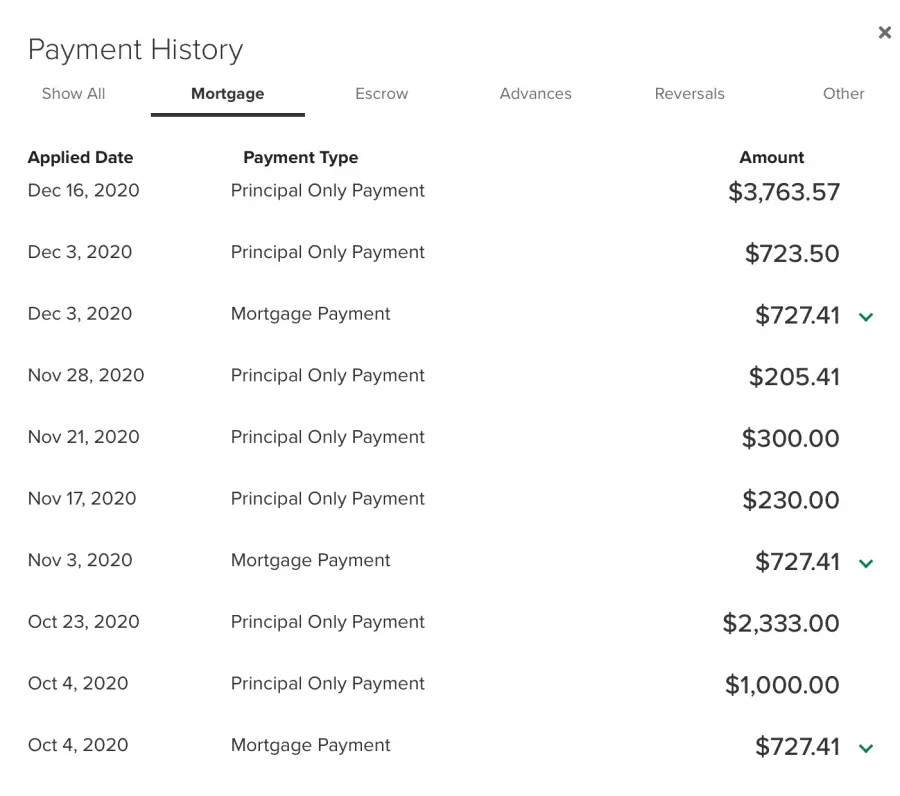

Regardless of the amount of funds applied towards the principal, paying extra installments towards your loan makes an enormous difference in the amount of interest paid over the life of the loan. Additionally, the term of the mortgage can be drastically reduced by making extra payments or a lump sum.

How Can I Pay Off My 30

A: Of course, this answer depends on the amount of your loan and your standard monthly payment. But for example, if you take out a 30-year loan of $300,000 and your monthly payment is $1,454, you would need to pay an additional $800 onto your principal amount to pay your loan off in 15 years. So instead, you could spread that extra $800 a month out by switching to a bi-weekly payment schedule and pay an extra $400 per paycheck in addition to what’s already being taken out for your standard mortgage payment.

Also Check: What Is Today’s Mortgage Interest Rate At Chase Bank

Drawbacks Of Additional Repayments

- Less money to spend, less savings

- Additional repayments may be subject to a fee

- If your mortgage is linked to a savings account or insurance policy, additional repayments may negatively affect your net monthly mortgage costs

- May lead to you losing the right to profit from tax-related interest deduction for specific mortgages types

- Making additional mortgage repayments may give tax consequences. Whether or not additional mortgage repayments are an interesting option for you depends on your personal situation

Find Out If Making Extra Mortgage Payments Makes Sense For You

Many mortgages let you pay off the loan early to save money on interest. You can do this by paying extra each month, making an extra payment every year, or just paying extra when you can.

Refinancing is a form of prepayment since you pay off your current mortgage and replace it with a new mortgage that has a lower interest rate or better terms. You will need to complete a new application and pay a new set of closing costs when you refinance, however. Think about these questions before you decide to pay off your mortgage early or refinance!

Read Also: What Is A 30 Year Fixed Jumbo Mortgage Rate

Making Extra Mortgage Repayments

If you have extra savings, inherited money or received a monetary gift, you may want to put these funds towards your mortgage by making an extra repayment in addition to your agreed monthly mortgage payment. Find out beforehand whether making extra repayments is the right option for you.

Should You Pay Off Your Mortgage Faster

This depends on the interest rate for your mortgage. Higher mortgage rates incentivize homeowners to accelerate the payoff process rather than accrue excessive interest. Mortgage rates are climbing, so refinancing may not be a great option for those whove already locked in a decent rate.

Weve broken down some bullets of things to consider when deciding whether to pay off your mortgage early.

In order, the considerations should be:

Also Check: Should I Get A 30 Or 15 Year Mortgage

Put Your Windfall On The Mortgage

If you receive a work bonus, an inheritance or other lump sum, you could consider putting some of this into your home loan. It might be tempting to book a holiday. But in the long run, reducing your loan period will probably be more relaxing.

As with any large sum, you may wish to consult your financial adviser or accountant before you decide where to put the money.

An Offset Account Is An Alternative To Making Extra Or Lump Sum Payments

Instead of making extra or lump sum payments, you could consider having a mortgage with an offset account instead.

An offset account is a transaction account attached to your mortgage where you can deposit money. The amount of money sitting in your offset account is offset against your mortgage, meaning you dont need to pay interest on it.

For example, if you had a loan balance of $400,000 and an offset account with $50,000 in it, you would only need to pay interest on $350,000. This can help you pay down your mortgage faster, without needing to constantly make extra contributions. Plus, the money can be accessed if you need it, and more money can be deposited into the account whenever you want to.

Also Check: How Long To Wait To Refinance Mortgage

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Potential Benefits Of Paying Extra On A Mortgage

Paying extra on a mortgage may help reduce the amount of interest paid over time, in addition to the total amount of time it takes to pay back your mortgage. You may be able to reduce the amount of interest paid and the time it takes to pay back your mortgage by applying extra payments directly to the principal balance. Making payments directly to the principal normally reduces the amount of interest paid because interest is calculated as a percentage of the principal. Typically, the lower the principal, the less interest owed.

Recommended Reading: How To Take A Mortgage Loan

Tips To Help You Pay Off Your Mortgage Faster

Looking for ways to pay off your mortgage faster? Thats great even small steps over time can make a big impact on helping you be mortgage free faster.

There are two parts to each mortgage payment the principal and the interest. The principal is the remaining balance of what you originally borrowed, while the interest rate is what youre charged while that principal is outstanding. You may be looking to pay as much as you can toward the principal to reduce the amount of interest youll pay over the life of your mortgage.

Well walk you through what you need to know to start paying off your mortgage faster.

During your mortgage term, youll have opportunities to make changes that will help you pay off your mortgage faster. There are some changes you can make at any point during your term, while others you can make when you renew your mortgage.

Keep in mind, its important to understand the terms of your mortgage agreement before making any changes to your payments. Your mortgage may come with certain prepayment privileges. At TD, we make it easier to pay off your mortgage faster with flexible mortgage payment features.

How Much Money Will You Save By Making Extra Payments

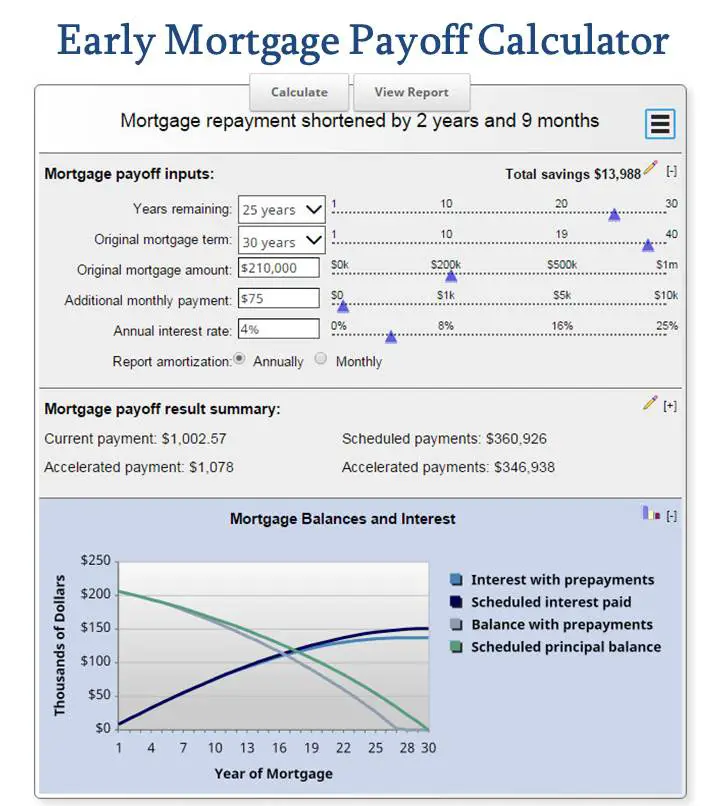

How much you might save on interest by paying off your mortgage early depends on many things. Your interest rate, the amount of principal you owe, your mortgage term, whether you have a fixed or adjustable rate, how long you plan to live in your home, and the amount you can pay extra all affect your potential savings. Consider this example for a 30-year fixed rate mortgage with an interest rate of 4%.

| Time to pay off loan | 30 years | 24 years, 7 months |

* Rate is an example only and may not reflect either your current interest rate, or the rate that is currently available.

**You may also be required to make monthly escrow payments for taxes and insurance as part of the mortgage obligation. Actual payment obligation may be greater.

***The amount of savings will vary over time depending on individual circumstances. The longer a consumer retains the property and loan at the stated rate, the more interest savings will be realized.

Keep in mind the sample savings above come from making extra payments on a 30-year mortgage. Your savings will be much less if you make extra payments of principal for only a few years.

Don’t Miss: Can You Get A Conventional Mortgage On A Manufactured Home

Take Advantage Of Lower Interest Rates:

If you renew into a lower interest rate, instead of paying less each month, consider keeping your regular payments the same as before you renewed. This is similar to increasing your payment amount. Youll be putting more toward your principal each month and chipping away at your mortgage balance faster.

Can I Make Extra Repayments On More Than One Loan

Yes, you can. You can check the impact of an additional repayment on each loan part and then approve the transaction. After making the first additional repayment, you can make a new additional repayment for a subsequent loan part. The first additional repayment will be added to your task list. You then need to sign for all of the additional repayments in one go. You cannot approve the first additional repayment one day and then the second the next day, for instance.

Read Also: Can You Be A Mortgage Broker Part Time

Should I Refinance Or Just Pay Extra

With mortgage interest rates near record lows, refinancing your current mortgage might seem like a no-brainer. Millions of homeowners could lower their monthly payments and save on long-term interest.

But what if you already have an ultra-low rate? Or youre nearly done paying off your home loan?

In some cases, starting your mortgage over with a refinance wont make sense. Luckily, you can still save on interest and potentially pay off your home early by paying extra toward your mortgage.

Heres how to choose the right strategy.

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Also Check: What Is A Second Lien Mortgage

How To Use The Early Repayment Calculator For Overpayments

When you use our calculator, well show you how to overpay your mortgage and what the benefits could be. All you need to do is enter:

-

Your outstanding mortgage balance

-

How long is left until you have paid off your mortgage

-

Your mortgages interest rate

-

The extra mortgage payments you would like to make

You can select overpaying your mortgage by the same amount each month, paying off a lump sum now, or doing both.

Well then show you:

-

How much money you could save in interest

-

How much sooner your mortgage could be paid off

Speed Up Your Payments

What it is: If youre currently making monthly mortgage payments, you might be able to switch to a more accelerated payment schedule. For instance, you can pay monthly, semi-monthly, biweekly or weekly, which over time, may make your mortgage disappear faster and potentially save you thousands of dollars in interest over the life of your mortgage.

Try our handy calculator to see how much your interest payments would be on a more frequent payment schedule and how much you can save over your amortization period.

How to do it: You can make this change at any time by talking to a Mortgage Specialist by phone or by making an appointment at a branch.

Don’t Miss: How Do You Calculate Mortgage Affordability

Find The Best Interest Rate

Interest rates determine how much you spend on interest in addition to the principal. Generally, the higher the rate, the more you pay over the length of your mortgage. So, its important to choose a mortgage with a rate that fits into your repayment plan.

Mortgages come in 2 interest rate categories:

- Fixed-rate mortgages lock your rate for an entire term. This makes it easy to track how much principal you pay back each month

- Interest rates on variable-rate mortgages can change at any time your rate could be higher or lower, depending on the market. But lower interest rates mean you pay more on the principal and pay off your mortgage faster

Interest rates vary on different mortgages, depending on their features. For example, you pay a higher interest rate on mortgages with cash-back benefits. With a cash-back mortgage, in addition to the mortgage principal you get a percentage of the mortgage amount in cash. You can use this money to buy investments, pay for a special event or renovate your home. But cash-back mortgages aren’t available at all financial institutions.

The Potential Drawbacks Of Prepaying Your Mortgage

There are a couple of disadvantages to additional mortgage payments. First, it ties up your income into your home. While you gain home equity quickly, it gives you less liquidity and room for other expenses in your budget. When you have less cash, you cannot put as much funds into emergency savings, your childs college tuition, or your 401 retirement funds.

The next thing to consider is the opportunity cost. When you prioritize mortgage payments, you cannot invest your money toward other worthwhile ventures. If youre thinking of investing in stocks or putting up a new business, these will have to wait if you choose to prepay your mortgage.

Moreover, if you have high-interest credit card debts, you wont have as much cash to pay them down. Thus, before prepaying your mortgage, its best to allocate finances toward large debts. Prioritize debts before they get much worse. In the long run, this will free up your cash flow. Without large debts, you can place more of your income into other important funds, such as your retirement plan.

Before making added payments to prepay your mortgage, ask yourself these following questions. These will help you decide if prioritizing your mortgage is more important that other expenses.

- Will I stay in the house for good?

- Do I have stable sources of income?

- Do I have a lot of high-interest debts?

- Have I saved enough for emergency funds?

- Do I have ample savings for my retirement?

- Is my monthly budget tight after meeting required expenses?

You May Like: What Does Pmi Cover On A Mortgage

Consider An Offset Account

An offset account is a savings or transaction account linked to your mortgage. Your offset account balance reduces the amount you owe on your mortgage. This reduces the amount of interest you pay and helps you pay off your mortgage faster.

For example, for a $500,000 mortgage, $20,000 in an offset account means you’re only charged interest on $480,000.

If your offset balance is always low , it may not be worth paying for this feature.

What Are The Advantages Of Refinancing Versus Extra Payments

One advantage of a refinance is you can get a new interest rate. When rates are significantly lower than the rate on your current mortgage, refinancing lets you reduce the amount of your monthly payment that goes toward interest and apply it to your principal payment instead.

By refinancing, the total finance charges may be higher over the life of the loan. It is important to keep your monthly payment and loan term the same to save money on interest when you refinance. If you reduce your monthly payment or extend the term of your mortgage, you may pay more for interest over the life of the loan. Use our home refinance calculator to estimate your potential savings in different scenarios.

Refinancing also lets you change the other terms of your mortgage. You could get more predictable interest payments by going from an adjustable rate to a fixed rate mortgage. You might be able to stop paying the mortgage insurance premiums of FHA loans by refinancing to a conventional loan too.

Read Also: What Factors Affect Mortgage Interest Rates

Economic Activity Impacts Mortgage Rates

- Keep an eye on the economy as well to determine mortgage rate direction

- If things are humming along nicely, mortgage rates may rise

- But if theres fear and despair out there, low rates may be the silver lining

- This all has to do with inflation or a lack thereof

Mortgage interest rates are very susceptible to economic activity, just like treasuries and other bonds.

For this reason, jobs reports, Consumer Price Index, Gross Domestic Product, Home Sales, Consumer Confidence, and other data on the economic calendar can move mortgage rates significantly.

As a rule of thumb, bad economic news brings with it lower mortgage rates, and good economic news forces rates higher. Remember, if things arent looking too hot, investors will sell stocks and turn to bonds, and that means lower yields and interest rates.

If the stock market is rising, mortgage rates probably will be too, seeing that both climb on positive economic news.

And dont forget the Fed. When they release Fed Minutes or change the Federal Funds Rate, mortgage rates can swing up or down depending on what their report indicates about the economy.

Generally, a growing economy leads to higher mortgage rates and a slowing economy leads to lower mortgage rates.

Inflation also greatly impacts home loan rates. If inflation fears are strong, interest rates will rise to curb the money supply, but in times when there is little risk of inflation, mortgage rates will most likely fall.